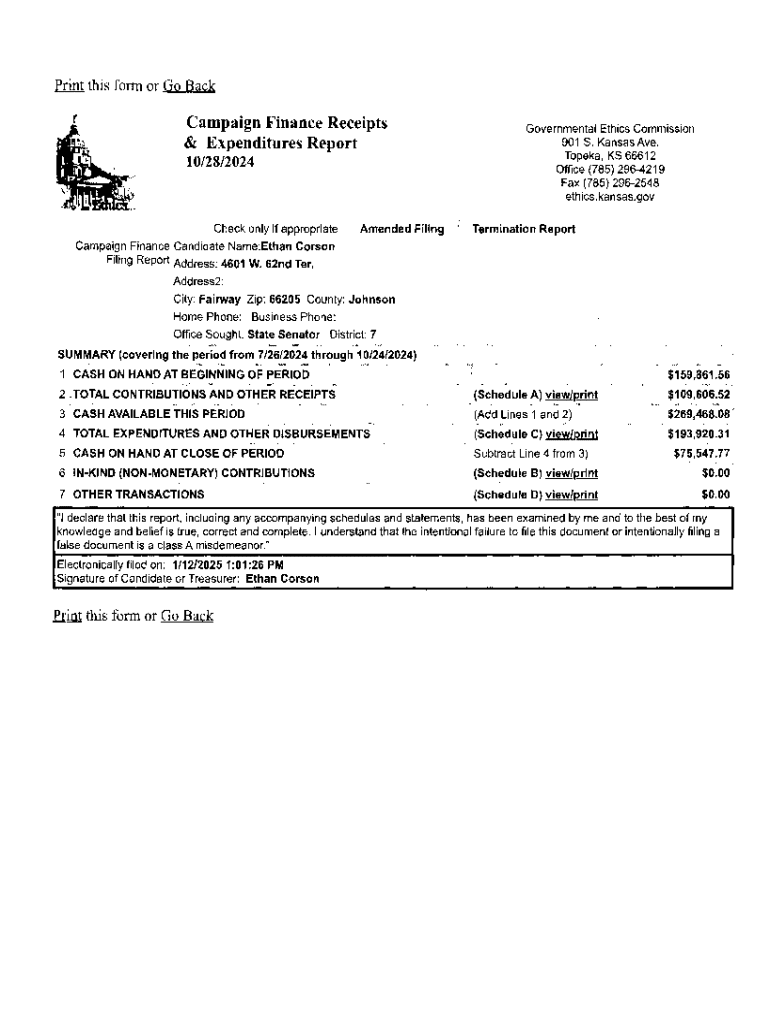

Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

Editing campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Understanding the Campaign Finance Receipts Expenditures Form

Understanding campaign finance forms

Campaign finance receipts and expenditures forms play a crucial role in the political financing landscape. These forms are essential for candidates, committees, and political organizations to report on the money they receive and spend during their campaigns. By maintaining transparency and accountability, these documents help ensure the political process functions fairly and openly. Each state has its own regulatory requirements that outline how these forms should be filled out, submitted, and maintained.

Key terms for anyone navigating these forms include contributions, which are funds given to a campaign; expenditures, the money spent on campaign-related activities; and the reporting period, which denotes the time frame within which all financial activities must be reported. A firm grasp of these terms is vital for accurate reporting.

Types of campaign finance forms

Campaign finance forms come in various types, each catering to specific aspects of campaign financing. Basic forms cover individual contributions and expenses, providing a straightforward way to track and report financial activities. Advanced forms may include in-kind contributions, which represent non-monetary support like donated goods or services; and loans and obligations, which detail any borrowed funds that need to be repaid.

It's important to note that state-specific variations exist in these forms. For instance, specific line items might differ based on state laws, and some may require additional documentation to accompany the forms. Candidates and campaign teams should familiarize themselves with the relevant laws in their state to ensure compliance.

Detailed breakdown of campaign finance receipts

When documenting campaign finance receipts, it’s essential to capture all types of contributions accurately. Contributions can come in various forms, including cash donations, checks, and online transactions. Each type requires specific information to be documented, such as the donor's details, the amount contributed, and the date of the contribution. This ensures that all receipts are traceable and verifiable.

Maintaining guidelines for documenting contributions is equally important. Best practices include keeping thorough records and receipts, which not only provides accountability but also protects candidates from potential legal repercussions related to improper documentation. Each state will have specific regulations regarding how long these records must be kept, further emphasizing the need for meticulous organization.

Managing campaign expenditures

Properly documenting campaign expenditures is just as critical as tracking receipts. Essential elements to report include various types of expenses such as advertising, salaries for campaign staff, event costs, and operational expenses. Each entry should be clear and accurately categorized to avoid confusion and misreporting.

Common pitfalls in this area include misclassifying expenses or neglecting to keep receipts altogether. Such errors could lead to compliance issues, financial discrepancies, and a potential loss of credibility with voters. Maintaining a clear system for categorizing and storing receipts will bolster your reporting accuracy and enhance overall campaign management.

Step-by-step guide to filling out the form

Filling out a campaign finance receipts expenditures form begins with thorough preparation. First, organize your financial data by compiling all necessary documents, including donation records and expenditure receipts. Understanding what information is required on the form is key, so reviewing state-specific requirements beforehand is advisable.

Next, proceed to fill out the form carefully. Break it down section by section, ensuring that you input data accurately. This includes recording each contribution and expenditure in their respective categories. Using tools like pdfFiller can enhance efficiency, enabling you to edit, sign, and manage documents seamlessly. Features such as eSigning and cloud-data storage ensure easy access and collaboration with team members.

Reviewing and submitting your campaign finance form

Once the form is completed, implementing best practices during the review phase is critical. Double-checking for completeness and accuracy is a must to ensure compliance with local regulations. Pay close attention to details such as amounts recorded, donor information, and dates. An error in reporting can lead to costly consequences.

After the review, the submission process can begin. Most states allow for both online and paper submissions, each with its own methods and regulations. Deadlines are strict, and knowing the specific filing requirements for your locality is vital, as late submissions can result in penalties.

Tracking and managing your reports

Utilizing tools for ongoing management of your campaign finance reports is essential. Platforms like pdfFiller provide features for tracking edits and changes, ensuring that all team members stay in the loop. Additionally, collaboration options allow team members to work together seamlessly, enhancing efficiency and communication. Such tools make it easier to maintain up-to-date records.

Staying updated on reporting changes is another critical factor. Regularly checking resources for updates on local regulations will help ensure compliance and prevent potential issues down the line. Understanding changes in campaign finance laws can save time and enhance transparency throughout your campaign.

Common questions about campaign finance forms

As candidates and campaign teams navigate the complexities of finances, questions often arise. Common queries include handling late submissions. Late filings can lead to penalties, thus understanding the implications and corrective actions is crucial. Similarly, knowing how to correct errors after submission can alleviate undue stress and prevent complications.

Expert tips are invaluable for best practices in campaign finance management. Veteran campaign managers often recommend staying organized, maintaining an updated log of contributions and expenditures, and leveraging digital tools for efficient reporting. Such practices ensure campaigns remain compliant and effectively managed.

Conclusion

Campaign finance management requires diligence and accuracy. Understanding the campaign finance receipts expenditures form is essential for transparent political campaigns. Proper management not only fulfills legal obligations but also builds trust with supporters and voters. With tools like pdfFiller at your disposal, navigating these complexities can become an organized and straightforward task, ensuring your campaign is grounded in transparency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in campaign finance receipts expenditures without leaving Chrome?

Can I sign the campaign finance receipts expenditures electronically in Chrome?

How can I edit campaign finance receipts expenditures on a smartphone?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.