Get the free Delinquent Tax List

Get, Create, Make and Sign delinquent tax list

Editing delinquent tax list online

Uncompromising security for your PDF editing and eSignature needs

How to fill out delinquent tax list

How to fill out delinquent tax list

Who needs delinquent tax list?

Comprehensive Guide to the Delinquent Tax List Form

Understanding delinquent taxes

Delinquent taxes are those that remain unpaid past their due date, which puts property owners at risk of incurring penalties, interest, and potential foreclosure. Addressing delinquent taxes promptly is crucial to avoid complications that could lead to loss of property and financial distress. In many cases, towns and local governments take assertive measures to recover these funds, impacting individuals and communities adversely.

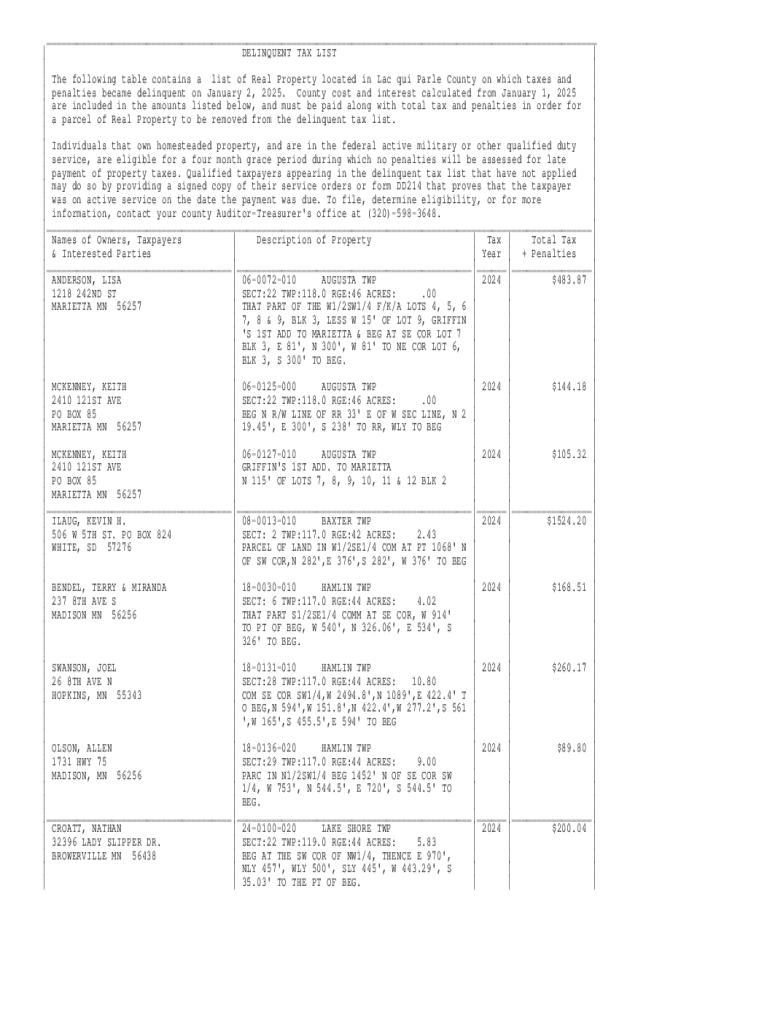

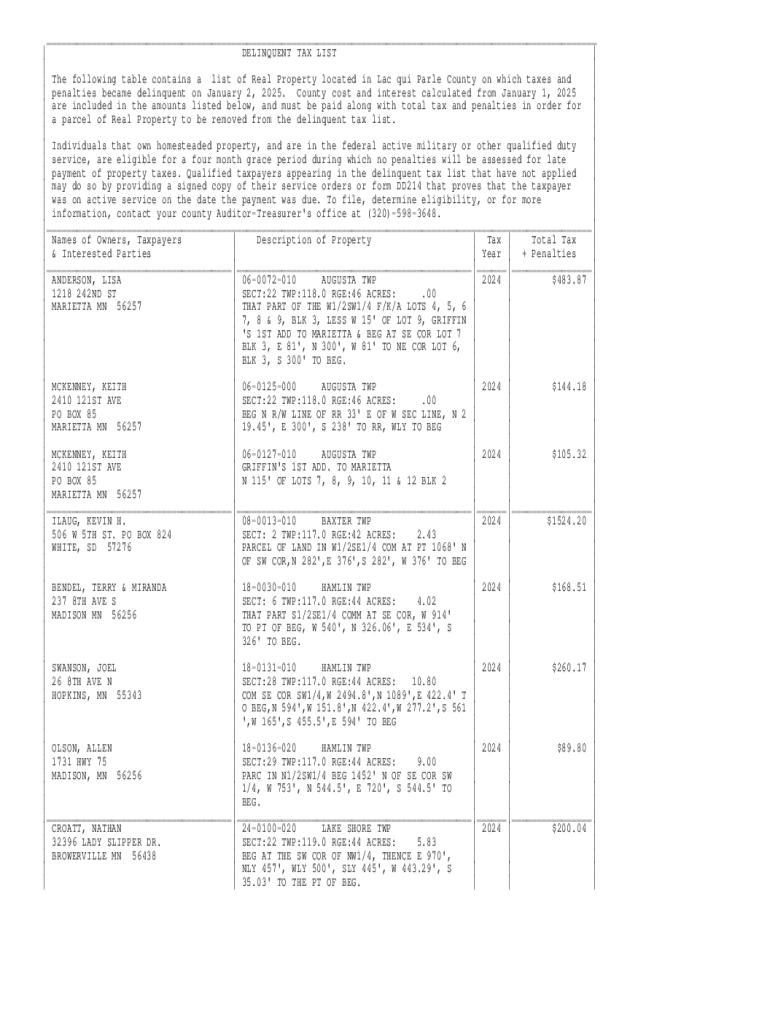

What is the delinquent tax list form?

The delinquent tax list form is an official document used by municipalities to list properties with unpaid taxes. This form is essential for tax collections, allowing local governments to track delinquent taxpayers and to manage property assessment efficiently. For individuals and teams, having a clear understanding of this form can facilitate better self-management and enhance collaboration when addressing tax liabilities.

By providing transparency, the form plays a crucial role in the financial health of a community, ensuring that properties are not unjustly penalized and that residents understand their obligations. It is also pivotal for legal and logistical processes involved in tax recovery.

Key features of the delinquent tax list form

Modern delinquent tax list forms often come equipped with interactive tools that enhance usability. These include online calculators and estimators that help users determine outstanding amounts and potential penalties. Integration with PDF editing and electronic signing processes simplifies the submission, allowing users to complete and file necessary documents seamlessly without any hassle.

Accessibility is a priority, ensuring that both individuals and teams can effectively use the form. PDF solutions like pdfFiller provide features that allow for collaborative efforts on completing the delinquent tax list form, ensuring that all team members are informed and updated about the tax status and submissions.

Step-by-step guide to completing the delinquent tax list form

Step 1: Gather necessary documents

Before filling out the delinquent tax list form, it is essential to gather relevant documents such as your identification, previous tax returns, and property records. These documents provide the necessary context and information required to accurately fill out the form.

Step 2: Fill out the delinquent tax list form

Begin by accurately entering your personal information in the designated fields. Detail the property address, tax year, and amount owed. Avoid common mistakes such as failing to double-check numbers or missing required signatures, which could delay the processing.

Step 3: Sign and date the form

After completing the form, you must sign and date it. Many platforms offer options for electronic signatures, which are legally binding and efficient. Always verify the accuracy of your document before submission to prevent further issues.

Step 4: Submit the form

The submission can typically be done online or via postal mail. Understanding the deadlines for form submission is crucial to avoid additional penalties or complications. Ensure to retain a copy of the submitted document for your records.

Frequently asked questions (FAQs)

What happens after submitting the delinquent tax list form? Typically, local tax authorities will review the submission and may contact you for further information or clarification. It's essential to keep track of your form’s progress by following up with the appropriate department.

Can I appeal the information on the delinquent tax list? Yes, if you believe the information is incorrect, you can appeal by providing supporting documentation that substantiates your claim.

What are the penalties for unfiled delinquent taxes? Penalties vary by jurisdiction, but may involve substantial late fees, accrued interest, and in some instances, legal action which can escalate to property liens or foreclosure.

Importance of collaboration on delinquent tax issues

Effective management of delinquent tax issues often requires a team approach. Collaboration can streamline processes, enhance information sharing, and improve the overall handling of tax obligations. Utilizing platforms like pdfFiller allows team members to efficiently share documents and relevant data, enabling collective problem-solving.

Best practices include establishing a clear file sharing system, using a central document repository, and regular meetings for updates. By keeping open lines of communication, teams can mitigate the confusion often associated with delinquent tax management.

Delinquent tax resources

To further assist you, pdfFiller offers extensive resources for addressing delinquent tax matters. Links to your local government tax department provide access to updates, payment plans, and educational materials about your rights and responsibilities as a taxpayer.

Additionally, various tools within pdfFiller are specifically designed for maximizing document management efficiency. From invoicing to performance tracking, these resources can be invaluable when navigating tax obligations.

Office hours and contact information

Most tax departments operate Monday to Friday, typically from 8 AM to 5 PM; however, exact hours vary by location. It is advisable to visit your local tax authority's website to verify.

For assistance, contact them via phone or email for swift resolutions to your inquiries. Following them on social media platforms may also provide timely updates and community engagement opportunities.

Potential future updates and important notices

Stay informed about upcoming changes in tax laws that might affect your responsibilities regarding delinquent taxes. Key dates for property tax sales or auctions could also be vital; missing these could lead to unfavorable consequences.

Setting up notification subscriptions can help you receive alert updates directly related to your tax obligations, ensuring you are always informed about deadlines and new policies.

Sharing and promoting awareness

Community awareness is crucial for understanding delinquent taxes. Encouraging others to share their experiences not only fosters a support system but also raises awareness about the implications of unpaid taxes.

Utilizing social media platforms to discuss the importance of addressing delinquent taxes can reach a wider audience, helping more individuals understand their obligations and the available resources. Sharing your insights can contribute significantly to community education.

Related documents and forms

In addition to the delinquent tax list form, there are several other relevant documents that can aid in tax management. Resources available on pdfFiller include forms for payment plans, appeals, and other tax-related documentation.

Organizing these documents efficiently will streamline the tax resolution process, ensuring that all necessary files are at your fingertips when needed. Explore additional tax-related documents that align with your situation to keep all your financial matters in order.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find delinquent tax list?

Can I sign the delinquent tax list electronically in Chrome?

Can I edit delinquent tax list on an iOS device?

What is delinquent tax list?

Who is required to file delinquent tax list?

How to fill out delinquent tax list?

What is the purpose of delinquent tax list?

What information must be reported on delinquent tax list?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.