Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q: A Comprehensive How-to Guide

Understanding the Form 10-Q

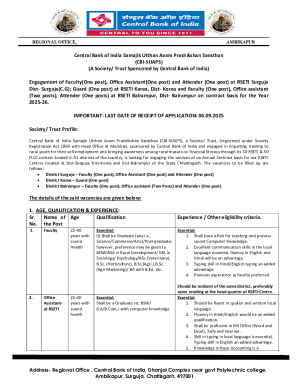

The Form 10-Q is a comprehensive quarterly report mandated by the U.S. Securities and Exchange Commission (SEC) for all publicly traded companies. This form offers insights into a company's financial health and operational performance over the past quarter. Unlike the annual Form 10-K, which provides a complete overview of a company’s financial activities for the year, the Form 10-Q focuses on more granular details that can show trends and shifts in performance that occur throughout the year.

The primary purpose of the Form 10-Q is to provide a transparent update on a company’s financial condition and operational results, thereby serving as a critical tool for investors and stakeholders. Investors rely on these reports to make informed decisions, enabling them to gauge a company's performance relative to its market position and competitors.

Key components of a Form 10-Q

The Form 10-Q consists of several key components that reveal critical information about a company's finances and operations. Firstly, financial statements, which include the income statement, balance sheet, and cash flow statement, provide quantitative data fundamental for assessing financial health. These numbers portray a snapshot of revenues, expenses, assets, liabilities, and cash flow patterns, laying the groundwork for financial analysis.

Next is the Management’s Discussion and Analysis (MD&A), where management offers insights into the numbers, discussing factors that influenced financial results. This section is particularly valuable as it goes beyond the raw data, giving context and strategic direction behind the figures. Furthermore, the business description elaborates on the company’s operations and strategies, offering a concise overview of how the company positions itself in its respective market. Lastly, companies must disclose quantitative and qualitative information about market risks they may face, adding yet another layer of transparency.

Steps to access and download a Form 10-Q

Accessing the Form 10-Q is straightforward thanks to the SEC's EDGAR database, where these forms are filed. Users can enter a company’s name or stock symbol and locate the desired filings by navigating to the appropriate section of the database. Once you have identified the most recent Form 10-Q, simply click through to view it in the native format.

Alternatively, pdfFiller enhances this process by allowing users to download, edit, and manage Form 10-Qs with ease. You can utilize the pdfFiller platform to streamline your document management with the following steps: log into your account, search for the Form 10-Q you need, and select the file format for download. pdfFiller also offers tools for collaboration and document sharing, which can significantly enhance team productivity.

Filing deadlines for Form 10-Q

Companies are required to file Form 10-Q within 40 days after the end of each fiscal quarter. This timeline ensures that shareholders and potential investors receive timely updates on a company’s performance. Distinguishing this from the annual reporting cycle, the Form 10-K, which encompasses a broader overview of the entirety of the year, is due 60 to 90 days post-fiscal year end, depending on the company’s public float.

Failure to file Form 10-Q within the stipulated period can have several consequences, including penalties and reputational harm for the company. Such delays can erode investor trust and potentially impact stock prices negatively. Ensuring on-time filings is thus critical for maintaining a company's credibility in the eyes of investors.

Troubleshooting common issues with Form 10-Q filings

While filing Form 10-Q, companies often encounter common issues such as data inaccuracies, incomplete disclosures, or formatting errors. Errors can lead to significant scrutiny from regulators and may require amendments to the filings, which can prolong the reporting process and lead to additional complexity.

To correct such inaccuracies, companies should have a dedicated compliance team that regularly reviews reports prior to submission, ensuring all data is not only accurate but clearly articulated. Additionally, addressing any delays in filing proactively is essential to maintain investor confidence and avoid penalties. Clear internal communication and a checklist for filing can help minimize the risks associated with errors.

Analyzing the financial data within a Form 10-Q

Analyzing the financial data within a Form 10-Q can provide invaluable insights for investors. Key financial ratios, such as the current ratio for liquidity, debt to equity for leverage assessment, and return on equity for performance can often be derived from the financial statements included. These metrics serve as vital indicators of a company's financial strength and operational efficiency.

Consider case studies where specific companies revealed significant growth or downturns in their Form 10-Q filings. Reacting to these documents allows investors to spot trends that may indicate future performance. Monitoring quarterly results enables stakeholders to make informed decisions based on real-time data rather than waiting on annual results, making Form 10-Q a critical touchpoint in ongoing investment strategy.

How to effectively utilize Form 10-Qs for investment decisions

Effectively utilizing Form 10-Qs in investment decisions begins with a methodical approach to reading the filings. Investors should look beyond just financial numbers; they need to comprehend the narrative provided by management in the MD&A segment, examining how past strategies impact current results. Key metrics to monitor include revenue growth rates, changes in margins, and any notes regarding risks that could affect future performance.

Further, highlighting potential risks and opportunities expressed in the filings allows investors to navigate the complex landscape of the market effectively. Understanding the context of these filings within industry trends and economic environments will enhance the decision-making process and help investors assess whether a company's stock is a worthwhile addition to their portfolios.

Advanced tools for managing Form 10-Qs

To facilitate ease of management, pdfFiller offers advanced tools for editing and collaborating on Form 10-Qs. This includes interactive features that allow users to add notes, comments, and relevant insights directly into the document, enabling a collaborative approach amongst team members. By utilizing cloud-based document management, teams can store and access forms anytime and anywhere, making it easier to maintain accurate records and historical data.

Template customization features are also available, allowing businesses to adjust standard templates to fit their unique workflows and requirements. Such capabilities not only save time but improve overall efficiency in document management, pivotal for teams under pressure to produce timely and accurate filings.

Comparing Form 10-Q with other financial reports

The Form 10-Q is distinct from other financial reports, especially Form 10-K, which encapsulates an organization’s entire financial year in a single document. Investors must understand when to refer to these reports; while the 10-Q offers a focused look at quarterly performance, other documents like Form 8-K provide immediate updates about significant events affecting the company. Quarterly earnings releases are essential, but they may lack the granularity and disclosure level of a Form 10-Q.

Each report serves different informational needs. While the annual Form 10-K is comprehensive and provides deep insights into a company's performance over an extended period, the Form 10-Q highlights shorter-term fluctuations, and the Form 8-K addresses urgent updates. Understanding the context of these varying reports can significantly enhance an investor's informational arsenal.

Future of Form 10-Q filing: trends and changes

Looking ahead, Form 10-Q filings may see shifts due to regulatory changes aimed at enhancing transparency and efficiency in financial reporting. As technology plays a greater role, the potential for automated reporting and AI-driven analytics may simplify the way companies prepare and file their 10-Qs. This transition could facilitate easier access to high-quality, structured data, enabling investors to leverage insights more effectively.

As platforms like pdfFiller continue to innovate, users may benefit from enhanced tools for document management even further. Being able to prepare for a landscape that increasingly incorporates technology will ensure that companies remain compliant and effective in their reporting, ultimately benefiting investors as they gather insights.

Frequently asked questions about Form 10-Q

Investors often have various queries regarding the Form 10-Q, such as the specific filing requirements and how to interpret the diverse elements included within this form. It is crucial for users to understand that information presented here is not merely a legal obligation; it is a critical piece of the puzzle for analyzing financial health. For additional support, individuals can reach out to compliance experts or utilize platforms like pdfFiller, which provides tools and resources geared towards helping users effectively manage and understand Form 10-Q filings.

Engagement through FAQs assists in demystifying the filing process and ensures that both new and experienced investors can navigate the complexities with greater confidence. The more educated an investor is about the context and contents of Form 10-Qs, the better equipped they will be to incorporate this report into their broader investment strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 10-q directly from Gmail?

How do I make changes in form 10-q?

How do I fill out the form 10-q form on my smartphone?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.