Get the free Co-insurance/co-payment Reimbursement

Get, Create, Make and Sign co-insuranceco-payment reimbursement

How to edit co-insuranceco-payment reimbursement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out co-insuranceco-payment reimbursement

How to fill out co-insuranceco-payment reimbursement

Who needs co-insuranceco-payment reimbursement?

Comprehensive Guide to Co-Insurance/Co-Payment Reimbursement Forms

Understanding co-insurance and co-payments

Co-insurance refers to the percentage of costs that consumers are responsible for after meeting their deductible. For instance, if your plan mandates 20% co-insurance, you will pay that percentage of the allowed amount for a service once your deductible has been met. Its role in health insurance is crucial, as it shapes out-of-pocket expenses related to medical services.

On the other hand, a co-payment is a fixed dollar amount that a patient pays for a specific service, with the remainder covered by their insurance. Co-payments are commonly associated with preventive services and routine visits, applicable at the time of service.

Understanding the differences between co-payments and co-insurance is vital. Co-insurance involves a variable cost based on the total expenses incurred, while a co-payment is a pre-determined amount regardless of the total expense. The division can influence budgeting for healthcare, as unexpected co-insurance costs can impact total healthcare spending.

Importance of co-insurance and co-payment reimbursement forms

Reimbursement forms are essential tools in seeking financial recovery for co-insurance and co-payment expenses. Without submitting these forms, you risk incurring unnecessary out-of-pocket payments and losing potential refunds from your insurer. By understanding and managing these forms, you facilitate your reimbursement process and ensure better financial health.

Common scenarios where individuals often seek reimbursement include when visiting out-of-network providers or when unexpected medical bills arise, leading to high co-insurance fees. Patients with high deductible plans may repeatedly file for reimbursement once their coverage kicks in.

Navigating the reimbursement process

Successfully submitting your co-insurance or co-payment reimbursement form requires careful attention to detail. Here’s a step-by-step guide to help streamline your process.

Accuracy is crucial during form completion. Failing to provide consistent information can delay processing or lead to a claim denial. Ensuring that every detail aligns with the documentation you submit can help mitigate these issues.

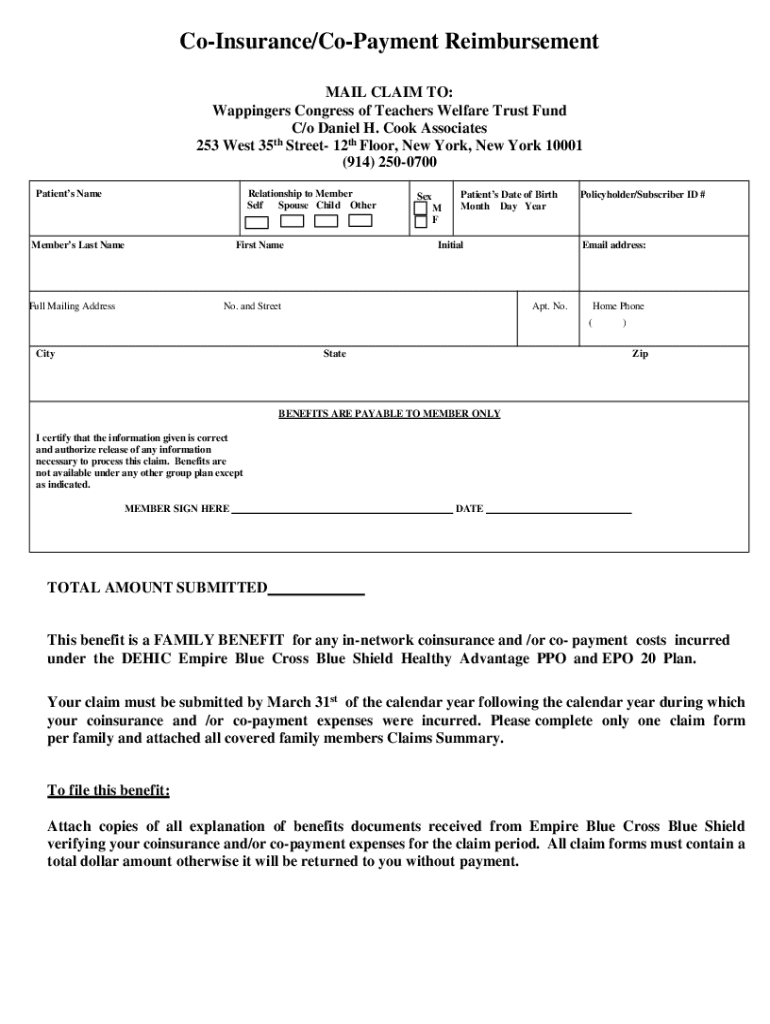

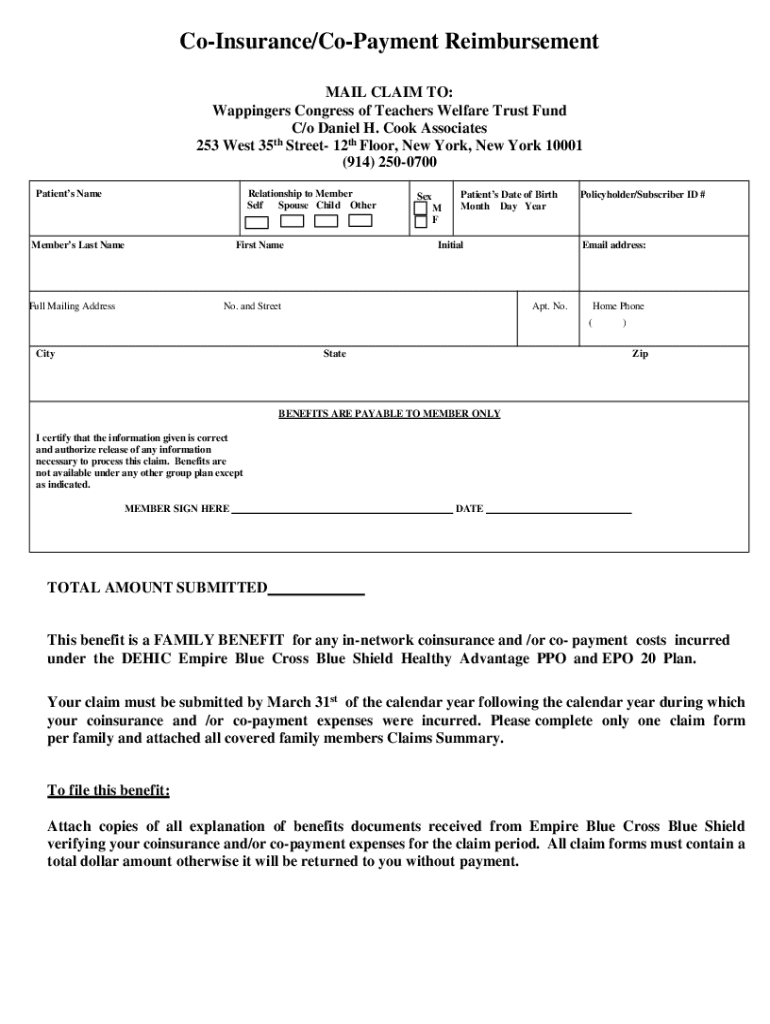

Filling out the co-insurance/co-payment reimbursement form

Filling out the reimbursement form correctly ensures the processing of your claims without unneeded delays. Required information typically includes patient details such as the full name and insurance policy number, provider information, and a description of the treatment received.

When filling out each section of the form, follow structured instructions to maintain clarity. For example, using the right medical codes from your provider can expedite the process.

Common pitfalls to avoid include missing signatures and failing to attach the necessary documentation, which could result in a denial. Before submission, double-check all entries for completeness.

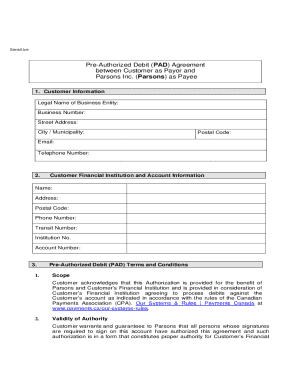

Tools for managing your reimbursement forms

Leveraging cloud-based solutions such as pdfFiller can significantly enhance your experience in handling reimbursement forms. The platform provides a centralized location for storing documents, allowing you quick access from anywhere.

Interactive features within pdfFiller facilitate efficient editing and signing of PDFs, enabling you to collaborate with insurance representatives or providers if needed. The ease of making adjustments to documents and the ability to securely sign them helps streamline the entire process.

Additionally, you can track your form's status using various digital tools available, offering peace of mind while you await your reimbursement. Knowing the current status of your submissions assists in planning financial responsibilities accordingly.

Collaborating with healthcare providers and insurers

Effective communication is key when engaging with healthcare providers. Discuss any co-payments or co-insurance requirements before receiving services to understand your potential financial obligation. Clarity prevents surprises and allows you to budget effectively.

Interacting with insurance companies can often feel daunting. When reaching out, have all relevant information handy, including policy numbers and documentation of previous correspondence. This preparation not only expedites your inquiry but also reinforces your position during discussions.

Frequently asked questions (FAQ) about co-insurance and reimbursements

What should you do if your reimbursement is denied? Start by understanding the reason for denial, usually detailed in the insurer's communication. Following that, gather supportive documents and submit an appeal. Ensure you adhere to any deadlines specified.

Timeframes for reimbursements can vary significantly, often depending on the type of claim. Typical reimbursements may take anywhere from several weeks to a few months. Being patient is vital while also ensuring to follow up periodically.

As a patient, understanding your rights within the reimbursement process is critical. You have the right to appeal any denied claims, request clear information on your bill, and obtain copies of records that pertain to your healthcare.

Conclusion and next steps in your reimbursement journey

In navigating the complexities of co-insurance and co-payment reimbursement forms, educate yourself about the processes involved and utilize available resources. Adopting an organized approach, utilizing pdfFiller for document management, and maintaining proactive communication with providers and insurers will enhance your experience and lead to more effective financial management regarding your healthcare expenses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit co-insuranceco-payment reimbursement on a smartphone?

How can I fill out co-insuranceco-payment reimbursement on an iOS device?

Can I edit co-insuranceco-payment reimbursement on an Android device?

What is co-insuranceco-payment reimbursement?

Who is required to file co-insuranceco-payment reimbursement?

How to fill out co-insuranceco-payment reimbursement?

What is the purpose of co-insuranceco-payment reimbursement?

What information must be reported on co-insuranceco-payment reimbursement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.