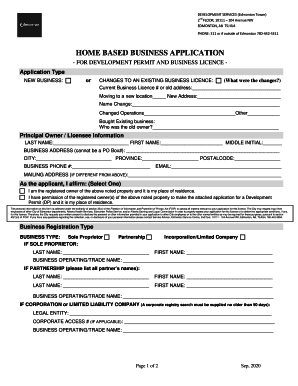

Get the free form 8971

Get, Create, Make and Sign irs form 8971 instructions

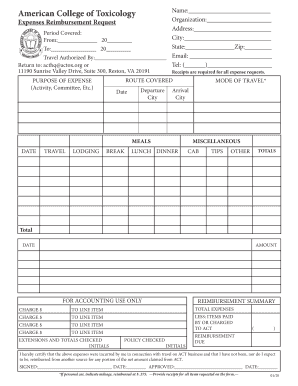

Editing form 8971 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8971

How to fill out schedule a form 8971

Who needs schedule a form 8971?

Scheduling a Form 8971: A Comprehensive How-To Guide

Understanding Form 8971: An Overview

Form 8971, officially known as the 'Information Regarding Beneficiaries Acquiring Property From a Decedent,' plays a critical role in estate tax reporting. It's essential for executors and administrators managing an estate to accurately report the values of assets inherited by beneficiaries. This information helps ensure compliance with IRS regulations and protects beneficiaries from future tax liabilities.

Key components of Form 8971 are detailed, including the gross estate value and any deductions that may apply. These details not only provide clarity regarding the estate's total worth but also delineate the permissible deductions that can minimize tax burdens.

Generally, individuals responsible for filing an estate tax return, such as the executor or administrator, must fill out Form 8971. It’s obliged for estates exceeding certain valuation thresholds, solidifying its necessity in the estate settlement process.

The importance of timely submission

Timely submission of Form 8971 is vital to avoiding complications in tax reporting. The due date for filing is typically nine months after the date of death, though an extension to file Form 706 can be requested. An estate that fails to file on time might incur significant penalties, including fines and additional interest on taxes owed.

Late filing can complicate the estate settlement process, leading to potential disputes among beneficiaries, as well as issues with the IRS. By adhering to the deadlines, executors not only protect the estate's interests but also ensure a smoother transition of assets to the rightful heirs.

How to obtain Form 8971

Accessing Form 8971 is straightforward. The form can be downloaded directly from the IRS website or through various professional tax software. Ensure you're obtaining the most current version of the form to avoid any issues related to outdated forms.

Any changes or updates to Form 8971 can be tracked by regularly visiting the IRS website or consulting with tax professionals. Staying informed about revisions ensures you remain compliant and well-prepared to fulfill your obligations.

Step-by-step guide to filling out Form 8971

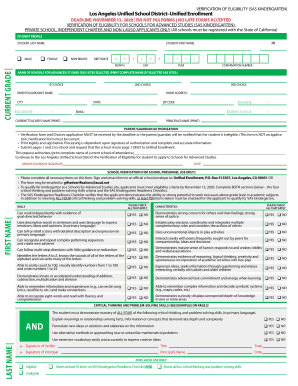

The completion of Form 8971 is structured in clear sections that guide you throughout. In Section 1, you'll need to provide taxpayer information, primarily detailing the executor's name and contact information. This ensures that the IRS can communicate efficiently with the responsible party.

Section 2 requires vital details about the decedent, including their name, date of death, and Social Security number. This information is crucial for identifying the estate’s tax obligations.

In Section 3, report the estate's total value, ensuring you include all pertinent assets. Section 4 addresses deductions and credits, where you will detail any relevant deductions, such as debts and administrative expenses. Finally, in Section 5, both the executor and preparing tax professional must sign and declare the submitted information is true and correct.

Common mistakes to avoid

One major pitfall when filing Form 8971 is misreporting values. Be meticulous in documenting the value of each asset to avoid disputes and penalties from the IRS.

Another common error is submitting incomplete information. Double-check that all required fields are filled out accurately to prevent processing delays. Providing a complete picture not only ensures compliance but also expedites the estate settlement process.

Tools and features at pdfFiller for managing Form 8971

pdfFiller offers a myriad of tools that simplify the task of managing Form 8971. With interactive document editing options, users can seamlessly fill out the form, modify content, and make any necessary adjustments quickly.

Additionally, pdfFiller's e-signature capabilities guarantee legal compliance with e-signature laws, giving users peace of mind that their submissions are secure. Collaboration features within pdfFiller enable teams to work together efficiently, ensuring everyone can review the document and provide input before finalizing the form.

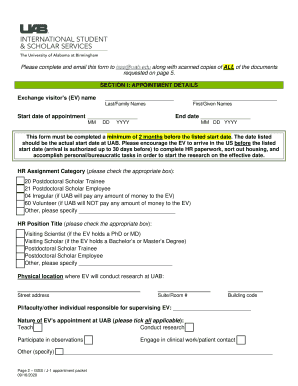

Managing and storing Form 8971 using pdfFiller

The digital age necessitates effective document management. pdfFiller allows for the organization of your documents in the cloud, making Form 8971 easily accessible whenever needed. This flexibility ensures that both executors and beneficiaries can retrieve the form promptly during critical times.

In terms of secure management practices, pdfFiller utilizes top-level encryption and security protocols to safeguard sensitive estate documentation from unauthorized access. Best practices for secure document management include regularly updating passwords and utilizing two-factor authentication.

Keeping up-to-date with Form 8971 regulations

Continuously monitoring changes in Form 8971 regulations is essential for compliance. One effective approach is subscribing to the IRS newsletters or updates, which provide timely information regarding any revisions. Consulting resources like tax preparation services can also keep you informed on significant regulatory changes.

Professional tax consultants can offer necessary insights and tailored advice specific to your estate’s needs. Engaging with a tax professional helps clarify complexities surrounding estate tax matters and ensures you’re not missing critical updates.

Related forms and documentation

Form 8971 is often filed in conjunction with other estate tax forms, such as Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return. Understanding when to file additional documentation is crucial; for instance, supporting statements may be necessary if certain deductions or asset valuations are disputed.

In some instances, Form 8971 may also need to be accompanied by documents illustrating the estate’s financial circumstances, including appraisals for real property or business interests. Maintaining a comprehensive filing strategy enhances submission accuracy and IRS compliance.

Frequently asked questions (FAQs)

Common inquiries regarding Form 8971 usually revolve around filing requirements and deadlines. Many want to know if filing is obligatory for all estates — the answer is no; it only applies to estates with values exceeding certain thresholds established by the IRS.

Another frequent concern is the implications of late filing. Executors often seek clarification on penalties and could inquire about options for extending filing deadlines. Engaging with tax professionals or the IRS directly can provide comprehensive answers to these pressing concerns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the form 8971 electronically in Chrome?

Can I create an electronic signature for signing my form 8971 in Gmail?

Can I edit form 8971 on an iOS device?

What is schedule a form 8971?

Who is required to file schedule a form 8971?

How to fill out schedule a form 8971?

What is the purpose of schedule a form 8971?

What information must be reported on schedule a form 8971?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.