Get the free M-3 Tax Exempt Application

Get, Create, Make and Sign m-3 tax exempt application

How to edit m-3 tax exempt application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out m-3 tax exempt application

How to fill out m-3 tax exempt application

Who needs m-3 tax exempt application?

Comprehensive Guide to the -3 Tax Exempt Application Form

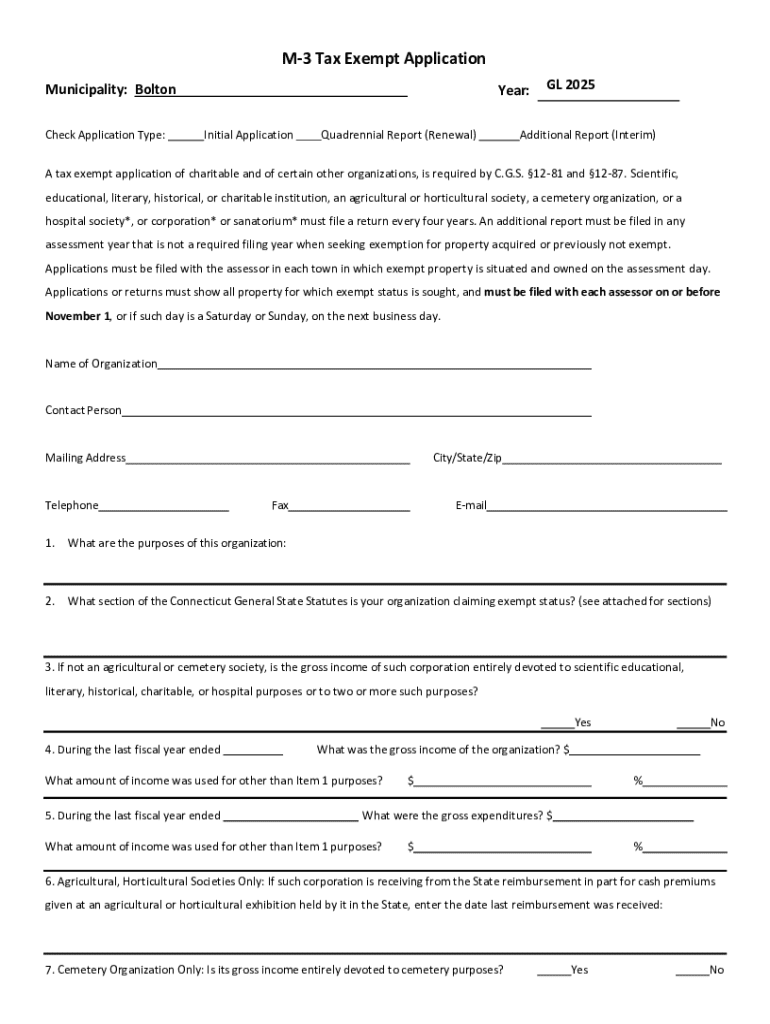

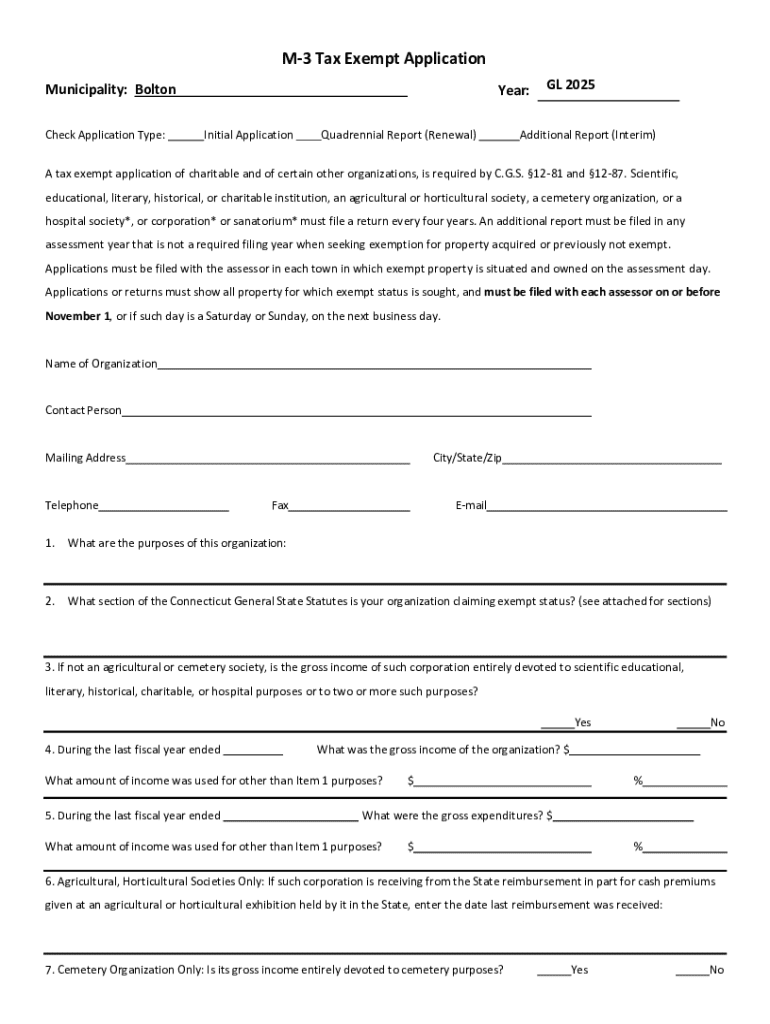

Understanding the -3 Tax Exempt Application Form

The M-3 Tax Exempt Application Form is a crucial document for organizations seeking tax-exempt status under the applicable laws. Primarily issued by state tax offices, the M-3 form serves to formalize requests for exemption from certain taxes, allowing nonprofits and similar entities to allocate more resources towards their missions. This form is integral for charities, churches, and educational entities that qualify for tax relief, ensuring they contribute effectively to their communities.

Key features of the -3 Tax Exempt Application Form

Understanding the key features of the M-3 form is essential to ensure that your application for tax exemption is complete and compliant. Each section of the M-3 form is designed to collect critical information about the applicant organization, including its structure and justification for seeking tax-exempt status. This clarity helps tax authorities process applications efficiently.

Step-by-step instructions for completing the -3 form

Completing the M-3 form involves a systematic approach to avoid errors that could result in delays. Start by gathering all necessary information related to your organization, such as its mission, financial data, and legal status. Ensure you understand the criteria for tax exempt status regarding your specific entity type.

Using pdfFiller to fill out the -3 form

pdfFiller simplifies the process of filling out the M-3 tax exempt application form with its user-friendly interface and features. Organizations can access the form template directly online, allowing for easy input of data and editing.

Troubleshooting common issues with the -3 form

Even with the best preparation, issues may arise when completing the M-3 form. Understanding these common challenges can help organizations resolve them effectively.

Managing your -3 form documents with pdfFiller

After completing the M-3 form, effective document management becomes crucial. pdfFiller offers robust solutions to keep your documents organized and accessible.

Additional tools and resources for filing the -3 form

Access to the right tools and resources can significantly ease the process of filing the M-3 form. pdfFiller aids this by providing comprehensive features that align with the needs of organizations.

Real-world examples and case studies

Understanding practical applications of the M-3 form can lend insight into its importance. Case studies of successful submissions illustrate best practices and potential pitfalls.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit m-3 tax exempt application on an iOS device?

How do I complete m-3 tax exempt application on an iOS device?

How do I edit m-3 tax exempt application on an Android device?

What is m-3 tax exempt application?

Who is required to file m-3 tax exempt application?

How to fill out m-3 tax exempt application?

What is the purpose of m-3 tax exempt application?

What information must be reported on m-3 tax exempt application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.