Get the free Sd 100x - tax ohio

Get, Create, Make and Sign sd 100x - tax

Editing sd 100x - tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sd 100x - tax

How to fill out sd 100x

Who needs sd 100x?

Understanding the sd 100x Tax Form: A Comprehensive Guide

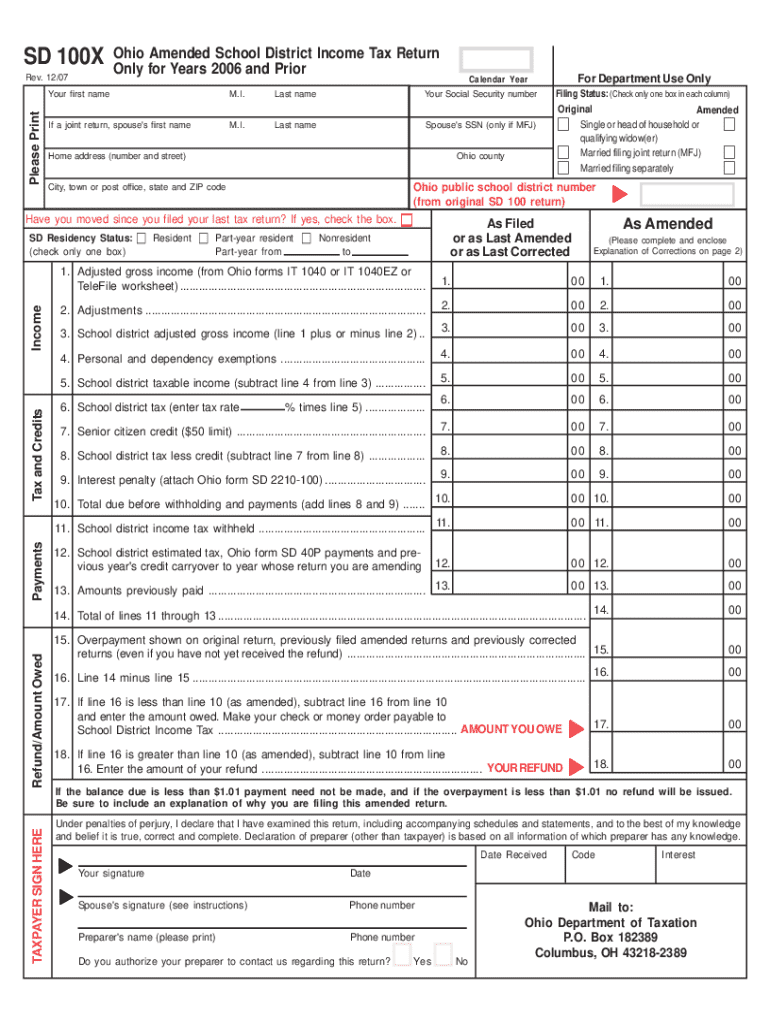

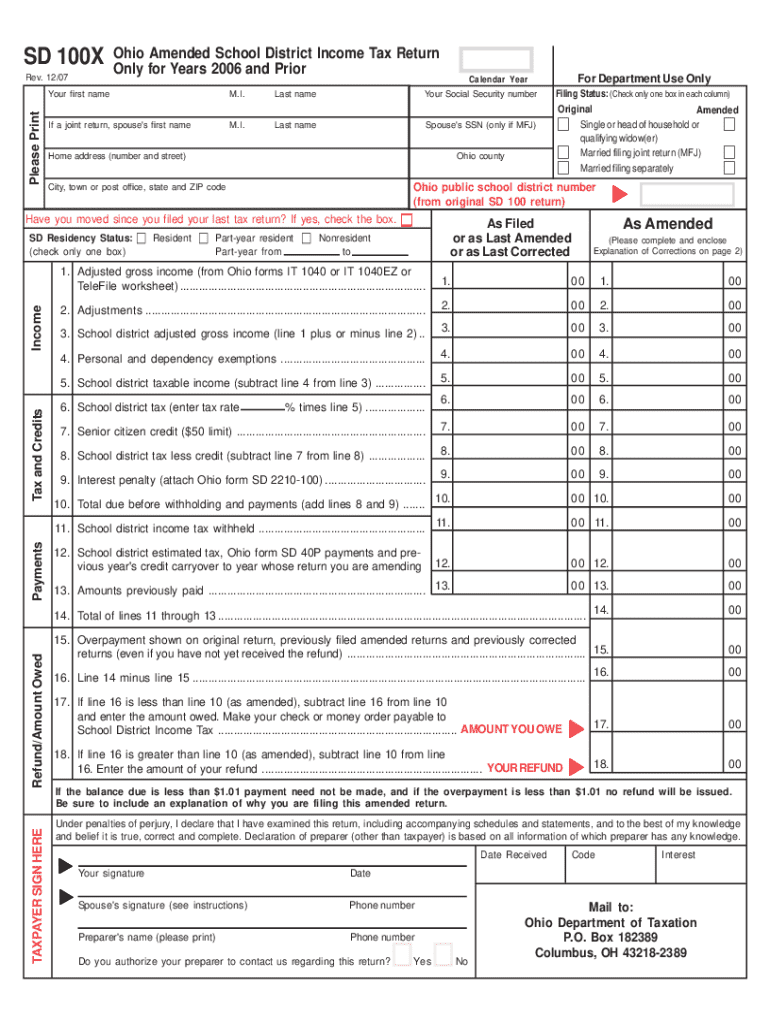

Overview of the sd 100x tax form

The sd 100x tax form serves as an essential document within the tax reporting framework, specifically designed for individuals and teams to report amendments to previously submitted tax returns. Its primary purpose is to enable filers to correct any errors or adjustments in income, deductions, or credits after the initial filing. Timeliness and accuracy in filing the sd 100x are crucial, as misreporting can lead to issues down the line, including penalties and audits.

Accurate reporting not only ensures compliance with tax regulations but also empowers individuals and teams to reclaim any overpaid taxes or rectify underreported income. The sd 100x form is characterized by multi-layered tax reporting capabilities and comprehensively addresses accessibility and compliance requirements outlined by the IRS.

Understanding the nuances of the sd 100x form will not only enhance your filing accuracy but also familiarizes you with the broader tax landscape relevant to your financial standing.

Understanding the structure of the sd 100x form

The sd 100x form comprises several sections, each designed to capture specific information pertinent to your tax situation. The personal information section requires essential details such as your name, address, Social Security Number, and filing status. These details help the IRS identify your record for accurate processing.

The income reporting section is where you document all sources of income, ranging from wages to investments, ensuring all revenue streams are accounted for. Additionally, deductions and credits are crucial in lowering your taxable income, which is captured in their dedicated section. Understanding and utilizing available deductions can greatly influence your overall tax liability.

Common terminologies associated with the sd 100x include 'Gross Income,' which refers to the total income received before any deductions; 'Taxable Income,' which is your gross income minus deductions; and 'Adjusted Gross Income' (AGI), which is your gross income adjusted for specific deductions. Familiarizing yourself with these terms is vital for accurate completion of the form.

Step-by-step instructions for filling out the sd 100x form

Filling out the sd 100x form can be straightforward if you follow these clear steps. First and foremost, gather all necessary documentation, including income statements such as W-2s and 1099s, as well as any receipts or statements that pertain to deductions and credits.

Next, begin with the personal information section. Be meticulous in entering your full name, address, and Social Security Number. A common mistake to avoid in this section is mismatching your name or providing an incorrect Social Security Number, as this can delay processing.

When it comes to reporting income, it is essential to specify the type and source of income accurately. Use tools like pdfFiller to facilitate accurate input, leveraging pre-populated fields and data verification features.

For claiming deductions and credits, refer to a comprehensive list of allowable deductions available in IRS guidelines. Identify your eligible deductions to potentially lower your taxable income significantly. Utilize pdfFiller’s interactive tools to fill in these sections seamlessly.

If applicable, complete any additional schedules that relate to your tax situation. Once all sections are filled out, conduct a final review to ensure compliance and accuracy, paying attention to each entry. You can submit your sd 100x form electronically through pdfFiller, ensuring a timely submission.

Editing and customizing your sd 100x form with pdfFiller

pdfFiller offers numerous editing features to customize your sd 100x form. You can add text, images, and even digital signatures easily, facilitating a streamlined documentation process. Whether you need to input additional notes for clarity or wish to annotate specific areas, the editing tools allow for a high degree of customization.

Collaboration is simplified with pdfFiller as it enables real-time co-editing features. Team members can contribute to the form simultaneously, and with the ability to track changes and comments, seamless collaboration is assured. This not only fosters teamwork but also ensures everyone involved is on the same page, minimizing the risk of errors.

Signing and managing your sd 100x form

In today's digital age, eSignature options available within pdfFiller allow for easy signing of your sd 100x form. Utilizing eSignature not only enhances efficiency but also ensures compliance, as electronic signatures are legally recognized for tax documents. To apply an eSignature, follow the straightforward prompts in pdfFiller, and your document will be instantly ready for submission.

Effective management of your tax documents is vital for future reference and compliance. pdfFiller provides secure options for storing and organizing your tax documents, ensuring they are accessible when needed. Additionally, sharing your tax documents with advisors or team members can be done securely, maintaining confidentiality and compliance throughout the process.

Troubleshooting common issues with the sd 100x form

Filing errors can occur, and understanding common mistakes will aid in swift resolution. Some frequent issues include incorrect Social Security Numbers, misreported income, and forgotten deductions. If you encounter an error, first consult IRS guidelines for corrective measures.

If you discover that you need to amend your submitted tax return after filing, the sd 100x form is specifically designed for that purpose. Following proper channels to file an amendment will help you avoid complications further down the line. Understanding IRS notifications related to errors can also assist in proactively addressing potential issues before they escalate.

Frequently asked questions (FAQs) about the sd 100x tax form

Many individuals have questions surrounding the impacts of income changes on the sd 100x form. A significant income change may necessitate amending previous submissions, impacting your obligations or refunds. Filers often ask about the implications of missing a filing deadline, which can result in penalties, but understanding the process of filing an extension is crucial.

For those needing specific assistance, professionals and resources are available to guide you through the nuances of the sd 100x form. It's advisable to reach out to tax professionals or utilize the support options offered by platforms like pdfFiller.

Case studies: successful sd 100x submissions

Several individuals and teams have experienced significant benefits from using the sd 100x submission process. For example, a small business was able to amend a tax return that inadvertently reported incorrect income, resulting in a substantial refund. The efficiency gained from utilizing pdfFiller’s tools allowed them to correct the issue promptly, avoiding potential penalties.

Analyzing challenges faced during the filing process reveals a common theme of documentation errors and misunderstandings of tax regulations. Utilizing pdfFiller not only simplified document management but also provided clarity in completing each step of the sd 100x form, resulting in savings of both time and stress.

Future changes to the sd 100x tax form

As the tax landscape evolves, it's crucial to stay informed about anticipated updates to the sd 100x form. Several changes are often anticipated with each new tax year, including adjustments to allowable deductions and credits based on legislative changes. Keeping abreast of these developments ensures compliance and optimal tax strategy.

pdfFiller proactively manages updates to filing requirements, so users can rely on the platform for up-to-date guidance and compliance assistance as rules and regulations shift in response to new tax laws.

Conclusion and next steps

The importance of timely and accurate filing of the sd 100x form cannot be overstated. By utilizing pdfFiller’s comprehensive features for editing, eSigning, and managing your tax documents, you can maximize efficiency and ensure compliance.

Take the first step by exploring additional tutorials and resources available on pdfFiller related to the sd 100x and other essential forms. Whether you are an individual or part of a team, the platform is designed to empower you in your document management journey, fostering a smoother, more effective filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sd 100x - tax for eSignature?

How do I edit sd 100x - tax straight from my smartphone?

How do I edit sd 100x - tax on an iOS device?

What is sd 100x?

Who is required to file sd 100x?

How to fill out sd 100x?

What is the purpose of sd 100x?

What information must be reported on sd 100x?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.