Get the free E61

Get, Create, Make and Sign e61

How to edit e61 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out e61

How to fill out e61

Who needs e61?

Understanding and Managing the e61 Form: A Comprehensive Guide

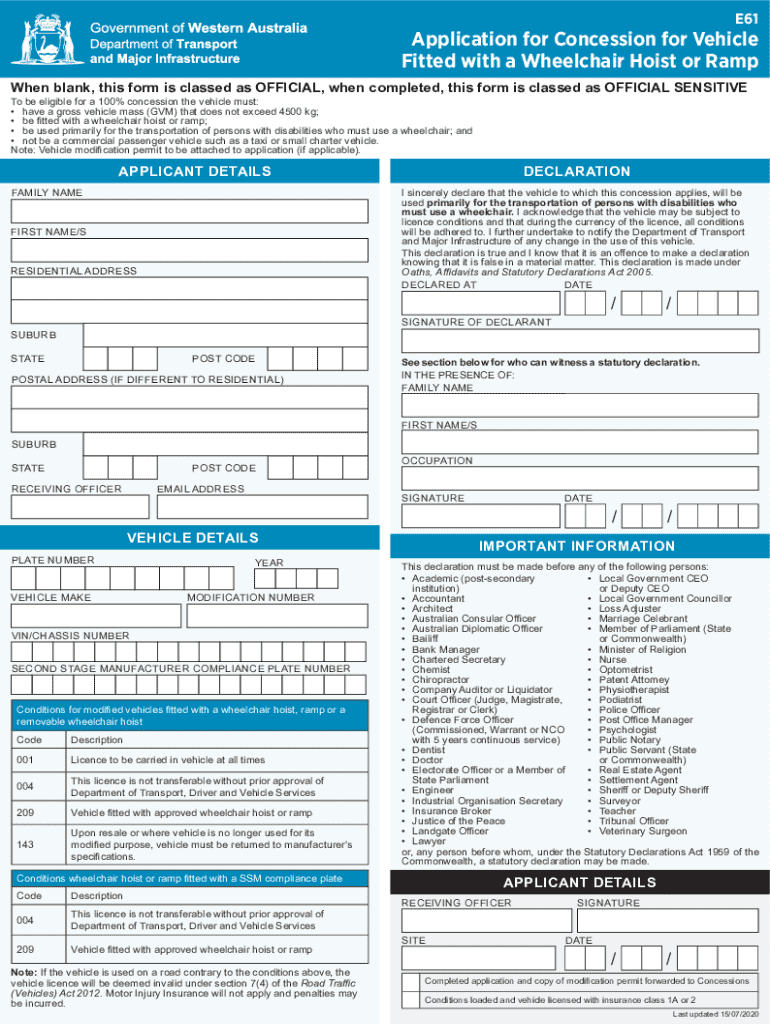

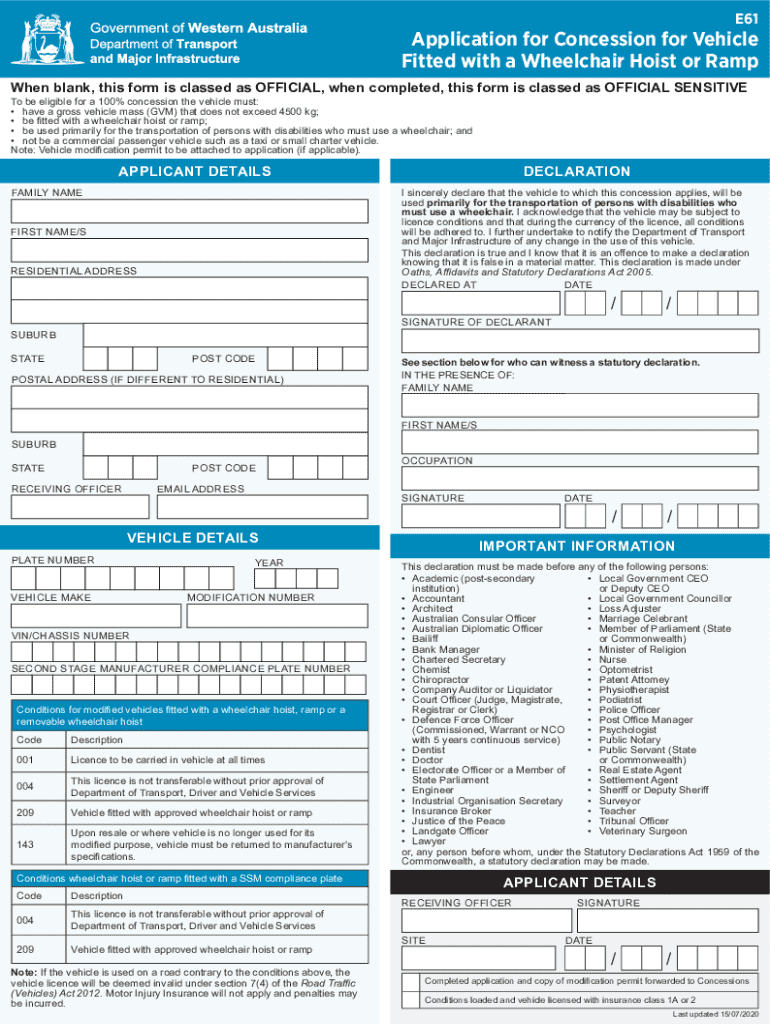

Understanding the e61 form

The e61 form serves a crucial function in various legal and administrative contexts, acting as a standardized document for specific data collection and processing. Primarily used in areas like legal documentation and governmental filings, the e61 form requests essential information tailored to the needs of the registering body. For instance, it may be utilized in immigration matters, tax submissions, or compliance reporting.

Due to its vital role, understanding the e61 form is essential for individuals and organizations alike. Filing it incorrectly can lead to delays, rejections, and even legal complications, emphasizing the need for careful attention to detail during the completion process.

Key features of the e61 form

Each e61 form typically contains several sections that capture a range of necessary data relevant to its purpose. The sections can include personal identification information, details pertinent to the form's application, and required signatures. A breakdown of each section includes:

Tools like pdfFiller offer interactive assistance in filling out the e61 form. These tools can help streamline data entry and reduce errors, making the process far less daunting.

Step-by-step instructions for completing the e61 form

Before tackling the e61 form, preparation is crucial. Gather all the necessary documents such as identification, prior correspondence relating to the matter, and any specific information needed to complete each section of the form. Ensuring that you have everything in order minimizes mistakes and inaccuracies.

The actual process of filling out the e61 form can be broken down into the following steps:

After filling out the form, it's vital to review it thoroughly. Use a checklist to ensure each section is complete and accurate. Some common mistakes to avoid include missing signatures, omitting essential details, and confusion with section placements.

Editing and customizing the e61 form

Using pdfFiller's editing features allows users to make necessary adjustments to the e61 form efficiently. You can save changes, rearrange sections, or replace data as needed without starting from scratch. The editing capabilities provide a user-friendly approach to document modification.

Additionally, annotation tools can enhance clarity or facilitate collaboration. You can add comments, highlight important information, or question certain entries before finalizing your form. Making sure that your collaborators are on the same page can greatly reduce errors and ensure that the completed document reflects your intent.

Signing the e61 form

Understanding electronic signatures is essential in today’s digital submissions. eSignatures are legally binding and must be compliant with regulatory frameworks. Using pdfFiller, you can sign the e61 form electronically, ensuring your submission adheres to legal requirements without the hassle of printing out physical copies.

To sign the e61 form electronically, follow these steps:

Once signed, the e61 form can be securely submitted, ensuring both authenticity and compliance with necessary regulations.

Managing your e61 form post-completion

After completing the e61 form, managing it effectively is paramount. Best practices for digital storage include using cloud-based solutions for easy access and security. With pdfFiller, you gain access to robust backup features that prevent data loss while keeping your documents organized.

To track progress and deadlines associated with your e61 form, utilize pdfFiller’s built-in reminder tools. You can set specific deadlines, use color-coded labels for easy organization, and ensure that you always stay on top of your document management tasks.

Troubleshooting common issues with the e61 form

Users often face various challenges when working with the e61 form, such as technical glitches during submission or correction requests due to incomplete fields. Understanding these common issues is the first step toward effectively managing them.

For quick solutions to frequently asked questions regarding the e61 form:

Understanding the broader context of the e61 form

The regulatory and procedural backdrop of the e61 form includes various laws and guidelines shaping how it should be filled out and submitted. Understanding these may prevent issues and enhance compliance. Regularly checking for updates or amendments to these laws is also essential for accuracy.

Case studies highlight successful uses of the e61 form, showcasing best practices and what led to effective outcomes. Learning from these experiences can provide valuable insights into navigating similar situations.

How pdfFiller enhances your experience with the e61 form

Using a cloud-based platform like pdfFiller to manage your e61 form offers unparalleled accessibility and convenience. Access your documents from anywhere, whether in the office or on the go, making collaboration seamless and efficient.

Customer support is readily available through pdfFiller, ensuring users can easily resolve queries or issues. Furthermore, a wealth of resources and training materials is at your disposal, making it easier to master the ins and outs of the e61 form.

Joining the pdfFiller community

Engaging with other users in the pdfFiller community provides valuable insights. Forums for discussion allow users to share experiences, best practices, and tips specific to the e61 form, fostering a collaborative learning environment.

Contributing to the knowledge pool encourages shared learning. Users are welcome to share their own tips and experiences, benefiting the entire community while enhancing their own comprehension of how to manage the e61 form efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in e61 without leaving Chrome?

Can I create an electronic signature for signing my e61 in Gmail?

How can I edit e61 on a smartphone?

What is e61?

Who is required to file e61?

How to fill out e61?

What is the purpose of e61?

What information must be reported on e61?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.