Get the free efile 1040nr

Get, Create, Make and Sign 1040nr online filing form

How to edit efile 1040nr form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out efile 1040nr form

How to fill out 1040nr

Who needs 1040nr?

1040NR Form: A Comprehensive Guide

Understanding the 1040NR Form

Form 1040-NR is the income tax return for nonresident aliens in the United States. Its primary purpose is to report income, gains, losses, deductions, and credits of individuals who are not U.S. residents for tax purposes. This form is particularly critical for foreign nationals earning income in the U.S., allowing them to fulfill their tax obligations and claim applicable tax benefits.

One of the main distinctions between the 1040-NR form and other tax forms such as the 1040 or 1040-EZ is that the latter are designed for U.S. citizens and resident aliens. Nonresident aliens must provide different information and follow unique provisions due to their tax status. The 1040-NR form considers the unique situations and tax treaties affecting nonresident aliens, making it essential for proper reporting.

Who needs to file Form 1040-NR?

Nonresident aliens must file Form 1040-NR if they received U.S.-source income that meets certain thresholds. This includes foreign students and scholars, who often need to declare income from fellowships, scholarships, or employment. For instance, F-1 and J-1 visa holders often find themselves needing to file this form, especially when they have income derived from U.S. sources, such as wages or stipends.

Additionally, foreign workers present in the United States on work visas may need to file this form if they earn wages subject to U.S. income tax. Understanding whether your circumstances trigger the need to file can help avoid any penalties associated with non-compliance.

Key components of Form 1040-NR

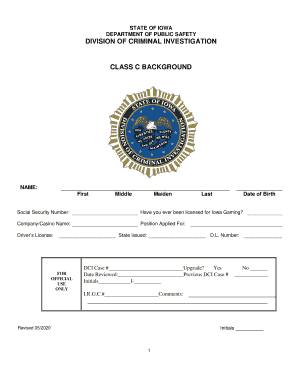

Filing the 1040-NR requires specific personal information, such as your name, address, and either a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN). The income you report on this form could include several categories: wages from employment, scholarships received, fellowship stipends, and even investment income like dividends or interest.

Furthermore, nonresident aliens may also need to understand the deductions and credits available to them. While they typically do not qualify for the standard deduction that resident aliens or citizens may claim, specific treaty benefits are applicable. Engaging with tax treaties can significantly affect tax liability and refunds, making it crucial to review details pertinent to your country.

Step-by-step instructions on filling out Form 1040-NR

Before beginning the tax filing process, gather the necessary documents. These typically include W-2 or 1099 forms reflecting your income, your passport, and any records of tax treaties that could apply to your income. Having these documents ready will facilitate a smoother filing experience.

Next, completing each section of the form requires careful attention. Start with the income section, where you will detail all U.S. source income. Be sure to accurately report wages, scholarships, or any awards received. Next, move on to the deductions and credits, ensuring you properly apply any tax treaty benefits you may be entitled to. Calculate your taxable income using the information you’ve provided, which will pave the way for determining your tax liability.

Filing process for Form 1040-NR

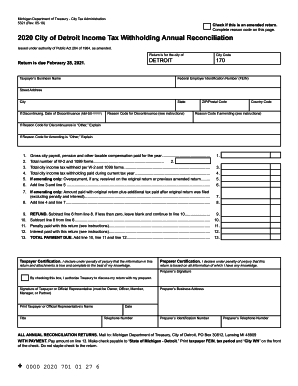

Once your Form 1040-NR is complete, you can file it either by mail or through an online software platform. While mailing is traditional, electronic filing has become more accessible, providing quick processing times and immediate confirmations of receipt. If filing electronically, follow the provided steps on the relevant tax software to ensure accuracy.

Where you send your Form 1040-NR depends on your state of residence. It's crucial to check the IRS guidelines or the instructions provided with the form for the correct mailing addresses. Timely delivery is essential, so consider using a trackable mailing option if sending by postal service.

Important deadlines related to Form 1040-NR

Form 1040-NR is generally due by April 15 for most taxpayers. However, if you're outside of the United States on this date, you might qualify for additional time to file, typically until June 15. It’s advisable for filers to check their eligibility for extensions where applicable.

Missing the filing deadline can result in penalties and interest charges on the unpaid tax amount. Options for late filing do exist, but it's beneficial to file as soon as possible to mitigate any financial repercussions.

Common issues and solutions

Mistakes can happen, and if you discover an error after filing your 1040-NR, filing an amended return using Form 1040-X is crucial. This ensures your tax records remain accurate, which is significant for future dealings with the IRS. Correcting mistakes promptly can often alleviate potential penalties.

Understanding how tax treaties impact your obligations can also be tricky. Many countries have tax treaties with the United States which allow for certain income types to be exempt from taxation or subject to reduced tax rates. You should familiarize yourself with treaties relevant to your country's situation to maximize your tax benefits efficiently.

Refunds and payments

Checking the status of your refund is straightforward through the IRS website which provides tools to track your tax refund process. Having your SSN, filing status, and the exact amount of your refund ready will streamline the checking process.

It’s important to note that tax treaties can affect your refund eligibility. Some benefits claim only limited U.S. tax without impacting your total tax liability, leading to possible refunds based on treaty claims. Hence, ensure all treaty benefits are applied while filing your taxes.

Additional insights for unique situations

International students on F-1 and J-1 visas have specific filing requirements. Typically, they must file a Form 1040-NR if they have any U.S. taxable income. However, certain scholarship money may not be subject to tax if used for qualified educational expenses.

For nonresident aliens with investment income, the process of reporting capital gains and dividends can be slightly complex. The income must be reported correctly to IRS, especially if sourced from U.S. financial institutions, and it's essential to understand how these are taxed under U.S. law.

For individuals needing assistance with filing the 1040-NR, resources like tax clinics specifically catering to international students and foreign nationals can provide valuable support. Utilizing these resources can help alleviate confusion surrounding tax responsibilities.

Filing 1040-NR online

Online tax filing services have become incredibly beneficial for individuals preparing their 1040-NR. Platforms supporting this form often include features that simplify the process, such as built-in calculations and error detection to maximize accuracy.

When choosing a tax filing service, look for those with interactive tools that help calculate your taxable income and verify the information entered. Such features not only enhance the filing experience but also provide peace of mind regarding compliance with IRS regulations.

Final thoughts on filing Form 1040-NR

Accurate tax filing is paramount for nonresident aliens, as deviations can have ramifications for future visa renewals and interactions with the IRS. Ensuring that all information is correct not only completes your obligation but helps maintain good standing with U.S. immigration status.

Leveraging tools such as pdfFiller can streamline the process of document management for these tax filings. Users can easily prepare, edit, eSign, and manage their forms in a secure, cloud-based environment, ultimately allowing for efficient document handling and organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send efile 1040nr form to be eSigned by others?

How do I complete efile 1040nr form online?

How do I edit efile 1040nr form in Chrome?

What is 1040nr?

Who is required to file 1040nr?

How to fill out 1040nr?

What is the purpose of 1040nr?

What information must be reported on 1040nr?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.