Get the free Franklin Templeton 403(b) Non-erisa Plan Establishment Guide

Get, Create, Make and Sign franklin templeton 403b non-erisa

Editing franklin templeton 403b non-erisa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out franklin templeton 403b non-erisa

How to fill out franklin templeton 403b non-erisa

Who needs franklin templeton 403b non-erisa?

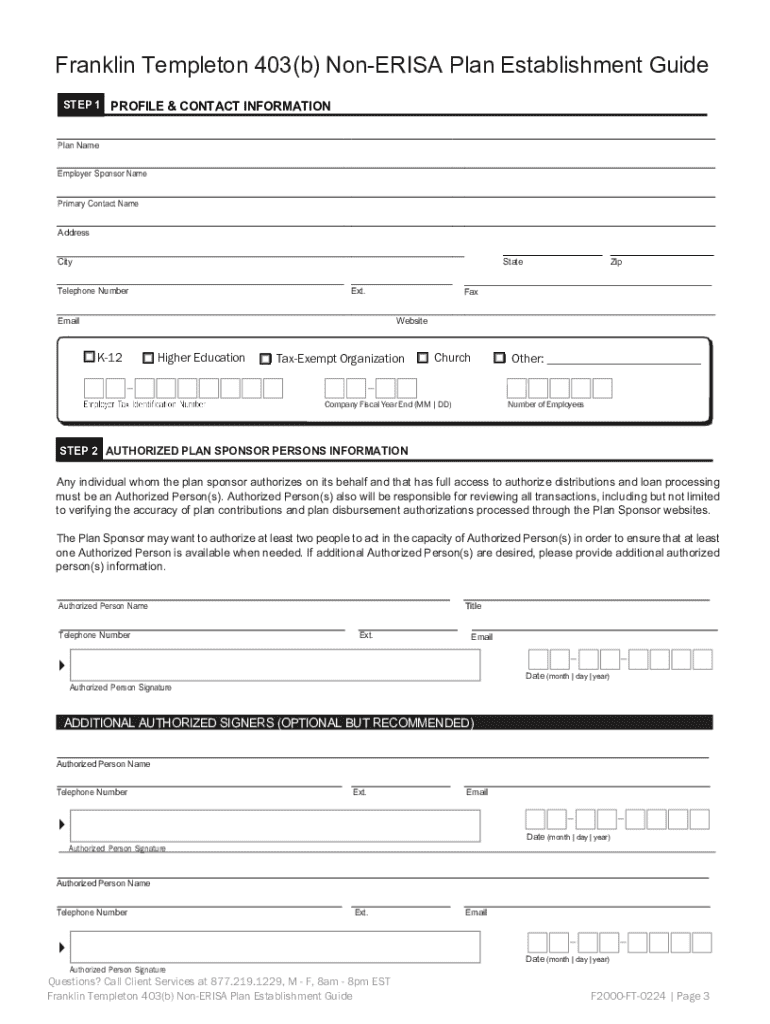

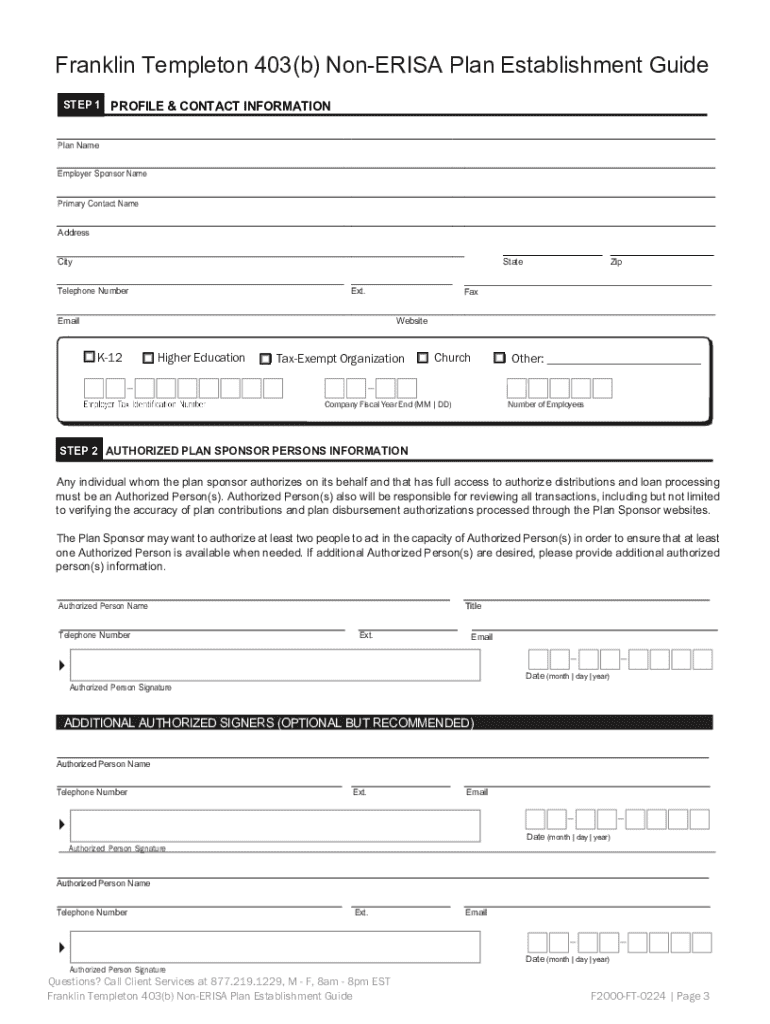

Comprehensive Guide to the Franklin Templeton 403b Non-ERISA Form

Understanding the Franklin Templeton 403b Non-ERISA Form

The 403b plan is a retirement savings program specifically designed for employees of nonprofit organizations, public schools, and some government entities. Unlike traditional retirement plans, 403b plans allow employees to contribute a portion of their salaries, which can grow tax-deferred until retirement. The Franklin Templeton 403b non-ERISA form is crucial for any participants in this plan, as it lays out the necessary information to manage contributions and investment choices effectively.

A significant distinction exists between ERISA (Employee Retirement Income Security Act) and non-ERISA plans. ERISA applies to most employer-sponsored retirement plans, providing various protections to employees. In contrast, non-ERISA plans, such as those utilized by specific educational institutions and certain non-profit organizations, may not be governed by all the same regulations, simplifying administrative processes. Understanding this distinction is pivotal for participants of the Franklin Templeton 403b non-ERISA form as it dictates their rights and responsibilities within the plan.

Utilizing the Franklin Templeton non-ERISA form is essential for participants. It allows them to clearly outline their contributions and make informed investment choices tailored to their retirement goals without the additional complexity that ERISA plans often entail.

Key features of the Franklin Templeton 403b Non-ERISA Form

This form serves as an integral part of managing a 403b account, detailing contributions, employment information, and investment decisions. Its key components include personal information, employment details, contribution levels, and investment choices, allowing participants to provide a comprehensive overview of their retirement planning.

Eligibility criteria for using the non-ERISA form typically require that the employee work for an eligible organization, such as a public school or certain non-profits. Additionally, these plans often have different contribution limits compared to ERISA plans, offering potential benefits such as less stringent reporting and compliance requirements.

Step-by-step guide to filling out the Non-ERISA form

Preliminary preparation

Before diving into the form, gathering the necessary documents and information is crucial. Participants should collect their Social Security number, employment verification details, and previous year’s contributions to ensure accuracy in reporting. Understanding the terminology used in the form, such as 'salary deferral' and 'vested benefits,' can minimize confusion and streamline the completion process.

Detailed instructions for each section

Common mistakes to avoid

Avoiding mistakes is critical in ensuring smooth processing of your Franklin Templeton 403b non-ERISA form. Participants often overlook critical sections or provide incomplete data, leading to submission delays. Double-checking numerical entries, particularly in contribution amounts, and verifying personal details can save time and prevent frustration.

Cross-reference your entries against supporting documents, such as pay stubs and previous tax filings, to ensure precision. A meticulous review can help avoid unnecessary setbacks, ensuring that your retirement contributions are accurately processed.

After submission: what to expect

Once you submit the Franklin Templeton 403b non-ERISA form, it goes through a processing period. Typically, you can expect this timeline to vary based on the volume of submissions and administrative efficiency, but most forms are processed within a few weeks. If additional information is needed, the processing team may reach out to clarify your submission.

After submission, remain vigilant for approval notifications and keep lines of communication open. Setting aside time for potential follow-up actions, such as submitting additional documents or adjustments to your contributions, is advisable.

Key points of contact for inquiries and assistance can often be found in the Franklin Templeton communication you receive or on the company website.

Utilizing pdfFiller for efficient form management

pdfFiller stands out as a powerful tool for efficiently managing the Franklin Templeton 403b non-ERISA form. With cloud-based document management, you can access your form from anywhere and at any time, ensuring you are never tied to a single device or location. This streamlines the form completion process, allowing participants to stay organized and efficient.

Editing and signing capabilities offered by pdfFiller empower users to make adjustments seamlessly. The platform also features collaboration tools, making it easy for teams to work together on the same document, ensuring that contributions align with organizational policies and goals.

Interactive tools and resources

To further facilitate the completion of the Franklin Templeton 403b non-ERISA form, numerous online interactive tools can assist participants. These may include fillable templates that guide users through each section, ensuring no detail is overlooked. Access to additional resources such as step-by-step video tutorials can enhance understanding and confidence in filling out the form correctly.

Utilizing these tools not only aids efficiency but also empowers individuals with knowledge about their retirement options, allowing for informed decision-making when it comes to investment choices.

Additional insights on 403b plans

Current trends in 403b plan investments tend to focus on ESG (Environmental, Social, and Governance) criteria. Many investors are now interested in socially responsible companies, reflecting a growing awareness of sustainability. As a participant in a 403b plan, staying informed about legislative changes, including compliance with updates such as the Secure 2.0 Act, is crucial. This act introduces provisions to enhance savings opportunities for participants and improve access to these retirement vehicles.

Monitoring plan fees and performance is equally essential. High fees can erode investment returns over time, making it critical to assess the cost-effectiveness of your investment choices regularly. Taking an active role in managing your 403b plan can lead to better financial outcomes and ensure that your retirement savings are on track.

FAQs about the Franklin Templeton 403b Non-ERISA Form

Many common questions arise regarding the Franklin Templeton 403b non-ERISA form. Participants often wonder about eligibility criteria, submission procedures, and the management of their contributions. Clarifying these points can help smooth out the process and ensure participants understand their responsibilities, including deadlines for contribution changes or fund selections.

It is advisable to access the official resources or reach out to customer service for accurate information. This proactive approach protects against potential misunderstandings and ensures participants are well-equipped to navigate their 403b plan.

Conclusion

Filling out the Franklin Templeton 403b non-ERISA form can be straightforward, especially with the help of tools like pdfFiller. This cloud-based platform makes it easy to complete, edit, and manage your documents from anywhere, providing a seamless experience throughout the form-filling process. Investing time in understanding the intricacies of the form ensures that participants can maximize their retirement savings effectively.

By leveraging pdfFiller’s streamlined features, participants can enhance their document management practices, thus paving the way for successful retirement planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out franklin templeton 403b non-erisa using my mobile device?

How do I edit franklin templeton 403b non-erisa on an iOS device?

How do I fill out franklin templeton 403b non-erisa on an Android device?

What is franklin templeton 403b non-erisa?

Who is required to file franklin templeton 403b non-erisa?

How to fill out franklin templeton 403b non-erisa?

What is the purpose of franklin templeton 403b non-erisa?

What information must be reported on franklin templeton 403b non-erisa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.