Get the free New Sales Tax Accounts (12/1/22 - 12/31/2022)

Get, Create, Make and Sign new sales tax accounts

Editing new sales tax accounts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new sales tax accounts

How to fill out new sales tax accounts

Who needs new sales tax accounts?

New Sales Tax Accounts Form: How-to Guide Long-Read

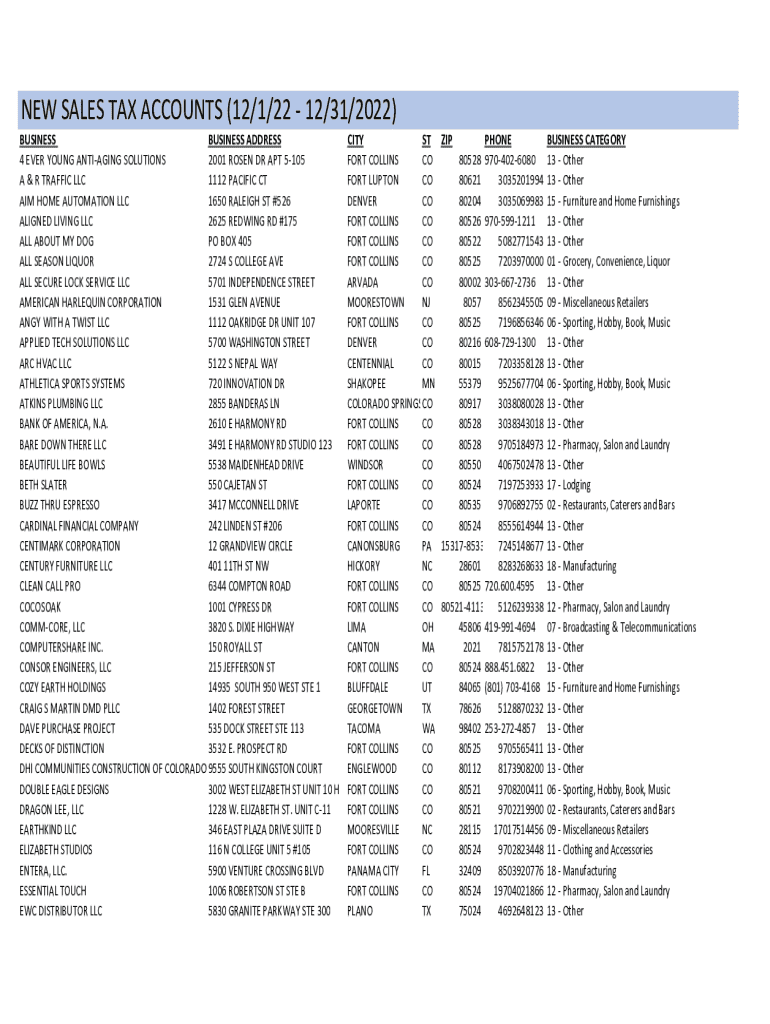

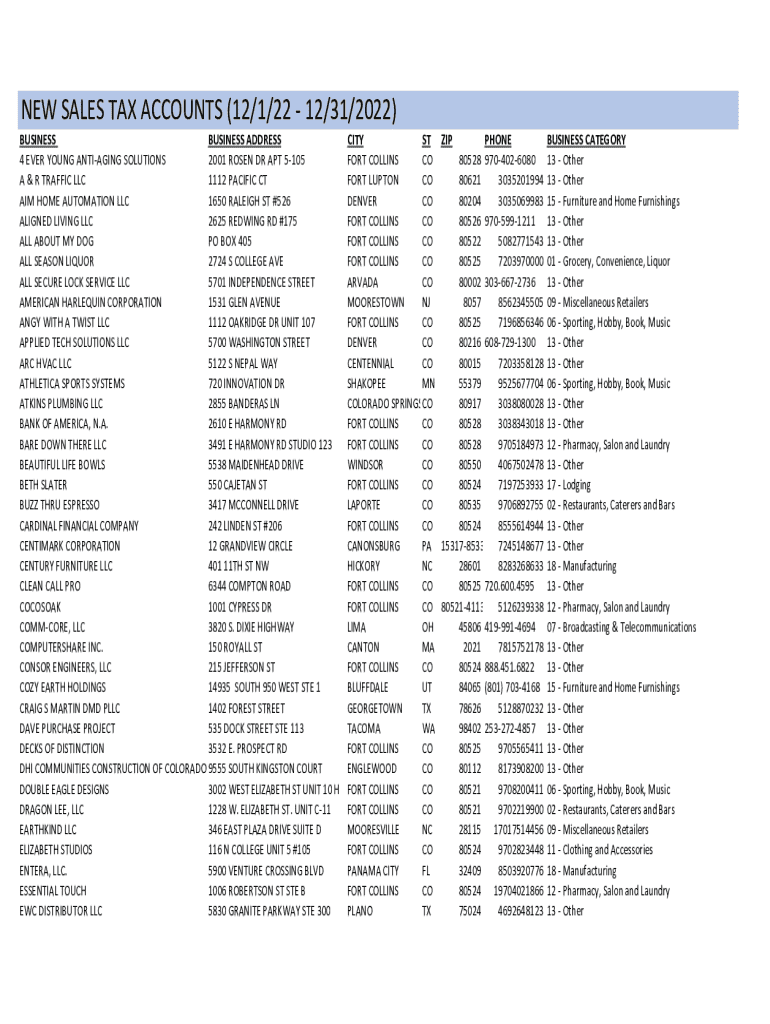

Understanding the new sales tax accounts form

The new sales tax accounts form is a critical document for businesses operating in areas that levy sales taxes. This form serves as a formal application for opening a sales tax account, enabling businesses to collect sales tax from customers and remit it to the appropriate tax authority. For any business seller, compliance is crucial, as the repercussions of failing to adhere to sales tax laws can include hefty penalties and ongoing audits.

The new sales tax accounts form is significant as it replaces older versions. The form has been updated to enhance compliance with recent legislative changes and technological advancements. Businesses must pay close attention to these changes to ensure they are correctly filing their accounts.

Who needs to file the new sales tax accounts form?

Understanding who needs to file the new sales tax accounts form is essential for compliance. Generally, any business that sells goods or services subject to sales tax is required to submit this form. This ensures that the business is registered and can lawfully collect sales tax from purchases.

Common scenarios where this form is necessary include small business owners who sell taxable goods directly to consumers. Similarly, e-commerce sellers who operate online and ship products across different states will usually need to file this form to remain compliant with laws applicable to distance sales.

Preparing to complete the new form

Before diving into the new sales tax accounts form, proper preparation is necessary. Collecting the right documents and information will streamline the process, minimizing mistakes and ensuring accuracy.

Key documents to have on hand include your business identification numbers, which are essential for verifying your legal entity. Additionally, your sales records will demonstrate your business's financial activities, while previous tax returns offer historical insight into your obligations.

Choosing the appropriate filing method is also a key step. Many businesses prefer online submission via pdfFiller for its convenience and efficiency, while others might consider face-to-face options for assistance.

Step-by-step guide to completing the new sales tax accounts form

Once you are prepared with the necessary documents, accessing the new sales tax accounts form is the next step. This form is available digitally, allowing for quick downloads and interactive completion.

To access the form, download the PDF version via pdfFiller and utilize its interactive tools for pre-filling. These features can guide you through the required fields to minimize errors.

When completing the form, pay close attention to each section. Start by providing clear business information, followed by tax registration details such as the expected sales tax collection method.

It’s important to avoid common mistakes which can delay your application or lead to penalties. Verify all information before submission, check for missing signatures, and be mindful of deadlines to ensure timely processing.

Editing and customizing the new sales tax accounts form

After downloading the form, editing it is made simple with pdfFiller's tools. Users can seamlessly make text edits, add signatures, and collaborate with team members on the document.

To edit effectively, utilize the available functionalities for customizing your document. This includes simple text changes and the ability to add digital signatures, ensuring that the completed form is both accurate and professional.

Moreover, saving your progress as you go is critical. With pdfFiller's cloud-based saving features, you can keep your work organized and ensure you can return to it without losing any progress.

Filing your new sales tax accounts form

Filing your completed new sales tax accounts form involves selecting the correct submission option. You can either choose to e-file – a fast and efficient method – or mail in your form, depending on your preference and the requirements of your local tax agency.

The e-filing process provides an overview of steps to ensure your submission is successful. For many, electronic filing not only expedites the process but also allows for quick confirmation of receipt.

Understanding submission deadlines is vital for compliance as well. First-time filers should mark their calendars with key dates to avoid late penalties. Familiarize yourself with the specific deadlines that apply to your jurisdiction to remain in good standing.

Managing your sales tax account post-submission

Maintaining your sales tax account after submission is just as important as completing the form. Keeping records organized helps in preparing for future filings and ensures compliance with tax obligations.

Utilizing tools like pdfFiller for ongoing document management can facilitate the organization of records, enabling easy access to vital information when needed. This can be especially useful if your business expands or if audits arise.

Set reminders for future filings to avoid missing deadlines. Staying proactive in tracking the sales tax you have collected versus what you owe can save your business from unwanted penalties.

Additional insights and FAQs

For further learning about the new sales tax accounts form, various resources can help you navigate its complexities. Websites that offer webinars or tutorials can provide invaluable information about compliance and updates.

Engaging in community forums can allow you to share experiences and ask questions from fellow taxpayers. This collaborative approach can assist you in maximizing your understanding of tax obligations.

Frequently asked questions about the new sales tax accounts form can help clarify common concerns among tax filers. For instance, understanding how often you need to file can simplify your business planning, while knowing what to do if amendments are required ensures you're prepared for adjustments.

Staying updated on sales tax regulations

Keeping abreast of changes in sales tax regulations is vital for all businesses. With tax laws frequently evolving, it’s important for taxpayers to remain informed to avoid compliance issues.

Utilizing services such as pdfFiller's subscription options can keep you updated on tax law changes. These services often provide email alerts and regular content updates designed to inform users of noteworthy revisions in guidelines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit new sales tax accounts from Google Drive?

How can I send new sales tax accounts to be eSigned by others?

Can I create an electronic signature for the new sales tax accounts in Chrome?

What is new sales tax accounts?

Who is required to file new sales tax accounts?

How to fill out new sales tax accounts?

What is the purpose of new sales tax accounts?

What information must be reported on new sales tax accounts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.