Get the free Schedule O

Get, Create, Make and Sign schedule o

Editing schedule o online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule o

How to fill out schedule o

Who needs schedule o?

Schedule O Form: A Comprehensive How-to Guide on pdfFiller

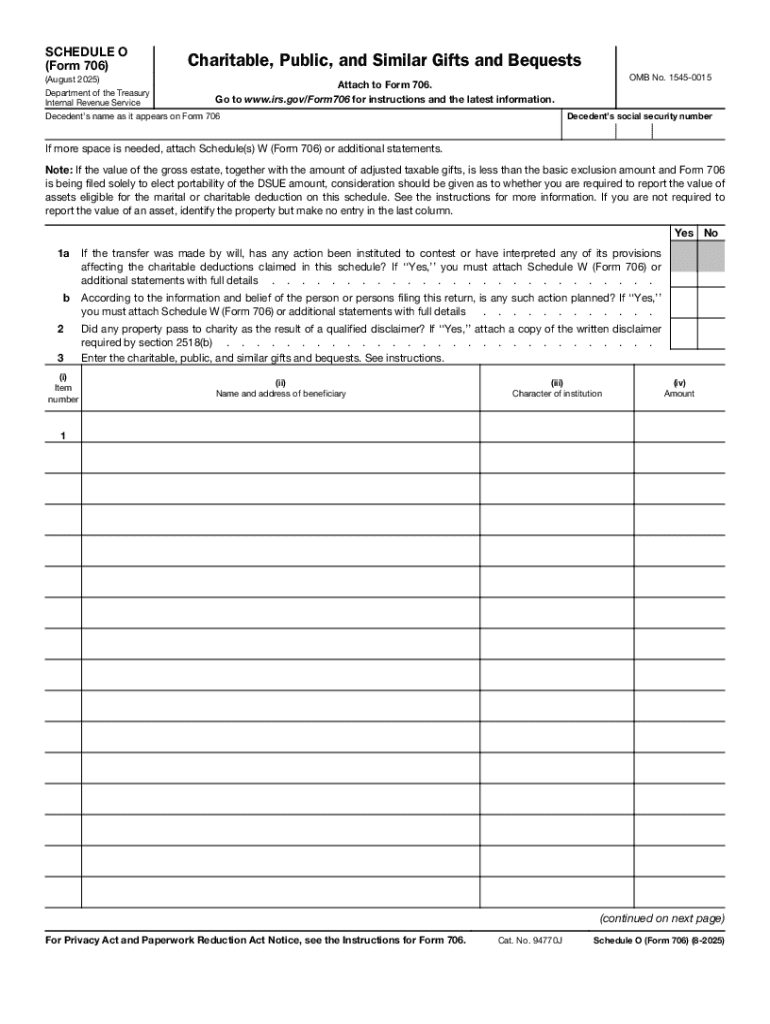

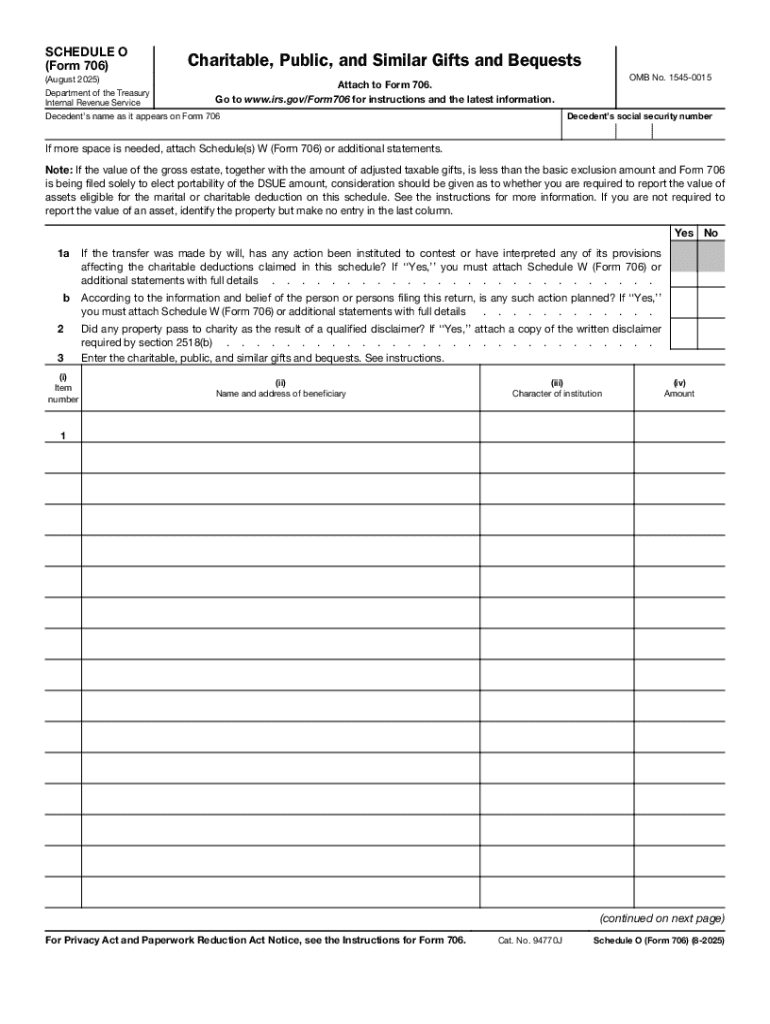

Understanding Schedule O Form

Schedule O is a critical part of the IRS Form 990 series, specifically designed for nonprofits that file Form 990 or Form 990-EZ. It serves as a supplemental statement where organizations can provide additional context and details about their mission, programs, and governance. This form is vital because it allows nonprofits to clarify their purpose and activities, enhancing transparency for donors, grantors, and the general public.

The importance of Schedule O lies in its ability to provide a comprehensive view of a nonprofit's operations and financial health beyond just the numbers. While Form 990 and Form 990-EZ capture financial and operational data, Schedule O is where organizations can explain their program accomplishments, governance structures, and policy determinations, making it a valuable tool for accountability.

Understanding the key differences between Form 990 and Form 990-EZ is crucial. While both forms serve similar purposes, Form 990 offers a more extensive reporting framework suitable for larger organizations, whereas Form 990-EZ is intended for smaller nonprofits. However, both forms necessitate the use of Schedule O when reporting.

Who needs to complete Schedule O?

Not all organizations are required to file Schedule O. Generally, tax-exempt organizations that are required to file Form 990 or Form 990-EZ must also submit this schedule. Eligibility criteria typically include organizations classified under section 501(c)(3) of the Internal Revenue Code, which must comply based on their size, revenue, and activities.

Specific categories of organizations required to submit Schedule O include private foundations, charities, and organizations with significant revenue streams. Common misconceptions about filing requirements often arise from the belief that smaller organizations are exempt from submitting the form altogether, which is not the case as compliance depends on the specifics of the organization's activities and finances.

Navigating the Schedule O Form

When you approach the Schedule O form, it's essential to understand its structure. The form is typically divided into several key sections, each focusing on different aspects of the organization’s operations. These sections include Part I, which covers revenue and expenses; Part II, highlighting program service accomplishments; and Part III, which addresses governance and management disclosures.

Understanding each section is critical for crafting a comprehensive and compelling narrative about your organization. For instance, Part I requires clear definitions of revenue streams and expenses, while Part II enables you to illustrate the impact of your programs. Part III invites you to discuss your governance policies and board composition, which are foundational to your organization's integrity.

Detailed instructions for completing Schedule O

Completing Schedule O begins with gathering necessary documentation. Organizations should have detailed financial records, impact reports, and governance policies ready for reference. Proper documentation not only speeds up the process but also ensures accuracy and completeness in responses across the form.

Once documentation is collected, you can proceed with Part I, where you'll detail your organization’s revenue and expenses. Accurate revenue calculations should reflect all funding sources, while expense reporting should break down costs into categories for operational clarity. Moving onto Part II, describe your organization’s mission succinctly before detailing the specific activities that demonstrate how you fulfill that mission. Finally, in Part III, focus on the composition of your board, noting any relevant policies regarding management and governance to underscore organizational integrity.

Common challenges and how to overcome them

Filing Schedule O can come with its own set of challenges, particularly when navigating complex questions that require specific and detailed information. Many organizations face difficulties in reporting accurately, leading to common errors such as misreported financial figures or vague program descriptions. To overcome these challenges, it’s crucial to consult existing documentation and seek clarification from resources when needed.

Dealing with potential IRS audits related to Schedule O requires being thorough and precise in your disclosures. Ensuring all parts of Schedule O are completely filled out with accurate data and clear explanations can be fundamental in defending against any inquiries. Many organizations benefit from peer review or legal advice to bolster the credibility of their submissions.

Resources for further assistance

Utilizing interactive tools like those offered by pdfFiller can simplify the completion of Schedule O. The platform provides a user-friendly interface to fill, edit and manage your documents seamlessly. Taking advantage of pdfFiller’s extensive knowledge base, including FAQs and support articles, can answer many of your queries regarding Schedule O.

For personalized help, contacting pdfFiller’s customer support is highly recommended. Their team is trained to assist users with a variety of forms, including Schedule O, ensuring you get the help you need to navigate and complete this important document effectively.

Filing process for Schedule O Form

File Schedule O through both paper and electronic means. However, e-filing is becoming increasingly popular due to its convenience and efficiency. Organizations should weigh the pros and cons of each method before deciding on a filing process. E-filing allows for immediate submission and reduces the risk of postal delays.

Using pdfFiller to submit Schedule O has numerous benefits. The platform provides a step-by-step e-filing guide that helps users navigate the complexities of online submissions. From filling out the form to electronic signing and secure submission, pdfFiller streamlines the entire process, making it easier for organizations to fulfill their filing responsibilities.

Important deadlines and renewal reminders

Staying aware of key filing dates for nonprofits is crucial to ensure compliance with IRS requirements. Generally, Form 990 and its accompanying schedules, including Schedule O, are due on the 15th day of the 5th month after the close of the organization’s fiscal year. Organizations seeking extensions must file Form 8868, which grants an additional six months for submission.

Beyond mere filing deadlines, nonprofits should also remember to stay updated with any changes in regulations or deadlines due to shifting IRS policies. Timeliness and compliance not only avoid penalties but also enhance an organization's credibility with stakeholders.

Maximizing your filing experience with pdfFiller

Cultivating an efficient workflow for document management using pdfFiller can significantly enhance your scheduling experience. With its cloud-based platform, team members can collaborate in real-time, editing documents as needed before they are finalized. Managing and storing documents securely in the cloud ensures that your organization’s data is both accessible and safe from loss.

Additional features such as eSigning and sharing options facilitate smoother communication within teams. These tools allow users to gather required approvals quickly while remaining organized throughout the entire filing process. By leveraging pdfFiller effectively, nonprofits can streamline their filing experiences, making compliance less burdensome.

Recent updates and changes to Schedule O guidelines

Maintaining compliance with the latest IRS guidelines is essential for filing Schedule O. Recent updates may involve changes in reporting requirements or additional disclosures that organizations need to address. For example, adjustments in effective dates or instructions tweaking how data should be reported are common; therefore, failing to stay informed could lead to misfilings.

Adapting to these changes often requires revisiting previous filing practices. Organizations should regularly consult IRS releases or subscribe to relevant newsletters to ensure they remain aware of any new compliance standards. By being proactive, nonprofits can cushion against potential pitfalls stemming from these updates.

Exploring related forms and schedules

Understanding related forms such as Form 990 and Form 990-EZ is essential, as they are directly connected to Schedule O. These forms contain the core financial data necessary for submitting Schedule O, emphasizing the importance of accuracy across all filed documents. Other related schedules—like Schedule A, which pertains to public charity status, and Schedule B, which details contributions—can also impact how Schedule O is completed.

Awareness of other schedules allows nonprofits to prepare comprehensive filings without missing critical information. Utilizing pdfFiller can assist organizations in accessing these forms easily, ensuring they file everything accurately and timely. Links to additional resources for these forms can provide direct access to key documentation, aiding nonprofits in comprehensive reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit schedule o in Chrome?

Can I create an eSignature for the schedule o in Gmail?

How can I edit schedule o on a smartphone?

What is schedule o?

Who is required to file schedule o?

How to fill out schedule o?

What is the purpose of schedule o?

What information must be reported on schedule o?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.