Get the free Crt-61 Certificate of Resale

Get, Create, Make and Sign crt-61 certificate of resale

Editing crt-61 certificate of resale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crt-61 certificate of resale

How to fill out crt-61 certificate of resale

Who needs crt-61 certificate of resale?

Your Comprehensive Guide to the CRT-61 Certificate of Resale Form

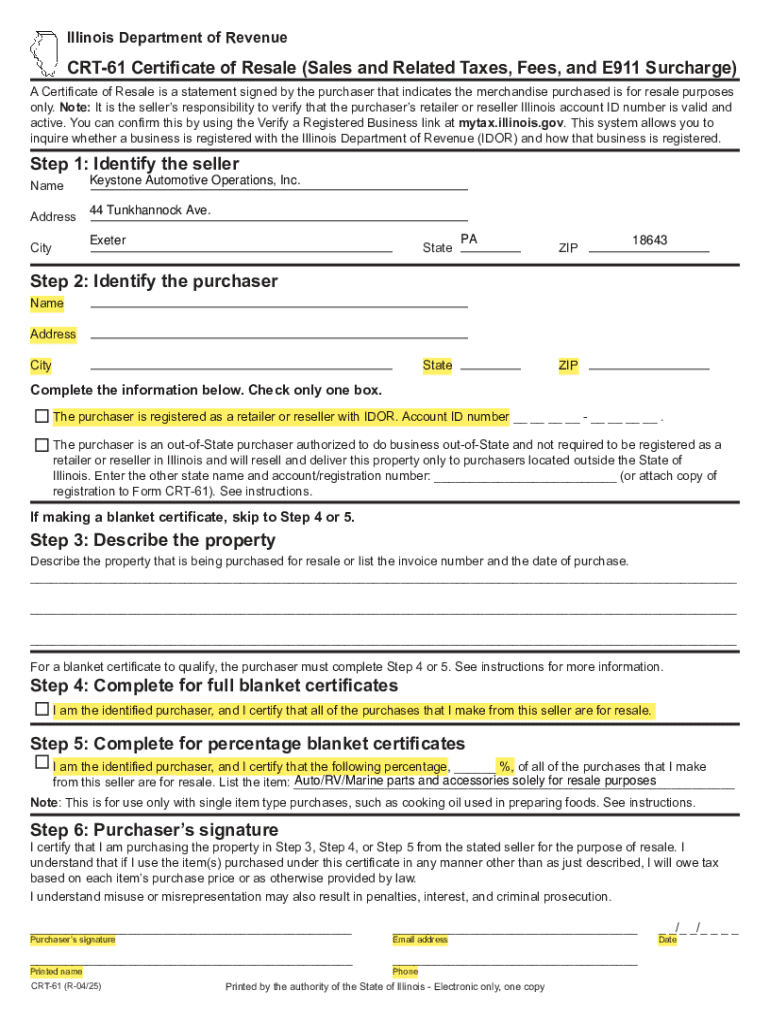

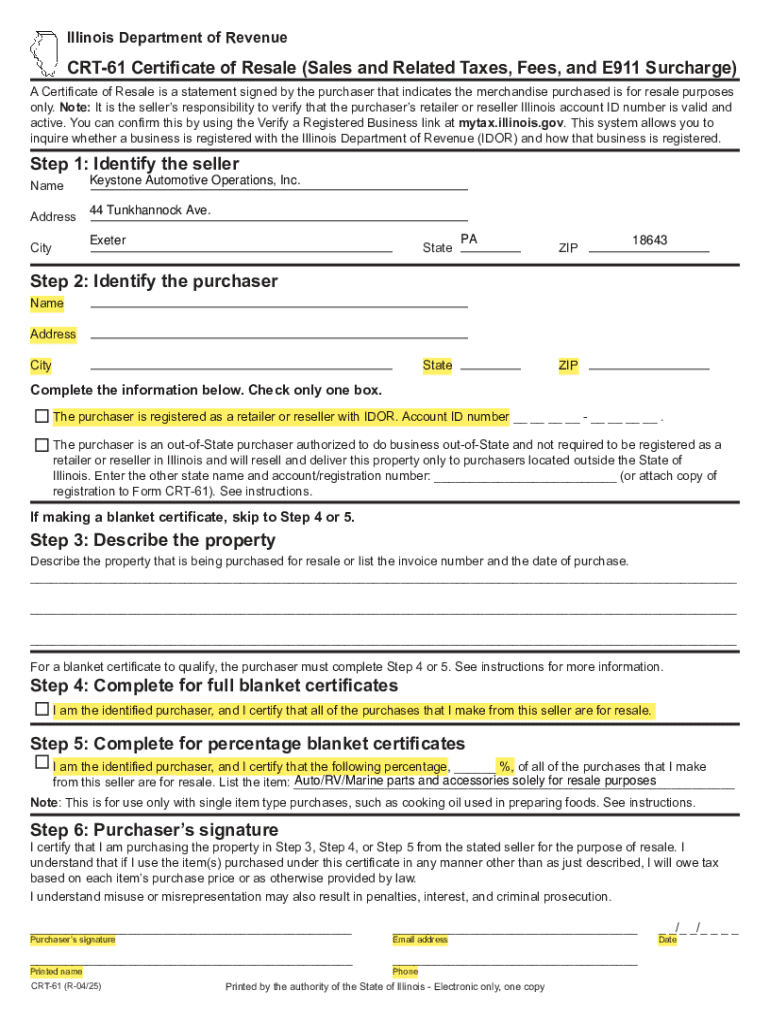

Understanding the CRT-61 Certificate of Resale Form

The CRT-61 Certificate of Resale Form serves as a crucial document for businesses seeking to purchase goods without paying sales tax, provided those goods will be resold. This certificate facilitates a tax exemption during the purchase phase, allowing businesses to maintain liquidity and streamline their financial operations.

Resale certificates, including the CRT-61, play a vital role in protecting both buyers and sellers. They not only prevent the double taxation of items intended for resale but also simplify compliance with tax regulations. This form is particularly significant for various retail and wholesale industries, where turnover can affect profitability.

Eligibility criteria for obtaining a CRT-61 certificate

Not everyone requires a CRT-61 Certificate of Resale; it’s primarily designed for businesses engaged in the sale of goods to end users. This includes wholesalers, retailers, and online sellers who regularly purchase items for resale. Understanding the eligibility requirements can prevent unnecessary complications during transactions.

To qualify for the CRT-61 certificate, individuals and businesses must demonstrate that they are in a legitimate trade or business operation. Typical requirements include a business license or registration, a valid tax identification number, and proof of ongoing sales activity. Stores selling at flea markets or temporary events often use the CRT-61 to ensure they do not incur unexpected taxes on their inventory.

How to obtain a CRT-61 certificate of resale form

Obtaining the CRT-61 Certificate of Resale Form is a straightforward process. Here’s a step-by-step guide to ensure you get the right documentation easily:

Once completed, the form can often be submitted either digitally or by mail through the official revenue office. Check regional guidelines for the most efficient submission method.

Detailed guide to filling out the CRT-61 certificate

Completing the CRT-61 Certificate involves several key sections that demand attention to detail. Here's what you need to know about each section:

Being meticulous while filling out this form reduces the risk of errors that can delay tax processing. Always review the information for correctness and completeness.

Common mistakes include omitting necessary details or using incorrect business identification numbers, which can hinder the acceptance of the form.

Important considerations when using the CRT-61 certificate

When using the CRT-61 Certificate of Resale, there are several important aspects to consider. Understanding these can help maintain compliance and avoid unexpected penalties:

Being well-informed about your responsibilities helps to ensure that your business remains compliant and in good standing with tax authorities.

How to eSign and share your CRT-61 certificate

Utilizing digital signatures is increasingly popular and for good reason. Here’s why and how to eSign the CRT-61 Form effectively with pdfFiller:

Digital signatures not only expedite the signing process but also provide a clear audit trail. They add to the document’s credibility in transactions.

Managing your CRT-61 certificate with pdfFiller

Once you have your CRT-61 Certificate of Resale Form ready, managing it efficiently is essential. Here’s how pdfFiller can help:

Efficient management means easy access to your documents, leading to smoother operations and renewed focus on growing your business.

FAQs about the CRT-61 certificate of resale

Understanding common queries surrounding the CRT-61 Certificate can streamline its usage. Here are some frequently asked questions:

Gathering clarity on these points ensures your compliance and assists in making informed decisions related to your resale transactions.

Additional resources for CRT-61 certificate and resale certificates

For anyone looking to streamline the resale process further, a wealth of resources is at your fingertips. These can provide additional support:

Using these resources can significantly streamline processes while keeping you informed about your rights and responsibilities as a business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit crt-61 certificate of resale online?

Can I sign the crt-61 certificate of resale electronically in Chrome?

How do I fill out the crt-61 certificate of resale form on my smartphone?

What is crt-61 certificate of resale?

Who is required to file crt-61 certificate of resale?

How to fill out crt-61 certificate of resale?

What is the purpose of crt-61 certificate of resale?

What information must be reported on crt-61 certificate of resale?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.