Get the free Schedule E

Get, Create, Make and Sign schedule e

Editing schedule e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule e

How to fill out schedule e

Who needs schedule e?

Schedule E Form How-to Guide

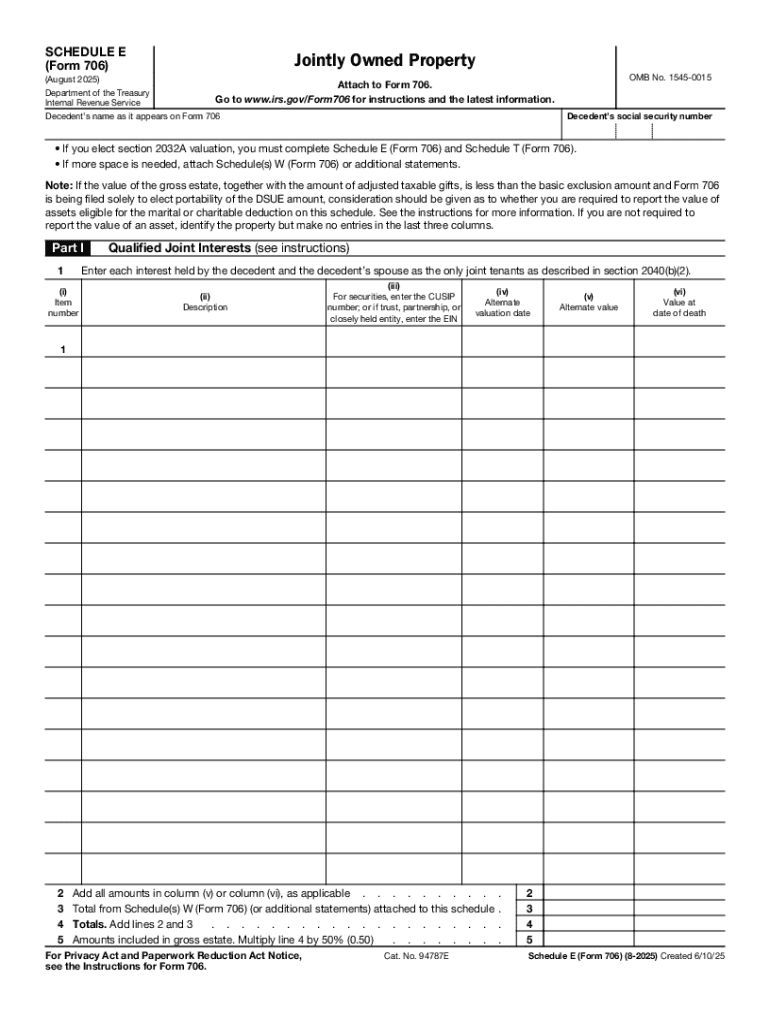

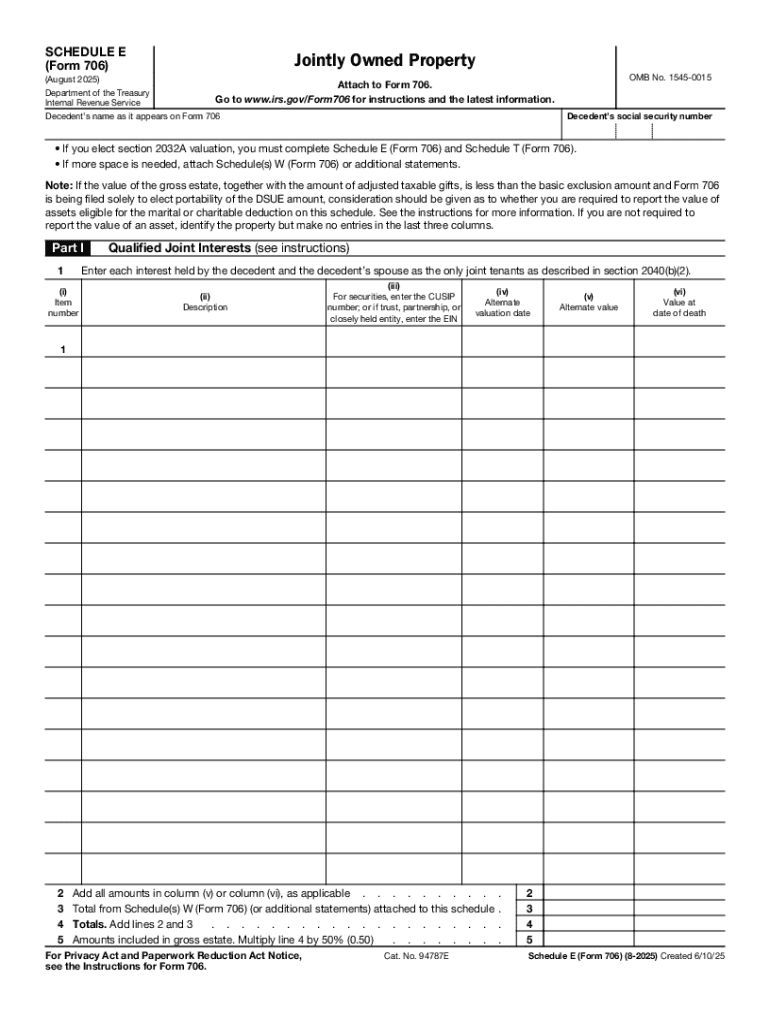

Understanding IRS Schedule E

IRS Schedule E is a critical tax form used to report supplemental income, specifically detailing income or losses from rental real estate, royalties, partnerships, and S Corporations. This form is instrumental for individuals and businesses that engage in activities outside of standard employment or ordinary business operations.

Tax filers need to understand the importance of Schedule E, as it not only affects tax liabilities but also impacts overall financial health for individuals and teams. Accurate reporting on this form can help in maximizing deductions and minimizing taxable income.

Who needs to file Schedule E?

Individuals who generate income through rental properties, royalties, or partnerships are primarily responsible for filing Schedule E. Homeowners who rent out part of their residence or any individuals who earn supplemental income through freelance work must understand their obligations under this form.

Businesses, specifically partnerships and S Corporations, also require Schedule E to report income accurately. Trusts and estates, too, need to file this form to report income distributed to beneficiaries. Additionally, expatriates must consider filing requirements based on foreign income, making Schedule E essential for a diverse group of taxpayers.

Essential components of Schedule E

Schedule E comprises several parts, each focusing on different sources of income or losses. Part I addresses rental real estate and royalties, requiring filers to report gross rental income and applicable deductions such as repairs and property management fees.

Part II discusses income or losses from partnerships and S Corporations, incorporating various K-1 forms received from partnerships for accurate computation. Part III is designated for reporting income or losses from estates and trusts, illustrating tax implications for beneficiaries. Lastly, Part IV deals with income or loss from Real Estate Mortgage Investment Conduits (REMICs), highlighting specialized reporting requirements.

Tips for completing Schedule E accurately

Effective record-keeping is critical for accurate reporting on Schedule E. Filers should maintain detailed records of rental income, expenses related to property management, and any documentation supporting business partnership earnings. Utilizing digital tools like pdfFiller can streamline this process and ensure all required information is organized.

Avoid common mistakes such as misreporting income or failing to account for all eligible deductions. Make certain that all expenses are well-documented and justifiable to maximize the benefits of filing Schedule E. Interactive features offered by pdfFiller can enhance the ease of completing and managing this form.

Step-by-step guide to completing Schedule E

To start filling out Schedule E, gather all necessary documents including income statements, expense receipts, and any K-1 forms from partnerships. Familiarity with what information you need is critical for efficiency. Begin with Part I by reporting gross rental income, then move on to expenses by itemizing each deduction, citing repairs, property management fees, and depreciation.

For Parts II through IV, follow the guidelines closely. Accurately enter figures from K-1 forms and ensure that losses reported in estates and trusts reflect properly to beneficiaries. After completing the form, it’s crucial to review and verify all entries to prevent errors before submission.

Filing Schedule E: Options and best practices

When it comes to filing Schedule E, taxpayers can choose between e-filing and traditional paper filing. Electronic submission via platforms like pdfFiller offers advantages such as faster processing times and reduced likelihood of errors in transcription. It allows interactive form features, which further improve user experience.

Be mindful of deadlines for filing. Taxpayers typically must submit Schedule E along with their income tax return by April 15. However, extensions may be granted, provided the IRS form is submitted ahead of time. Furthermore, if you have foreign income, utilizing the Foreign Tax Credit (FTC) can help mitigate the risks of double taxation.

Understanding passive activity loss (PAL)

Passive activities typically involve trade or business activities in which you do not materially participate. Rental real estate activities, for instance, are considered passive, and thus Schedule E is crucial to accurately claim passive activity losses. Knowing how to distinguish between passive and non-passive activities can help taxpayers navigate limitations on losses.

If losses are claimed on Schedule E, certain rules apply limiting how much of those losses can be deducted. Often, higher income taxpayers face restrictions, therefore understanding the regulations surrounding passive activity is essential for optimal tax outcomes.

FAQs about Schedule E

Individuals have various questions about Schedule E, including how it differs from other tax forms like Schedule C, which focuses on business income, versus Schedule E’s focus on passive income sources. Additionally, taxpayers often inquire about handling multiple properties on Schedule E and whether electronic filing is an option.

Taxpayers may also ask about reporting losses: Generally, if a loss exists, it can be reported, but it’s essential to come equipped with documentation. Clarifying these aspects can demystify the process and encourage accurate filings.

Real-life examples and case studies

Successful Schedule E filings often illustrate the significance of meticulous documentation. For instance, an individual renting out a home can benefit from using pdfFiller to manage receipts, ensuring every deduction is documented accurately. Careful tracking of property management expenses and rental income allows taxpayers to maximize their returns.

Complex cases, such as mixed-use properties where part of a property is rented while the owner resides in the other part, can pose challenges. Understanding how to equitably apportion income and expenses becomes pivotal in such scenarios. These examples highlight the necessity for clarity in reporting and ensuring compliance with IRS regulations to avoid penalties.

Additional considerations for expats

For US citizens living abroad, the implications of filing Schedule E can be significant. Special instructions apply, specifically regarding foreign rental income and property management. Understanding local tax obligations alongside US requirements is crucial for expats to avoid potential legal pitfalls.

Common challenges include navigating complex tax treaties and foreign tax credits. Solutions often involve strategic financial planning and, at times, professional guidance to ensure all reporting is accurate. Organizations and platforms like pdfFiller can simplify the document management process, enabling better compliance for expatriates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send schedule e for eSignature?

How do I edit schedule e in Chrome?

How do I complete schedule e on an Android device?

What is schedule e?

Who is required to file schedule e?

How to fill out schedule e?

What is the purpose of schedule e?

What information must be reported on schedule e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.