Get the free Schedule K

Get, Create, Make and Sign schedule k

How to edit schedule k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule k

How to fill out schedule k

Who needs schedule k?

Understanding Schedule K Form: A Comprehensive Guide

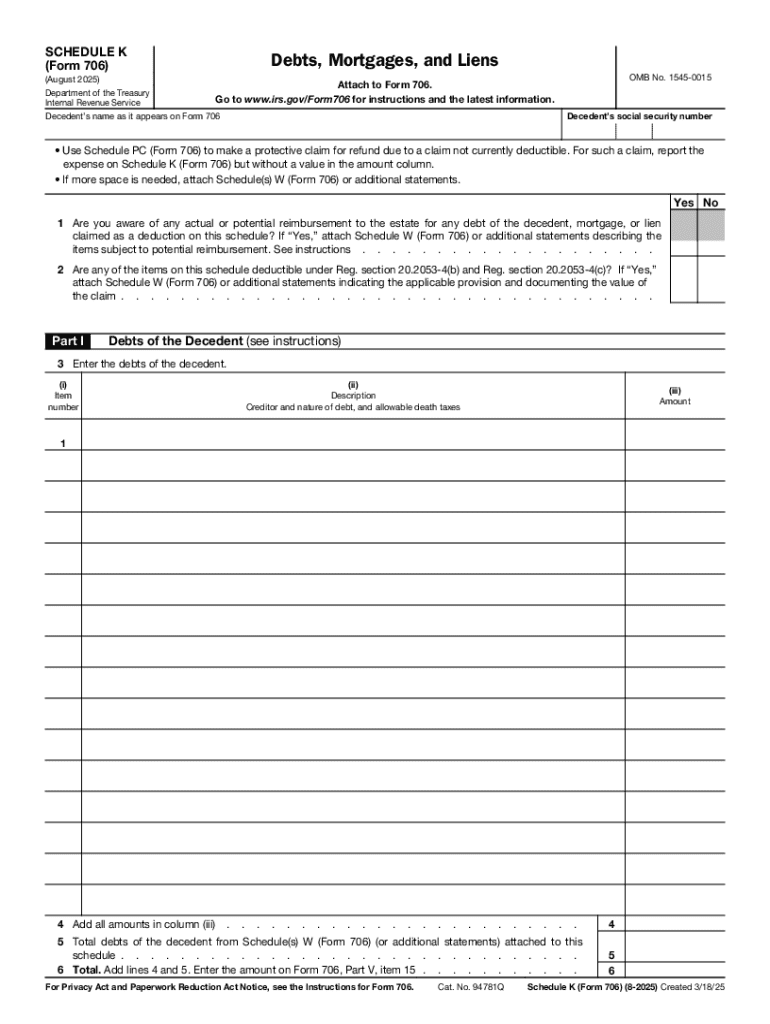

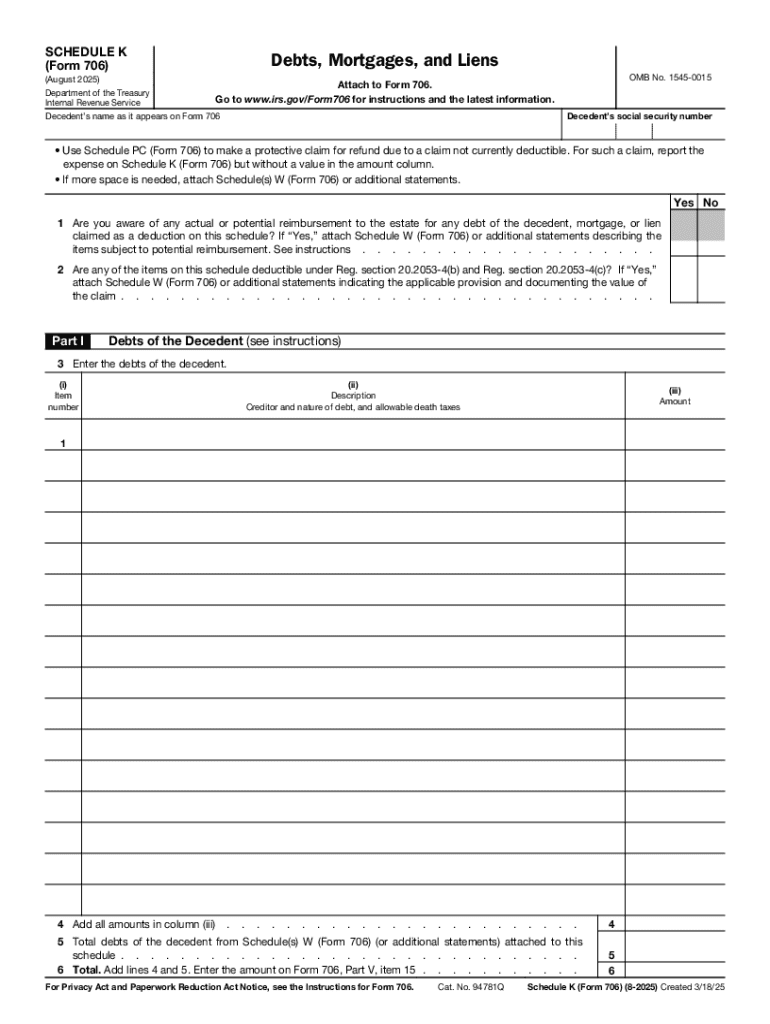

Overview of Schedule K Form

Schedule K forms are essential tax documents that play a pivotal role in reporting income, deductions, and credits for partnerships, S corporations, and certain multi-member LLCs. These forms facilitate the flow of information from entities to their partners and shareholders, ensuring everyone is on the same page regarding income distributions and obligations.

The importance of Schedule K forms in tax reporting cannot be overstated. They help businesses comply with IRS regulations and ensure that partners accurately report their income on their individual tax returns. Understanding the key terminology associated with Schedule K is also crucial, as it sets the groundwork for navigating the complexities of tax filings.

Types of Schedule K Forms

Schedule K has various forms tailored to different business entities and their unique reporting needs. Most commonly, these include Schedule K-1, Schedule K-2, and Schedule K-3, each serving a distinct purpose within the partnership taxation framework.

Schedule K-1 is utilized to report each partner's or shareholder's proportionate share of the entity's income, deductions, credits, etc., while K-2 and K-3 provide supplemental information crucial for international tax issues and additional disclosures.

Key components of Schedule K Form

Understanding the breakdown of components within the Schedule K forms is crucial for effective reporting. Primarily, these components match categories crucial for tax compliance, including income reporting, deductions, and partner distributions.

The income reporting section details various sources of earnings that the partnership generates, while the deductions and credits section lists allowable expenses that reduce taxable income. Additionally, the partner's share of liabilities informs partners about their responsibility for debts incurred by the partnership.

How to fill out Schedule K Form

Filling out the Schedule K form accurately is essential to prevent errors that may lead to audit or misinformation. A step-by-step guide can help in simplifying this process.

Here are the steps to effectively complete the Schedule K Form:

Accurate completion of the Schedule K form can avoid common pitfalls. Ensuring that all financial entries correlate with documented evidence makes for a straightforward audit trail.

Utilizing pdfFiller for Schedule K Form management

pdfFiller stands out as an invaluable tool for managing tax forms like the Schedule K. Its suite of features streamlines the form-filling process, enhancing efficiency and ease of use.

Key features include:

To get started with pdfFiller, users can create an account, upload necessary Schedule K forms, access them easily, and save or share the completed documents painlessly.

Common issues and troubleshooting for Schedule K Form

Encountering issues while completing the Schedule K form can be frustrating. However, understanding common challenges can equip users with strategies to overcome them.

Some frequently encountered problems include incorrect income entries, wrong partner distributions, and miscalculating deductions. Resolving these common errors often requires careful verification against original documents and astute attention to detail.

For additional help, resources such as IRS guidelines, tax professionals, and online forums can provide valuable insight and assistance.

Frequently asked questions about Schedule K Form

Navigating the intricacies of tax forms can lead to several queries. Understanding the most common questions regarding Schedule K can alleviate uncertainty among users.

Best practices for managing Schedule K Forms

Adopting best practices can significantly enhance the management of Schedule K forms. Keeping accurate records, conducting regular compliance checks, and leveraging digital solutions like pdfFiller can streamline the entire process.

Here are some effective tips:

The impact of Schedule K Form on business structuring

How businesses structure themselves plays a significant role in tax obligations and liability exposure. The Schedule K form highlights this dynamic, showcasing how partnerships and LLCs can align their taxation strategies effectively.

For example, partnerships can manage profits and losses flexibly, while LLCs offer limited liability protection to their members. Utilizing Schedule K effectively can unlock tax planning strategies that benefit partners, such as managing distributions smartly to minimize overall tax burdens.

Success stories: How pdfFiller helped users with Schedule K Forms

The transformative power of pdfFiller extends to helping businesses streamline their Schedule K form management. Numerous users have reported enhanced efficiency and accuracy due to the platform's robust features.

Testimonials highlight how the integration of digital solutions into tax processes not only simplifies workflows but also reduces stress related to filing deadlines. By showcasing user experiences, one can witness the direct impact of pdfFiller on successful tax reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get schedule k?

How do I make edits in schedule k without leaving Chrome?

How can I edit schedule k on a smartphone?

What is schedule k?

Who is required to file schedule k?

How to fill out schedule k?

What is the purpose of schedule k?

What information must be reported on schedule k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.