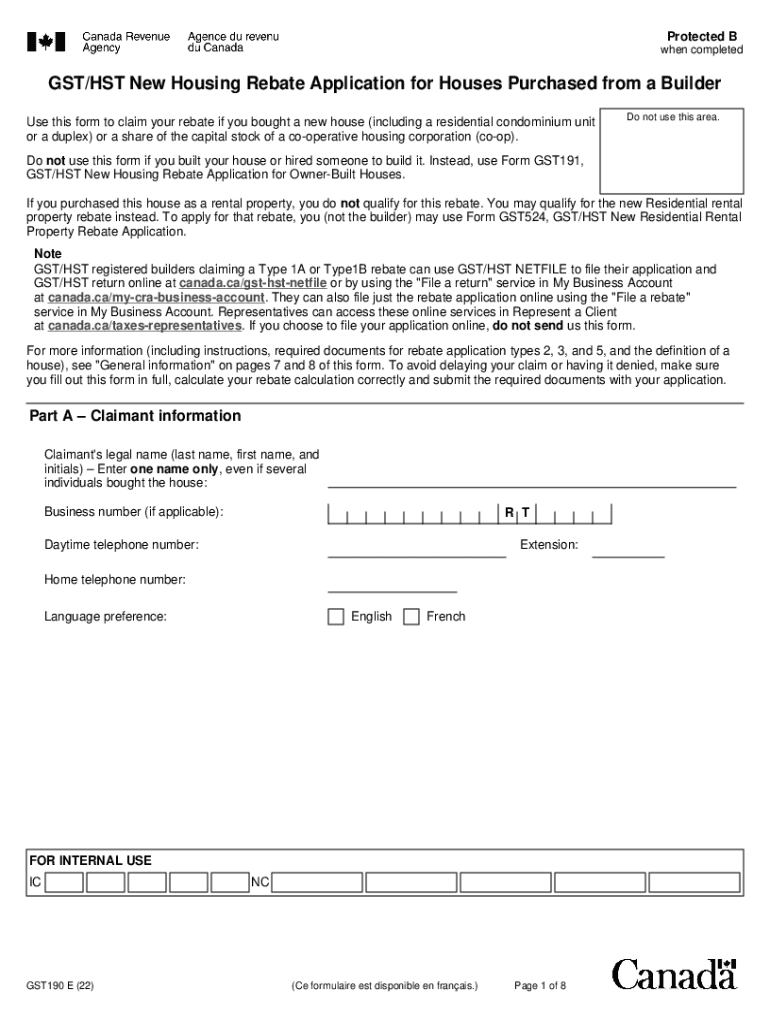

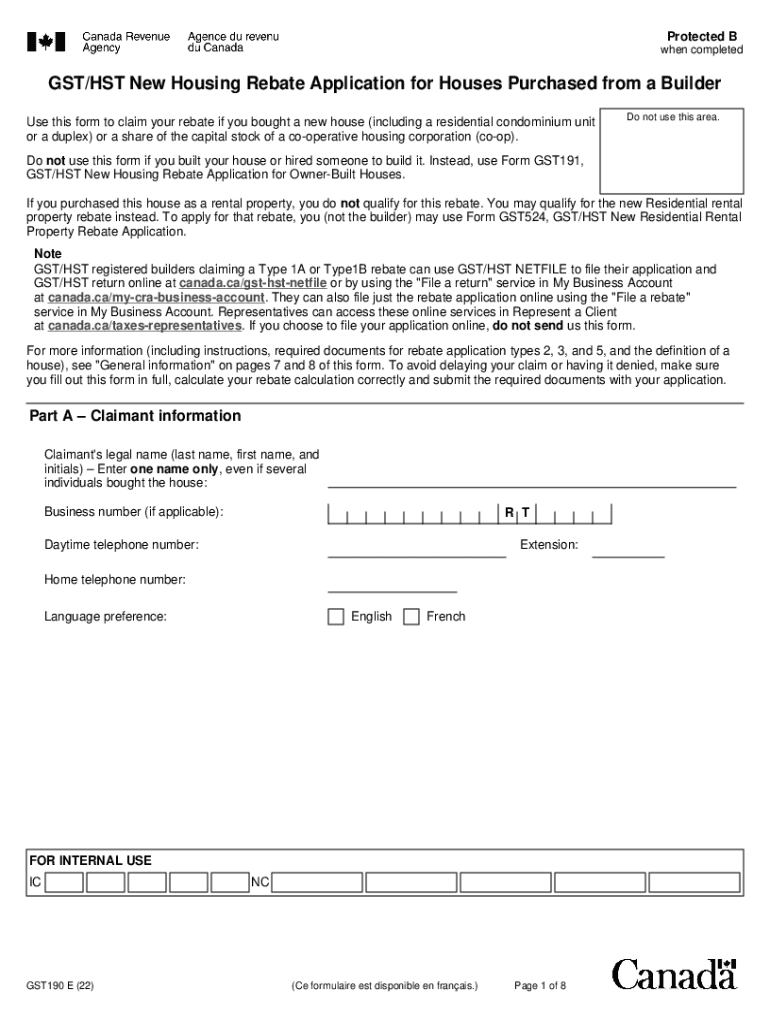

Get the free Gst190

Get, Create, Make and Sign gst190

Editing gst190 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gst190

How to fill out gst190

Who needs gst190?

A Comprehensive Guide to the GST190 Form

Overview of the GST190 form

The GST190 form serves as a pivotal document for individuals seeking the GST/HST New Housing Rebate in Canada. This rebate is designed to provide financial relief to homebuyers, particularly those purchasing new homes. The form is essential for claiming a portion of the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST) associated with newly constructed or substantially renovated residential properties.

Understanding the significance of the GST190 form is crucial for homeowners looking to diminish their purchase costs. This rebate is particularly impactful for first-time homebuyers and those investing in new builds, making it a valuable aspect of the home buying process.

Key features of the GST190 form

The GST190 form is structured to gather comprehensive information necessary for processing the rebate. It consists of several sections that must be accurately filled out to ensure your application is not delayed or rejected.

One of the primary sections includes personal information such as the applicant's name, address, and details of the property. Additional sections require information regarding the purchase agreement, the GST/HST paid, and calculations pertinent to the rebate amount.

Eligibility criteria for the GST/HST new housing rebate

Eligibility for the GST/HST New Housing Rebate encompasses a wide range of applicants. Primarily, first-time homebuyers and builders/developers can qualify for this rebate. However, there are specific criteria that must be met.

To successfully claim the rebate, applicants must ensure that their property meets several key conditions. The property must be new, or substantially renovated, and it can't be a resale home. Moreover, applications must be submitted within the required timeframes following the purchase or completion of the home.

Step-by-step guide: how to fill out the GST190 form

Filling out the GST190 form requires meticulous attention to detail. Before you begin, prepare all necessary documentation, including your purchase agreement, receipts for any GST/HST paid, and identification proof.

Start by entering your personal information. Next, provide the details of the home purchase, including the date of purchase and the total cost. Pay special attention to the calculation section, where you will determine your rebate amount, ensuring all computations are accurate to avoid rejections.

Submitting your GST190 form

Once completed, the GST190 form must be submitted to the appropriate tax authority. This can often be done electronically, making the process more efficient. Utilizing tools like pdfFiller can streamline the electronic submission process, allowing for easy access and filing.

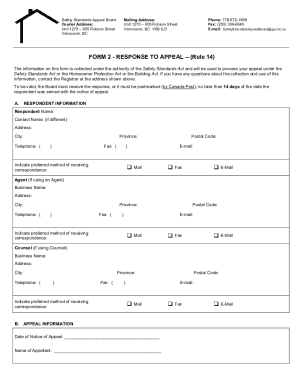

Ensure you are aware of filing deadlines. Missing these deadlines can result in denial of your rebate application. If, however, your application is rejected, carefully review the feedback provided to address any missteps before resubmitting.

Additional considerations for British Columbia residents

Residents of British Columbia have additional nuances to consider regarding the GST190 form. The province offers specific rules and rebates that enhance the benefits of the federal GST/HST New Housing Rebate.

In British Columbia, the provincial home buyer’s rebate can significantly increase potential savings, especially for new homes under a set purchase price threshold. Homebuyers should also be aware of local regulations and seek assistance from local resources to navigate these rebates effectively.

Understanding the rebate process

Understanding the timeline for processing GST190 applications is crucial. Typically, applicants can expect a processing time ranging from a few weeks to several months, depending on the volume of applications and the accuracy of submitted forms.

Post-submission, applicants should regularly check for updates on their application status. Having questions is normal, and knowing how to navigate the rebate process can significantly ease any anxieties associated with waiting for financial relief.

Simplifying your document management with pdfFiller

Utilizing pdfFiller to manage your GST190 form provides numerous benefits. The platform not only allows for easy editing and signing but also facilitates secure storage and sharing of your completed documents.

With collaborative features, teams can work together seamlessly, ensuring that all necessary inputs are collected before submission. This convenience makes pdfFiller an invaluable tool for anyone navigating governmental forms and documents.

Troubleshooting common issues with the GST190 form

Even with thorough preparation, submitting the GST190 form can lead to challenges. Common issues include incomplete sections, inaccuracies in personal data, or miscalculations in the rebate amount.

If you find yourself in need of assistance, resources are available to help troubleshoot problems. Understanding what resources are at your disposal can streamline the process and alleviate potential frustrations.

Conclusion: maximizing your home purchase with GST/HST rebates

Navigating the GST190 form and the associated rebate process can be daunting. However, armed with the right information, individuals can maximize their home purchase benefits significantly. It’s essential to meticulously fill out the GST190 form, adhere to deadlines, and leverage tools like pdfFiller for document management.

By understanding the intricacies of the GST/HST rebate and utilizing available resources, homebuyers can optimize financial relief and ensure a smoother home purchasing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my gst190 directly from Gmail?

Can I create an eSignature for the gst190 in Gmail?

How do I fill out gst190 using my mobile device?

What is gst190?

Who is required to file gst190?

How to fill out gst190?

What is the purpose of gst190?

What information must be reported on gst190?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.