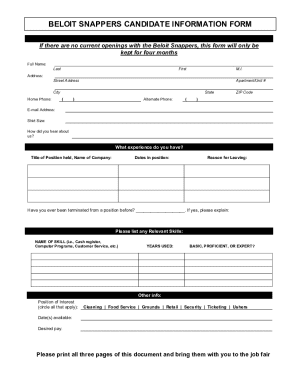

Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Form 8-K Form: A Comprehensive How-to Guide

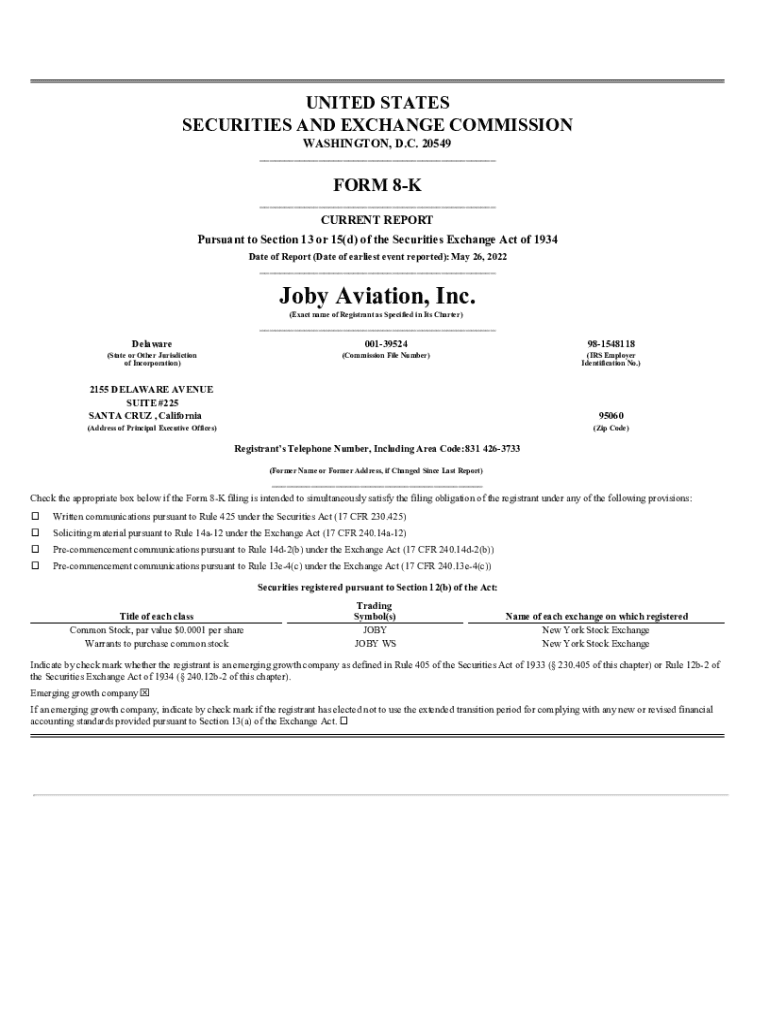

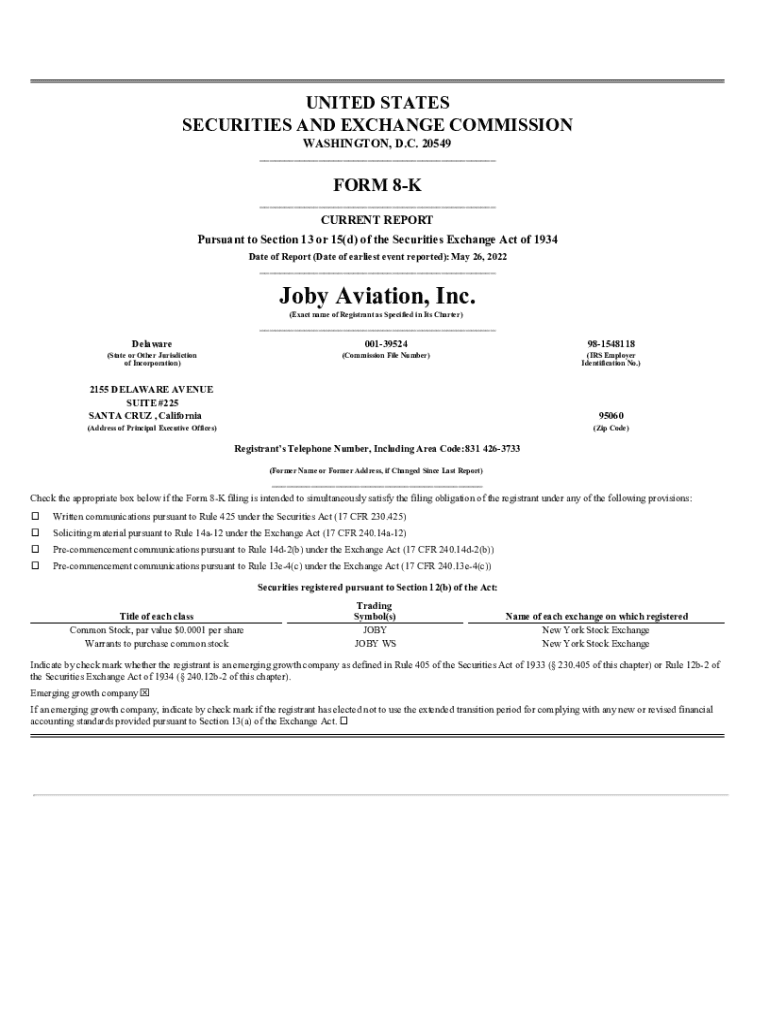

Understanding the Form 8-K

A Form 8-K filing is a critical document that public companies are required to submit to the U.S. Securities and Exchange Commission (SEC). This form serves the vital purpose of informing investors and the public about significant events that could influence a company's financial condition or share price. Public companies are obligated to file a Form 8-K to ensure transparency and maintain investor trust.

The importance of Form 8-K cannot be overstated. It acts as a safeguard for investors, providing timely updates on material changes that could affect an investment decision. By filing this form, companies uphold their commitment to transparent and responsible reporting, which is essential for maintaining a good relationship with stakeholders.

When is a Form 8-K Required?

Certain events trigger the filing of a Form 8-K. These include, but are not limited to, significant corporate changes, acquisitions, bankruptcy, changes in executive leadership, or any legal proceedings that could materially impact the company's financial standing. These events necessitate a prompt disclosure to ensure that all investors have the same information in a timely manner.

Consequences of Not Filing a Form 8-K

Failure to file a Form 8-K when required can lead to significant legal repercussions for a company. The SEC may impose fines or sanctions for non-compliance, which can severely affect the company’s reputation. Additionally, this neglect can damage investor relations and erode public trust. In a landscape where transparency is crucial, companies that fail to disclose relevant information risk losing investor confidence.

Non-filing can also lead to misinformation circulating among investors, potentially eliciting panicked reactions that can harm the stock price. It’s crucial for public companies to adhere strictly to SEC regulations related to Form 8-K to avoid these consequences.

Key components of Form 8-K

The Form 8-K has several required disclosures that companies must include when filing. The structure of the form is specifically designed to provide comprehensive information across various scenarios that might affect public perception and investment decisions. Each section of the form aims to communicate vital information succinctly.

Structure of the Form

Form 8-K is structured to ensure clear and effective communication. It consists of several sections, each designated for specific disclosures. For instance, Section 1 discusses the relevant events triggering the filing, while Sections 2 and 3 detail the financial implications. This clear breakdown helps companies present information logically.

Understanding each section’s purpose enables smoother compliance and renders the filing process less daunting. For example, Section 5 is known for detailing other pertinent information that doesn’t fit neatly into previous sections, allowing flexibility in disclosures.

Common mistakes made when filing

Accurate filing of the Form 8-K is crucial, yet companies often make common mistakes that can have serious implications. Some frequent errors include providing incomplete information, failing to check the deadlines, or misclassifying the nature of the event requiring disclosure. Such mistakes could lead to misunderstandings or regulatory penalties.

The filing process

To file a Form 8-K, companies must go through a clear process. This includes drafting the document, ensuring all relevant data is included, and reviewing it before submission. It's vital to adhere to a step-by-step approach to minimize errors and ensure compliance. Companies can use various tools and digital platforms to enhance the efficiency of this process.

Tools for filing

To streamline the filing process, many companies rely on electronic filing systems, such as the SEC's EDGAR platform. This system allows for the efficient submission of Form 8-K and other SEC forms, maintaining compliance with federal regulations. In addition, platforms like pdfFiller simplify the creation and management of forms, making it easier to draft, edit, and sign the necessary documents.

With pdfFiller, users can access pre-filled templates that significantly reduce the time to complete filings. The integration of e-signature capabilities enables quick approval from stakeholders, facilitating faster submission. This not only saves time but also ensures that forms are less prone to inaccuracies.

Best practices for timely submissions

Ensuring timely submissions of Form 8-K requires careful planning and organization. Establishing a dedicated team responsible for monitoring potential triggering events can significantly enhance an organization’s responsiveness. Additionally, routine training and updates on compliance requirements can keep all team members informed and efficient.

Post-filing considerations

After filing a Form 8-K, companies need to manage the outcomes effectively. This includes preparing for a potential review by the SEC, where the company might need to respond to inquiries regarding any inaccuracies or omissions. Keeping stakeholders informed is pivotal.

Companies should prepare a communication strategy to articulate the information presented in the filing clearly. This involves notifying investors, analysts, and possibly the media about significant disclosures, such as executive leadership changes or major corporate events.

Managing reactions to 8-K filings

The way a company communicates its Form 8-K filings can significantly affect market perception. Companies should strive to be proactive in their communications following a filing. This means being transparent about the implications of any changes and addressing potential concerns head-on.

Archive and documentation management

Archiving Form 8-K filings is crucial for compliance and historical reference. Companies must maintain accurate and comprehensive records of all disclosures to monitor changes over time and maintain clarity in their reporting history.

Using tools like pdfFiller helps companies manage their archives efficiently. This cloud-based platform allows users to categorize, tag, and retrieve documents quickly, ensuring that past filings are available for review whenever needed.

Benefits of effective Form 8-K management

Companies that manage their Form 8-K filings effectively enhance transparency and build trust among investors. Accurate and timely disclosures not only demonstrate a commitment to compliance but also cultivate a positive reputation in the market.

Key highlights and considerations

For companies engaging with Form 8-K filings, several key takeaways can facilitate smoother operations. Remembering the critical points of filing can prevent mistakes that may affect compliance and stakeholder relations.

Additional tips for using pdfFiller effortlessly

pdfFiller offers a range of features that enhance the user experience when filing Form 8-K. From easy-to-navigate templates that ensure compliance to collaborative tools that allow teams to work together in real time, pdfFiller provides comprehensive support.

Real-world examples and case studies

Learning from real-world applications of Form 8-K can illuminate effective practices. Companies that have mastered the art of transparent reporting via Form 8-K stand out as models for others to emulate. Notable instances of filers illustrating best practices can motivate companies to prioritize timely and accurate disclosures.

Advanced resources and tools

To facilitate the filing process, various advanced tools and resources are available. pdfFiller's interactive features—including document creation, eSigning, and structured data management—empower users to navigate Form 8-K filings smoothly.

Tutorials and guided demonstrations available within pdfFiller help users maximize their efficiency and streamline workflows, ensuring compliance with SEC regulations while enhancing document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 8-k without leaving Chrome?

How do I fill out the form 8-k form on my smartphone?

How do I complete form 8-k on an iOS device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.