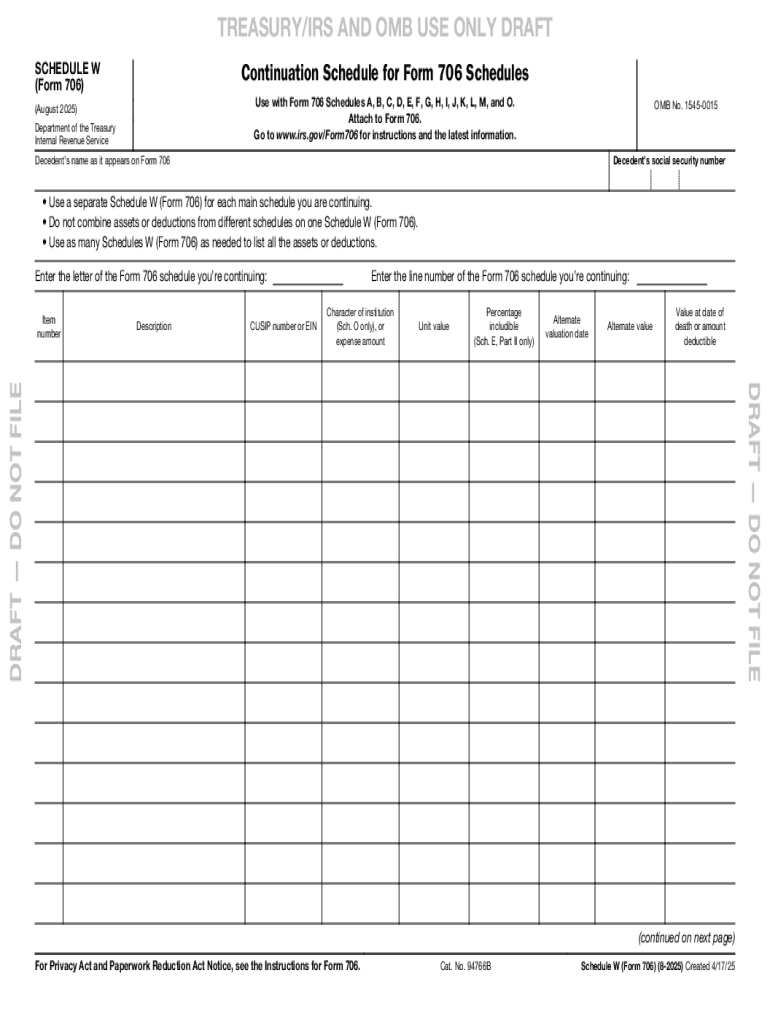

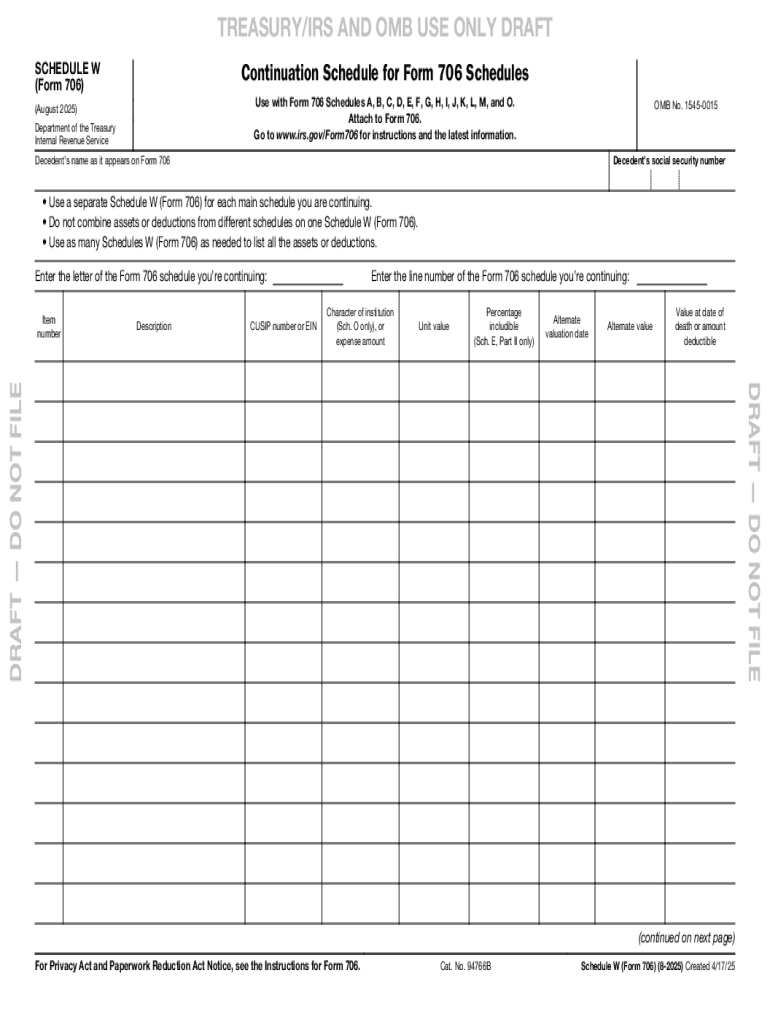

Get the free Schedule W (form 706)

Get, Create, Make and Sign schedule w form 706

Editing schedule w form 706 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule w form 706

How to fill out schedule w form 706

Who needs schedule w form 706?

Understanding Schedule W Form 706: A Comprehensive Guide

Understanding Schedule W Form 706

Schedule W Form 706 is a crucial document in the estate tax filing process, designed specifically for reporting specific debts and expenses that can be deducted from a decedent’s gross estate. Understanding this form is essential for anyone navigating the complexities of estate tax obligations, as it directly impacts the overall estate tax calculations.

The primary purpose of Schedule W is to detail any outstanding debts, administrative expenses, and other costs that could reduce the gross value of the estate. Properly accounting for these can result in significant savings on estate tax liabilities.

Overview of the estate tax landscape

Estate taxes are levied on the transfer of property upon a person’s death. These taxes are based on the overall value of the estate, including cash, real estate, and personal property. In 2023, the federal estate tax exemption is set at $12.92 million for individuals, meaning estates valued below this threshold generally do not incur estate taxes, unless state laws dictate otherwise.

Form 706 is the standard form used to report the value of an estate for tax purposes. Many individuals mistakenly believe it's only relevant for large estates, but even estates that fall below the exemption limit must file under certain conditions, such as claiming portability for a surviving spouse.

Step-by-step guide to filling out Schedule W Form 706

Before diving into the form, gather the required information. This includes a detailed list of debts, expenses, and any information related to the decedent’s estate. Good organization of these documents can save time and ensure accuracy.

Begin with Part 1, which captures the decedent’s information—including their name, Social Security number, and date of death. Accuracy here is critical as errors can lead to processing delays.

Part 2 focuses on assets and liabilities. Ensure that all assets are accurately valued at their fair market value at the date of death. Include all applicable debts that could potentially affect the estate's gross value.

Lastly, Part 3 deals with debts and additional considerations. Include all outstanding debts that legally impact the estate's value. This may include loans, mortgage balances, and credit card debts. Be meticulous with documentation here to substantiate each claim.

Interactive tools for completing Schedule W Form 706

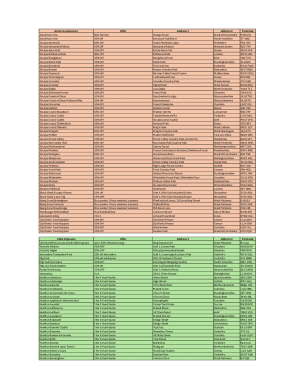

Using online tools like pdfFiller can make the process of filing Schedule W much simpler. The platform offers cumulative calculators which can assist in estimating potential tax obligations based on the provided estate information.

In addition to calculators, pdfFiller's eSignature features allow users to digitally sign the completed forms, making it easier to send documents to relevant parties without the hassle of printing and scanning. This can facilitate collaboration among beneficiaries and advisors, helping streamline the process.

Managing your estate tax documents with pdfFiller

pdfFiller's cloud-based platform provides numerous advantages for managing estate tax documents. Users can store, edit, and share Schedule W Form 706 with ease. Furthermore, the platform ensures that important documents remain secure and accessible at all times.

Utilizing pdfFiller also simplifies the process of collaborating with lawyers and financial advisors. Users can grant access, share information securely, and track changes, which is especially beneficial during complex estate planning discussions.

FAQs about Schedule W Form 706

Many common questions arise regarding Schedule W Form 706. Primarily, users often ask about the types of debts that can be included. Generally, any unpaid debts at the time of death can be reported, provided they are valid and documented.

Another frequent query relates to filing deadlines and possible extensions. The standard deadline for filing Form 706, including Schedule W, is within nine months of the decedent's date of death. Extensions can be requested to extend this time frame, although interest may still accrue on any unpaid taxes.

Additional considerations for estate planning

Comprehensive estate planning is vital to ensuring that a person's last wishes are fulfilled according to their intentions. Schedule W is just one piece of the puzzle, and other associated forms should be considered, including Form 706 and others that outline various components of the estate.

In cases with substantial complexities such as multiple property types or complicated family structures, consulting with professionals is advisable. Tax professionals or estate planners can provide invaluable insights and assistance, ensuring compliance with the law while optimizing the estate planning process.

Keeping updated with tax regulations

Estate tax laws are subject to changes, making it crucial for individuals and teams involved in estate planning to stay informed. Resources such as IRS publications, tax advisory websites, and professional networks can provide updates regarding any legislative changes that may affect estate tax filing requirements.

Using tools like pdfFiller not only streamlines the document management process, but it also ensures that users have access to the latest versions of forms and templates, keeping their estate planning efforts compliant and up to date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in schedule w form 706 without leaving Chrome?

How can I edit schedule w form 706 on a smartphone?

Can I edit schedule w form 706 on an Android device?

What is schedule w form 706?

Who is required to file schedule w form 706?

How to fill out schedule w form 706?

What is the purpose of schedule w form 706?

What information must be reported on schedule w form 706?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.