Get the free Ohio Sd 2210-100 - tax ohio

Get, Create, Make and Sign ohio sd 2210-100

How to edit ohio sd 2210-100 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ohio sd 2210-100

How to fill out ohio sd 2210-100

Who needs ohio sd 2210-100?

Ohio SD 2210-100 Form: A Comprehensive How-to Guide

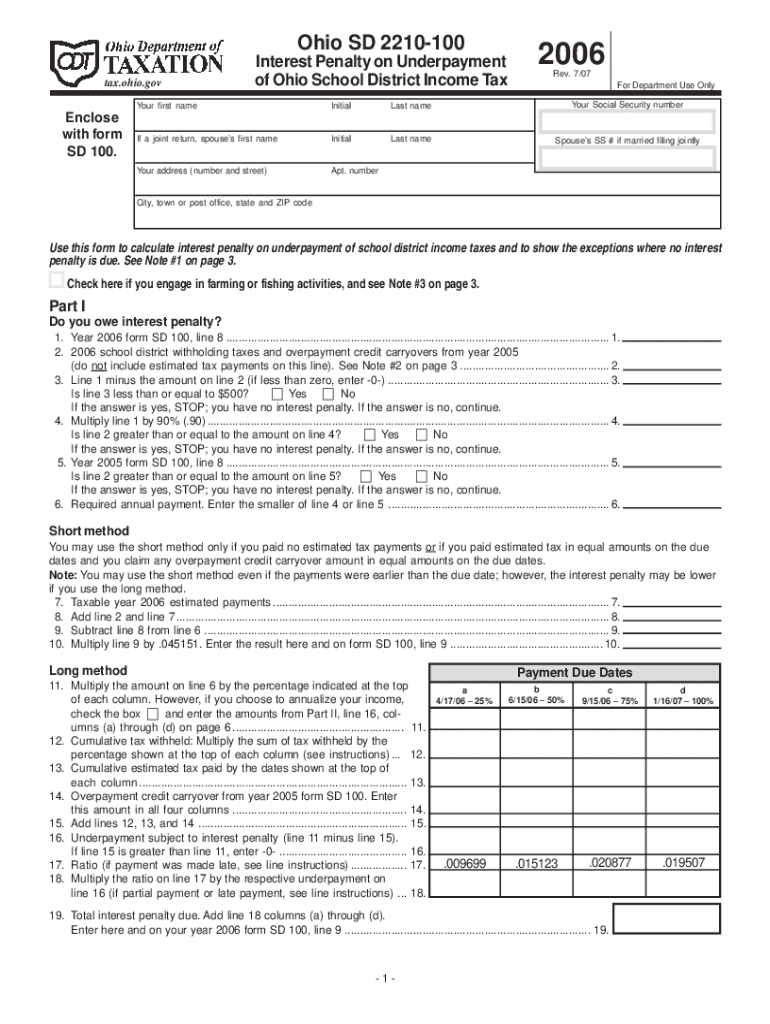

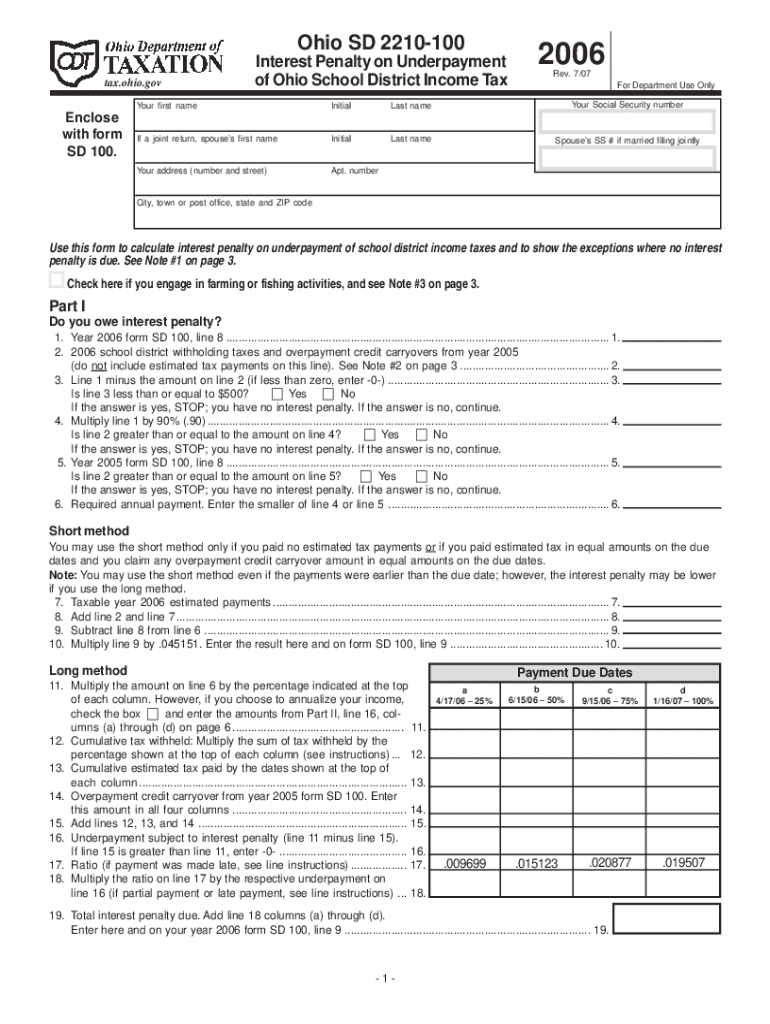

Overview of the Ohio SD 2210-100 Form

The Ohio SD 2210-100 Form serves as a crucial document for taxpayers subject to Ohio school district income tax. It is designed to report income earned and determine the appropriate local school district tax due. Understanding the purpose and implications of this form is vital for accurate tax compliance and financial management.

For individuals and teams managing affairs related to school district income taxes, timely filing of the Ohio SD 2210-100 Form is essential. Missing deadlines or inaccuracies in the form can lead to penalties and complications. Key deadlines typically align with the general tax-filing deadlines, but specific details may vary by school district.

Who needs to fill out the Ohio SD 2210-100 Form?

Filing the Ohio SD 2210-100 Form is necessary for specific groups of taxpayers. This includes any individual with income that qualifies under Ohio’s school district tax guidelines. Understanding the criteria can help taxpayers avoid unnecessary complications during tax season.

Typical candidates for this form encompass both employees receiving W-2 forms and self-employed individuals who report earnings through 1099s. Common scenarios include receiving wages from a job located in a school district or freelance income that is subject to local tax laws.

Key sections of the Ohio SD 2210-100 Form

The Ohio SD 2210-100 Form comprises several key sections that guide the taxpayer in declaring their income and calculating their tax liabilities. Each section has unique requirements and offers specific instructions for accurate completion.

Section 1 captures essential personal information like name, address, and social security number, while Section 2 requires an accurate income calculation based on various income sources. In Section 3, taxpayers apply the relevant tax rate based on their school district, and Section 4 discusses penalties for underpayment of taxes.

Step-by-step instructions for filling out the form

Filling out the Ohio SD 2210-100 Form may seem daunting at first, but following a clear step-by-step approach can simplify the process significantly. Begin by gathering the necessary documents that will inform your figures on the form.

Step 1 involves collecting essential items like W-2 forms from employers, 1099 revenue documents if self-employed, and your previous tax returns for reference. Once you've gathered these, move to Step 2 by placing your personal information in the form with precision. Accurate details here are critical, as any mistakes can lead to processing delays or errors.

In Step 3, calculate your total income based on the documents you collected. This step often requires understanding how to report different types of income, especially if you have various sources. Proceeding to Step 4, determine the relevant tax rates applicable to your school district, which should be clearly addressed in the instructions accompanying your form.

Tips for editing and managing your Ohio SD 2210-100 Form

Using cloud-based solutions like pdfFiller can significantly streamline the process of managing your Ohio SD 2210-100 Form. With features designed to facilitate editing, eSigning, and collaboration, pdfFiller empowers users to work more efficiently and accurately when handling their tax documents.

When using pdfFiller, you can easily edit your PDF document online, making it simple to correct errors or update information. Collaboration with tax professionals becomes straightforward through shared access and cloud-based capabilities, allowing both parties to work on the same document from different locations. Additionally, eSigning enables you to finalize and securely submit your form, ensuring compliance and timely filing.

Common errors and how to avoid them

When filling out the Ohio SD 2210-100 Form, taxpayers often encounter specific pitfalls. Common mistakes include inaccuracies in income reporting or misapplication of tax rates relating to the school district, which could lead to underpayment penalties.

To mitigate these issues, best practices are essential. Double-check your calculations, ensure you're referencing the correct tax rate, and ask for assistance if uncertain about any figures. A systematic review of the completed form before submission can catch errors that might otherwise lead to regrettable financial consequences.

Resources for further assistance

To support taxpayers in navigating the complexities of the Ohio SD 2210-100 Form, several resources are available through the Ohio Department of Taxation. Their website provides comprehensive guides and materials specifically geared toward this and other Ohio tax forms.

Apart from official state resources, many tax professionals specialize in Ohio tax law and can provide insightful assistance. Interactive tools on platforms like pdfFiller also offer help with form completion, giving taxpayers the guidance they need to fill out the Ohio SD 2210-100 Form accurately.

Related tax forms and categories to consider

Understanding the Ohio SD 2210-100 Form is critical, but it's also beneficial to recognize how it relates to other relevant tax forms. For instance, taxpayers may need to reference Ohio SD 2210 and other general Ohio income tax forms when completing their filings.

The Ohio SD 2210-100 Form fits into the larger framework of tax compliance, making it essential for taxpayers to be aware of all related documentation. Failure to consider these forms might lead to incomplete filings or missed deductions that could otherwise reduce tax liabilities.

Frequently asked questions (FAQs) about the Ohio SD 2210-100 Form

Taxpayers often have several questions when navigating the Ohio SD 2210-100 Form. Common inquiries involve the electronic filing process, deadlines, and amendments to submitted forms. Addressing these FAQs helps demystify the complexities surrounding this essential document.

For example, electronic filing options are increasingly available, providing convenience for busy taxpayers. If someone were to miss a filing deadline, it’s crucial to outline the repercussions and possible remedies. Finally, understanding the amendment process for previously submitted forms is vital in ensuring compliance with Ohio’s tax laws.

Final thoughts on effective document management with pdfFiller

In conclusion, the Ohio SD 2210-100 Form represents a pivotal component of tax compliance for residents subject to local school district income taxes. Using pdfFiller can streamline the management of this form, enhancing the experience of preparing and filing tax documents.

By harnessing pdfFiller’s capabilities—such as seamless editing, collaborative document creation, and easy eSigning—users can navigate tax obligations more effectively. Emphasizing the benefits of all-in-one document solutions empowers users to tackle their tax responsibilities with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ohio sd 2210-100 in Gmail?

How can I get ohio sd 2210-100?

Can I edit ohio sd 2210-100 on an Android device?

What is ohio sd 2210-100?

Who is required to file ohio sd 2210-100?

How to fill out ohio sd 2210-100?

What is the purpose of ohio sd 2210-100?

What information must be reported on ohio sd 2210-100?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.