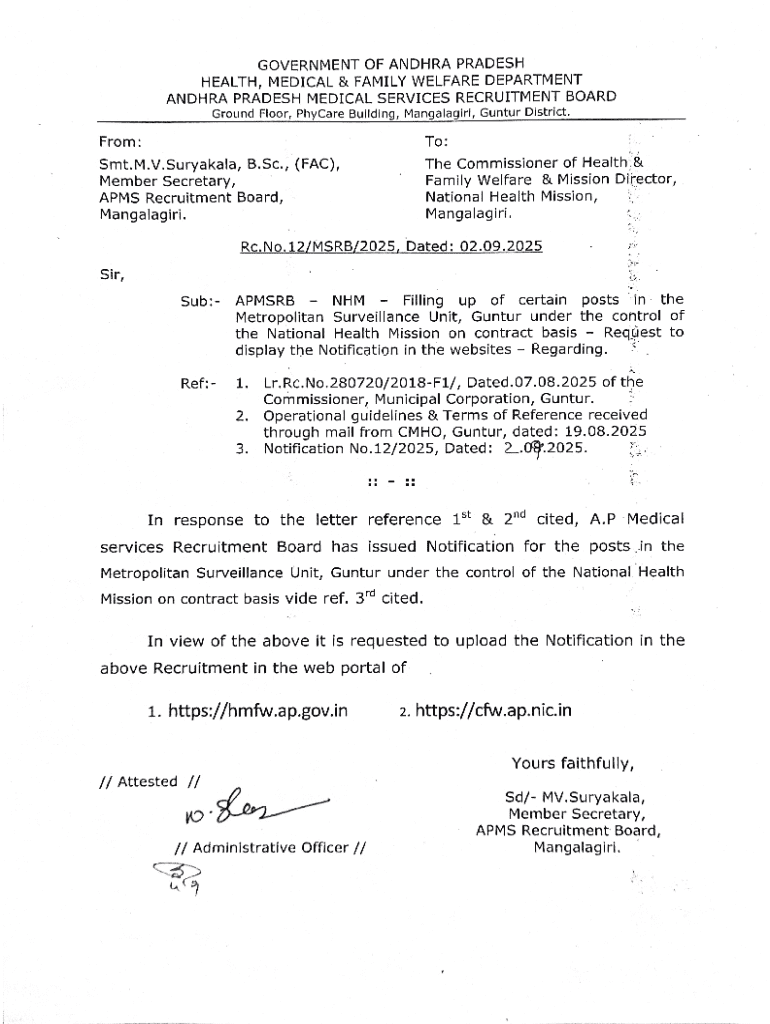

Get the free Government Notification No. 12/2025 - cfw ap nic

Get, Create, Make and Sign government notification no 122025

How to edit government notification no 122025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out government notification no 122025

How to fill out government notification no 122025

Who needs government notification no 122025?

Understanding the Government Notification No 122025 Form

Understanding Government Notification No 122025

Government Notification No 122025 is a critical document within India's regulatory framework, aimed at enhancing compliance and streamlining processes across various sectors. Such notifications serve to inform the public and stakeholders about changes in laws, policies, or regulations instituted by the government. They are integral to policy-making as they provide clarity on compliance requirements and regulatory means.

This particular notification addresses specific directives within the realm of customs and indirect taxes, impacting industries involved in import/export activities. It outlines compliance expectations for stakeholders, ensuring they align with the latest practices mandated by the Central Board of Indirect Taxes and Customs (CBEC) under the Ministry of Finance.

Significance of the Government Notification No 122025 Form

The Government Notification No 122025 Form is designed to provide a structured approach for individuals and companies to report information as mandated by the government. This form plays a crucial role in ensuring that all relevant stakeholders maintain compliance with the latest regulatory requirements regarding customs, tariffs, and indirect taxes, thus safeguarding against legal penalties.

Businesses engaged in international trade are particularly affected; they must regularly engage with this form to ensure adherence to customs compliance protocols. Failure to use this form correctly can lead to significant legal implications, including fines and delays in the processing of goods at ports. Therefore, understanding the importance of this form is imperative for any trade-related entity.

Step-by-step guide to filling out the Government Notification No 122025 Form

Before beginning to fill out the Government Notification No 122025 Form, it is essential to gather all required documents, including your business registration details, tax identification numbers, and any relevant customs documentation. Missing information can lead to discrepancies, which may result in delays.

Each section of the form is designed to capture specific information necessary for compliance. Start with your identifying information, including your company name, address, and contact details. Afterward, clearly articulate the purpose of your submission, ensuring you provide a long explanation if required. Lastly, attach any supporting documentation that reinforces your submission.

Editing and making changes to the Government Notification No 122025 Form

Once you have completed the Government Notification No 122025 Form, careful review is essential. Using pdfFiller can streamline this process significantly. First, upload your completed form to pdfFiller, where you can easily edit or update any necessary sections without needing to restart from scratch.

When managing multiple versions of the form, best practices include naming your files systematically with the date and version number. This ensures easy retrieval and mitigates the risk of unintentional submission of outdated forms.

Signing and submitting the form

Electronic signatures have gained traction and are recognized legally in many jurisdictions, including India. When using the Government Notification No 122025 Form, signing electronically via pdfFiller ensures both legality and efficiency. Simply follow the instructions within pdfFiller to add your eSignature seamlessly.

Submission methods vary; you can submit online through designated portals or send a physical copy depending on the requirements specified in the notification. Keep an eye on deadlines to ensure timely submissions, especially considering adjustments during customs and logistics processing.

Managing and tracking your Government Notification No 122025 Form submission

After submission, it's critical to keep track of the status of your Government Notification No 122025 Form. Utilize tools like email notifications or submission tracking via the pdfFiller platform. Be prepared to respond promptly to any requests for additional information or clarifications from the relevant authorities.

If issues arise, such as submission rejections, have a plan in place. This may include direct communication with the customs authority or legal advisors specializing in customs compliance to resolve the matter expediently.

Additional tips for effective document management

Collaborating within teams can enhance document preparation efficiency. pdfFiller's collaborative features allow multiple team members to review, comment, and finalize documents in real-time, making it easier to align everyone's input before final submission.

Document security is non-negotiable. Ensure that sensitive information is protected through password protection and secure sharing links provided by pdfFiller. Additionally, remember to take advantage of cloud storage for easy access and audit trails, making it simpler to manage indirect taxes and customs documentation.

Frequently asked questions (FAQs)

Common questions around Notification No 122025 often include its relevance to specific sectors, timelines for implementation, and how to effectively meet compliance requirements. Many users are unsure whether the information they provide could put them at risk for audits or misunderstandings.

As for pdfFiller, users frequently inquire about features like eSigning, collaboration, and cloud storage integration. Comprehensive user support via FAQs ensures that you will be equipped with all necessary knowledge to utilize pdfFiller efficiently.

Success stories and case studies

Numerous users have navigated the complexities of the Government Notification No 122025 Form with the help of pdfFiller. Case studies highlight the experiences of businesses that efficiently managed their submissions, leading to fewer compliance issues and smoother customs processing.

Feedback from users emphasizes how streamlined processes and enhanced collaboration led to greater compliance and satisfaction, showcasing pdfFiller as a powerful tool for document management in trade and customs.

Resources for further information

For more details on Government Notification No 122025 and its implications, stakeholders can consult official resources from the Government of India, specifically the Central Board of Indirect Taxes and Customs. Regulatory bodies often provide updates and clarifications that are pertinent to compliance.

For personalized assistance with pdfFiller, users can access customer support directly through the platform where experts can guide them in resolving any specific concerns related to the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my government notification no 122025 in Gmail?

How do I complete government notification no 122025 online?

Can I create an electronic signature for the government notification no 122025 in Chrome?

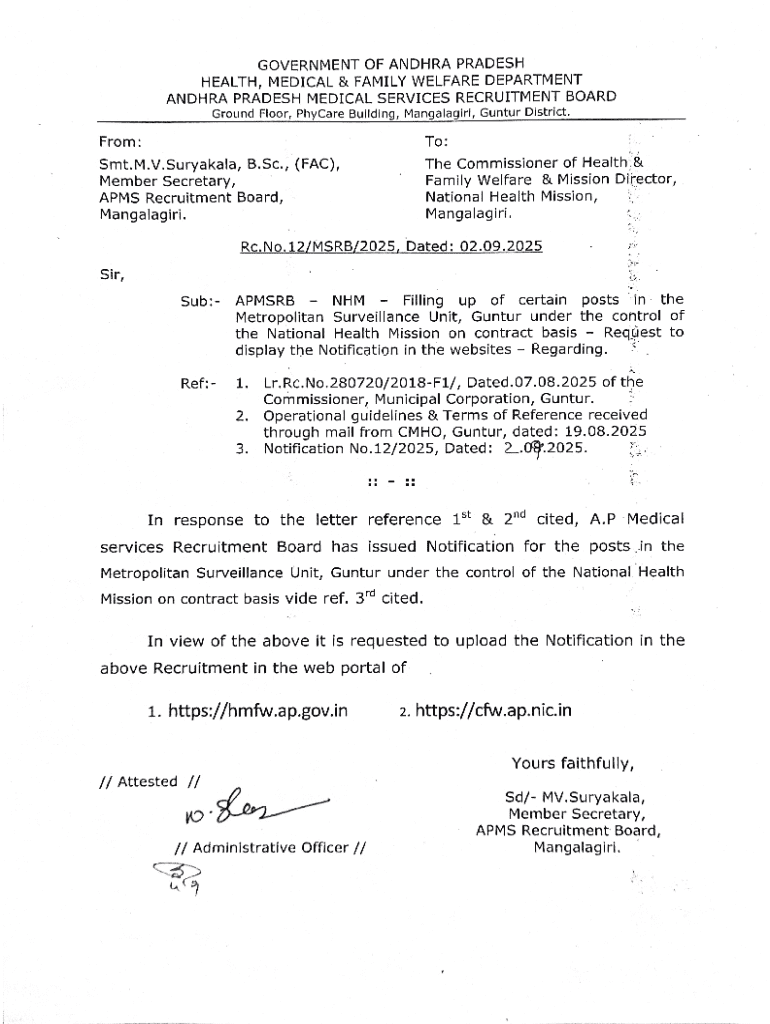

What is government notification no 122025?

Who is required to file government notification no 122025?

How to fill out government notification no 122025?

What is the purpose of government notification no 122025?

What information must be reported on government notification no 122025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.