Get the free Notice of Assessed Value Sample (English)CCSF Office of ...

Get, Create, Make and Sign notice of assessed value

How to edit notice of assessed value online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessed value

How to fill out notice of assessed value

Who needs notice of assessed value?

Understanding and Managing Your Notice of Assessed Value Form

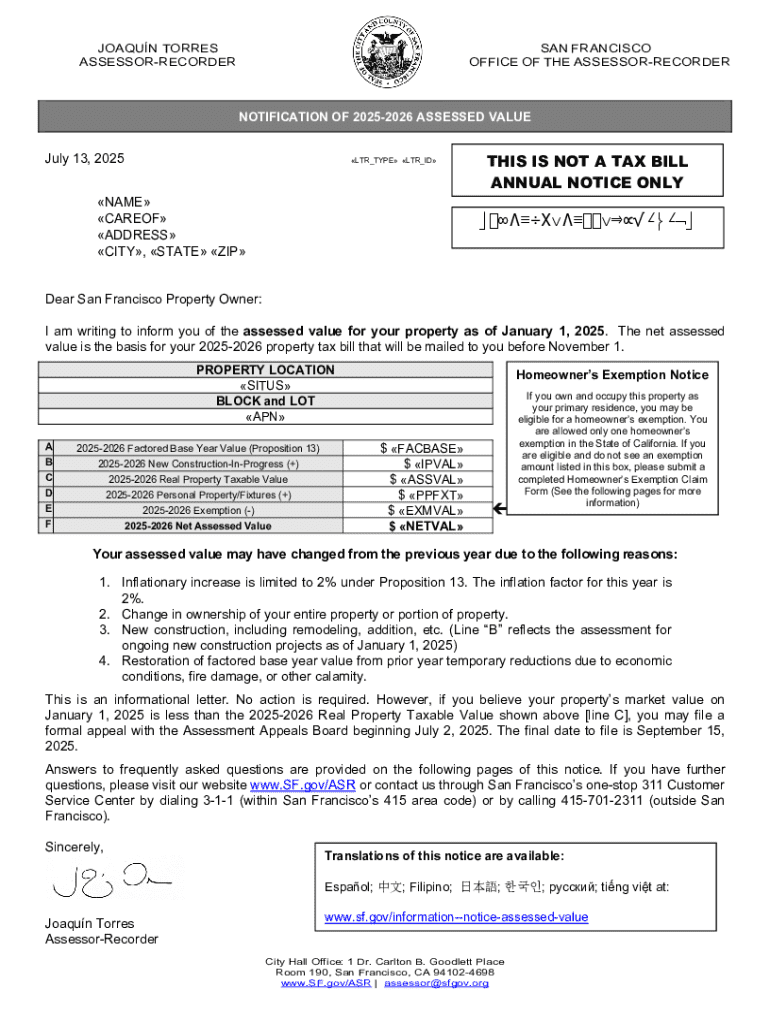

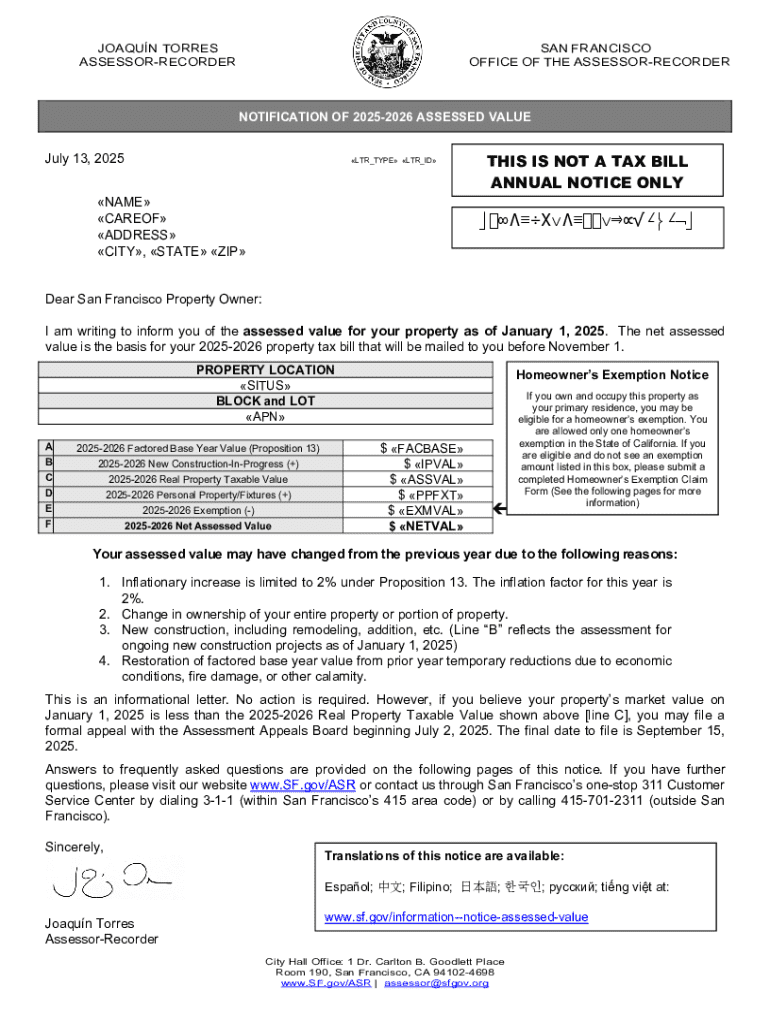

Understanding the Notice of Assessed Value

The Notice of Assessed Value (NAV) form serves as a critical document in the realm of property taxation. This notification informs property owners about the assessed value of their property, which plays a pivotal role in determining the amount of property tax owed. It's essential to understand that the NAV is calculated by local assessors using various methods, which can include market analysis, property characteristics, and tax regulations.

For property owners, the NAV is more than just a piece of paper; it directly impacts financial obligations and potential changes in property status. Here’s why it matters: it can affect property resale values, mortgages, and even eligibility for property tax exemptions.

Components of the Notice of Assessed Value

A typical NAV consists of several key sections, each serving a distinct purpose. Understanding what each component signifies can empower property owners to make informed decisions.

Understanding these terms provides a solid foundation for examining your assessed value and addressing potential discrepancies.

How to obtain your Notice of Assessed Value

Acquiring your NAV can be straightforward. Typically, you can find it through local government websites or directly from the Assessor's Office. Many municipalities have online portals where property owners can input their details to retrieve their NAV.

What if you didn’t receive your NAV? It's crucial to contact your local Assessor's Office immediately to ensure your property records are up to date and that you're not missing important tax information.

Filling out the Notice of Assessed Value form

When completing your NAV form, accuracy is essential. Each detail you provide can affect how your property is assessed and ultimately taxed. Here's a step-by-step guide on how to fill it out correctly.

Additionally, here are some tips to ensure your NAV is filled out correctly: use clear and legible writing, and consider using digital tools like those provided by pdfFiller for editing and signing.

Editing and updating your assessed value form

If you believe your assessed value is incorrect, you have the option to appeal the assessment. Start by understanding the grounds for a challenge, which might include overvaluation or errors in description.

It's important to keep track of deadlines for filing an appeal, as missing these could result in permanent acceptance of the assessed value. Each jurisdiction has its own timelines, so be vigilant.

Understanding how your assessed value affects taxes

The relationship between assessed value and property taxes is direct; the higher the assessed value, the higher the property taxes you will owe. Various factors can influence your assessed value, including property improvements, local market conditions, and economic trends.

Staying proactive about your property’s assessed value can save you money on taxes, thereby allowing you to budget more effectively.

Resources for assistance with your Notice of Assessed Value

Navigating property assessments can be complex, and utilizing local resources can provide invaluable assistance. Contacting your Assessor’s Office is a good starting point.

Consider attending local events that focus on property taxes and assessments, as these can provide deeper insights into the annual processes.

Common questions about the notice of assessed value

Disagreements over assessed values are common among property owners. If you disagree with your assessed value, begin by reviewing the details on your NAV form, comparing them to current market data.

Ensure that you have all necessary information at hand when approaching your local Assessor's Office to discuss your NAV.

Additional information related to assessments and property taxes

Property owners may encounter several notices regarding their properties. The Notice of Property Value (NOPV) is another key document that communicates changes in property valuation and is similar to the NAV.

Being educated about various property notices allows homeowners to remain proactive and advocate effectively for their financial interests.

Key terms to know

Familiarizing yourself with terminology associated with the NAV and property taxes can significantly enhance your understanding and management of property assessments.

Understanding these terms will not only assist in filling out your NAV but also empower you to engage with your local Assessor's Office more effectively.

Navigating digital resources

In today’s digital age, utilizing tools for document management can streamline the process of handling your Notice of Assessed Value. pdfFiller provides a robust platform that allows users to efficiently edit, sign, and manage their documents from any location.

Moreover, pdfFiller makes accessing your documents simple through cloud services, allowing seamless management of your property-related paperwork from anywhere.

Conclusion

Handling your Notice of Assessed Value accurately is crucial for effective property tax management. By understanding its components, utilizing available resources, and leveraging tools like pdfFiller, property owners can navigate this aspect of property ownership with confidence.

It's important to stay informed, proactive, and engaged in the assessment process to ensure your financial interests are well protected as a property taxpayer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute notice of assessed value online?

Can I sign the notice of assessed value electronically in Chrome?

Can I create an eSignature for the notice of assessed value in Gmail?

What is notice of assessed value?

Who is required to file notice of assessed value?

How to fill out notice of assessed value?

What is the purpose of notice of assessed value?

What information must be reported on notice of assessed value?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.