Get the free Schedule R

Get, Create, Make and Sign schedule r

Editing schedule r online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule r

How to fill out schedule r

Who needs schedule r?

Schedule R Form: A Comprehensive How-to Guide

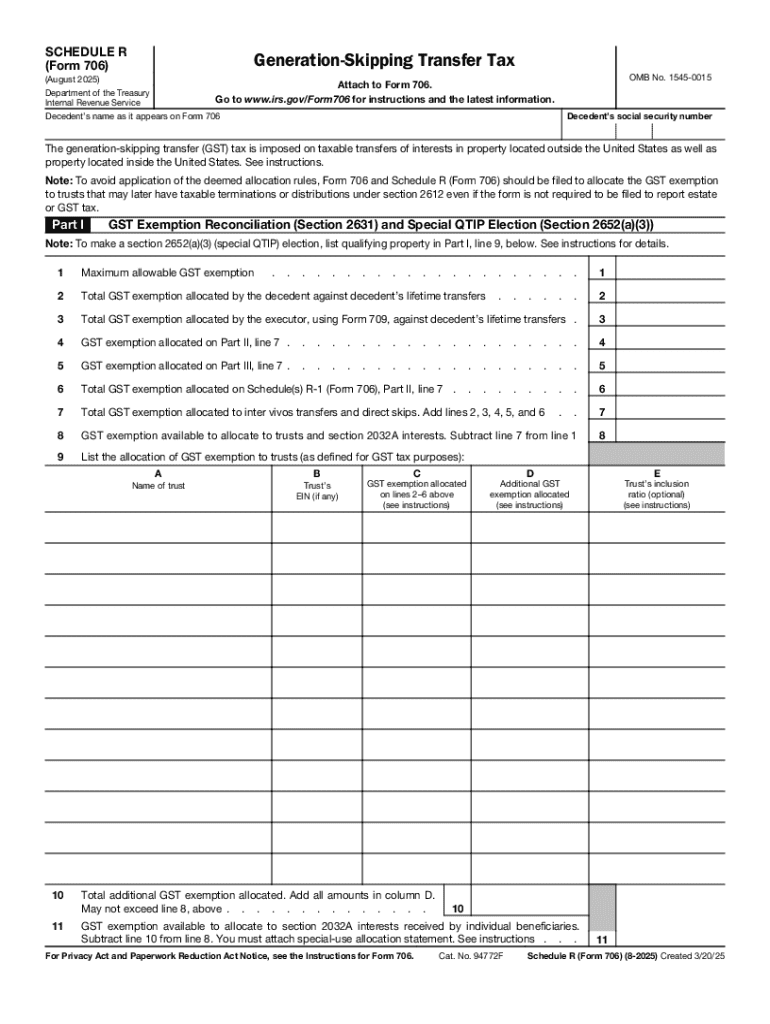

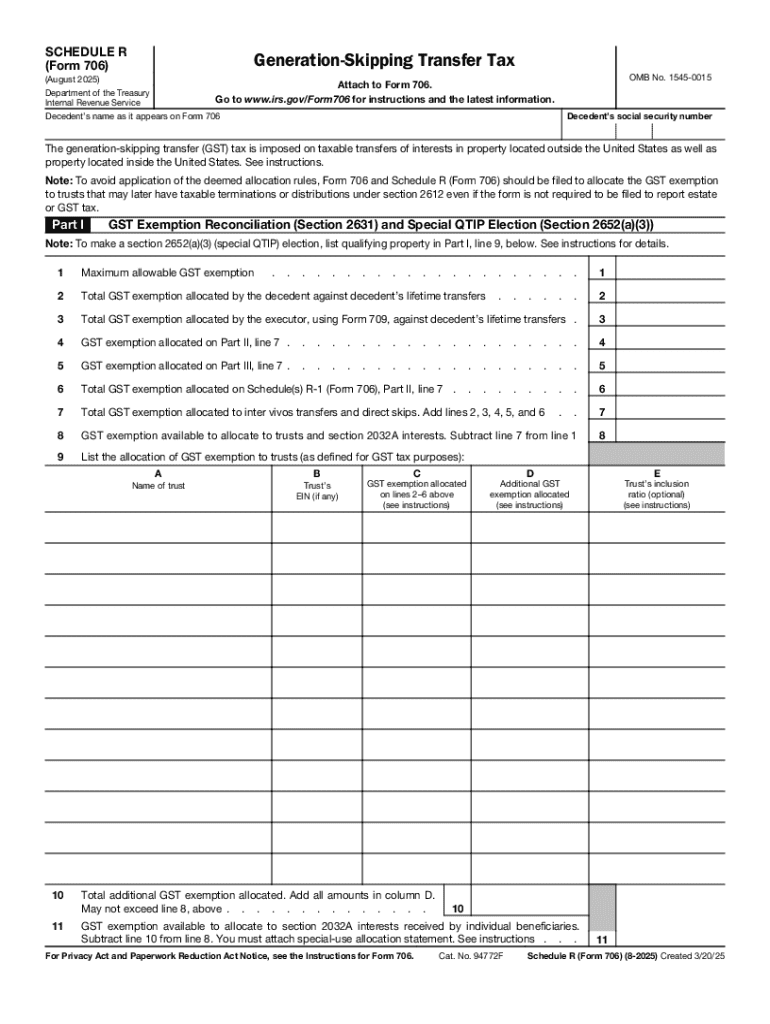

Overview of Schedule R Form

The Schedule R form is an essential document used primarily in the context of apportioning income for taxation purposes, especially for corporations and businesses. It allows filers to allocate their income among various jurisdictions according to specific factors such as property, payroll, and sales. The primary purpose of the Schedule R form is to provide a clearer picture of a taxpayer’s business activity, ensuring that income is taxed appropriately where it is generated.

Understanding the Schedule R form is crucial for proper tax filing. Filing this form correctly can help reduce tax liabilities and comply with state regulations. Failure to accurately complete this form may lead to audits or unnecessary tax penalties, making its importance clear to both individual taxpayers and business entities.

Who needs to use Schedule R

Individuals and businesses must determine whether they need to file the Schedule R form based on specific criteria. For individuals, the requirement typically arises if they have income that must be reported on a water's-edge basis, or if they are part of a larger corporate filing. Partnerships and LLCs similarly utilize this form if they have income in multiple states or jurisdictions.

Businesses, especially partnerships and LLCs, must consider that if they employ the water's-edge election in their tax filings, they may be required to fill out Schedule R. Water's-edge filers benefit from simplified tax calculations and reduced reporting requirements, which can make the filing process more efficient.

Preparing to fill out Schedule R

Before diving into the completion of the Schedule R form, it’s crucial to gather the necessary documentation. Essential documents include income records such as profit and loss statements, sales receipts, and any other relevant financial material. Equally important are the expense records, which will demonstrate operational costs associated with different jurisdictions.

Understanding key terms associated with Schedule R can also prove beneficial. Familiarize yourself with terms like apportionment, allocation, property factor, payroll factor, and sales factor. To ease the filing process, tools and resources—like those available on pdfFiller—can provide interactive solutions for completing tax forms effectively, eliminating the confusion often associated with tax paperwork.

Detailed instructions for completing Schedule R

When filling out Schedule R, begin with the Basic Information Section. This section requires you to provide your entity's name, identification number, and contact details. Accurately entering this information is critical as it forms the basis for your tax filing and ensures that your submission is processed correctly.

Next, move onto the Apportionment and Allocation section. This part of the form explains how to apportion your income among different jurisdictions based on specified formulas. Understanding these allocation methods is key; they typically involve property, payroll, and sales factors, which will be elaborated on in the following sections.

Common errors to avoid

Submitting an accurate Schedule R form is crucial; thus, there are common pitfalls that filers should be aware of. Misreporting income is a frequent mistake that can lead to significant tax issues. Additionally, using inaccurate calculations when determining factors such as property, payroll, and sales can mislead the apportionment percentage.

Moreover, be vigilant about missing required fields. Each line of the Schedule R form needs to be filled out correctly to avoid delays in processing. To ensure your completion is error-free, taking time to review your filled form and utilizing checklists can be highly beneficial.

Additional forms relevant to Schedule R

In conjunction with the Schedule R form, various additional forms—ranging from Schedule R-1 to Schedule R-6—may be relevant for different types of income and deductions. Understanding when to utilize these forms is essential. For instance, Schedule R-1 may apply in specific scenarios involving partnerships, while others are tailored to unique reporting requirements.

Those who find themselves filing multiple forms would benefit from exploring the quick links provided on pdfFiller to access each required form. This ensures a streamlined process when completing your tax returns, simplifying the overall experience.

Specific line instructions for Schedule R

Each line of the Schedule R form is assigned a specific purpose. For example, Line 1A through Line 3B typically addresses identification and basic reporting details. It's crucial to pay close attention to these items when completing the form to ensure clarity in your filing.

Line 5B is particularly important as it may require special notes on tax reporting, indicating special conditions or unique situations. Using visual guides and fillable examples that pdfFiller provides can significantly help navigate these specifics correctly.

Maintaining compliance and best practices

Achieving consistency in reporting is essential for maintaining compliance. Adopting a systematic approach to record-keeping ensures that all relevant documentation is readily available when it’s time to fill out the Schedule R form. Implementing best practices, including regularly updating financial records, can simplify future filings and promote transparency.

Additionally, pdfFiller's document management features can empower you to streamline your filing process. By keeping all files organized in one cloud-based platform, teams can easily access necessary documents, collaborate on tax filings, and eliminate the stress associated with last-minute paperwork.

Leveraging pdfFiller for seamless workflow

Using pdfFiller enhances the Schedule R filing experience through its intuitive PDF editing capabilities. Users can easily fill out, sign, and send forms directly from their devices—no more printing, scanning, or mailing forms the old-fashioned way. This cloud-based platform is designed for collaboration, allowing teams to work together seamlessly on document completion.

The efficiency of pdfFiller extends beyond simple editing; features such as easy eSigning and real-time collaboration enable users to streamline their workflow. Cloud-based management also ensures that your documents are accessible from anywhere, making tax season less daunting.

User stories: Successful experiences with Schedule R

Feedback from individuals and businesses illustrates the tangible benefits of using Schedule R efficiently through pdfFiller. Users have reported significant time savings when filling out their tax forms, especially in businesses with multiple states or jurisdictions. Many individuals have shared their appreciation for how pdfFiller's intuitive interface simplifies the tax filing process.

Testimonials highlight not only the ease of use but also improved accuracy in tax reporting. Users have noted that through pdfFiller’s support, they have minimized errors due to its structured tools, ensuring that their Schedule R forms are both accurate and complete.

FAQs: Commonly asked questions about Schedule R

Understanding what to do if you face an audit is critical for any tax filer. It is advisable to maintain all records and documentation related to your Schedule R filing, as these will be your best defense in case of an inquiry. Furthermore, knowing how to correct mistakes after submission can save you from potential penalties. It's typically necessary to file an amended Schedule R and provide proper documentation for the corrections.

For those needing additional support, consulting a tax professional can also provide peace of mind. They can help navigate any complex situations surrounding Schedule R filings and ensure that you are compliant with all regulations.

Interactive tools for Schedule R

pdfFiller provides interactive tools designed to assist users with their Schedule R filings. Tax calculation tools allow for precise estimations of tax liabilities based on entered data. Additionally, interactive checklists can help prepare all necessary documentation before submitting the Schedule R form.

For immediate questions or concerns, pdfFiller offers live chat support. This enables users to seek real-time assistance on specific concerns, making the filing process smoother and less stressful.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my schedule r in Gmail?

Where do I find schedule r?

How do I edit schedule r straight from my smartphone?

What is schedule r?

Who is required to file schedule r?

How to fill out schedule r?

What is the purpose of schedule r?

What information must be reported on schedule r?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.