Get the free CFPB Request for Information Regarding HMDA ...

Get, Create, Make and Sign cfpb request for information

Editing cfpb request for information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cfpb request for information

How to fill out cfpb request for information

Who needs cfpb request for information?

Understanding the CFPB Request for Information Form

Overview of the CFPB request for information

The CFPB, or Consumer Financial Protection Bureau, provides a Request for Information form that enables consumers to gain access to their financial records. The purpose of this form is to ensure transparency and make it easier for individuals to monitor their financial health and compliance with consumer rights. By maximizing consumer access to their financial data, the CFPB promotes informed decision-making and enhances accountability within financial institutions.

As organizations increasingly harness consumer data to offer tailored products and services, it becomes essential for consumers to have clarity regarding their own financial information. The CFPB regularly updates the Request for Information form to reflect the evolving needs and rights of consumers, empowering them to engage more fully in managing their financial affairs.

Detailed insights on the CFPB request for information form

The CFPB Request for Information form features a user-friendly interface designed to simplify the process of submitting requests. Users can easily navigate through the form, ensuring that they can articulate their information needs clearly. Furthermore, the form includes a range of accessibility options, catering not only to technologically savvy individuals but also to those who might require additional assistance due to disabilities.

Common use cases for this form encompass a variety of scenarios. For individuals seeking records regarding their own accounts, this tool can be invaluable. Additionally, research organizations and legal entities that require access to consumer data for statistical analysis or litigation can benefit significantly from using this form. As such, the CFPB has designed the Request for Information form to meet diverse needs.

Step-by-step instructions for completing the form

Gathering the necessary information prior to completing the CFPB Request for Information form is crucial. Applicants should possess valid identification, like a driver's license or passport, to confirm their identity. Additionally, it is essential to collect relevant documentation, such as account numbers and previous correspondences with financial institutions.

When filling out the form, it is beneficial to understand the components involved. The first section generally requires personal information, allowing the CFPB to effectively process requests. Next, users need to outline the specific details of their requests clearly—this can range from asking for particular transaction histories to access data related to certain services. Finally, an included signature section confirms consent for the CFPB to manage this request accordingly.

Upon completion, submitting the form is straightforward. Users can opt for the online submission process on the CFPB website, or they may alternatively choose to send their forms via mail or fax, ensuring that everyone has the chance to submit their requests in a manner most comfortable for them.

Editing and managing the form

For users desiring to make adjustments or manage their CFPB Request for Information form, pdfFiller provides an excellent platform for PDF editing. Users can effortlessly import the form into pdfFiller, allowing for a smooth editing experience. The platform offers capabilities for annotations, ensuring that users can add notes or comments, and facilitating collaboration with others involved in the request process.

One significant advantage of using pdfFiller is the ability to add digital signatures to documents. By following specific steps, users can eSign the form securely and ensure compliance with legal standards valued by the CFPB. This digital integration accelerates the submission process while maintaining the form's integrity and advancing consumer rights.

Frequently asked questions (FAQs)

A wide array of inquiries often arises concerning the CFPB Request for Information form. One primary question is about the types of information that can be requested. Consumers can seek access to their personal financial records, transaction histories, and even broader data concerning their interactions with financial services.

Another common FAQ pertains to the expected response time. Generally, the CFPB aims to address requests within a reasonable period, albeit this can vary based on request complexity. Furthermore, should individuals wish to monitor the status of their requests, proactive steps can be taken to check in with the CFPB. Lastly, clients should be aware of any potential fees associated with their requests to ensure a transparent understanding of the process.

Interactive tools and resources

To enhance user experience, pdfFiller provides access to a variety of form templates, including the CFPB Request for Information form. This enables individuals and entities to find exactly what they need efficiently. Moreover, digital tools designed for collaboration allow real-time editing and sharing, making it significantly easier for teams to work together on requests or adaptations.

Additionally, educational resources such as tutorials and webinars provide users with advanced knowledge regarding the form and the submission process. These resources can demystify complex components of the CFPB process, reinforcing the importance of consumer access and empowerment.

Important links and contact information

When seeking guidance on the CFPB Request for Information form, accessing official CFPB resources is essential. Users are encouraged to explore the CFPB website for in-depth information about consumer rights, practices, and the procedures related to data acquisition. Furthermore, the site contains links to additional guidelines and support options that can significantly aid users unfamiliar with the process.

For personalized assistance, contacting the CFPB directly can provide clarification and support tailored to individual needs, thereby ensuring that consumers can effectively navigate the request system.

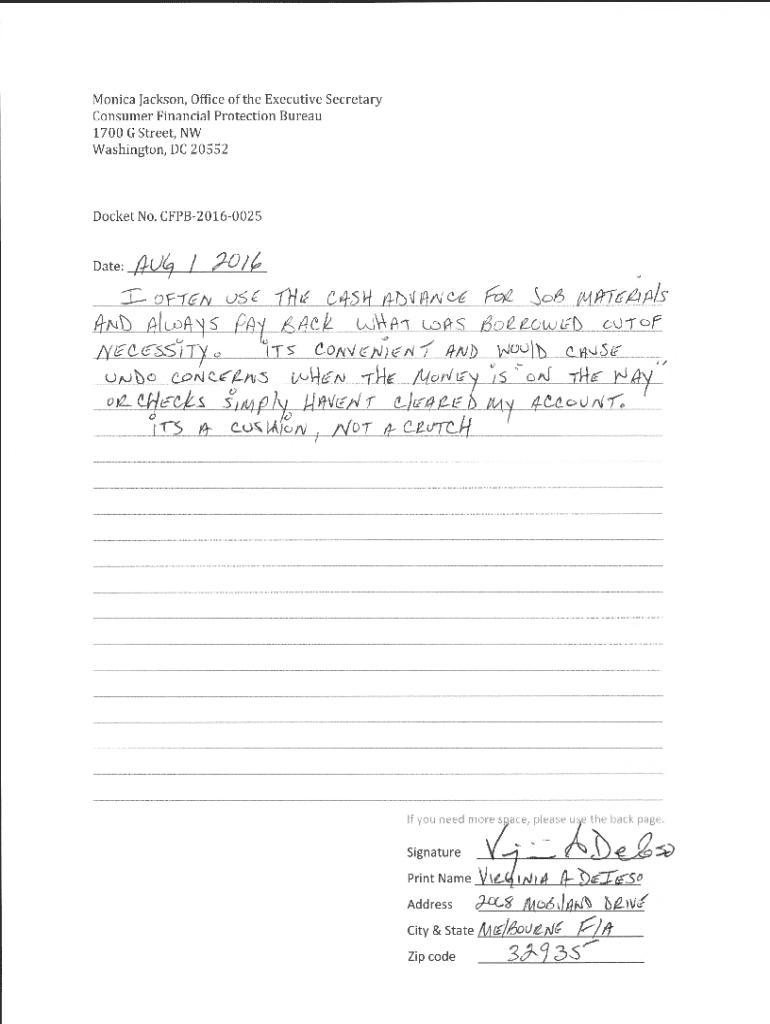

Public comments and engagement process

The CFPB values public input, offering numerous opportunities for citizens to submit comments on various financial policies and practices. Increased engagement from consumers can lead to significant changes and improvements in financial regulations. Individuals can submit their comments through designated platforms, ensuring their voices are heard and fostering stronger connections between the CFPB and the public.

Public participation plays a crucial role in shaping policy, and consumers are encouraged to share their experiences and perspectives, particularly regarding issues affecting consumer rights and access to financial services. This collaborative effort empowers individuals and provides the necessary framework for systemic change.

Case studies and success stories

Numerous individuals have successfully utilized the CFPB Request for Information form to obtain crucial financial data. One notable example involved a consumer who, after enduring months of denied access to records by a financial institution, used the form to submit a formal request, ultimately receiving the information needed to clarify erroneous charges on their account.

In another instance, a research organization focused on consumer behavior leveraged the form to gather data for a study on financial practices among different demographics. This not only contributed valuable insights but also emphasized the impact of public engagement on policy changes, showcasing how transparency in consumer data can lead to better financial products.

Recent updates and future changes

The CFPB frequently reviews its Request for Information form to align with consumer needs and regulatory changes. Recent updates have streamlined the request process, making it more intuitive and user-centric. A timeline of these changes indicates a growing trend toward digital transformation and enhanced accessibility.

As the landscape of consumer finance evolves, the CFPB anticipates future amendments to improve the clarity and efficiency of the Request for Information form. Interested users are encouraged to sign up for notifications concerning any future developments to stay updated on pertinent changes that may affect their consumer rights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit cfpb request for information in Chrome?

Can I sign the cfpb request for information electronically in Chrome?

How do I fill out the cfpb request for information form on my smartphone?

What is cfpb request for information?

Who is required to file cfpb request for information?

How to fill out cfpb request for information?

What is the purpose of cfpb request for information?

What information must be reported on cfpb request for information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.