Get the free Schedule L (form 706)

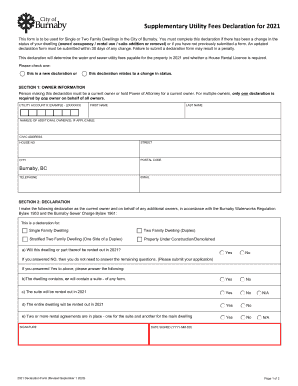

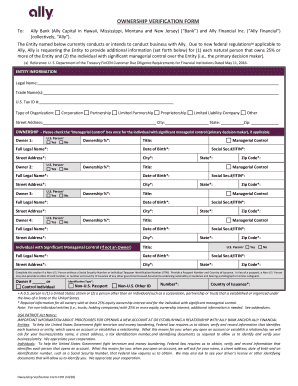

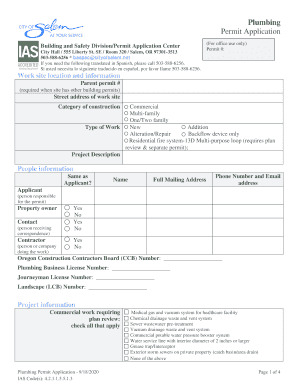

Get, Create, Make and Sign schedule l form 706

How to edit schedule l form 706 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule l form 706

How to fill out schedule l form 706

Who needs schedule l form 706?

A Comprehensive Guide to Schedule Form 706

Understanding the Schedule Form 706

Schedule L of Form 706 is a crucial component of the United States estate tax return. It is specifically designed for reporting the value of the gross estate. By itemizing various types of assets, it aids in ensuring accurate tax calculations. The estate tax is applied to the transfer of an individual's assets upon their death, making the accuracy of this form essential in determining the tax due.

The significance of Schedule L lies not just in its function, but also in its influence on overall estate tax returns. Inaccuracies can lead to potential penalties, audits, or even costly litigation. Hence, understanding the intricacies of this form is vital not only for estate executors but also for beneficiaries involved in the estate settlement process.

Form 706 itself encompasses several schedules, but Schedule L stands out due to its specific focus on jointly owned properties and their valuations. This insight into the gross estate prepares individuals for comprehensive reporting and tax compliance.

Who needs to file Schedule Form 706?

Understanding eligibility is key when it comes to filing Schedule L Form 706. Generally, any estate that exceeds the estate tax exemption threshold requires the filing of an estate tax return, which includes Schedule L. As of 2023, the federal estate tax exemption stands at approximately $13 million per individual, subject to adjustments for inflation.

Scenarios necessitating the inclusion of Schedule L may vary widely, but typically include estates with jointly owned property or assets with significant valuation discrepancies. It is crucial to include this schedule even if it's tempting to bypass it, as the IRS requires a complete and accurate presentation of assets.

Common mistakes include failing to report jointly owned property, underestimating asset values, or misinterpreting tax credits and deductions. It is essential to consult a tax professional who can guide you through these common pitfalls.

Key components of the Schedule Form 706

Understanding the key components of Schedule L Form 706 is essential for accurate completion. This form includes fields primarily dedicated to the valuation of the gross estate, relating to both the direct assets owned by the deceased and those held jointly with others.

The valuation of the gross estate signifies the total market value of all assets owned by the decedent at the time of death. Typically, this includes real estate, personal property, and financial assets. Deductions, such as debts owed by the deceased or estate expenses, can reduce the gross estate value, thereby impacting the taxable estate.

Accurate valuation is crucial for compliance and to avoid legal consequences. Special cases, like jointly owned property, require careful assessment as they may have different tax implications depending on ownership percentages.

Step-by-step guide to filling out Schedule Form 706

Filling out Schedule L Form 706 can initially seem overwhelming, but breaking it down into manageable steps makes the process straightforward and efficient.

During each step, it’s important to pay close attention to detail. Particularly in step two, a qualified appraiser can significantly affect the reported value of estate assets, potentially lowering tax liabilities. Always document all valuations and appraisals to ensure clarity during the filing process.

Using pdfFiller to manage your Schedule Form 706

pdfFiller offers a robust solution for individuals looking to manage their Schedule L Form 706 efficiently. By streamlining document handling, pdfFiller enhances the filing experience, making it more accessible.

Users can access and edit the form online from anywhere, ensuring that they have the flexibility needed to get the job done. Collaborative features allow for seamless involvement from multiple parties, which is particularly beneficial when dealing with shared estates and joint ownership.

Common questions and answers about Schedule Form 706

Frequently asked questions about Schedule L Form 706 often focus on common pitfalls. For instance, what to do if you make a mistake on the form? The best course is to consult the IRS instructions and, if necessary, file an amended return.

Handling complex estates can also raise questions. If your estate involves multiple types of assets, consider consulting an estate planning professional or tax advisor to navigate complexities effectively.

Understanding these common questions will help preparers stay ahead of any potential issues, making the submission process smoother and more transparent.

Tips for a smooth filing process

Filing deadlines are a crucial aspect of the tax return process. Estate tax returns are due nine months after the decedent's date of death; extensions can be obtained if you're facing complex situations. Knowing this timeline will help you stay compliant.

Engaging with tax professionals can elevate the quality of your filing and ensure compliance with IRS regulations. Their insights can be invaluable when dealing with extensive estates or intricate deductions.

Real-life scenarios and case studies

Examining real-life case studies can offer insight into the nuances of filing Schedule L Form 706. For example, a small estate with minimal real estate holdings might only require basic considerations for Schedule L, but a high-value estate involving multiple properties and significant investments demands meticulous attention to detail.

In a tactical approach for high-value estates, solid documentation and diverse asset valuation come into play to accurately report and minimize potential tax liabilities. Such cases highlight the importance of foresight in estate planning.

Further assistance and support

For those in need of additional support while filling out Schedule L Form 706, pdfFiller offers customer service options tailored to your queries. With its intuitive platform, assistance is readily available, making the filing experience less daunting.

Additionally, pdfFiller allows further personalization and customization options within their document management system, helping users craft their forms to meet specific needs.

The value of efficient document management

Effective document management goes beyond just Schedule L Form 706 at pdfFiller. It empowers users to keep track of all related paperwork, ensuring nothing is overlooked during the estate planning and tax filing process.

Managing assets involves aligning convenience, compliance, and collaboration. pdfFiller serves as a centralized resource for users, providing tools not only for completing forms but also for maintaining an organized workflow that is essential during estate settlements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify schedule l form 706 without leaving Google Drive?

How can I send schedule l form 706 to be eSigned by others?

How do I fill out schedule l form 706 using my mobile device?

What is schedule l form 706?

Who is required to file schedule l form 706?

How to fill out schedule l form 706?

What is the purpose of schedule l form 706?

What information must be reported on schedule l form 706?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.