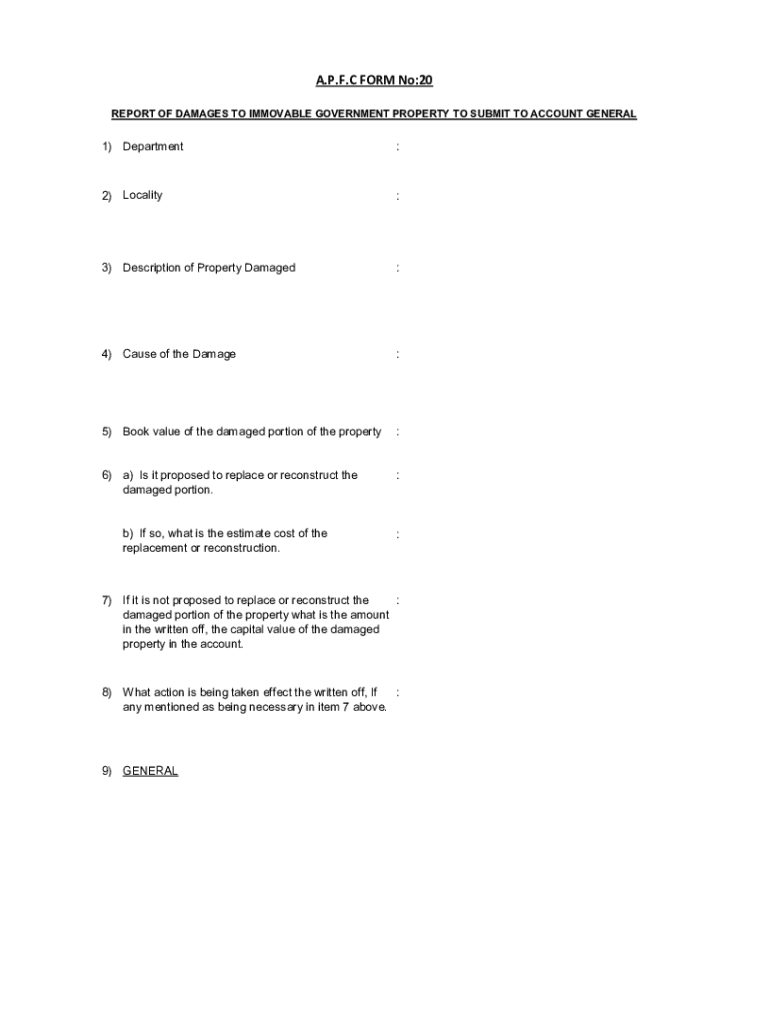

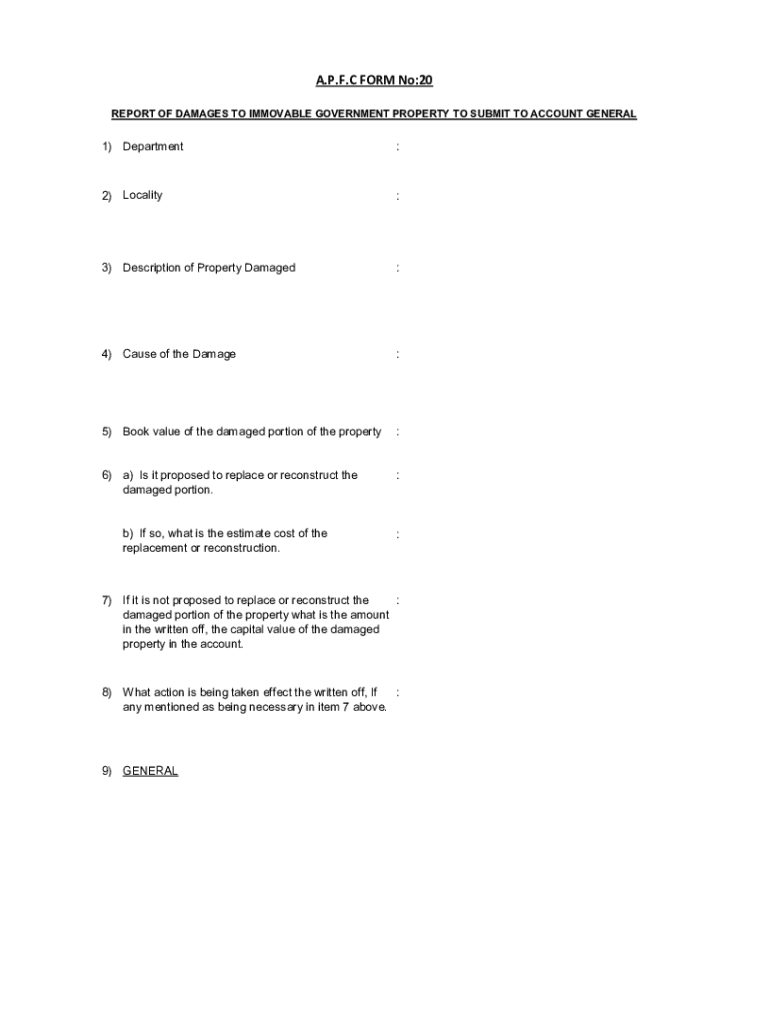

Get the free a.p.f.c Form No:20

Get, Create, Make and Sign apfc form no20

How to edit apfc form no20 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out apfc form no20

How to fill out apfc form no20

Who needs apfc form no20?

Comprehensive Guide to APFC Form No 20 Form

Understanding APFC Form No 20

APFC Form No 20 is a crucial document related to the Employees’ Provident Fund (EPF) scheme. It serves multiple purposes, primarily enabling employees to withdraw their accumulated provident fund balance after resignation or transfers between jobs. This form must be correctly completed and submitted to ensure that employees can access their hard-earned savings with minimal hassle.

Understanding the importance of APFC Form No 20 in the context of EPF becomes vital for employees managing transitions in their careers. It acts as a gateway to accessing funds that are pivotal during times of need, allowing for improved financial management post-employment.

Eligibility criteria for filling APFC Form No 20

Not every individual is eligible to fill APFC Form No 20. The primary groups include:

Certain conditions must be fulfilled to qualify for completing the form. These include the minimum service period required, typically a few months, and the necessary documentation such as resignation letters, bank account details, and prior EPF statements.

Detailed instructions on filling out APFC Form No 20

Filling out APFC Form No 20 is straightforward if you follow a step-by-step approach. Here’s a detailed guide:

Accurate completion of each section is crucial to avoid delays in processing your application.

Common errors to avoid when submitting APFC Form No 20

Mistakes can occur while filling out APFC Form No 20, leading to unnecessary delays. Common errors include:

To ensure accuracy before submission, double-check all entries, and consider using a checklist to verify that all required information is included.

Submitting your APFC Form No 20

Once your APFC Form No 20 is completed, it's time to submit it through the appropriate channels. The submission can be done physically at the nearest EPF office or submitted online through the EPF portal if available.

When submitting online, ensure your electronic documents are ready and that the submission process is completed before any deadlines. If you are submitting physically, note any timelines associated with the processing of your form.

Tracking the status of your APFC Form No 20

Once you've submitted your APFC Form No 20, checking its status is important for peace of mind. You can track the status using the online tracking system available on the EPF website.

Alternatively, if you prefer direct interaction, you can contact the nearest EPF office for updates on your application status.

Key benefits of using pdfFiller for APFC Form No 20

Using pdfFiller to manage your APFC Form No 20 can enhance your experience significantly. This platform allows you to edit, sign, and manage your documents conveniently from anywhere.

By utilizing the interactive tools provided by pdfFiller, users can ensure compliance and accuracy when filling out important forms like APFC Form No 20.

Frequently asked questions (FAQs) about APFC Form No 20

Conclusion on the significance of properly managing APFC Form No 20

Properly managing your APFC Form No 20 is essential for a smooth transition in your employment journey. Timeliness and accuracy in completing this form can significantly impact your financial stability during job changes. Ensuring proper management not only facilitates efficient fund withdrawals but could also influence future employment opportunities as you navigate your career trajectory.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send apfc form no20 for eSignature?

Can I create an electronic signature for the apfc form no20 in Chrome?

How can I fill out apfc form no20 on an iOS device?

What is apfc form no20?

Who is required to file apfc form no20?

How to fill out apfc form no20?

What is the purpose of apfc form no20?

What information must be reported on apfc form no20?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.