Get the free Tax Laws

Get, Create, Make and Sign tax laws

How to edit tax laws online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax laws

How to fill out tax laws

Who needs tax laws?

Tax laws form: A comprehensive how-to guide

Understanding tax laws: An overview

Tax laws are the regulations imposed by governmental entities that dictate how taxes are assessed and collected. They are critical for maintaining societal structure and funding public resources, from roads to education. For individuals and businesses, understanding these laws is vital for ensuring compliance and avoiding penalties.

Compliance with tax laws directly affects taxpayers' legal standing and financial health. Not only do tax laws govern how much one pays, but they also delineate rights and responsibilities. Common types of taxes include income tax, which affects personal earnings; sales tax, applied to purchased goods; property tax, levied on real estate; and corporate tax, which pertains to business profits.

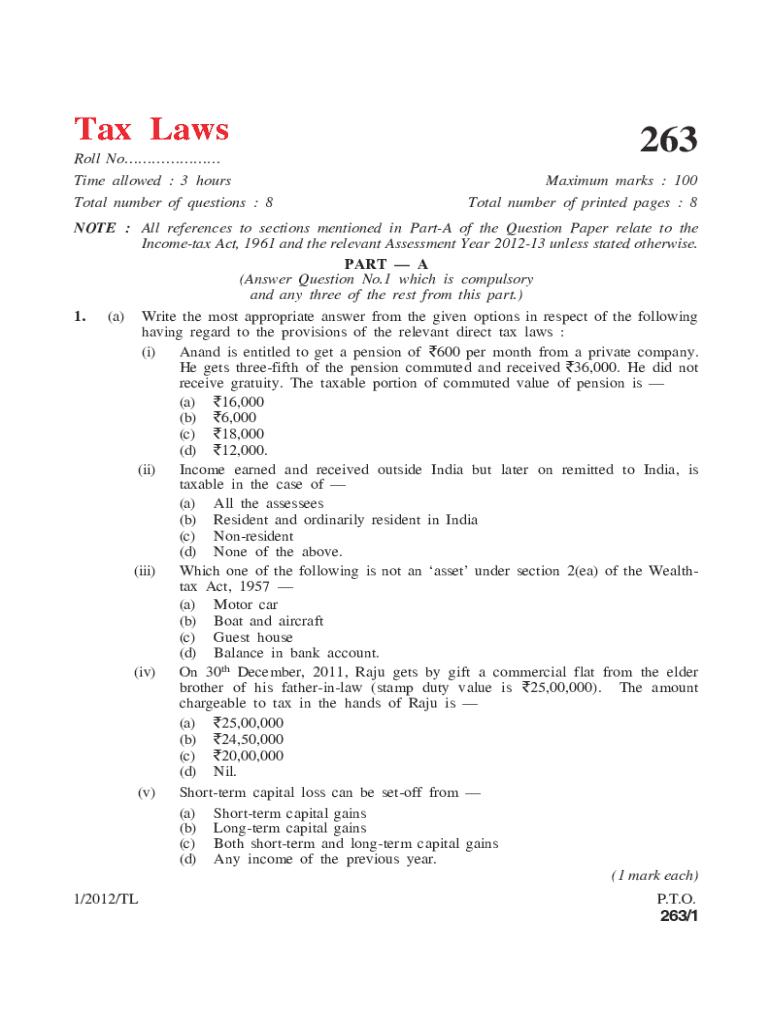

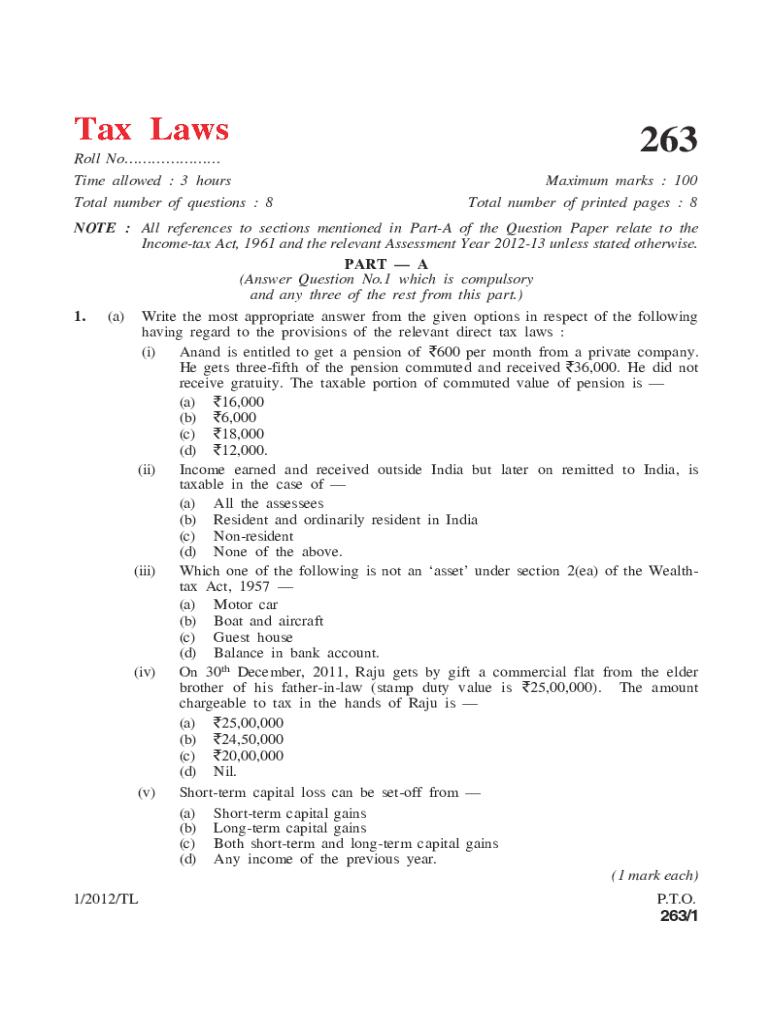

Introduction to tax forms

Tax forms are essential documents utilized to report income, claim deductions or credits, and compute the tax that is owed to the government. Each form has a specific purpose based on the taxpayer’s situation; for example, individuals will often use the Individual Income Tax Return (1040), while businesses may use forms like 1120 or 1065.

Correct and complete filling of tax forms is vital, as it not only determines the tax liability but also guards against audits and penalties from the income tax department. Errors can lead to issues that might necessitate appeals with a joint commissioner or other tax authorities. Therefore, understanding key forms and their specific requirements is crucial for taxpayers.

Navigating the tax laws form

Accessing tax forms is straightforward, especially through platforms like pdfFiller, which offers a variety of popular tax forms ready for completion. Users can browse forms necessary for their specific situations and download or fill them out directly online.

Understanding the instructions on tax forms is crucial for accuracy. The IRS provides official instructions for each form, detailing step-by-step how to complete them effectively. pdfFiller further enhances accessibility by consolidating these instructions alongside editable forms, allowing users to refer to guidance without navigating away.

Step-by-step instructions for filling out tax forms

Filling out a tax form requires meticulous attention to detail. Begin by gathering all necessary documentation, such as income statements like W-2 or 1099 forms, information about possible deductions, and your personal identification details.

For example, when completing Form 1040, follow these detailed steps: Start with the Personal Information Section, ensuring that your name and Social Security number are correct. Next, accurately report total income by summing all sources of earnings, including wages, rental income, and interest. After reporting, proceed to the deductions and adjustments section where applicable deductions can be claimed, such as contributions that qualify under Section 80G of the Income Tax Act.

Identifying potential tax credits can further reduce your liability, so be thorough when exploring these options. Finally, ensure that you sign and date the form; lack of signature could result in processing delays. Common mistakes include mismatched names or incorrect arithmetic, so double-check your entries.

Editing and managing tax forms with pdfFiller

pdfFiller offers robust editing tools for tax forms, making it easy to modify existing documents. Users can add, delete, or alter text directly on the forms, which streamlines the process of correcting errors or updating information from year to year.

Adding digital signatures is also effortless, as pdfFiller allows you to create and insert an eSignature directly on documents. This feature is essential not only for compliance with IRS submission requirements but also for securing your documents during transmission.

eSigning and security features

Signing tax documents—whether electronically or traditionally—is a legal requirement. With pdfFiller, you can easily eSign your forms; eSignatures are valid under federal law and carry the same weight as handwritten signatures in legal contexts.

In addition to signing features, pdfFiller adheres to stringent security protocols, protecting sensitive information from unauthorized access. These measures include data encryption, secure servers, and user access controls, so your private information remains safeguarded while you manage your tax documents.

Keeping track of your tax forms and deadlines

Organizing tax documents can be a daunting task, especially if you are dealing with multiple years or different types of forms. Utilizing pdfFiller allows you to keep everything organized; you can save forms in folders and label them for easy retrieval at any point.

Additionally, pdfFiller's reminder features help set alerts for critical tax filing dates, ensuring that you don’t miss deadlines. If you ever need more time, understanding the extension options available can provide a strategic advantage, allowing a buffer to gather further information if necessary.

Frequently asked questions (FAQs) about tax laws forms

Common concerns raised by taxpayers often revolve around the integrity and accuracy of their submissions. For instance, if you discover a mistake on a tax form after submission, it is important to act quickly. Typically, you can amend a tax return using Form 1040-X, but be cautious of penalties that could arise from late filings.

The distinction between individual and business tax laws can also lead to confusion. Businesses have different compliance requirements and specific forms they must use, depending on their structure, whether it's a corporation, partnership, or sole proprietorship. Understanding these differences is crucial for accurate and compliant filing.

Best practices for tax filing using technology

With advancements in technology, cloud-based solutions like pdfFiller have emerged as game changers for tax preparation. These platforms provide interactive tools that allow users to seamlessly complete tax forms from anywhere, reducing errors that occur from manual entry.

Staying informed about changes in tax laws is also crucial. Legal updates can significantly affect tax liabilities, so users should subscribe to updates regarding changes in the income tax act and other relevant regulations as they pertain to their responsibilities. Utilizing technology enables taxpayers to embrace change quickly and effectively.

Support and technical assistance on pdfFiller

Navigating tax forms can be complicated, but pdfFiller provides robust support to its users. If you encounter issues while filling out forms or need assistance understanding the features, accessing help is straightforward through their customer support.

Additionally, pdfFiller offers a wealth of educational resources and tips, making it easier for users to handle tax-related documentation with confidence. This is particularly crucial during tax season when timely assistance can alleviate potential stress regarding filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the tax laws electronically in Chrome?

How do I complete tax laws on an iOS device?

Can I edit tax laws on an Android device?

What is tax laws?

Who is required to file tax laws?

How to fill out tax laws?

What is the purpose of tax laws?

What information must be reported on tax laws?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.