Get the free Form 990-pf

Get, Create, Make and Sign form 990-pf

How to edit form 990-pf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-pf

How to fill out form 990-pf

Who needs form 990-pf?

Form 990-PF: How-to Guide

Understanding Form 990-PF

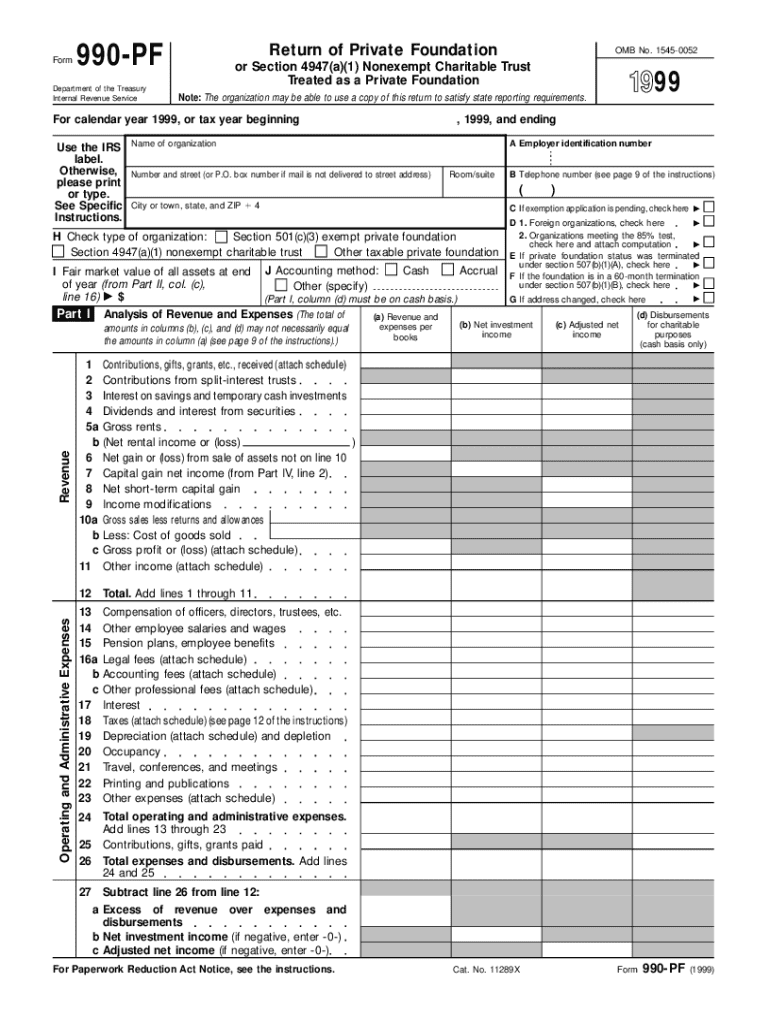

Form 990-PF, specifically designed for private foundations, is a crucial document that organizations must submit to the IRS annually. This form provides a detailed financial report of the foundation's activities, helping ensure transparency and compliance with federal regulations. It has unique amendments and regulations that differ from other nonprofit forms, such as Form 990, which is used for public charities.

The primary purpose of Form 990-PF is to furnish information about a foundation's income, expenditures, and governance. By collecting this data, the IRS can monitor the foundation's adherence to tax laws and ensure they meet their charitable goals. Submitting this form is essential for maintaining tax-exempt status, thus playing a pivotal role in the sustainability of nonprofit organizations.

Who needs to file Form 990-PF?

Private foundations must file Form 990-PF annually, regardless of their size or income. This requirement applies to all private foundations created under Internal Revenue Code Section 509(a). However, there are exceptions based on specific criteria, such as certain foreign organizations, foundations operating solely for religious purposes, or those that exist for less than a year.

Entities like donor-advised funds and private operating foundations may have separate filing requirements. Understanding these nuances is vital for compliance and to avoid penalties. Therefore, it's essential to assess the foundation's structure and activities to determine the necessity of filing this form.

Filing deadlines for Form 990-PF

The standard due date for submitting Form 990-PF is the 15th day of the 5th month after the end of the foundation’s fiscal year. For example, for foundations on a calendar year basis, the form is due by May 15. New foundations established during the tax year may have different rules regarding their first filing, providing some flexibility.

Extensions are available through IRS Form 8868, which allows a foundation to extend its filing deadline by six months, granting more time to compile necessary financial data and ensure accuracy. It's prudent to apply for an extension if there are concerns about meeting the initial deadline.

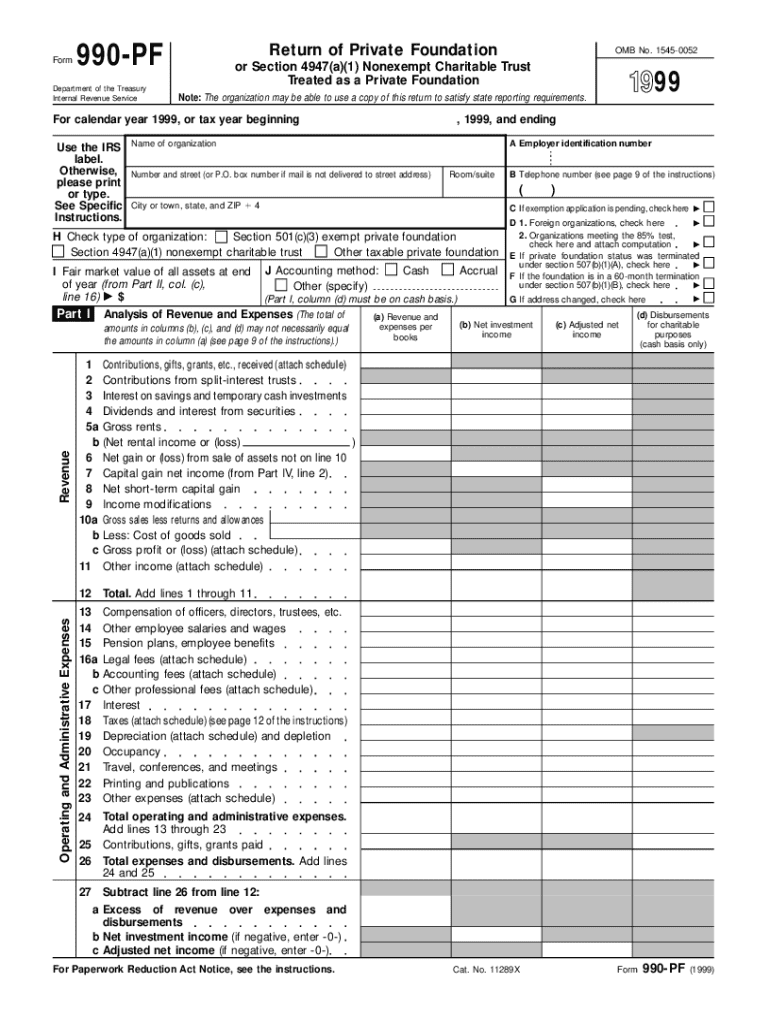

Navigating the Form 990-PF structure

Form 990-PF's layout is methodical, consisting of several key sections that require comprehensive information. Understanding these sections facilitates accurate and efficient completion of the form. The three main parts include financial information, details on governance and management, and program service accomplishments. Grasping the purpose of these sections aids in assembling relevant documentation and data.

Common pitfalls when filling each section can arise from lack of clarity or misinterpretation of questions. To avoid mistakes, ensure that numbers correspond accurately with your financial statements and carefully read any guidance provided by the IRS. Attention to detail is critical here, as errors can lead to penalties or misunderstandings.

Step-by-step instructions for completing Form 990-PF

Completing Form 990-PF requires thorough preparation. Start by gathering all relevant documentation, including financial statements, disbursement records, and any organizational bylaws. These elements serve as a foundation for filling in the required fields accurately.

Detailed instructions for each section guide you through the line-by-line requirements. For instance, under financial information, you need to report income, expenses, and the net asset value of the foundation. Utilizing interactive tools such as templates from pdfFiller can enhance accuracy by allowing easy edits and management of the documents.

E-filing Form 990-PF

In 2024, the IRS mandates electronic filing for Form 990-PF for all private foundations, streamlining the submission process and minimizing errors associated with traditional paper forms. E-filing provides several advantages, including improved accuracy, automated calculations, and faster acknowledgment from the IRS.

The e-filing process is intuitive. Users can start by accessing the IRS e-file platform or authorized e-file providers that can facilitate submission. This shift towards e-filing is designed to make compliance more straightforward and efficient for organizations of all sizes.

Additional requirements and considerations

Each state may have specific filing requirements concerning Form 990-PF beyond federal obligations. It's crucial to review state regulations, as some states require additional forms or specific disclosures related to philanthropic activities. Note that financial reviews may also be necessary, depending on the foundation's revenue size.

Implementing robust record-keeping practices is essential for ensuring compliance and easing the filing process. Maintaining organized files of all financial transactions, grants made, and donor communications helps prepare for potential audits and fosters transparency.

Penalties for late filing

Failing to file Form 990-PF on time can result in significant financial penalties for private foundations. The IRS may impose fines, which vary based on the foundation's size and the duration of the delay. In extreme cases, consistent late filers may even risk their tax-exempt status, a critical aspect of their operational approval.

To mitigate the risks associated with late filing, foundations can proactively ensure timely submissions by implementing a tracking system for their filing deadlines. Consulting with financial or legal experts can also provide additional guidance on best practices and support.

Common questions and answers about Form 990-PF

Many foundations encounter similar challenges regarding Form 990-PF. Some frequently asked questions relate to the specific information required in each section, the distinction between private and public foundations concerning form requirements, and the possible consequences of errors or omissions on the form.

Clearing up misconceptions surrounding Form 990-PF is crucial. For instance, some believe that smaller foundations are exempt from filing obligations, but all private foundations must file, regardless of their financial threshold. Addressing these questions helps prepare foundations to meet compliance needs effectively.

Getting help with Form 990-PF

Navigating Form 990-PF can be complex, but support is readily available through platforms like pdfFiller. This service offers interactive form tools that streamline the filing process, allowing users to edit, collaborate, and sign documents with ease.

pdfFiller also provides expert consultation and community support resources, ensuring that users have access to personalized assistance when needed. The combination of collaboration features and management solutions enables teams to effectively handle their filing processes.

Exploring related forms and resources

Understanding other IRS forms related to nonprofit organizations can enhance overall compliance knowledge. For instance, while Form 990 pertains to public charities, distinctions between it and Form 990-PF are substantial. Form 990 is broader, while Form 990-PF is specific and detail-focused regarding private foundations.

Additionally, accessing tools and resources designed for nonprofit financial management, such as grant applications or budgeting templates, can further equip organizations to maintain their financial health while meeting IRS requirements.

Success stories and testimonials

Numerous foundations have successfully navigated the complexities of Form 990-PF, utilizing tools and resources to streamline their filing processes. These success stories often highlight the effectiveness of using platforms like pdfFiller for enhanced accuracy and confidence during submissions.

User feedback reveals that many organizations have experienced reduced stress and improved compliance rates through collaborative features and expert resources offered by pdfFiller, making the filing process more manageable and efficient.

Interactive tools and features

Engagement with interactive tools can significantly simplify filling out Form 990-PF. For instance, tools like an interactive checklist for preparation ensure that all necessary elements are covered before submission. Editable form templates allow for quick adjustments, tailored to specific organizational needs.

A visual guide for filling out the form offers a step-by-step overview, making the intimidating task of filing manageable. These resources not only clarify each step but also foster confidence in completing the form accurately.

Leading the charge: join the community

Engaging with a community of nonprofits is beneficial for sharing experiences and tips related to filing Form 990-PF. Connecting through forums enables individuals to exchange ideas and strategies, fostering an environment of collective learning.

Additionally, subscribing to newsletters from resources like pdfFiller ensures users receive ongoing updates and support, keeping them informed of changes in IRS regulations or filing procedures relevant to their operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990-pf to be eSigned by others?

How can I get form 990-pf?

How do I complete form 990-pf on an iOS device?

What is form 990-pf?

Who is required to file form 990-pf?

How to fill out form 990-pf?

What is the purpose of form 990-pf?

What information must be reported on form 990-pf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.