Get the free Mutual Fund

Get, Create, Make and Sign mutual fund

Editing mutual fund online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual fund

How to fill out mutual fund

Who needs mutual fund?

A Comprehensive Guide to Mutual Fund Forms

Understanding mutual fund forms

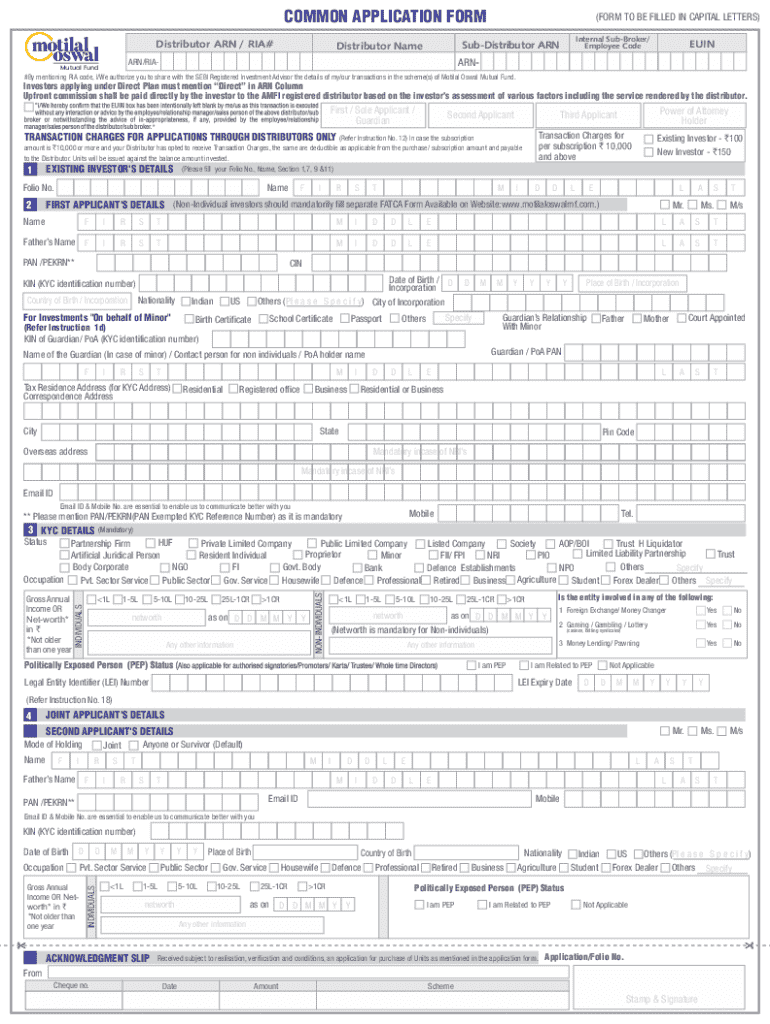

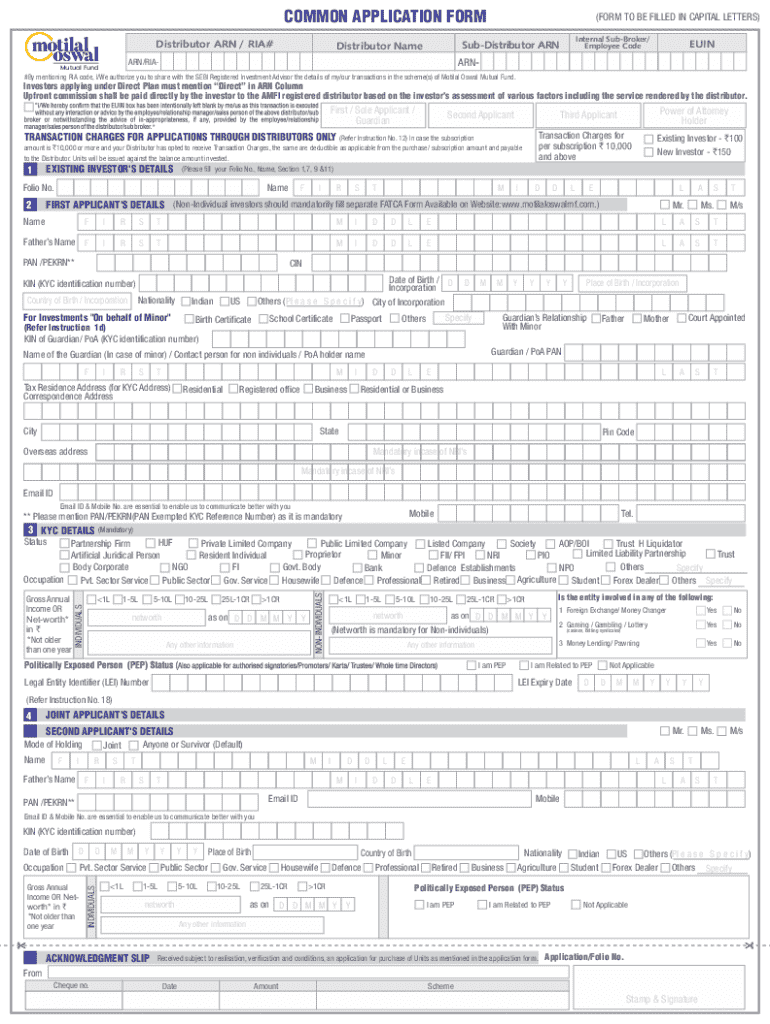

Mutual fund forms are essential documents that facilitate various transactions in mutual fund investments. These forms serve as the primary interface between investors and mutual fund companies, enabling the management of investment accounts efficiently. Proper completion of these forms is crucial; any inaccuracies can lead to delays in transactions or even unintended financial consequences.

Beyond their administrative function, mutual fund forms also play a significant role in ensuring compliance with financial regulations. They require a variety of essential details to streamline processes, determine eligibility, and maintain accurate records. Investors who meticulously fill out these forms are often rewarded with a smoother investment journey that maximizes their potential for success.

Types of mutual fund forms

Key components of a mutual fund form

Each mutual fund form is structured into specific sections that collect necessary information. Understanding these components can vastly improve the accuracy of your submissions. One of the first sections you'll encounter is the personal information section, which requests key details such as your full name, address, and Social Security Number. These details are critical for identity verification and account setup.

Following personal information, the investment details section requires you to specify the type of investment you wish to make, the amount of money to invest, and your preferred payment method. Accuracy in this section is vital as it influences your investment allocation. Another substantial component is the beneficiary designation section; this area allows you to name individuals who will inherit your investments in the event of your passing. Properly designating beneficiaries helps avoid potential disputes and ensures a seamless transfer of assets.

Step-by-step guide to filling out mutual fund forms

Completing a mutual fund form can initially seem daunting, but a step-by-step approach can simplify the process. Start by preparing your information. Gather necessary documentation, including identification, financial statements, and your Social Security Number. Having these documents at hand will ensure you can fill out each section accurately and swiftly.

Next, consider whether you’ll fill out the form online or on paper. Online submissions, especially using a platform like pdfFiller, provide various advantages, such as easy editing, saving progress, and accessing forms from anywhere. Each section of the form usually has specific instructions, so read through them carefully to understand what is required. Common pitfalls include omitting signatures or failing to double-check information before submission; always proofread to ensure accuracy.

Editing and customizing mutual fund forms with pdfFiller

Utilizing pdfFiller for mutual fund forms opens up a range of interactive tools that enhance your document management experience. The platform allows users to edit existing forms intuitively, adapting them to fit specific needs. With drag-and-drop features and a user-friendly interface, making necessary adjustments is a breeze.

In addition to editing capabilities, pdfFiller supports the integration of electronic signatures. This feature streamlines the submission process as it eliminates the need for printing or mailing forms. Simply fill out your form, eSign it, and submit it directly through the platform. Furthermore, pdfFiller encourages collaboration by allowing users to share forms with team members for feedback and additional input, which is especially beneficial for teams managing joint accounts.

Managing your completed mutual fund forms

After successfully submitting your mutual fund forms, it is essential to manage these documents effectively. First and foremost, consider storing your documents securely in a cloud-based solution. This not only enhances accessibility but also ensures that sensitive information is protected against unauthorized access. Secure storage options help maintain a long-term record of your investment documents.

Tracking your investment forms is another critical aspect. Keeping a log of submitted forms and monitoring their status will enable you to stay organized and informed. If you need to make changes post-submission, be aware that it varies by fund company; generally, you'll need to contact customer service or access your online investment account to amend any submitted forms. This proactive approach can help alleviate any potential issues.

Common FAQs about mutual fund forms

Investors often have questions when dealing with mutual fund forms. One of the most common issues involves mistakes during completion. Common pitfalls include incorrect personal information, missing signatures, or failing to provide requisite documentation. Avoid these errors by reviewing your form multiple times before submission.

Should your form be rejected, it is crucial to act quickly. Contact your mutual fund company immediately to understand the reasons for rejection and what steps to rectify the errors. Additionally, if you require assistance, pdfFiller’s customer service is available to help with form completion queries, ensuring investors have dependable support during their investment journey.

Benefits of using pdfFiller for mutual fund forms

The utilization of pdfFiller for managing mutual fund forms equips users with several transformative advantages. First, the cloud-based solution allows seamless document management from anywhere, ensuring that users have their forms accessible on-the-go. This is particularly advantageous for individuals balancing multiple investments or managing finances while traveling.

Secondly, pdfFiller enhances collaboration features. Whether you're part of a financial team or managing joint accounts with family members, the ability to share forms and gather input from different stakeholders can streamline the decision-making process. Lastly, pdfFiller prioritizes security and compliance, maintaining high standards to protect user information, which helps cultivate trust when handling sensitive investment data.

Additional tools and resources for mutual fund investors

To further assist mutual fund investors, pdfFiller provides a suite of investment planning tools. These resources help users to strategize their investment decisions effectively. From performance trackers to projection calculators, these tools enable informed decision-making by forecasting potential investment outcomes based on input data.

Moreover, pdfFiller offers comprehensive guides on using various calculators designed specifically for investment projections. These calculators can provide insights into potential growth rates and assist investors in determining suitable investment amounts. Lastly, users are encouraged to utilize pdfFiller’s knowledge center, which houses articles educating on mutual fund basics and advanced investment strategies, ensuring that you remain well-informed.

Engaging with your investment

After your investments are initiated, regularly reviewing your portfolio becomes fundamental. Conducting thorough portfolio analysis allows investors to assess their performance and make necessary adjustments based on market conditions and personal financial goals. Keep a close watch on your investment records, understanding when to rebalance or modify your holdings.

Being informed about market trends is equally vital. Staying updated on regulatory changes concerning mutual funds ensures that you remain compliant and ready to capitalize on new opportunities as they arise. Engaging consistently with your investments establishes a proactive financial strategy that can improve outcomes in the long run.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mutual fund in Gmail?

How do I make changes in mutual fund?

How do I fill out the mutual fund form on my smartphone?

What is mutual fund?

Who is required to file mutual fund?

How to fill out mutual fund?

What is the purpose of mutual fund?

What information must be reported on mutual fund?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.