Get the free Schedule I

Get, Create, Make and Sign schedule i

Editing schedule i online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule i

How to fill out schedule i

Who needs schedule i?

Schedule Form - How-to Guide

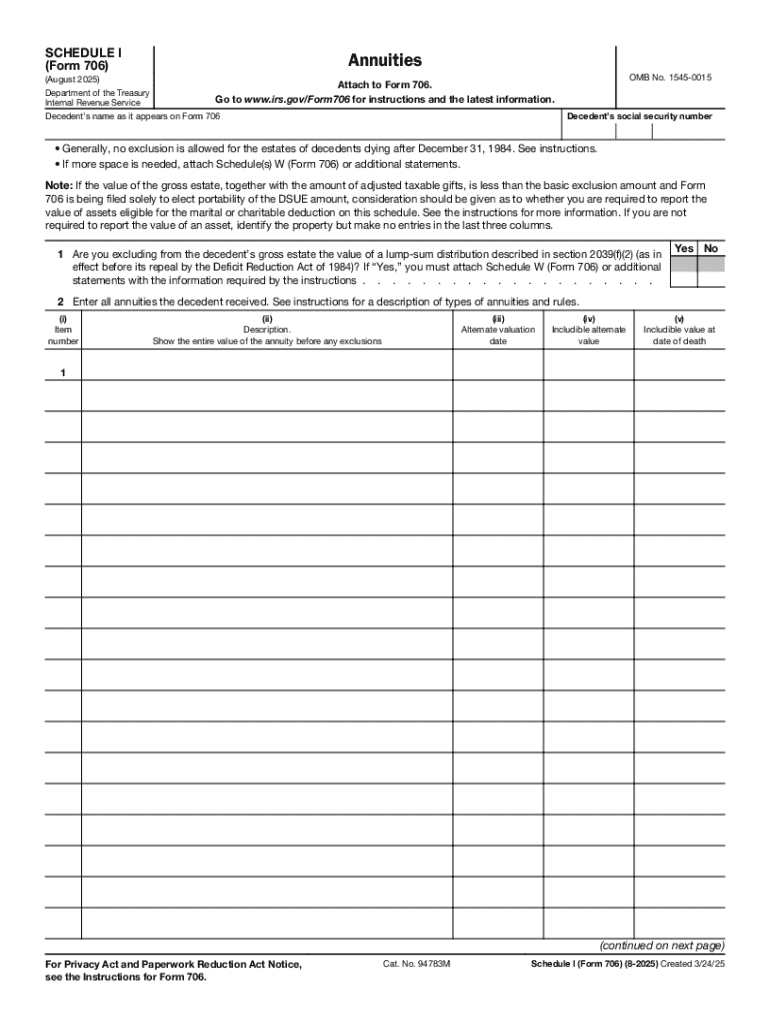

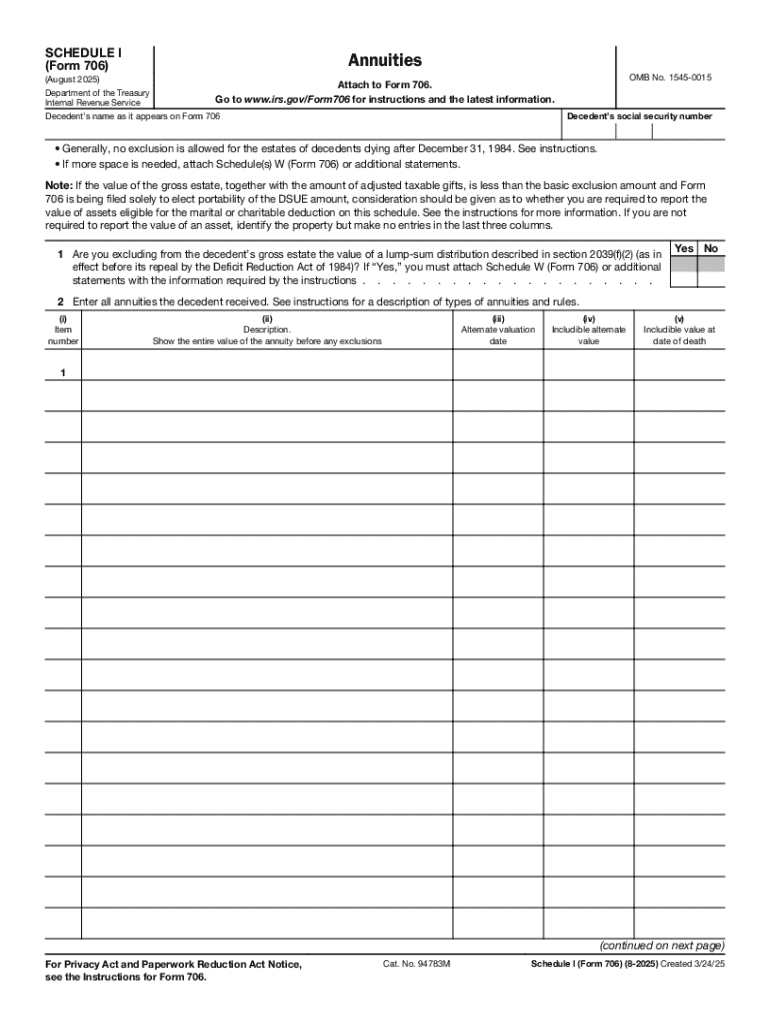

Understanding the Schedule Form

The Schedule I Form is a crucial document in the tax filing process, serving as an indispensable resource for taxpayers seeking to detail specific income and deductions. It allows you to report various forms of income or adjustments to income that affect your overall tax liability. Understanding this form is essential for ensuring compliance with tax obligations and optimizing your return.

Importance cannot be overstated, as the Schedule I Form plays a vital role in adjusting your overall taxable income. By including various sources of income and claiming deductions, this form impacts your refund or amount owed to the IRS for any given year. The necessity of filing this form is particularly pronounced for certain categories of taxpayers, making awareness and comprehension vital.

Key components of the Schedule Form

The Schedule I Form consists of several key components that taxpayers must understand to fill it out correctly. The sections are designed to categorize various aspects of your income and applicable deductions, providing a clear format for efficient reporting. Familiarity with these sections is critical for optimizing your tax return.

The main sections of the Schedule I Form include personal information, income reporting, and deductions and credits. Each section has its unique requirements and nuances that need to be adhered to when completing the form. Understanding the terminology used in the form will also assist in providing accurate information, ensuring compliance, and maximizing your return.

Detailed instructions for completing the Schedule Form

Accurately completing the Schedule I Form requires careful attention to detail and thoroughness. Start by gathering all necessary information and documentation that supports your income and deductions, as organized records make it easier to fill out the form accurately and effectively.

Begin with the personal information section, where clarity is crucial; provide your full name, Social Security Number, and confirm your filing status. Next, report your income in the income reporting section. Be meticulous in entering all forms of income, ensuring that each source is clearly delineated to avoid discrepancies.

Identifying and documenting deductions can significantly affect your taxable income. Common deductions include student loan interest, tuition, and certain business expenses if self-employed. It's essential to refer to IRS guidelines or a qualified tax professional to maximize these deductions properly.

To avoid common errors, it is advisable to double-check each section. Cross-reference reported figures with your supporting documents to ensure accuracy. Misrepresentations or errors can lead to delays or complications with your overall tax situation.

Interactive tools for Schedule Form management

Leveraging technology can simplify the process of completing your Schedule I Form. A tool like pdfFiller provides a robust platform for digital completion, allowing for ease of editing and adjustments as needed. Its user-friendly interface enables you to fill out the form efficiently, promoting a streamlined approach.

Additionally, pdfFiller offers features that facilitate collaboration, enabling you to work alongside teams on necessary documentation. When it comes to validating the Schedule I Form, employing eSignature tools provided by pdfFiller ensures that your submission is legally binding, providing peace of mind throughout the entire process.

Tips for filing the Schedule Form

To ensure that your Schedule I Form is filed timely and accurately, practicing best filing practices becomes essential. Begin by understanding the deadlines associated with the form submission and staying informed about any updates or changes from the IRS for the current tax year. Early preparation and filing can help minimize stress and allow time for any unforeseen issues.

Common filing mistakes include inaccurate reporting, misplacement of documentation, and overlooking deductions. Make it a point to keep supporting documents organized in a dedicated folder, making them easily accessible when required. If errors are identified post-submission, be prepared to amend the Schedule I Form. Understanding the amendment process ahead of time can save both time and resources.

Frequently asked questions (FAQs) about the Schedule Form

While many taxpayers have a basic understanding of the Schedule I Form, various myths and misconceptions still linger. For instance, some believe only specific groups need to file this form, when in fact, anyone with qualifying income sources or deductions may need it. Clarifying the regulations and understanding who is required to file helps clear up these misunderstandings.

Understanding filing deadlines also alleviates confusion surrounding Schedule I submission. The IRS typically announces deadlines early, and staying updated with these changes can prevent last-minute panic for many taxpayers. Accessing resources for further questions can also direct individuals toward more personalized assistance or insight.

Managing your documents post-submission

Once you’ve submitted your Schedule I Form, it’s essential to ensure the secure storage and organization of your documents. Keeping a digital and physical copy will provide peace of mind and easy access if required for any future references or audits. Utilizing pdfFiller aids in organizing these important documents, enabling you to store everything neatly in one cloud-based location.

Moreover, leveraging pdfFiller’s document management tools allows teams to collaborate seamlessly on documents, ensuring everyone involved is in the loop and can access the required information easily. This not only improves efficiency but also enhances communication when managing tax-related documents collectively.

Additional considerations

Understanding the impact of the Schedule I Form on your overall tax strategy is vital for effective financial planning. It helps you discover various avenues for potential savings and adjustments, which can influence your long-term financial goals. Considering the myriad of details required for completion, reviewing the effects of your income and deductions will aid in crafting a robust tax strategy.

Consulting a tax professional is sensible when dealing with complexities or if you're unsure about certain entries on the Schedule I Form. Experts can provide invaluable insights for personalized financial strategies. Additionally, staying informed on changes to the Schedule I Form for future tax years will ensure you remain compliant and reap benefits from updated deductions or credits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in schedule i without leaving Chrome?

Can I edit schedule i on an iOS device?

How can I fill out schedule i on an iOS device?

What is schedule i?

Who is required to file schedule i?

How to fill out schedule i?

What is the purpose of schedule i?

What information must be reported on schedule i?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.