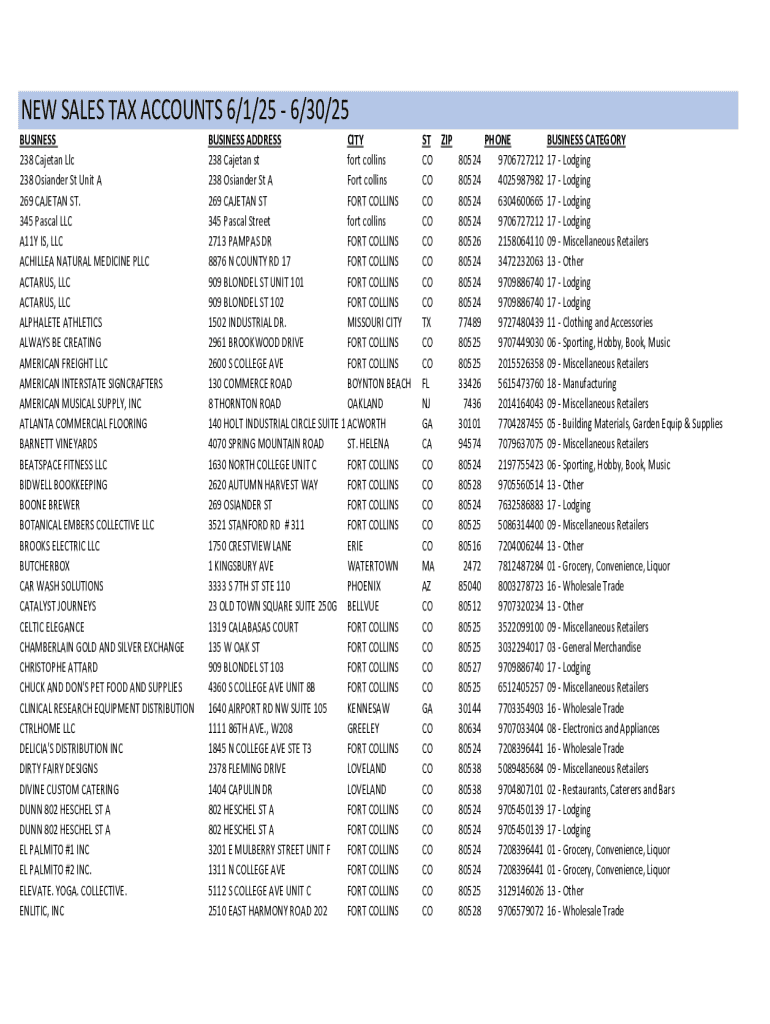

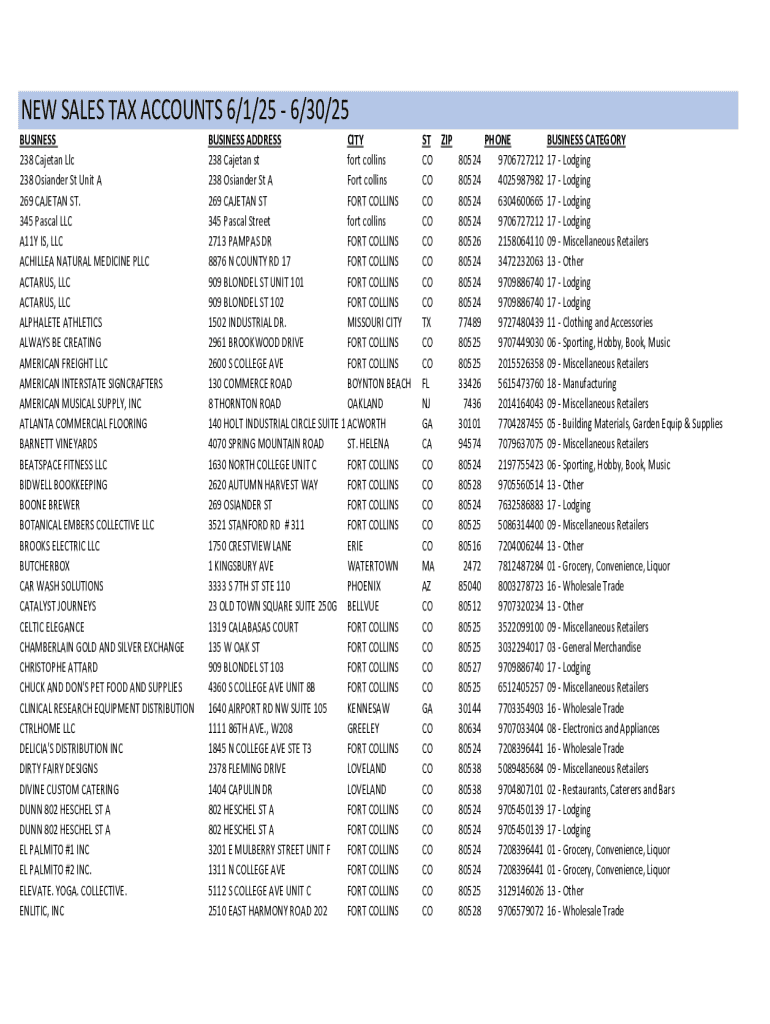

Get the free NEW SALES TAX ACCOUNTS 6/1/25 - 6/30/25

Get, Create, Make and Sign new sales tax accounts

How to edit new sales tax accounts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new sales tax accounts

How to fill out new sales tax accounts

Who needs new sales tax accounts?

Navigating the New Sales Tax Accounts Form: A Comprehensive Guide

Understanding sales tax accounts

A sales tax account is an essential component for businesses involved in the sale of taxable goods or services. To operate within the legal framework, a business must obtain this account from the relevant tax authority, which allows it to collect sales tax from customers and remit the same to the state. Compliance with sales tax regulations is not only a legal obligation but also a critical factor for maintaining business credibility and avoiding potential penalties.

Sales tax compliance is paramount for safeguarding your business’s financial health. The failure to collect or remit sales taxes can lead to significant fines and interest charges. Additionally, understanding key terms, such as 'nexus'—which refers to the connection between the business and the state requiring taxes to be collected—is necessary. Staying informed about the sales tax rate applicable in your area is also crucial for accurate reporting.

The new sales tax accounts form: Overview

The latest version of the new sales tax accounts form has introduced several updates aimed at improving user experience and ensuring that businesses can meet their tax obligations efficiently. Notably, these changes include simplified language, enhanced online submission capabilities, and clearer guidelines on what documentation is required, making it more accessible than ever for users at all levels of experience.

This form is required for any business wishing to start collecting sales tax or modifying their existing sales tax account. Common reasons for utilizing the sales tax accounts form include opening a new business location, changing the business structure (e.g., from sole proprietorship to LLC), or adjusting the type of goods sold. Understanding who should use this form helps target specific business setups seeking compliance.

Step-by-step guide to completing the new sales tax accounts form

Completing the new sales tax accounts form requires careful preparation to ensure accuracy and completeness. Here’s a detailed step-by-step guide.

Step 1: Gather required information

Before you even begin filling out the form, gather all essential information. This includes your business identification details such as the legal business name, physical address, and Federal Employer Identification Number (FEIN). You will also need financial information detailing projected monthly sales, as this helps determine sales tax obligations.

Step 2: Filling out the form

As you fill out the form, carefully navigate through each section. Key fields to consider include:

Step 3: Double-check your information

Once you have completed the form, conduct a thorough review. Verify all entries for accuracy, as mistakes can lead to processing delays or issues with your account. Common errors include incorrect tax ID numbers, typos in the business name, or miscalculations in sales projections.

Filing the new sales tax accounts form

After completing the form, it’s time to file. You have options for submission: either online or via mail. Online submission is generally faster, allowing you to receive immediate feedback from the taxing authority. On the other hand, mailing the form may require additional time for processing.

Filing deadlines and important dates

Awareness of deadlines is crucial to maintain compliance. Most states offer specific timelines within which the form must be submitted, often aligning with tax reporting periods. Keeping track of these dates helps you avoid late fees and ensures uninterrupted sales tax collection.

Tracking your submission status

Post-filing, utilize available resources, often provided by the state's tax agency, to track the status of your submission. This transparency allows you to handle any follow-up inquiries or issues that may arise promptly.

Managing your sales tax accounts after filing

After filing your sales tax accounts form, keeping your sales tax obligations up-to-date is essential. This includes regularly filing returns and remitting collected taxes as per the scheduled timelines. Understanding the specific requirements for your sales tax account, including filing frequency, is a vital aspect of tax management.

As your business evolves, so might your sales tax responsibilities. Make it a routine to review and update your sales tax account information, especially in instances of name changes, address updates, or when expanding your business operations.

Interactive tools and resources

Services like pdfFiller offer several interactive tools to streamline your sales tax account management, including tax calculation tools that make it easier to compute your estimated tax liabilities. Additionally, keeping templates for record-keeping simplifies profit calculations and compliance audits down the line.

A dedicated FAQ section can answer common queries, helping you navigate the complexities of sales tax management with greater confidence. Tapping into these resources allows for better-informed decisions and a structured approach to tax obligations.

eSigning and collaboration features

With pdfFiller, electronic signatures simplify the signing process for the new sales tax accounts form. Instead of printing, signing by hand, and scanning, users can quickly add their eSignature directly onto the document, saving time and reducing paper waste.

For teams working together on tax documentation, collaboration features enable multiple users to access and edit the form simultaneously. This functionality can streamline the preparation process, ensuring that all relevant parties are involved while maintaining security and compliance standards.

Troubleshooting common issues

Despite best efforts, forms may occasionally get rejected. If this occurs, it’s essential to understand the reasons for rejection; common issues may include incomplete information or discrepancies in business data. Addressing these promptly can save considerable time and effort.

In case of disputes regarding the rejection, familiarize yourself with the appeal processes provided by the tax agency. Keeping contact information handy for customer support addresses inquiries effectively, allowing for a clearer path in resolving issues.

Staying informed: Updates to sales tax regulations

Sales tax regulations can undergo frequent changes. To avoid compliance pitfalls, it’s essential to seek out reliable sources for ongoing education and updates. Subscribing to newsletters from your state’s tax authority or relying on reputable tax-related publications can keep you informed.

Staying updated is not just about compliance; it can also provide valuable insights that lead to potential savings for your business. Leveraging tools like pdfFiller to monitor changes in tax laws ensures that you are always in tune with necessary adjustments.

Conclusion of resources

As you navigate the complexities of the new sales tax accounts form and your obligations thereafter, utilizing the resources available on pdfFiller can enhance your efficiency. Quick links to further assistance, connections with tax professionals, and access to similar forms and templates streamline the entire process.

Empowering users through seamless document creation and management, pdfFiller stands out by offering tools that facilitate compliance and collaboration, ensuring that your sales tax obligations are handled efficiently and accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new sales tax accounts in Gmail?

How can I get new sales tax accounts?

How do I fill out new sales tax accounts on an Android device?

What is new sales tax accounts?

Who is required to file new sales tax accounts?

How to fill out new sales tax accounts?

What is the purpose of new sales tax accounts?

What information must be reported on new sales tax accounts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.