Get the free Business Corporation Annual Report

Get, Create, Make and Sign business corporation annual report

How to edit business corporation annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business corporation annual report

How to fill out business corporation annual report

Who needs business corporation annual report?

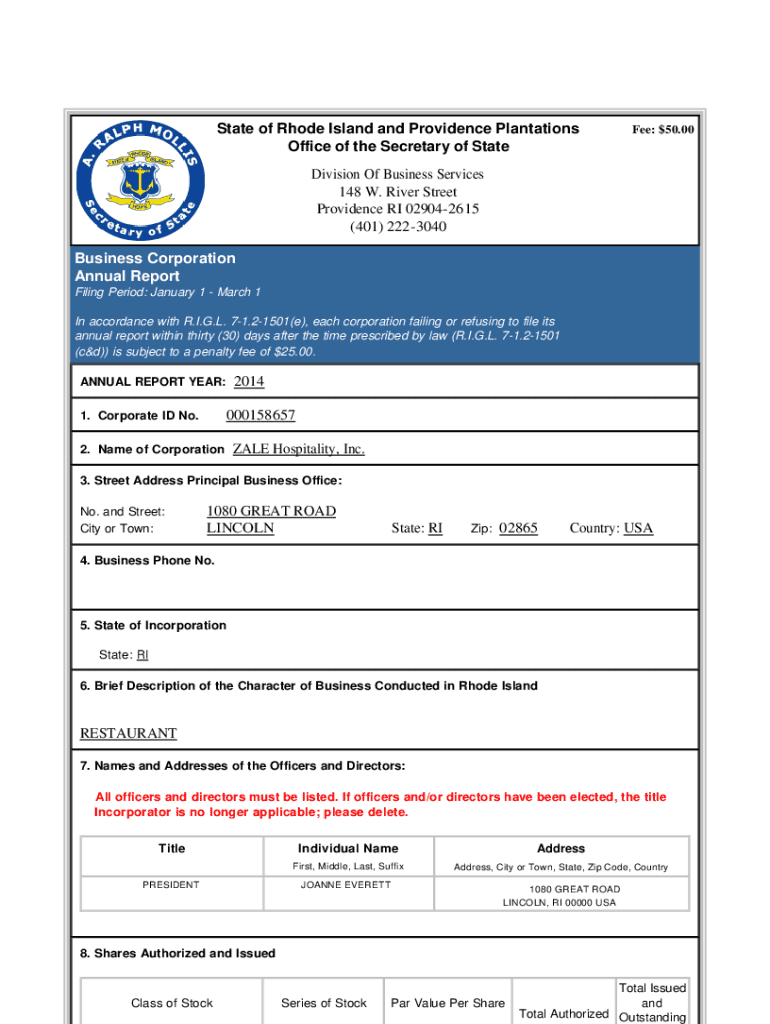

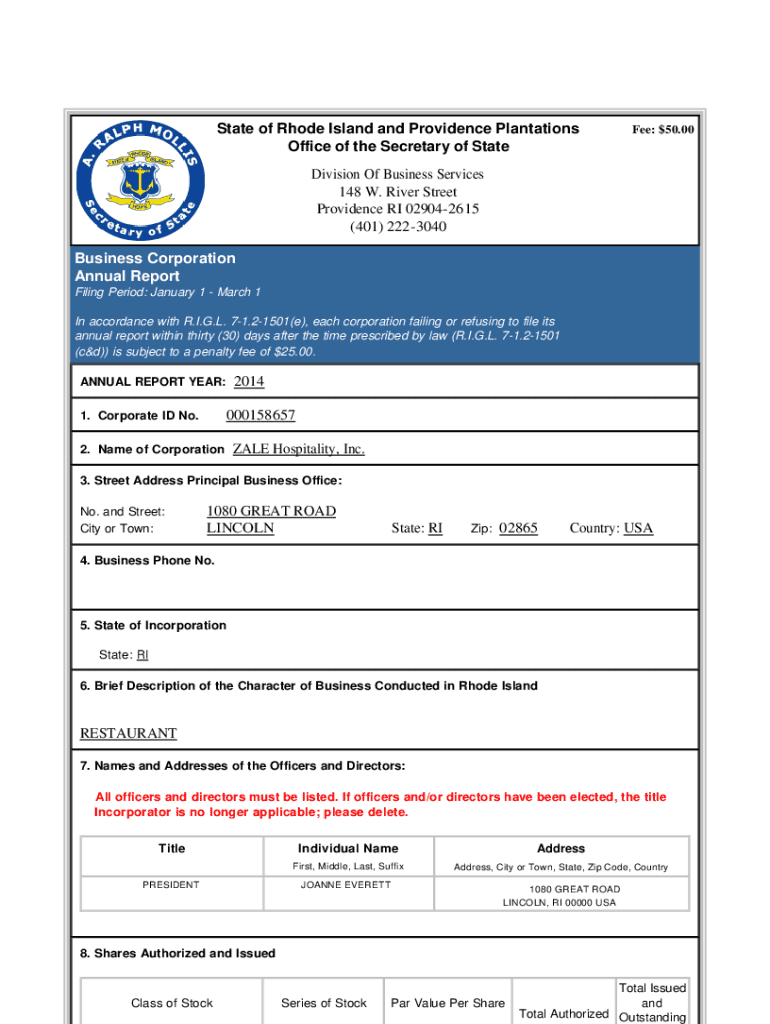

A Comprehensive Guide to the Business Corporation Annual Report Form

Understanding the business corporation annual report

A business corporation annual report is a crucial document that reflects the company's health and progress over the past year. By definition, it is a comprehensive report that provides stakeholders, including shareholders, employees, and potential investors, with vital insights into the company's operations, financial situation, and strategies.

The importance of an annual report cannot be overstated. It serves not only as an accountability tool for management but also plays a significant role in enhancing transparency, building trust, and maintaining compliance with regulatory bodies. This report is often mandatory for corporations as part of their obligations to their respective state government organizations.

Filing a business corporation annual report

Filing the business corporation annual report is a requirement imposed on corporations to inform stakeholders and the government about their financial health and operational activities. Typically, this process includes various legal obligations by both federal and state jurisdictions.

Not all businesses are required to file annual reports. For example, in North Carolina, corporations registered in the state must submit their annual report to maintain their good standing. The deadlines for filing may vary; however, many states require that these reports be submitted annually on the anniversary of the corporation's formation. Therefore, it's crucial to stay aware of these dates to avoid potential penalties.

Accessing the business corporation annual report form

To file your business corporation annual report successfully, you need to access the correct form, which is typically available through official state resources. Each state has its specific website for these documents. For instance, the North Carolina Secretary of State's website provides downloadable forms for corporations operating in the state.

Alternatively, you can find the form conveniently on pdfFiller. The platform offers a user-friendly interface where you can directly download the annual report form as a PDF. Before filling out the form, make sure you gather all necessary documents and relevant information related to your corporation.

Filling out the business corporation annual report form

Filling out the business corporation annual report form requires careful attention to detail to ensure accuracy and compliance with state regulations. Each section of the form is designed to capture essential information regarding the financial and operational status of your business.

Start with Section 1, which typically requires business information such as your corporation's name, state of incorporation, and address. Section 2 focuses on the financial overview, including revenue, expenses, and profits for the reporting period. The last section details ownership and management, asking for names and titles of key personnel.

Editing and signing the form with pdfFiller

Utilizing pdfFiller allows you to edit, sign, and manage your business corporation annual report form efficiently. The tool supports easy uploads of your PDF form; from there, you can add text, images, and annotations as needed. This feature is particularly useful if you find you need to modify specific sections or provide additional explanations.

Once your form is ready, attending to the signing process is straightforward. With pdfFiller, you can eSign your document effortlessly. The platform offers multiple signature options, making it easy for individuals and teams to mark their approval without the hassle of printing and scanning.

Submitting the business corporation annual report

After completing your business corporation annual report, submitting it is the next essential step. Most states offer e-filing options which provide a more efficient and faster method to process your document—ideal for businesses looking to save time and reduce paperwork.

If you prefer paper filing, you can mail your completed form along with any payment for the required filing fees. The structure of the fees can differ by state; hence, it’s vital to confirm the fee requirements beforehand. Most states accept various payment methods, including credit/debit cards or checks.

Managing your annual report filing

Once your business corporation annual report is submitted, keeping track of its status is vital. Many state websites allow you to check the submission status and processing timelines, ensuring that your corporation remains compliant and avoids penalties.

In case you need to amend your report after submission, the process generally involves submitting a correction form. Understanding the implications of filing late, such as potential penalties or lapses in good standing, is crucial to maintaining your corporation's status.

Frequently asked questions (FAQs)

Navigating the business corporation annual report filing can raise several questions. For instance, if you forget your document number or filing details, most state websites provide assistance in recovering this information. Understanding the consequences of late filing or non-filing, including possible fines or penalties, is essential.

Another common concern is whether businesses need to file if they are closed; typically, this varies by state, but most require at least a final report. For those seeking a copy of their filed report, state agencies typically offer this access, either online or via request.

Additional considerations and legal compliance

Beyond the logistical aspects of filing the business corporation annual report, there are broader matters concerning corporate governance and compliance with best practices. Adhering to transparency and accountability through your annual report fosters trust among stakeholders and promotes ethical management.

Another essential evolution in this space is the reporting of beneficial ownership information, now more critical than ever under new regulations. This information can have far-reaching implications for your annual reporting process, ensuring compliance with laws aimed at preventing fraudulent activities.

Connecting with pdfFiller for support

When navigating the intricate process of filling out your business corporation annual report form, pdfFiller is there to assist you every step of the way. With an array of customer support options and interactive tools available, users can manage their documents efficiently.

Testimonials from satisfied users highlight how pdfFiller has transformed their document management processes, allowing them to focus more on growth rather than administrative burdens. Whether it’s editing, eSigning, or filing, pdfFiller empowers users to handle it all in one seamless cloud-based platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business corporation annual report from Google Drive?

How do I make changes in business corporation annual report?

How do I complete business corporation annual report on an Android device?

What is business corporation annual report?

Who is required to file business corporation annual report?

How to fill out business corporation annual report?

What is the purpose of business corporation annual report?

What information must be reported on business corporation annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.