Get the free Insurance form Personal Plan - plum.com.au

Show details

Insurance form Personal Plan You can use this form to apply for or change your death and total and permanent disablement (TED) insurance or salary continuance insurance (SCI) cover in the Personal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance form personal plan

Edit your insurance form personal plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance form personal plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

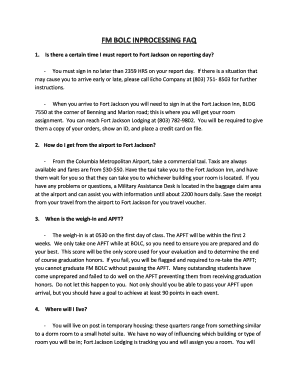

How to edit insurance form personal plan online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit insurance form personal plan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance form personal plan

How to fill out insurance form personal plan:

01

Start by gathering all the necessary information. You will need personal details such as your full name, contact information, date of birth, and social security number. Make sure to have any relevant documents or identification cards ready.

02

Identify the type of insurance plan you are applying for. This could be health insurance, life insurance, or any other type of personal insurance coverage. Understand the specific requirements and terms of the plan before proceeding.

03

Carefully read through the form instructions. Insurance forms can be lengthy and complex, so it's important to understand the questions and sections before providing your answers. Take note of any supporting documents or additional information that may be required.

04

Begin filling out the form section by section. Follow the provided guidelines and provide accurate and honest information. Double-check your responses for accuracy and clarity. If you are unsure about any question, seek clarification from the insurance provider.

05

Pay close attention to any sections that require additional documentation. This could include attaching proof of income, medical records, or any other supporting documents. Ensure that all attachments are labeled correctly and securely attached to the form.

06

Review the completed form thoroughly. Check for any mistakes, omissions, or missing information. It's crucial to provide accurate details to ensure the effectiveness and validity of your insurance coverage.

07

Sign and date the form as required. Some insurance forms may require signatures from other individuals, such as a spouse or guardian. Make sure to follow all instructions regarding signatures and date of completion.

Who needs insurance form personal plan:

01

Individuals looking to protect themselves and their loved ones financially in case of unforeseen circumstances should consider getting insurance. This includes individuals who want to safeguard their health, life, property, or any other valuable assets.

02

People who have dependents or financial responsibilities towards others, such as spouses, children, or aging parents, should seriously consider obtaining a personal insurance plan. This ensures that their loved ones are protected and financially supported in case of emergencies or unexpected events.

03

It is advisable for anyone who owns or plans to purchase valuable assets, such as a house, car, or business, to have an insurance plan in place. This helps in minimizing potential financial losses in case of theft, damage, or accidents.

04

Individuals with specific health conditions or occupational hazards may require insurance coverage tailored to their unique needs. Having a personal insurance plan can provide financial assistance for medical treatments, therapy, or disability benefits.

05

Self-employed individuals may benefit from personal insurance plans to protect their income and cover any unexpected business-related expenses. This includes professionals like doctors, lawyers, consultants, or freelancers who rely on their own income to support themselves and their families.

Remember, it's always recommended to consult with an insurance professional or advisor to understand your specific needs and find the most suitable insurance plan for your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify insurance form personal plan without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including insurance form personal plan, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I edit insurance form personal plan on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing insurance form personal plan.

How can I fill out insurance form personal plan on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your insurance form personal plan, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is insurance form personal plan?

Insurance form personal plan is a document where individuals can outline their insurance coverage, including health, life, disability, and property insurance.

Who is required to file insurance form personal plan?

Any individual who has insurance coverage must file an insurance form personal plan.

How to fill out insurance form personal plan?

To fill out an insurance form personal plan, individuals must provide detailed information about their insurance policies and coverage.

What is the purpose of insurance form personal plan?

The purpose of an insurance form personal plan is to document and organize an individual's insurance coverage for reference.

What information must be reported on insurance form personal plan?

Information such as insurance policy numbers, coverage limits, and insurance company contact information must be reported on an insurance form personal plan.

Fill out your insurance form personal plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Form Personal Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.