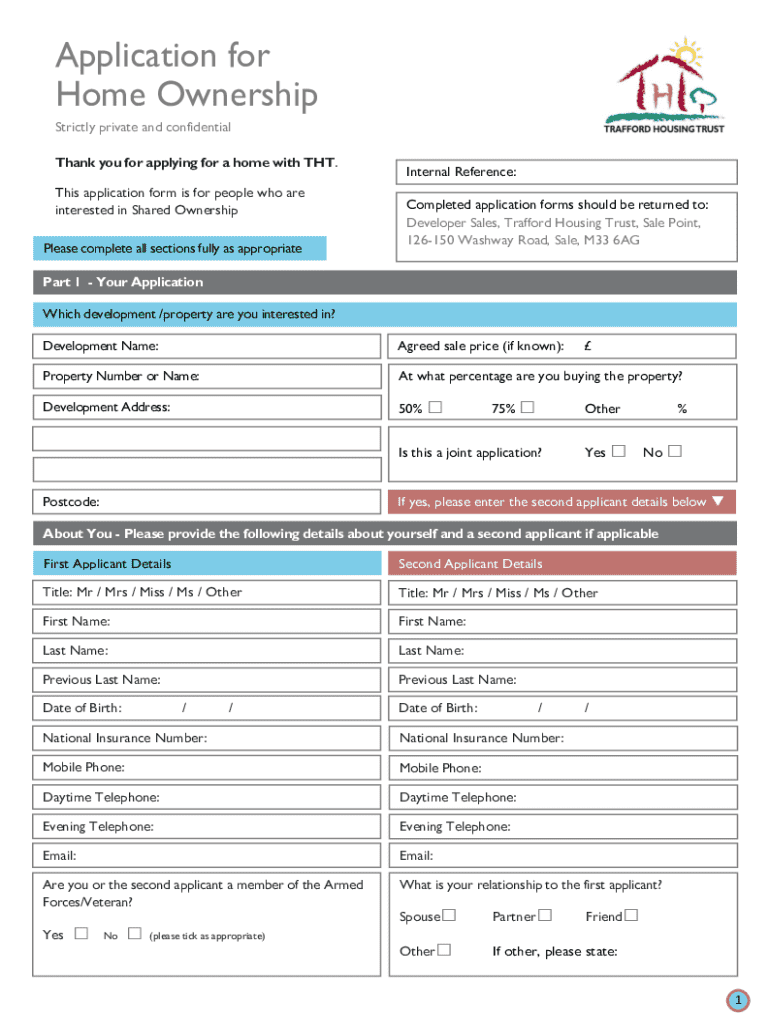

Get the free Application for Home Ownership

Get, Create, Make and Sign application for home ownership

Editing application for home ownership online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for home ownership

How to fill out application for home ownership

Who needs application for home ownership?

Application for Home Ownership Form: A Comprehensive Guide

Understanding home ownership applications

A home ownership application form is a critical document that individuals must complete to initiate the process of purchasing a property. This form collects essential information about the applicant’s personal and financial backgrounds, which lenders or housing authorities use to assess eligibility for a mortgage or assistive programs like a home assistance loan scheme. It serves as the starting point for applicants to express their interest in buying or financing a home.

The importance of this documentation cannot be overstated. A well-prepared application lays the groundwork for securing financing and navigating the complex landscape of home buying. By providing your buyer's information accurately, you set yourself up for a smoother experience, minimizing delays and misunderstandings with lenders or underwriting agencies during the execution of the assignment.

Eligibility criteria for home ownership

Eligibility criteria are vital to ensure that applicants meet the requirements for home ownership. Generally, lenders look for a combination of qualifications that demonstrate financial stability and responsibility. These criteria can vary widely, but common qualifications for applicants typically include sufficient income, having a stable employment status, and, in some cases, specific age and residence considerations.

Income requirements often set the foundation for eligibility. For many programs, applicants should ideally have a consistent income that meets the minimum threshold set by lenders or local housing authorities. Employment status also plays a substantial role; individuals in steady, full-time positions are preferred candidates. Moreover, being of legal age and having established residency in the area can influence one's eligibility, especially under local home ownership schemes.

Essential documents required

Submitting an application for home ownership requires several essential documents. First and foremost, identification documents are crucial. Government-issued IDs, such as a driver's license or passport, help validate your identity, while a Social Security card is necessary for income verification and tracking. Proper identification establishes the applicant's legitimacy and crucial for the application process.

Financial documentation is the next category of essential paperwork. Proof of income, like pay stubs or tax returns, helps demonstrate the applicant’s ability to meet mortgage obligations. Meanwhile, obtaining a credit history report is critical for lenders to assess your financial reliability. Additional supporting materials should not be neglected either. Bank statements reflecting savings, employment verification letters, and any relevant financial commitments ensure a comprehensive application.

Step-by-step guide to filling out the application

Filling out the application for home ownership can appear daunting, but following a structured approach can ease the process. Begin with accessing the home ownership application form. You can easily find the form on your local housing authority's website or through lenders. Ensure you download and print it, or if using online options, utilize the interactive filling tools available on platforms like pdfFiller.

Next, the essential step is completing the application form, which requires detailed attention. Each section of the form typically requests personal information, which includes basic identifying details. The financial section delves into your income sources and obligations, while the property information section may require specifics about the home you're purchasing, such as its address and appraisal. Accurate and thorough completion is crucial.

Once completed, reviewing your application is of utmost importance. Taking the time to check for accuracy can prevent costly mistakes that lead to processing delays or even denial. In this step, double-checking your supporting documents ensures that everything matches up. Finally, submit the application. Submission methods vary; you can submit online, through mail, or in-person at designated locations, and adhere to tips for timely submission to avoid oversights and delays.

Interactive tools for your application process

In today's digital age, leveraging technology can significantly enhance your home ownership application experience. Online application filling assistance tools have emerged as invaluable resources for applicants. Such tools guide you through each section of the application, ensuring you don’t miss any important details. They streamline the process, saving time and reducing the risk of errors.

Document management features are increasingly made available on platforms like pdfFiller, helping applicants organize their paperwork efficiently. This can be especially important as various documents are needed throughout the application process. Moreover, eSignature capabilities enable quick handling of required signatures, making it more convenient for applicants working remotely or those with busy schedules.

Common mistakes to avoid

Even small mistakes on an application for home ownership can have lasting repercussions. One of the most frequent errors is submitting incomplete information. Ensure every section is filled out completely, as omissions can lead to delays or denials. Additionally, double-check that you include all required documents; missing paperwork can stall the review process.

Errors in personal details, such as misspellings or wrong addresses, can also cause significant issues. These discrepancies can lead to confusion during verification and result in processing delays. Furthermore, not meeting deadlines with submissions can also jeopardize your application, especially if you’re applying under limited-time programs or schemes.

After submission: what to expect

After you have submitted your application for home ownership, it's essential to know what happens next. You'll typically receive an acknowledgment from the housing authority or lender confirming the receipt of your application. Expected processing times can vary, often ranging from several days to a few weeks, depending on the complexity of your application and the volume of submissions.

You can check the status of your application, often through online portals provided by your housing authority or lender. Regular communication will help you stay in the loop and address any additional requests from the home ownership authority that may arise during processing.

Managing your home ownership journey

Successfully navigating the home ownership process requires ongoing diligence and awareness even after submitting your application. Utilize various tools to track your application progress, which some online platforms provide, ensuring you remain informed throughout the review period. Additionally, accessing resources for financial education can empower you, teaching budgeting and credit management, essential for future home ownership responsibilities.

Connecting with local housing support services proves beneficial during your journey. These services often provide guidance on local home assistance programs and support mechanisms, expanding your understanding of options available to you. This comprehensive support network can help you avoid common pitfalls and make informed decisions.

Frequently asked questions (FAQs)

Many applicants have questions about the home ownership application process. One common misconception is that all applications will be approved, regardless of individual circumstances. It’s vital to clarify that conditional approvals may be issued based on specific stipulations that applicants must meet before final approval can be granted. Understanding these conditions can guide applicants in fulfilling any additional requirements.

In the event of a denial, knowing the next steps to take is essential. Applicants should inquire about the reasons for denial and explore opportunities to address the issues that led to their application being turned down. This proactive approach is key to opening doors for future home ownership opportunities.

Additional support for applicants

For those navigating the application for home ownership, access to additional support resources can be invaluable. Financial counseling services provide tailored advice that can help applicants prepare their finances for home ownership. Workshops specifically for first-time homeowners cover vital topics like budget management, understanding mortgage terms, and navigating local home ownership schemes.

Furthermore, networking opportunities with experienced homeowners can offer insights into the practical aspects of owning and maintaining a home. Such connections can lead to invaluable advice, helping applicants build a supportive community around one of life’s biggest investments.

Benefits of using pdfFiller for your home ownership application

Utilizing pdfFiller for your application for home ownership can significantly streamline your documentation process. This platform offers seamless document editing and eSigning capabilities, eliminating the need for physical paperwork while ensuring compliance with submission standards. Collaborative tools allow for multiple users to work together on applications, making it ideal for teams submitting joint requests.

Access-from-anywhere convenience means you can manage your home ownership journey anytime, anywhere. Whether you need to make last-minute changes to your application or sign documents on the go, pdfFiller’s cloud-based platform accommodates all these needs, making it a preferred choice for individuals and teams alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify application for home ownership without leaving Google Drive?

How can I get application for home ownership?

Can I edit application for home ownership on an Android device?

What is application for home ownership?

Who is required to file application for home ownership?

How to fill out application for home ownership?

What is the purpose of application for home ownership?

What information must be reported on application for home ownership?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.