Get the free New Account Application - colsa unh

Get, Create, Make and Sign new account application

Editing new account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new account application

How to fill out new account application

Who needs new account application?

New Account Application Form - Comprehensive How-To Guide

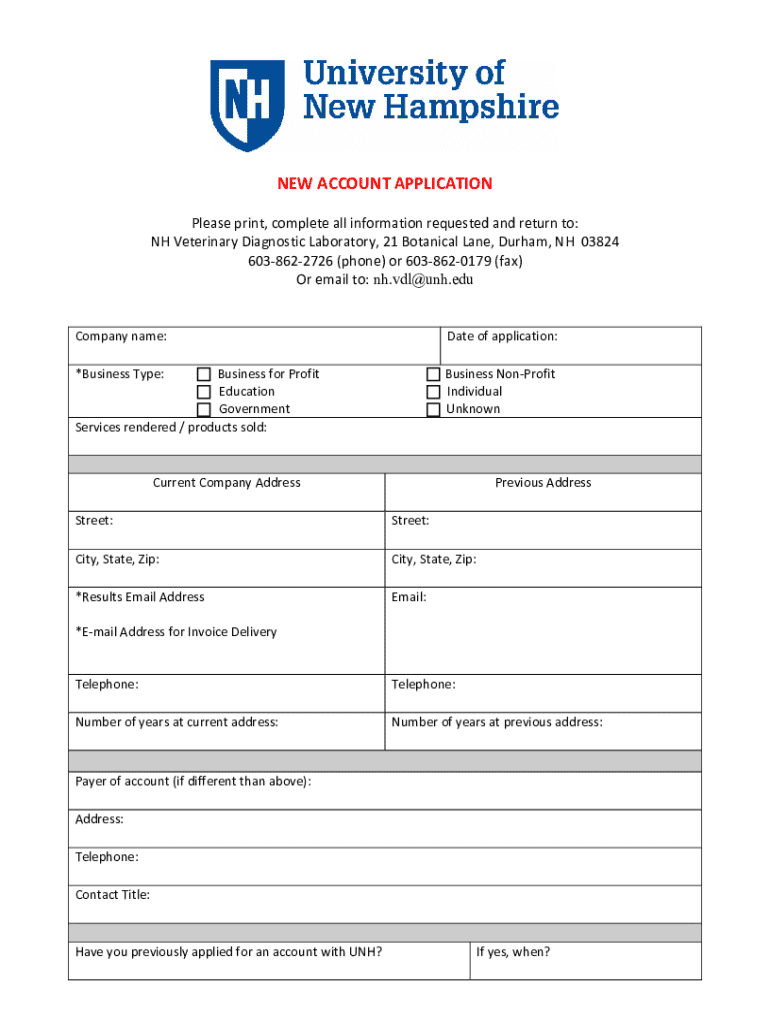

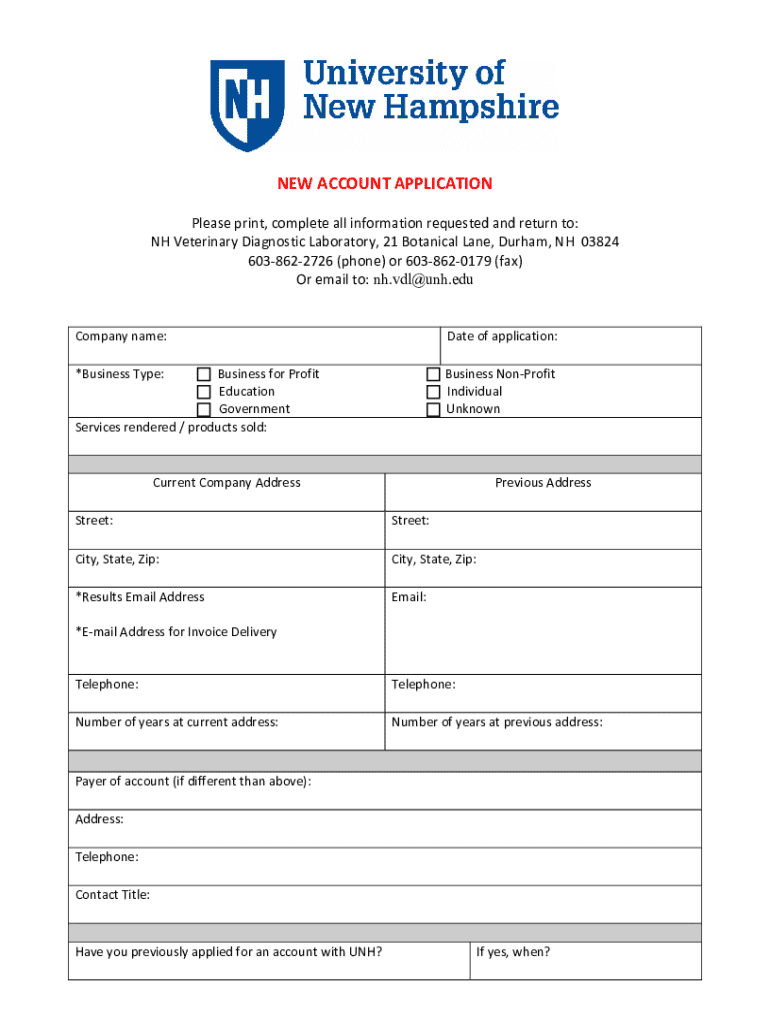

Understanding the new account application form

The new account application form serves as the gateway for individuals and businesses to establish formal relationships with financial institutions. Rather than just a bureaucratic hurdle, it is a critical document designed to collect necessary information to evaluate eligibility and compliance. Successful completion of this form can lead to smooth access to services like banking, investment accounts, and retirement funds.

Different account types come with unique purposes. For instance, non-retirement accounts typically focus on day-to-day transactions, while retirement accounts prioritize long-term investments for secure futures. Meanwhile, business accounts cater to the operational needs of companies, including managing cash flows and facilitating employee expenses.

Key requirements before filling out the form

Before diving into filling out the new account application form, it is essential to gather the right documents. Identification documents, such as a driver’s license or passport, confirm your identity. Proof of address, like a utility bill or lease agreement, establishes residency. Additionally, financial information including employment status, income levels, and tax identification numbers might be required to assess financial viability.

Being aware of eligibility criteria is also crucial. Each financial institution may have specific requirements, such as age restrictions or credit score minimums that you must meet. Common mistakes to avoid include not verifying the information beforehand, overlooking sections within the form, or submitting the application without the necessary documentation.

Navigating the new account application form

The structure of a new account application form comprises several key sections designed to elicit essential information from applicants. Typically, the personal information section requires your name, contact details, date of birth, and social security number. The financial information section inquires about your income, other accounts, and liabilities. Lastly, additional information often includes questions related to your financial goals or investment preferences.

Filling out personal information requires attention to detail. Ensure that all names are spelled correctly and that the contact details are accurate to avoid communication delays. Providing accurate financial details means disclosing your income and any existing debts, enabling the institution to better recommend account types that suit your needs. Finally, acknowledging terms and conditions can be misunderstood, so read them carefully to avoid unexpected obligations.

Interactive tools available on pdfFiller

pdfFiller offers an extensive range of interactive tools, making the process of editing and signing application forms more manageable than ever. Users can upload their new account application form onto the platform for instant access to editing features that allow for adjustments, annotations, and corrections. The pdfFiller editor facilitates easy modification of the form’s content, ensuring accuracy and professionalism.

In addition, eSigning features empower users to add their digital signatures swiftly. With a simple click, your eSignature can be integrated into the application, maintaining the legal weight and validity necessary for financial documentation. This process removes the need for printing, scanning, or mailing the physical forms, exemplifying the efficiency of cloud-based solutions.

Collaborating with your team

Collaboration is key, especially when multiple team members are involved in the new account application process. pdfFiller allows users to easily share application forms with colleagues, enabling real-time input and feedback. This collaborative feature means that all parties can engage with the document simultaneously, streamlining discussions and ensuring that the application reflects everyone's agreement and understanding.

The platform's built-in commenting system adds a layer of transparency, allowing team members to leave notes or ask questions directly on the document. This immediate communication enhances clarity and reduces errors in submissions. Once everyone has contributed, pdfFiller makes approval straightforward with just a few clicks, promoting effective teamwork.

Managing your new account application

Once the application is submitted, managing its status becomes essential. Most institutions provide an online portal where you can track the progress of your new account application. Real-time updates keep you informed about whether further information is needed or if your application has moved to the approval stage.

In the event of a denial, it's crucial to understand common reasons, such as discrepancies in provided information, failure to meet eligibility criteria, or insufficient documentation. Knowing how to appeal can empower applicants; institutions often provide a process for re-evaluation. Additionally, should your circumstances change, the ability to adjust or update your account information is vital for maintaining accurate records and data compliance.

Frequently asked questions (FAQs)

Filling out a new account application form often raises questions. If you find yourself stuck at any point during the process, checking frequently asked questions can provide clarity. Most institutions will have a dedicated section for FAQs, offering guidance based on common inquiries. Beyond the text on the form, you may need additional support; look for customer service contacts or live chat options for immediate assistance.

Another common question pertains to editing the application post-submission. Generally, most institutions allow a short window for modification, especially if quickly caught after sending. Contacting customer support should be your first step if changes are necessary. Understanding these processes beforehand can dramatically improve your experience with filling out your new account application form.

Exploring more forms and applications on pdfFiller

pdfFiller hosts a variety of templates and forms that extend beyond just the new account application. Users seeking similar application forms can find connections to other financial documents essential for managing personal or business finances. From templates for loans to rental agreements, pdfFiller offers an extensive library tailored to a multitude of user needs.

The benefits of using pdfFiller are numerous. Its user-friendly interface allows for easy navigation, giving you access from anywhere with an internet connection. The platform is designed for convenience, saving time while providing efficient document creation solutions, whether in a collaborative setting or for personal tasks.

Legal and compliance information

Understanding the legal implications of the new account application form is essential for both individuals and businesses. Applicants must be aware of relevant regulations and compliance standards that govern financial documentation. This includes accurately reporting personal and financial information to prevent misrepresentation, which can lead to severe penalties.

Additionally, protecting your data privacy and understanding the security measures in place to safeguard personal information are paramount. Financial institutions are required to follow strict security practices to ensure that your data is not only used for the intended purpose but is also protected against unauthorized access. Familiarizing yourself with these compliance standards enhances your overall application experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my new account application directly from Gmail?

Can I sign the new account application electronically in Chrome?

How do I edit new account application straight from my smartphone?

What is new account application?

Who is required to file new account application?

How to fill out new account application?

What is the purpose of new account application?

What information must be reported on new account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.