Get the free Schedule D

Get, Create, Make and Sign schedule d

Editing schedule d online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule d

How to fill out schedule d

Who needs schedule d?

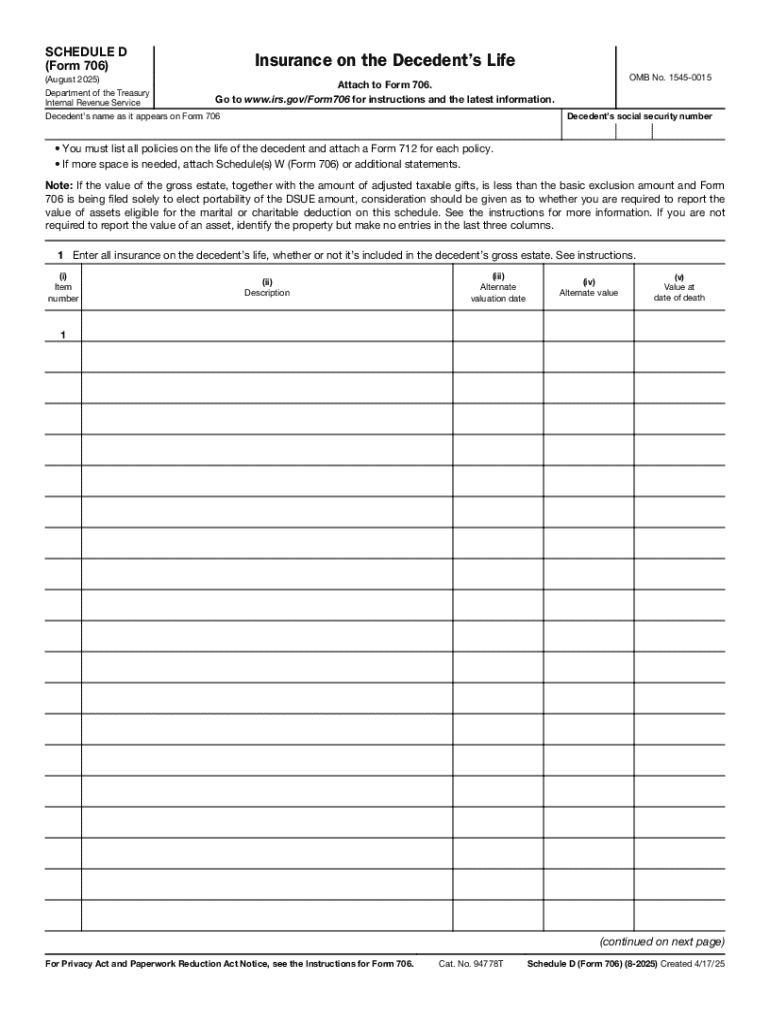

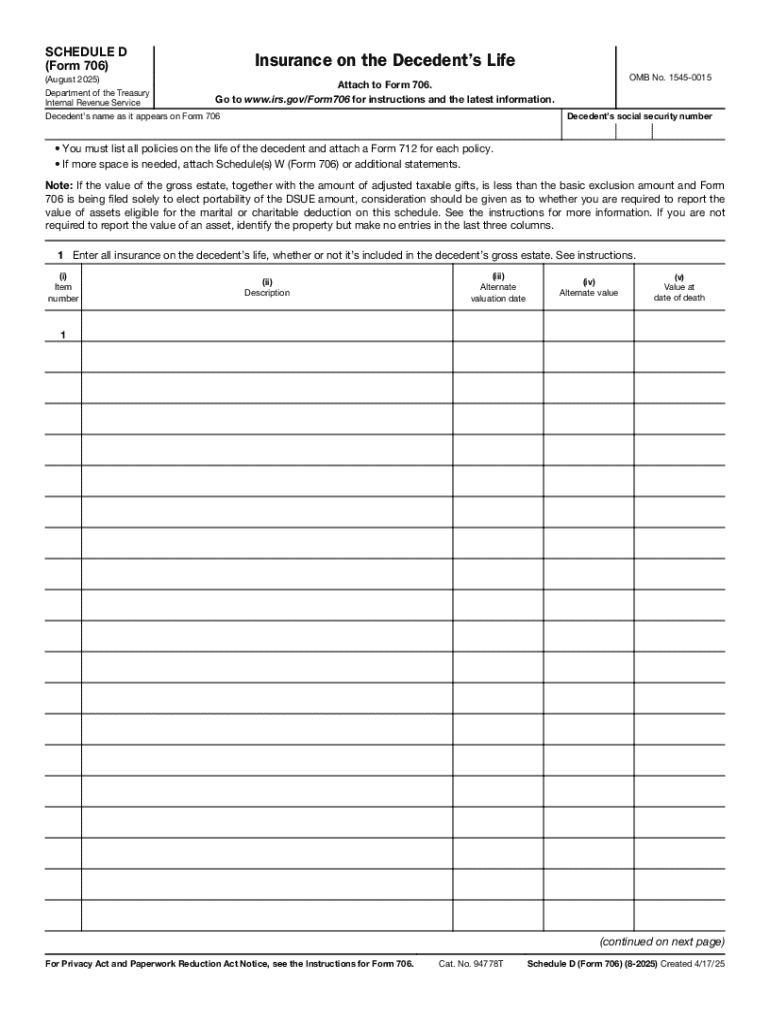

Comprehensive Guide to Schedule Form

Understanding the Schedule Form

Schedule D is a vital IRS form used for reporting capital gains and losses from the sale of assets, such as stocks, bonds, and real estate. This form provides taxpayers with the means to detail the financial transactions that influence their taxable income, ensuring accurate reporting of profits or losses from investments during the tax year.

Importance for tax filers cannot be overstated. Individuals who engage in buying or selling capital assets must file Schedule D to reflect their activities. Failure to file could lead to discrepancies in tax calculations, resulting in penalties, interest on unpaid taxes, or an IRS audit.

Key sections of the Schedule Form

Understanding the layout of Schedule D is essential for accurate completion. The form is divided into several key sections to categorize your capital transactions, providing both a visual and structured method for reporting.

Detailed instructions for completing the Schedule Form

Completing the Schedule D form requires careful attention to detail. Start by gathering all necessary records related to your asset sales, including purchase and sale dates, amounts, and any associated costs.

To file accurately, follow these steps:

Avoid common pitfalls such as misreporting the holding period of an asset, which could classify a long-term gain as short-term, impacting the tax rate applied. Always double-check calculations and seek assistance if needed.

Interactive tools and resources

Utilizing online calculators can simplify calculating capital gains and losses. Tools available on pdfFiller allow users to input their data and automatically determine their gains, making the process easier.

Additionally, pdfFiller offers robust PDF editing features. Users can upload their Schedule D form, edit it as necessary, and customize it to suit their filing needs without hassle.

eSigning capabilities further streamline the process. Users can sign the form digitally, ensuring a speedy submission to the IRS.

Managing your Schedule Form

Proper organization of tax documents is crucial. pdfFiller aids in storing and managing your Schedule D form securely in the cloud. This allows for easy access and retrieval, ensuring that users can find their documents whenever necessary.

If collaborating with tax professionals, pdfFiller makes sharing Schedule D forms straightforward. Simply share the document for review or advice, enhancing communication efficiency during deadlines.

Frequently asked questions (FAQs) about Schedule

Several common questions arise regarding the Schedule D form, including:

Additional considerations and advanced tips

Employing effective tax strategies can maximize benefits related to Schedule D. Consider harvesting losses to offset gains strategically. Selling underperforming assets at the end of the year can reduce tax liability by balancing out profitable sales.

Staying updated with changes to tax laws affecting Schedule D is also vital. Recent amendments might alter reporting requirements or impact the tax rate applied to gains, so keeping informed can prevent potential issues during filing.

pdfFiller’s value proposition for Schedule management

pdfFiller offers a comprehensive solution for managing tax documents, particularly the Schedule D form. Its user-friendly platform features robust tools for editing, eSigning, and collaborating, making it a preferred choice during tax season.

Customer testimonials highlight the ease of document management. Users appreciate the cloud-based access that allows them to manage documentation from anywhere, significantly simplifying tax preparation.

Filing after completing the Schedule Form

Once completed, taxpayers have options for submitting the Schedule D form. eFiling is often quicker and more efficient, allowing for immediate processing, while paper filing might be preferred by those who feel more comfortable with physical documentation.

After submission, it’s important to track the status of your filing. pdfFiller includes features that help users monitor their document status, ensuring peace of mind as taxpayers await IRS processing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send schedule d to be eSigned by others?

How can I get schedule d?

How do I edit schedule d straight from my smartphone?

What is schedule d?

Who is required to file schedule d?

How to fill out schedule d?

What is the purpose of schedule d?

What information must be reported on schedule d?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.