Get the free EMPLOYEE PENSION PLAN AND TRUST - Gary Public ...

Show details

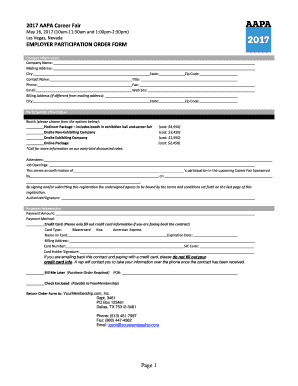

REQUEST FOR QUOTES (RFQ) # 201204 EMPLOYEE PENSION PLAN AND TRUST (Non ERICA Plan) AUDIT SERVICES OCTOBER 29, 2012, GARY PUBLIC TRANSPORTATION CORPORATION 100 W. 4TH AVENUE GARY, IN 46402 PHONE: (219)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee pension plan and

Edit your employee pension plan and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee pension plan and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employee pension plan and online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit employee pension plan and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee pension plan and

How to fill out employee pension plan:

01

Gather necessary information: Start by collecting all the required information for filling out the employee pension plan. This may include personal details, employment history, and any relevant financial information.

02

Review the plan documents: Carefully read through the employee pension plan documents provided by your employer. Understand the eligibility criteria, contribution requirements, and key benefits associated with the pension plan.

03

Complete the enrollment form: Fill out the enrollment form accurately and provide all the requested information. Double-check entries for accuracy and make sure to sign and date the form where required.

04

Understand contribution options: Familiarize yourself with the contribution options available for the pension plan. This may include assessing whether you can make additional voluntary contributions, in addition to any mandatory contributions set by your employer.

05

Designate beneficiaries: Determine who you would like to designate as your beneficiaries in case of your death. Fill out the beneficiary designation form and ensure the information is up to date and accurately reflects your intentions.

06

Seek professional guidance (if needed): If you have any questions or concerns about filling out the employee pension plan, consider seeking guidance from a financial advisor or consulting with your human resources department. They can assist you in understanding the plan details and provide any necessary clarification.

Who needs an employee pension plan:

01

Employees planning for retirement: An employee pension plan is essential for individuals who want to plan for their retirement and ensure they have a stable source of income after they stop working.

02

Employers offering retirement benefits: Employers typically offer employee pension plans to attract and retain quality talent. By providing a pension plan, employers demonstrate their commitment to employees' long-term financial well-being.

03

Individuals seeking tax advantages: Depending on the country and specific regulations, employee pension plans can provide tax advantages. Contributions made towards the pension plan may be tax-deductible, potentially reducing the individual's overall tax liability.

04

Those looking for financial security: An employee pension plan offers an additional layer of financial security during retirement. By contributing to a pension plan over the course of their career, individuals can build a retirement fund that ensures financial stability.

05

Individuals concerned about pension gaps: Many government pension systems may have limitations or gaps when it comes to providing sufficient retirement income. By having an employee pension plan, individuals can supplement these government benefits and bridge any potential gaps.

Remember, it is essential to consult with professionals and carefully analyze the specific terms and conditions of a pension plan to determine its suitability for individual needs and financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is employee pension plan?

Employee pension plan is a retirement savings plan offered by employers to their employees, usually consisting of contributions from both the employer and the employee.

Who is required to file employee pension plan?

Employers who offer pension plans to their employees are required to file employee pension plan forms.

How to fill out employee pension plan?

Employers must provide information about the pension plan, contributions made by both the employer and employee, and investment options available to employees.

What is the purpose of employee pension plan?

The purpose of employee pension plan is to provide retirement benefits to employees and help them save for their future.

What information must be reported on employee pension plan?

Employee pension plan must include information about plan contributions, investment options, vesting schedules, and any other relevant details.

What is the penalty for late filing of employee pension plan?

The penalty for late filing of employee pension plan can vary, but it may include fines or interest on unpaid contributions.

How can I send employee pension plan and for eSignature?

Once you are ready to share your employee pension plan and, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I edit employee pension plan and on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing employee pension plan and right away.

How do I fill out employee pension plan and using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign employee pension plan and and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your employee pension plan and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Pension Plan And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.