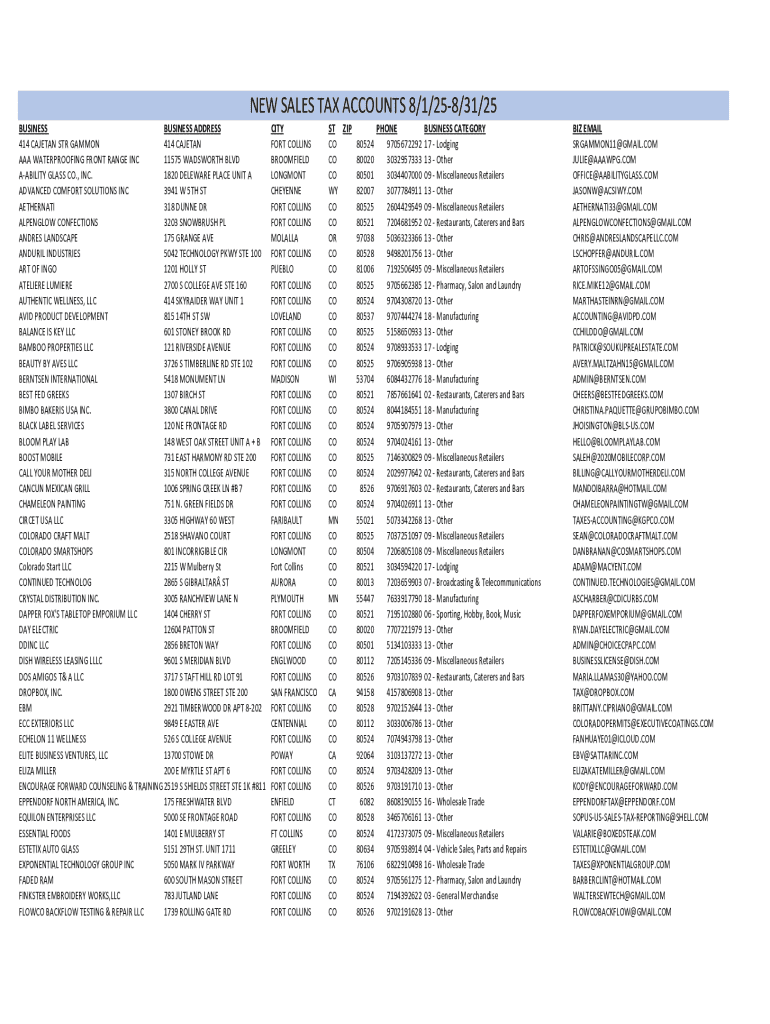

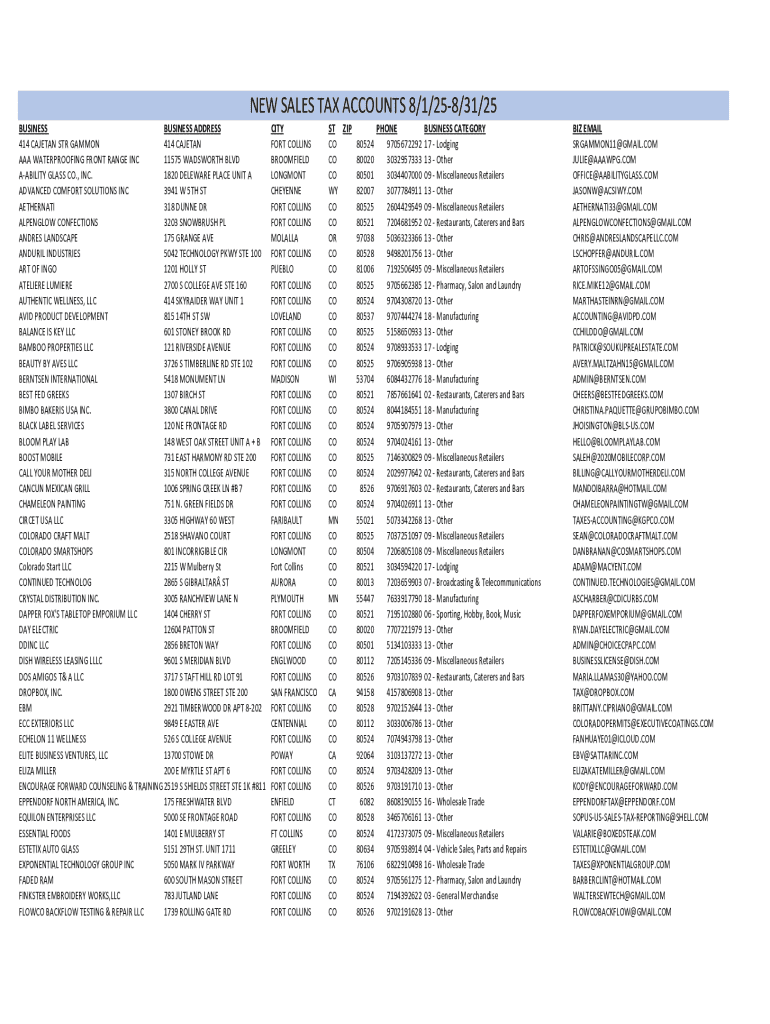

Get the free New Sales Tax Accounts 8/1/25-8/31/25

Get, Create, Make and Sign new sales tax accounts

How to edit new sales tax accounts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new sales tax accounts

How to fill out new sales tax accounts

Who needs new sales tax accounts?

Comprehensive Guide to the New Sales Tax Accounts Form

Understanding sales tax accounts

A sales tax account is a designated account that allows businesses to collect and remit sales tax to the state or local government. This account is crucial for any business that sells goods or services subject to sales tax, as it ensures compliance with state tax laws.

Having a sales tax account helps businesses manage their sales tax obligations effectively. Failure to maintain a proper sales tax account can lead to significant penalties and interest on unpaid taxes, negatively impacting a business’s financial health.

Who needs to file a new sales tax account form?

Businesses that sell taxable goods or services are typically required to file a new sales tax account form. This includes retail shops, service providers, and even online businesses that meet specific sales thresholds.

Various business types require sales tax registration, including corporations, partnerships, and sole proprietorships. It's essential to understand local laws as they vary significantly by state.

Preparing to register: essential information required

Before filing the new sales tax account form, gather essential information. This includes your business’s identifying details like the Employer Identification Number (EIN) and the legal name registered with the state.

You'll also need to provide your business's address and contact information. A detailed description of the goods and services sold, along with an estimation of your monthly sales tax liability, is crucial for accurate tax assessment.

Step-by-step guide to completing the new sales tax accounts form

Accessing the new sales tax accounts form

You can find the new sales tax accounts form on the pdfFiller website, where a user-friendly interface guides you through filling out the necessary fields. Additionally, you can obtain the form by downloading it as a PDF or through online eForms.

Detailed instructions for filling out each section

Each section of the new sales tax accounts form has specific requirements:

Common mistakes to avoid

Common errors when completing the new sales tax accounts form include selecting the incorrect business structure, not providing all required documentation, and failure to sign the form. Carefully reviewing each section before submission can prevent these issues.

Submitting the new sales tax account form

Once completed, submit the new sales tax account form through various methods: online submissions are often the fastest, but traditional mail or in-person delivery to your local tax authority are options as well.

Depending on your state, you may need to pay registration fees upon submission. After submitting, ensure you save confirmation documents and track communication from your tax authority to understand the next steps in the registration process.

Managing your sales tax account after registration

Once your sales tax account is established, it's crucial to manage it effectively. Access your account online through your state's tax authority portal, where you can update your business information if necessary.

Staying informed about local notices and compliance requirements is essential for avoiding penalties. Regularly check for updates from your tax authority to ensure your sales tax account remains in good standing.

Filing sales tax returns: ongoing responsibilities

Filing sales tax returns is an ongoing responsibility for businesses with sales tax accounts. Depending on your state, returns may be due monthly, quarterly, or annually. Understanding your filing frequency is essential to avoid penalties.

Using tools like pdfFiller can simplify the filing process. The platform provides step-by-step guidance to fill out your returns accurately and on time, helping you stay compliant with state laws.

Frequently asked questions (FAQs)

Many businesses encounter similar questions regarding sales tax accounts. One common question is about selling only exempt items. If you are exclusively selling exempt items, you may not need a sales tax account, but it's wise to verify with state tax authorities.

Another frequent inquiry involves the cancellation of a sales tax account. If you no longer sell taxable products, you can formally close your account by submitting a cancellation request to your state's tax authority.

Additional tips for managing your sales tax obligations

To streamline your sales tax obligations, consider setting reminders for due dates. Utilize calendar alerts or task management tools to ensure timely payments and filings.

Automating your filing process through pdfFiller and other digital solutions can save you time. Explore resources specific to your state for the latest information on tax laws and compliance requirements.

Consultation and support services

Consider seeking professional advice when navigating complex tax matters or if your business grows. Tax consultants can provide tailored guidance and help you optimize your sales tax strategy.

For direct assistance with filing the new sales tax account form or addressing specific queries, pdfFiller offers support services. Users can access community forums and webinars to gain insights from tax experts.

Interactive tools and resources

Engage with interactive tools available on pdfFiller to enhance your experience with the new sales tax accounts form. Utilize the interactive form completion tool, ensuring you're guided through every necessary detail.

In addition, make use of the sales tax calculator to estimate your potential liabilities and understand the impact on your business finances. Explore additional learning modules that provide in-depth knowledge surrounding state-specific sales tax regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new sales tax accounts in Gmail?

How can I send new sales tax accounts for eSignature?

Can I create an electronic signature for the new sales tax accounts in Chrome?

What is new sales tax accounts?

Who is required to file new sales tax accounts?

How to fill out new sales tax accounts?

What is the purpose of new sales tax accounts?

What information must be reported on new sales tax accounts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.