Get the free Boe-305-r

Get, Create, Make and Sign boe-305-r

How to edit boe-305-r online

Uncompromising security for your PDF editing and eSignature needs

How to fill out boe-305-r

How to fill out boe-305-r

Who needs boe-305-r?

Your Comprehensive Guide to the BOE-305-R Form

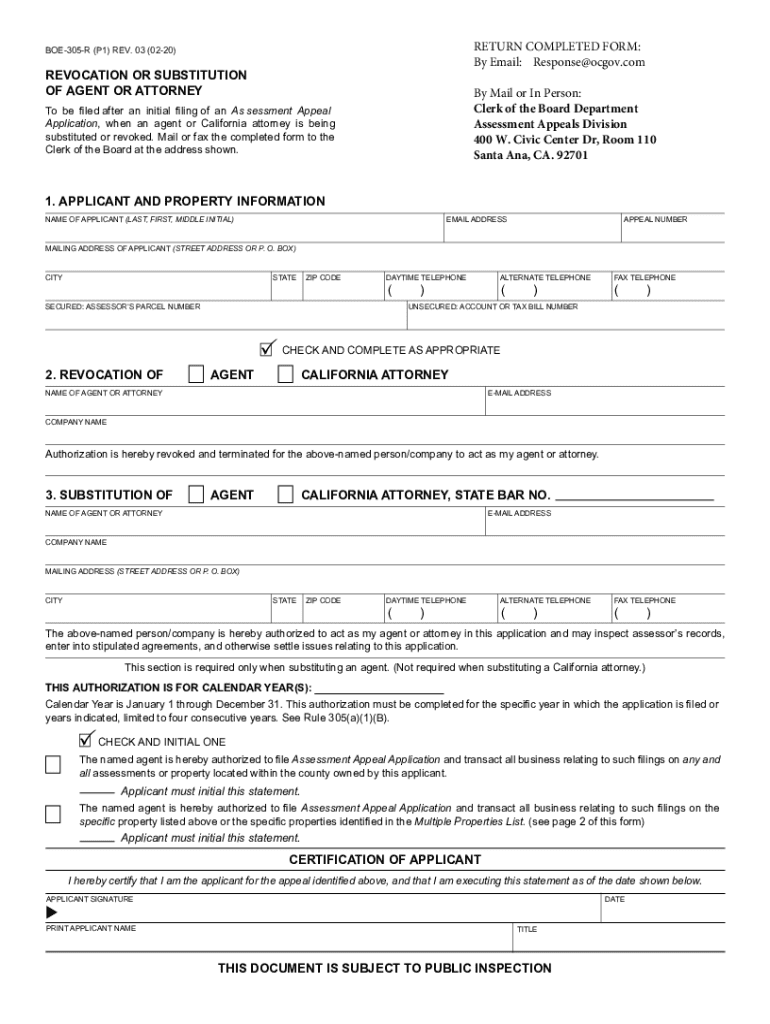

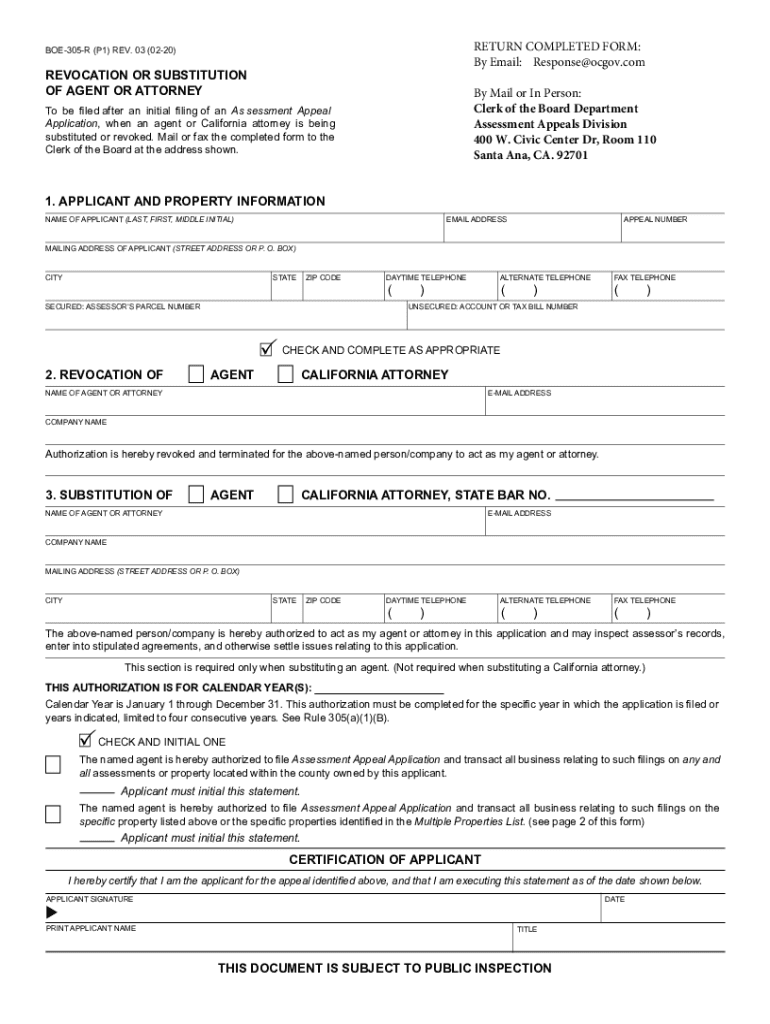

Overview of the BOE-305-R Form

The BOE-305-R Form, formally recognized as the 'Claim for Exemption from Property Tax', is essential for property owners seeking to claim various exemptions and reductions on their property tax obligations in California. This form is pivotal for individuals and businesses who wish to leverage potential tax savings by accurately reporting their eligibility for specific exemptions. Accurate completion of the BOE-305-R Form is vital, as any discrepancies can lead to delays in processing or denial of the tax exemption.

Common uses of the BOE-305-R Form include requesting exemptions for properties utilized for religious, educational, or charitable purposes, as well as addressing specific scenarios that may warrant adjustments in property tax valuations. Understanding the form's importance and implications aids in maximizing one’s financial position when it comes to property ownership.

Key features of the BOE-305-R Form

The BOE-305-R Form comprises several key sections that guide applicants through the information necessary for a successful exemption claim. Each section addresses different aspects of the claim, ensuring all relevant information is provided to the tax authority.

Completing each essential field accurately is crucial; discrepancies can result in processing delays, necessitating resubmission, or even the rejection of your claim. Being diligent with the required information paves the way for a smoother process.

Step-by-step guide to filling out the BOE-305-R Form

To effectively fill out the BOE-305-R Form, preparation is critical. Begin by gathering necessary documents such as property deeds, previous tax returns, and any relevant financial statements. Understanding the requirements outlined in the instructions will empower you to complete the form accurately.

Avoiding common mistakes is equally important. Double-check entries, ensuring that names and figures are accurate. Misstated information can not only complicate your claim but may also necessitate additional clarifications from tax authorities.

Editing and eSigning the BOE-305-R Form

Utilizing tools like pdfFiller greatly simplifies the process of editing and signing the BOE-305-R Form. To begin, upload your completed document directly to the platform. The user-friendly interface allows you to add text, annotations, and even digital signatures with ease.

The eSignature feature is particularly beneficial for busy individuals. You can create a signature quickly and send documents for signature from various stakeholders without the hassle of physical paperwork.

Managing your BOE-305-R Form documents

Once your BOE-305-R Form is completed, effective management becomes crucial. pdfFiller allows you to store and organize your form documents in the cloud safely. This means you can access your forms from anywhere, ensuring your important paperwork is always at your fingertips.

Moreover, tracking the status of your forms directly within pdfFiller helps you stay organized and accountable, giving you peace of mind that everything is in order.

Frequently asked questions (FAQs)

Common questions arise regarding the BOE-305-R Form. Queries such as 'What if I make a mistake on my form?' are frequent. If you realize an error post-submission, contact your local tax authority immediately to understand the necessary steps for correction.

Additional resources and support

Navigating the complexities of property tax exemptions can be daunting. Access to additional resources enhances your understanding of the BOE-305-R Form. pdfFiller provides links to related forms and documents that can further assist users in their filing process.

Utilizing these resources can significantly ease the complexities associated with filing and managing your BOE-305-R Form.

Checklist for completing the BOE-305-R Form

Before you dive into filling out the BOE-305-R Form, having a checklist can be a game-changer. Consider the following points to ensure a thorough approach:

Tips for success when submitting your BOE-305-R Form

For a successful submission of the BOE-305-R Form, understanding the timelines and deadlines is crucial. Submitting the form on time avoids penalties or complications regarding your exemption status.

Adopting these best practices ensures a smoother process and can significantly alleviate the stress often associated with tax filings.

Keeping your BOE-305-R Form updated

After submitting your BOE-305-R Form, it’s important to keep your information updated. Real estate conditions and personal circumstances change, and the form must reflect current information accurately. Regularly updating not only keeps your records straight but also ensures adherence to local regulations.

Being proactive in maintaining updated records fortifies your standing with tax authorities and protects your financial interests.

Conclusion: Leverage pdfFiller for effortless document management

In summary, the BOE-305-R Form plays a significant role in navigating property tax exemptions effectively. Utilizing pdfFiller not only simplifies the process of filling, editing, and signing this important document but provides you with a suite of tools that streamline document management. From eSigning to cloud storage, pdfFiller empowers individuals and teams with everything necessary for efficient and accurate document handling.

Exploring the various features of pdfFiller can enhance your experience, making document management not only more accessible but also more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my boe-305-r directly from Gmail?

How do I edit boe-305-r on an Android device?

How do I complete boe-305-r on an Android device?

What is boe-305-r?

Who is required to file boe-305-r?

How to fill out boe-305-r?

What is the purpose of boe-305-r?

What information must be reported on boe-305-r?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.