Get the free Third Party Gift Deposit Confirmation

Get, Create, Make and Sign third party gift deposit

How to edit third party gift deposit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out third party gift deposit

How to fill out third party gift deposit

Who needs third party gift deposit?

Third Party Gift Deposit Form – How-to Guide

Understanding the third party gift deposit form

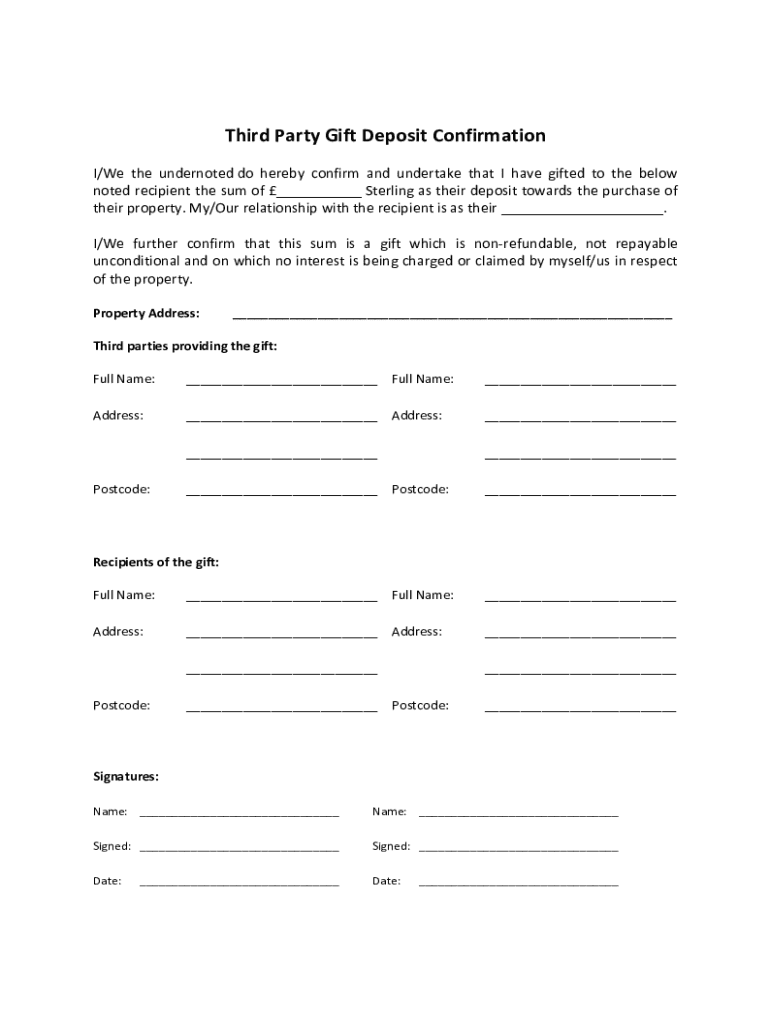

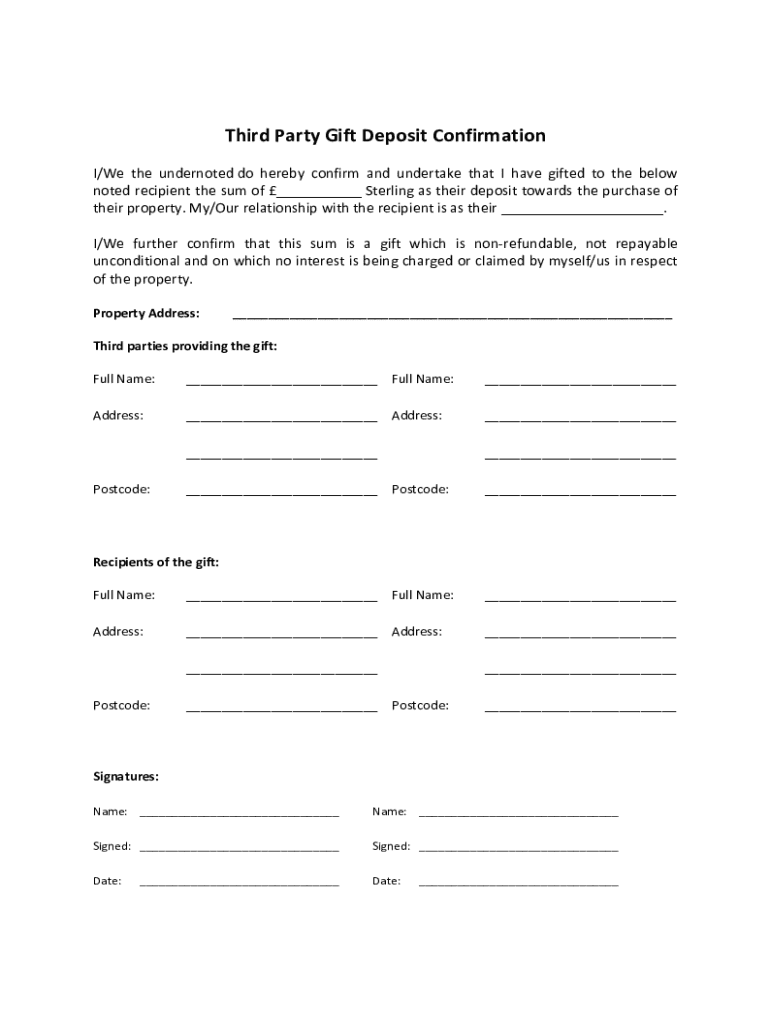

A third party gift deposit is a financial contribution made by someone other than the buyer towards the purchase of a property, typically seen in real estate transactions. This form serves as a formal declaration that the funds are indeed a gift and not a loan, clarifying the source of the funds to lenders, whose requirements for down payments are often stringent.

Common scenarios where a gifted deposit might apply include parents helping their children buy their first home, situations where a close friend wishes to lend support, or even grandparents assisting grandchildren. Understanding how this gift works is pivotal for both donors and recipients, especially in navigating the complexities of mortgage lending.

The importance of the gift deposit declaration

The Gifted Deposit Declaration is a crucial document that delineates the relationship between the donor and the recipient while clearly stating the purpose of the funds. This declaration typically includes essential details such as the donor’s name, address, and financial information, as well as the amount gifted and the explicit acknowledgment that the funds are a gift rather than a loan.

Legally, this declaration carries significant implications in the mortgage application process. Lenders require this declaration to ascertain that the buyer’s contribution is genuine and not subject to repayment, reducing the risk of lending. The importance of its correctness and clarity cannot be overstated.

Filling out the third party gift deposit form

Completing the third party gift deposit form involves several steps to ensure accuracy and compliance with lender requirements. Firstly, gather essential information from both the donor and the recipient: full names, addresses, relationship, and the amount of the gift should be clearly stated. Each section of the form is pivotal for lenders to validate the source of the funds and their intent.

Specific fields often include the donor's statement, where they affirm the funds are a gift. Common mistakes include failing to adequately document the relationship between the donor and the recipient or not providing complete information, which can delay the process significantly. Double-checking the accuracy of these details is vital to prevent hiccups during the mortgage application.

What if have a mortgage?

When applying for a mortgage, incorporating a gift deposit can significantly influence the application process. Lenders generally view gift deposits favorably, as they demonstrate the buyer's ability to secure additional funding, potentially easing the path to approval. However, it's essential to disclose any intention of third-party assistance early in the application process to avert complications.

It's crucial that any gifted amounts are declared in the mortgage application. Failure to do so can lead to issues, including loan denial or complications during the underwriting process. Communicating this information to your lender clearly and upfront enhances transparency, helping to foster trust.

What if am a cash purchaser?

Purchasing without a mortgage doesn't negate the need for proper documentation regarding gift deposits. Even in a cash transaction, the source of the gifted funds must be accounted for. This transparency reassures sellers and may prevent future disputes over ownership or financial obligations related to the property's purchase.

Essential documentation will include proof of the funds being transferred as a gift, such as bank statements, to support the legitimacy of the transaction. Sellers generally appreciate knowing that funds are secure and legitimate, which can speed up the purchase process.

Changes to the gifted deposit amount

If circumstances necessitate a change in the amount of the gifted deposit after the application has been submitted, it’s critical to adhere to set procedures quickly. Notifying the lender about any modifications as soon as possible is necessary to maintain goodwill and can prevent misunderstandings or complications that could arise during the approval process.

Proper communication strategies, including clearly outlining the reasons for the change and providing any supplementary documentation, will be essential. This proactive approach mitigates negative reactions from lenders, ensuring that both parties are aligned on expectations moving forward.

Documentation required for a gift deposit

Gathering the necessary documentation for a gift deposit is vital to streamline the process and ensure compliance with lender requirements. Key documents typically include proof of identity for both the donor and the recipient, bank statements demonstrating the transfer of funds, and any lender-specific forms required for verification purposes. This diligent preparation can significantly alleviate concerns for all parties involved.

Your solicitor(s) play an important role in this process; their expertise is critical in ensuring that all documentation is accurate and complete. A legal review can highlight potential discrepancies that may arise, establishing peace of mind and clarity in the legality of the gifted funds.

Interactive tools and resources

Navigating the complexities of your third party gift deposit form can be simplified through tools like pdfFiller. This powerful platform offers features for editing, signing, and managing documents efficiently. The cloud-based structure allows users to access important forms and templates from any device, ensuring access whenever necessary.

Utilizing such services not only streamlines the documentation process but also provides for easy collaboration between donors and recipients. Customizing documents to fit your needs is straightforward, making pdfFiller an invaluable asset in managing the intricacies of gift deposits.

Frequently asked questions (FAQs)

As individuals navigate the landscape of third party gift deposits, several common questions often arise. These may pertain to the legalities surrounding gift deposits, how they interact with various lenders, and the implications for both parties involved. By addressing these common queries, potential users can gain clarity, enabling more informed decisions throughout the process.

Additionally, seeking expert insights or legal assistance can be beneficial. Personalized guidance ensures that you’re making informed decisions based on your specific circumstances, reinforcing the importance of not only understanding the process but having an experienced ally to navigate through it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit third party gift deposit in Chrome?

How can I edit third party gift deposit on a smartphone?

How do I edit third party gift deposit on an iOS device?

What is third party gift deposit?

Who is required to file third party gift deposit?

How to fill out third party gift deposit?

What is the purpose of third party gift deposit?

What information must be reported on third party gift deposit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.