Get the free Form 1139

Get, Create, Make and Sign form 1139

Editing form 1139 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1139

How to fill out form 1139

Who needs form 1139?

A Comprehensive Guide to Form 1139: Everything You Need to Know

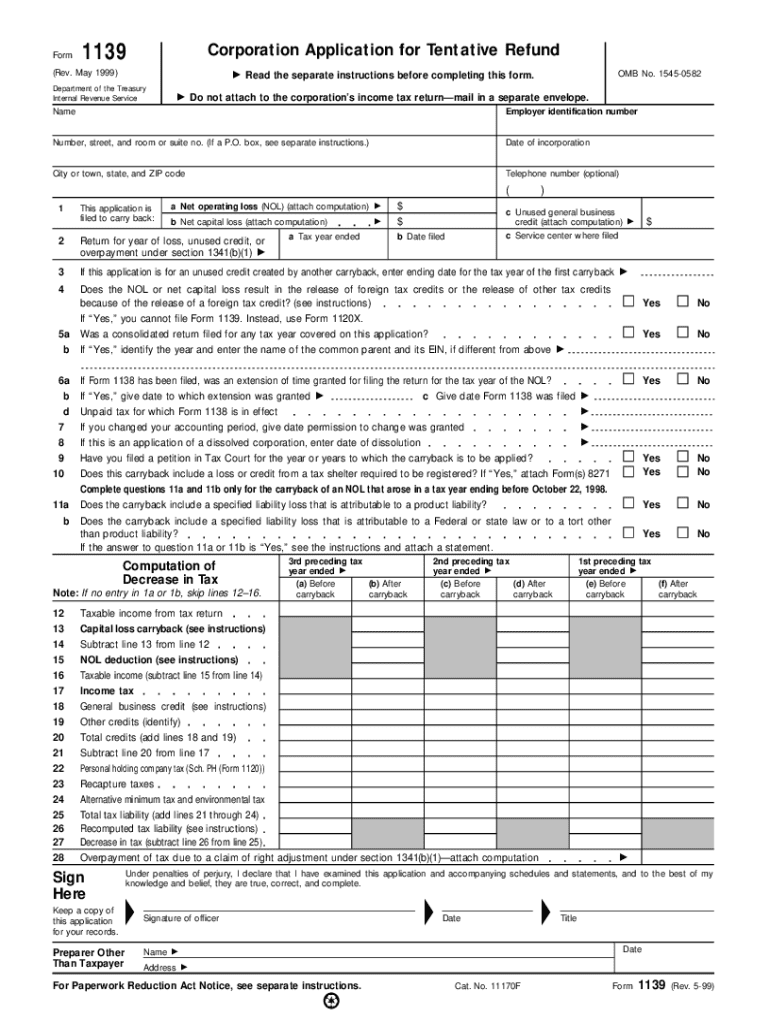

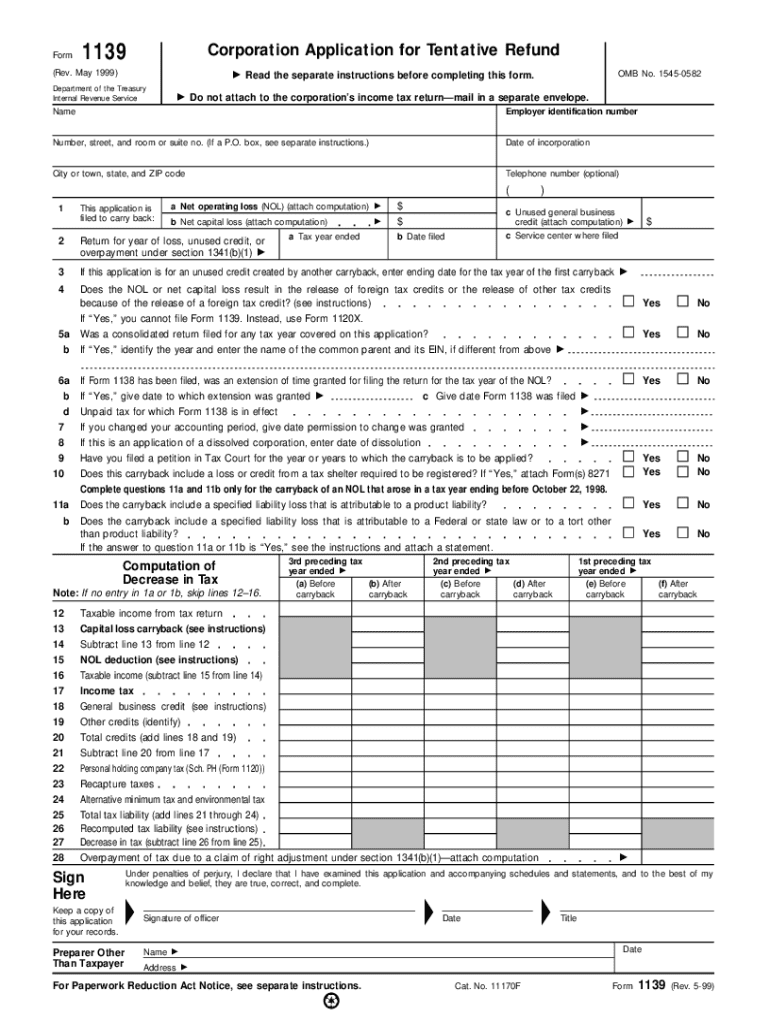

Understanding Form 1139

Form 1139 is a specialized document used by corporations to claim a quick refund of certain tax overpayments. This form is primarily relevant in situations where corporate tax attributes need to be adjusted due to events such as ownership changes or net operating loss (NOL) carrybacks. By filing Form 1139, corporations can expedite the refund process, allowing them to reinvest quickly instead of waiting for months for traditional tax refunds.

Who needs to use Form 1139?

Form 1139 is specifically designed for corporations and certain partnerships that qualify under the Internal Revenue Code. Typically, these entities find themselves in situations such as undergoing an ownership change, experiencing tax attribute modifications due to mergers or acquisitions, or realizing a net operating loss. Understanding whether your business falls under these categories is crucial before attempting to file this form.

Key components of Form 1139

Form 1139 consists of several critical sections that provide detailed information necessary for the IRS to process the claim. The form is divided into sections where each section has its unique focus, ranging from identification information to the computation of refundable credits and the reduction of tax attributes. Understanding these sections in detail will enable filers to provide accurate data.

Step-by-step instructions for filling out Form 1139

Preparing to fill out Form 1139 requires careful organization and documentation. Before diving into the specifics of each section, collect all necessary documents related to your tax filings, including previous tax returns, statements of tax attributes, and any supporting materials that explain the financial events leading to your refund claim.

After gathering the necessary information, begin filling out the form methodically. Start with Section A, providing accurate identification information such as the corporation's name, Employer Identification Number (EIN) and relevant tax year. Ensure every detail is correct to avoid any potential processing delays.

Completing each section

Section B requires a tempering approach; calculate refundable credits carefully based on previous filings. This section can be a bit complex due to the interaction between different tax credits, so it’s wise to consult a tax professional if uncertainties arise. Moving to Section C, focus on accurately mapping any reductions to your tax attributes. This section often proves to be tricky; hence, common pitfalls include miscalculating the attribute reductions. Ensure these values are double-checked against your historical data.

Finalizing and reviewing your form

Once you’ve completed Form 1139, a thorough review is essential. Check for mathematical accuracy, as even small calculation mistakes can lead to significant processing delays. Also, verify that all identification information aligns with IRS records; mismatched details can lead to complications. If you want to rectify a mistake after submission, the process isn’t overly complicated; you may submit an amended Form 1139. Always retain copies of filed forms and any correspondence with the IRS for your records.

Interactive tools for Form 1139

Utilizing online resources for filling out Form 1139 can significantly streamline the process. pdfFiller offers interactive templates that allow users to fill in forms digitally. Online templates reduce the likelihood of errors associated with handwriting and allow easy corrections. The interface is user-friendly, enabling individuals and teams to complete the form efficiently.

In addition to filling out the form, pdfFiller’s eSigning capabilities offer a secure method for signing forms digitally. This eliminates delays related to printing and mailing paperwork. Teams can collaborate in real-time, adding comments or suggestions on the same document, which ensures everyone stays on the same page.

Filing and managing your Form 1139

When it comes to filing Form 1139, one key consideration is choosing between electronic filing and traditional mailing. Each method has its advantages; e-filing generally allows for faster processing and fewer chances for errors compared to paper submissions. Ensuring you understand the filing deadlines and method-specific requirements can further enhance your efficiency.

After submission, tracking the status of your Form 1139 is essential. The IRS provides tools to check the status of filed forms, which can offer peace of mind as you await processing. Expect some processing times; these can vary, particularly during peak tax seasons.

Frequently asked questions about Form 1139

When it comes to filing Form 1139, many common queries arise. For instance, if you file late, understanding the penalties involved and possible extensions needed is vital. If amendments are necessary post-submission, the IRS does allow corrections, but there are specific procedures to follow.

When dealing with rejection notices from the IRS, knowing how to rectify issues efficiently is crucial. Forms may be rejected for lack of signature, missing data, or incorrect calculations. Hence, having a plan to address these swiftly can save you time and stress.

Advanced tips for hassle-free form management

Leveraging tools like pdfFiller can vastly improve your experience with Form 1139 and future filings. By saving your data securely within the platform, you can easily reuse accurate information year after year, minimizing the time spent on each tax cycle. By maintaining organized digital folders, your tax documents can be readily accessible.

Engaging with the community

Connecting with others who are tackling similar tax issues can prove invaluable. Online forums and local support groups offer a space to discuss questions, share experiences, and solicit advice regarding Form 1139. Platforms like Reddit or specific tax-related discussion groups can yield practical insights from fellow taxpayers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 1139 to be eSigned by others?

How do I make changes in form 1139?

Can I sign the form 1139 electronically in Chrome?

What is form 1139?

Who is required to file form 1139?

How to fill out form 1139?

What is the purpose of form 1139?

What information must be reported on form 1139?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.