Get the free Form 8824

Get, Create, Make and Sign form 8824

Editing form 8824 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8824

How to fill out form 8824

Who needs form 8824?

Comprehensive Guide to Form 8824: Understanding Like-Kind Exchanges

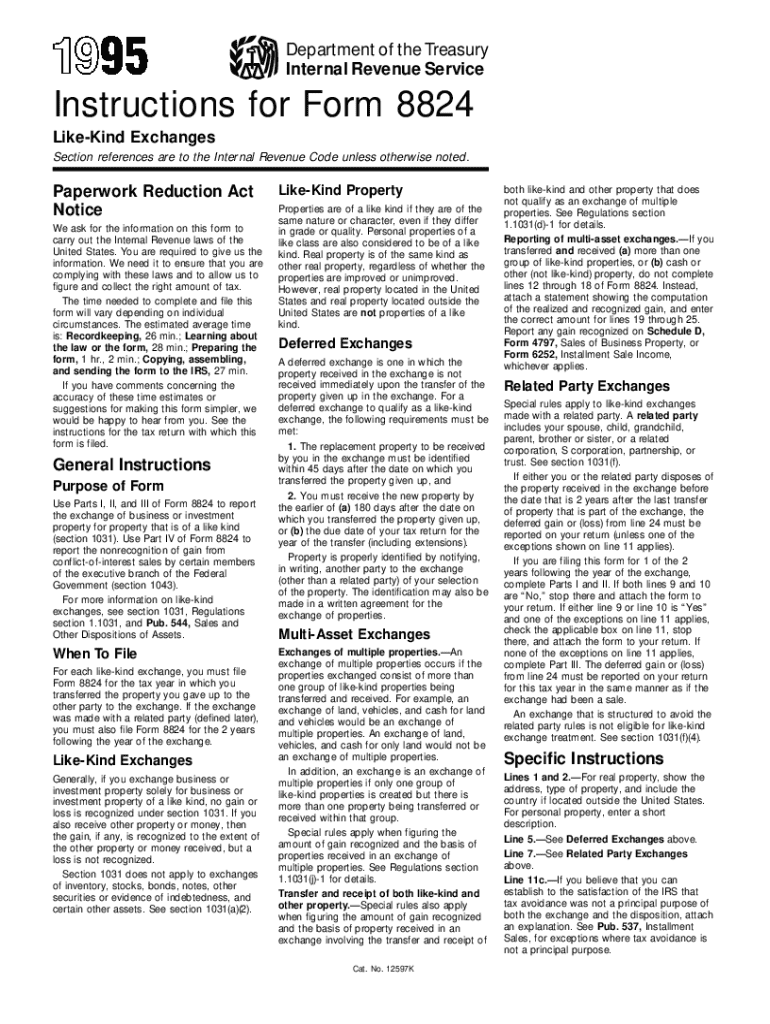

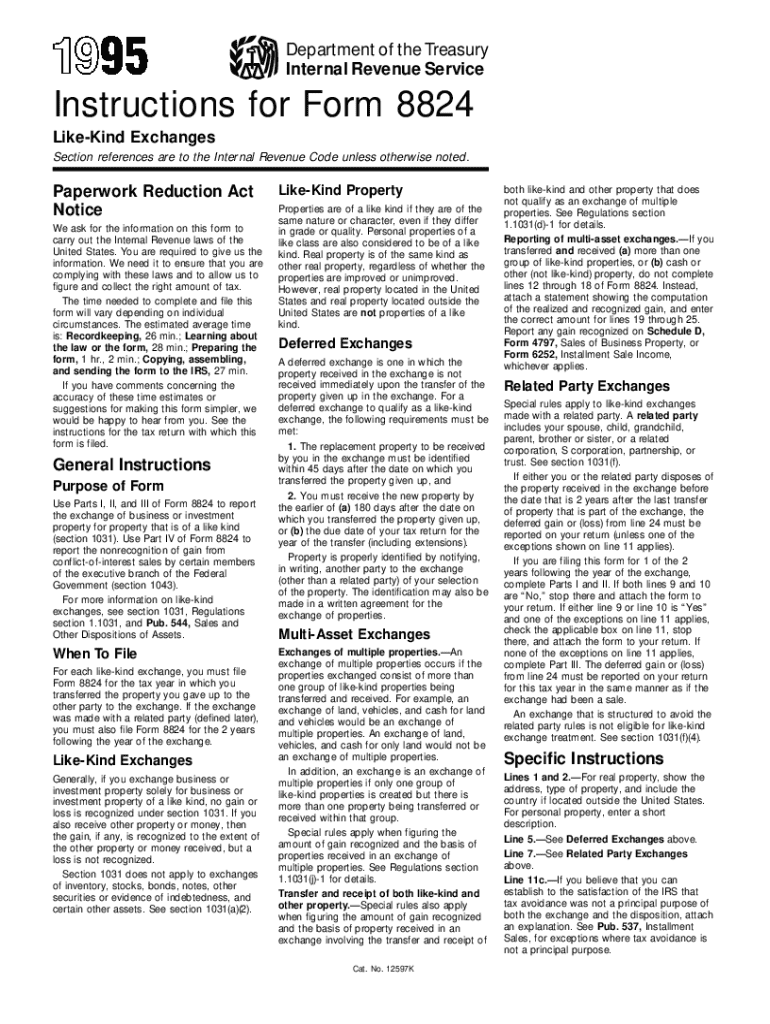

Overview of Form 8824

Form 8824 is a crucial document for taxpayers engaging in like-kind exchanges, particularly under Section 1031 of the Internal Revenue Code. This form is essential for reporting the exchange of real or personal property that is similar in nature, allowing the deferral of capital gains taxes. Understanding Form 8824 is vital as it helps facilitate tax compliance while maximizing investment potential through strategic property exchanges.

The tax code defines like-kind exchanges as exchanges of property that do not result in taxable events, provided specific regulations are met. By utilizing Form 8824, taxpayers can accurately report the details of their transactions, including properties exchanged, gain realized, and the taxes due. Awareness of key terms associated with tax law ensures proper usage and adherence to IRS guidelines.

Key terms related to like-kind exchanges

Who needs to file Form 8824?

Both individuals and businesses that partake in like-kind exchanges must file Form 8824. Individuals typically use the form for personal investments, while businesses often engage in exchanges as part of their asset management strategies. Understanding the eligibility criteria is essential for ensuring compliance with IRS regulations and avoiding any potential penalties.

Certain situations necessitate filing Form 8824, such as selling property and investing in like-kind properties. These transactions can arise in various scenarios including real estate swaps, asset upgrades, and organizational restructurings. By identifying when and how to file, taxpayers can utilize Form 8824 to their advantage while adhering to tax laws.

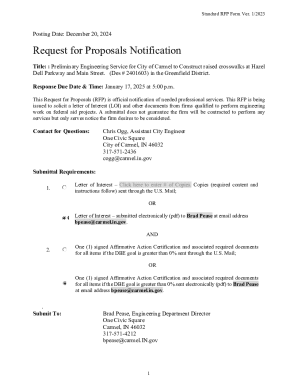

Preparing to fill out Form 8824

Before filling out Form 8824, it is critical to gather necessary information and documents, including detailed descriptions of both original and replacement properties. This includes tax identification numbers, addresses, and fair market valuations. Completing the form accurately hinges on the completeness of the information collected prior to the filing.

Common mistakes that can derail a successful filing often stem from inadequate preparation. Taxpayers should ensure that all relevant data is precise and organized. Failing to provide correct property details or miscalculating gains can lead to significant consequences, including missed deductions or audits. A methodical approach in gathering information will enhance the accuracy and efficiency of the filing process.

Step-by-step instructions to complete Form 8824

Completing Form 8824 requires a systematic approach to ensure no details are overlooked. The following steps break down the process.

Step 1: Identifying the properties involved

Begin by clearly defining the properties involved in the exchange. Note the details of the original property you sold and the replacement property acquired. Accurate descriptions should include type, location, and usage of each property.

Step 2: Reporting like-kind property exchanges

Fill out Part I of Form 8824, detailing the properties involved in the like-kind exchange. Provide all necessary acquisition and disposition dates as well as the adjusted basis for the properties during the transaction.

Step 3: Calculating gain realized and recognized

In Part II, calculate the gain realized and recognized from the exchange. This step involves outlining the formulas for gains and losses, which may require assistance from a tax professional to ensure accuracy.

Step 4: Completing Part : Like-kind exchange information

Complete Part III with comprehensive and accurate like-kind exchange information, including any disclosures regarding receipt of boot. This section must clearly outline any additional tax implications arising from the exchange.

Step 5: Reviewing your completed form

Before submission, diligently review your completed Form 8824 for any errors or omissions. Look for discrepancies, ensure calculations make sense, and confirm that supporting documentation is in order to prevent issues after filing.

Frequently asked questions about Form 8824

Many taxpayers have similar inquiries regarding Form 8824, centering on the qualifications and obligations of like-kind exchanges. These questions can significantly impact their tax strategy.

Special cases in reporting with Form 8824

There are unique scenarios in like-kind exchanges that can complicate the filing process, including distinctions between personal property and business property. Understanding these differences is essential for accurate reporting and compliance.

In addition, the handling of simultaneous and delayed exchanges requires careful documentation to ensure each party's responsibilities are clear and that the forms are accurately filled out. Furthermore, debt relief during the exchange can complicate tax implications, making it crucial to seek advice from tax professionals to navigate these nuances.

Tools and resources for completing Form 8824

Utilizing advanced interactive tools, pdfFiller provides a streamlined experience for completing Form 8824. Their platform allows users to conveniently edit PDFs and utilize eSignature options, significantly enhancing the filing process.

Best practices in document management can further aid in maintaining accurate records related to like-kind exchanges. Links to IRS guidelines are also integrated into the platform, providing users with immediate access to essential tax information and updates.

Case studies and real-world examples

Examining successful like-kind exchanges using Form 8824 unveils practical insights into the process. For instance, a real estate investor swapping a rental property for another can highlight how proper documentation and reporting can yield tax advantages.

Equally important are lessons learned from common errors, such as miscalculations that led to unexpected tax burdens. Such case studies can provide invaluable learning experiences for future exchanges.

Expert insights on Form 8824 filing

Tax professionals emphasize the importance of thorough documentation and due diligence when filing Form 8824. Engaging with a tax advisor can often provide clarification on complexities surrounding like-kind exchanges and help in navigating the IRS regulations effectively.

Before filing, it’s advisable to consult experienced professionals to ensure forms are filled out correctly and that the taxpayer's best interests are considered, ultimately facilitating a smoother transaction.

Benefits of using pdfFiller for Form 8824

Utilizing pdfFiller for Form 8824 offers numerous advantages, especially its seamless editing and collaboration features. Users benefit from a unified platform that handles various aspects of documentation, from editing to eSigning.

Moreover, pdfFiller enables remote accessibility and offers enhanced security for sensitive documents. Its cloud-based capabilities allow users to manage paperwork from anywhere, making it an ideal solution for busy individuals and teams engaged in real estate transactions.

Customer experiences with pdfFiller

Many users have shared positive testimonials regarding pdfFiller's efficiency in handling Form 8824. Clients appreciate the straightforward editing tools and the ability to sign documents electronically, reducing unnecessary delays in the filing process.

Real-world examples cite the value of pdfFiller in streamlining document management, particularly in scenarios involving urgent property exchanges where time is of the essence.

Next steps after filing Form 8824

Once Form 8824 is filed, taxpayers are encouraged to monitor their filing status through IRS channels, allowing them to confirm processing and follow up on any outstanding information required by the tax authorities.

Understanding implications for the next tax year is also crucial. Taxpayers need to account for any depreciation recapture or gain recognized that may affect subsequent tax filings. Staying informed will help in successfully planning future transactions and potential additional filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8824 for eSignature?

Where do I find form 8824?

How do I complete form 8824 on an iOS device?

What is form 8824?

Who is required to file form 8824?

How to fill out form 8824?

What is the purpose of form 8824?

What information must be reported on form 8824?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.