Get the free Sunpower Financing Agreement

Get, Create, Make and Sign sunpower financing agreement

How to edit sunpower financing agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sunpower financing agreement

How to fill out sunpower financing agreement

Who needs sunpower financing agreement?

Comprehensive Guide to the Sunpower Financing Agreement Form

Understanding the Sunpower Financing Agreement

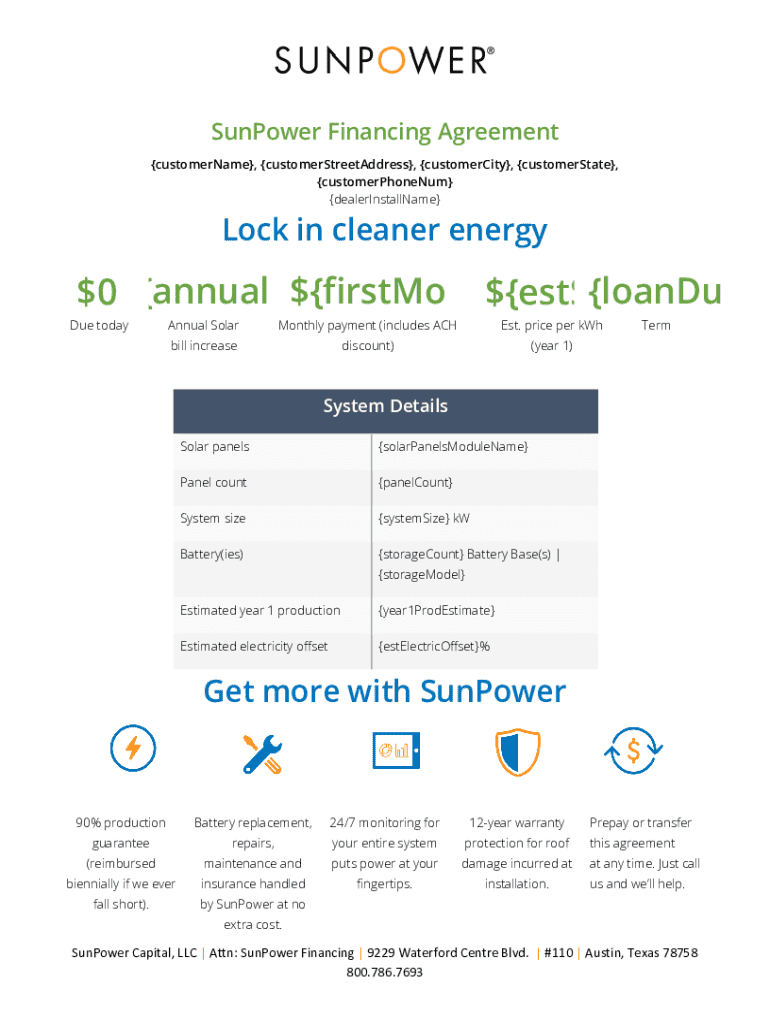

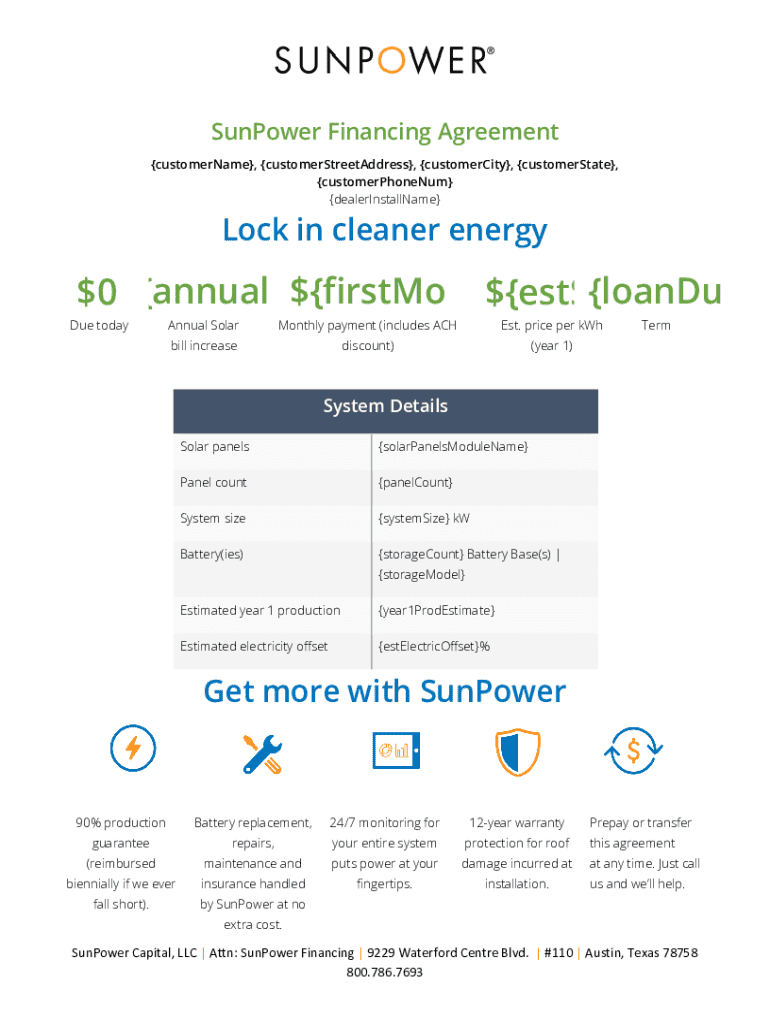

A Sunpower financing agreement is a crucial document that facilitates the funding of solar power installations. This form outlines the specifics of the financing arrangement between the installer and the homeowner or business owner, ensuring that both parties are clear on the terms, conditions, and obligations involved. Given the significant financial commitment associated with installing solar panels, having a well-structured financing agreement is essential for protecting investments and clarifying expectations.

The agreement establishes the framework for how financing will be handled, whether through loans, leases, or power purchase agreements (PPAs). Understanding these elements can help potential solar energy users navigate their financing landscape more effectively.

Benefits of Sunpower Financing

Opting for Sunpower financing presents a range of benefits that go beyond just cost savings. First and foremost, installing solar technology significantly reduces electricity bills compared to traditional energy sources. By leveraging solar power, property owners can expect long-term financial relief from rising energy costs. In many cases, the savings from decreased utility bills often offset the costs associated with financing, making solar an economically savvy choice.

Moreover, utilizing solar power also has positive environmental ramifications. Transitioning to solar energy reduces the carbon footprint associated with fossil fuel consumption, contributing to broader sustainability efforts. As more individuals and businesses make the switch, the collective impact on the environment can be profound.

The Sunpower Financing Agreement Form: A Step-by-Step Guide

Completing the Sunpower financing agreement form is a straightforward process, but it's essential to gather all necessary information upfront. Start by collecting your personal information, such as your name, address, social security number, and other relevant identification. Additionally, you will need to provide property information, including the address of the installation site and your energy usage history, which can help assess your energy needs and financing options.

Once all information is collected, you can begin completing the agreement form. Pay special attention to the type of financing you have chosen—be it a loan, lease, or PPA. Each option has specific details and implications, so clarity is essential. The terms and conditions section will be particularly crucial; ensure you read and understand all stipulations. Avoid common pitfalls, such as leaving sections unfilled or misinterpreting financial terms.

Editing and customizing your agreement

Using pdfFiller tools makes customizing your Sunpower financing agreement form both user-friendly and efficient. To begin, access the pdfFiller platform, where you'll find an intuitive interface designed for document editing. The platform allows for easy editing of your financing agreement, from adding text and personalizing details to modifying terms as needed.

Key features you’ll want to utilize include adding annotations to clarify important terms, inserting digital signatures, and denoting dates for signing. These features streamline the document preparation process and ensure compliance with legal requirements. Having a well-edited document reduces the chances of misunderstandings and serves as a reliable record of what was agreed upon.

Signing your financing agreement

Once the agreement is filled out and customized, it's time to sign. pdfFiller simplifies the eSigning process, providing step-by-step instructions to ensure you sign your document accurately. Begin by navigating to the eSignature feature on the pdfFiller platform. Here, you’ll be prompted to create a signature if you don't have one saved. You can also choose to draw it, upload an image, or type it out in your preferred style.

It's essential to understand the legal validity of electronic signatures. In the context of solar financing agreements, eSignatures hold the same weight as traditional handwritten signatures, complying with federal regulations. This means that signing digitally through pdfFiller is a secure and efficient way to formalize your agreement.

Managing your financing agreement

After signing your Sunpower financing agreement, managing it effectively becomes essential. pdfFiller provides tools that allow users to track the status of their agreements throughout its lifecycle. Users can easily check whether the document has been signed and finalized or if any actions are required from the other party involved in the financing.

Furthermore, there may be circumstances under which you need to modify your agreement post-signing. Whether due to updated financial situations or changes in your solar installation, contacting Sunpower for amendments is straightforward. It is advisable to initiate this process sooner rather than later to avoid complications with your financing arrangement.

FAQs about Sunpower financing agreements

Potential concerns and misconceptions around Sunpower financing agreements are common among prospective users. A frequent question is what happens if you change your mind after signing the agreement. Most agreements allow for a grace period where changes can be made. However, it's critical to understand the specific terms of your agreement regarding cancellation and modifications to avoid unwanted fees.

Another common worry is about financial changes that could impact your ability to fulfill the terms of the financing agreement. If you foresee changes in your financial situation, it's vital to proactively communicate with Sunpower. Their customer support can guide you through your options, ensuring you remain in compliance with the terms of your agreement.

Conclusion: Empowering your solar journey

Navigating the Sunpower financing agreement process can initially seem complex, but this guide helps clarify each step. Understanding the various financing options, the process of completing the form, and the importance of effective management will empower you to make informed decisions regarding your solar investment. The pdfFiller platform further enhances this experience with its user-friendly tools that simplify document creation, customization, and electronic signing.

In the quest for sustainable energy, leveraging resources like the Sunpower financing agreement form through pdfFiller ensures you embark on your solar journey with confidence and clarity, ultimately contributing to a greener planet.

Document metadata

Keeping accurate record-keeping is essential when handling your Sunpower financing agreement. The types of documents included usually encompass the financing agreement itself, credit applications, and any relevant supporting documents required by the lender. Ensuring that all documents are readily accessible and properly identified will facilitate smoother processes in the future.

Essential identification for future reference of your financing agreement includes your Sunpower customer ID, contract number, and any associated loan numbers or transaction IDs. This organizational tip will save time and provide quick access if questions arise.

Table of contents

1. Understanding the Sunpower Financing Agreement 2. Benefits of Sunpower Financing 3. The Sunpower Financing Agreement Form: A Step-by-Step Guide 4. Editing and Customizing Your Agreement 5. Signing Your Financing Agreement 6. Managing Your Financing Agreement 7. FAQs about Sunpower Financing Agreements 8. Conclusion: Empowering Your Solar Journey 9. Document Metadata

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the sunpower financing agreement form on my smartphone?

Can I edit sunpower financing agreement on an iOS device?

How do I complete sunpower financing agreement on an iOS device?

What is sunpower financing agreement?

Who is required to file sunpower financing agreement?

How to fill out sunpower financing agreement?

What is the purpose of sunpower financing agreement?

What information must be reported on sunpower financing agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.