Get the free Char500

Get, Create, Make and Sign char500

How to edit char500 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out char500

How to fill out char500

Who needs char500?

A Comprehensive Guide to the char500 Form for New York Charities

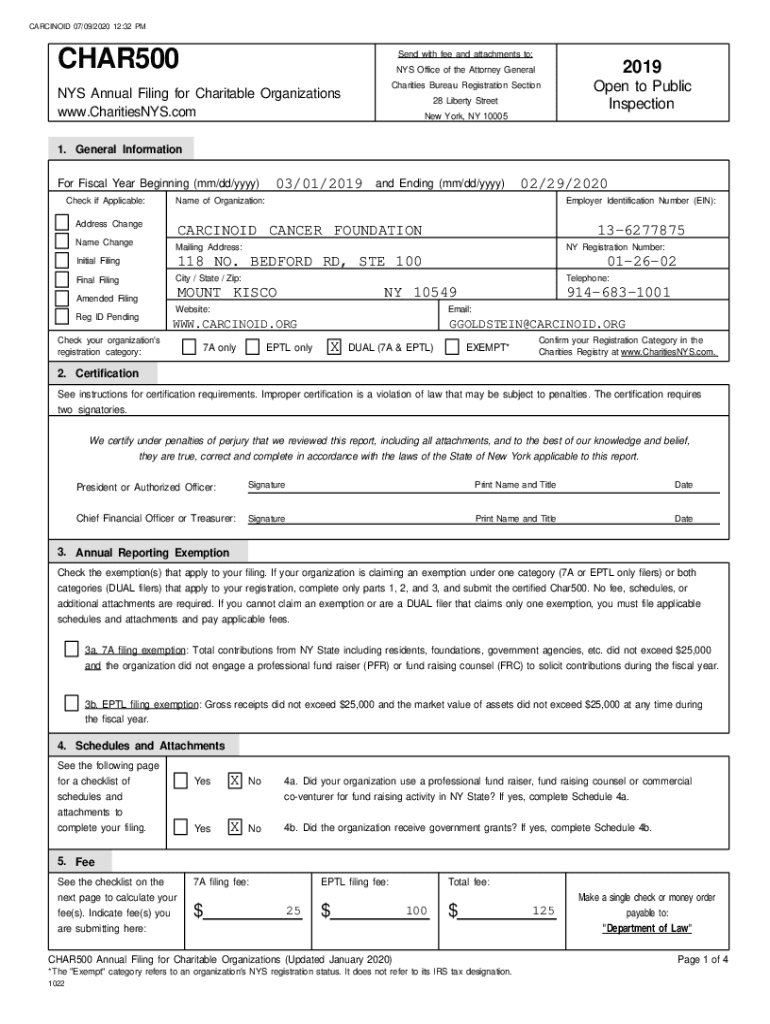

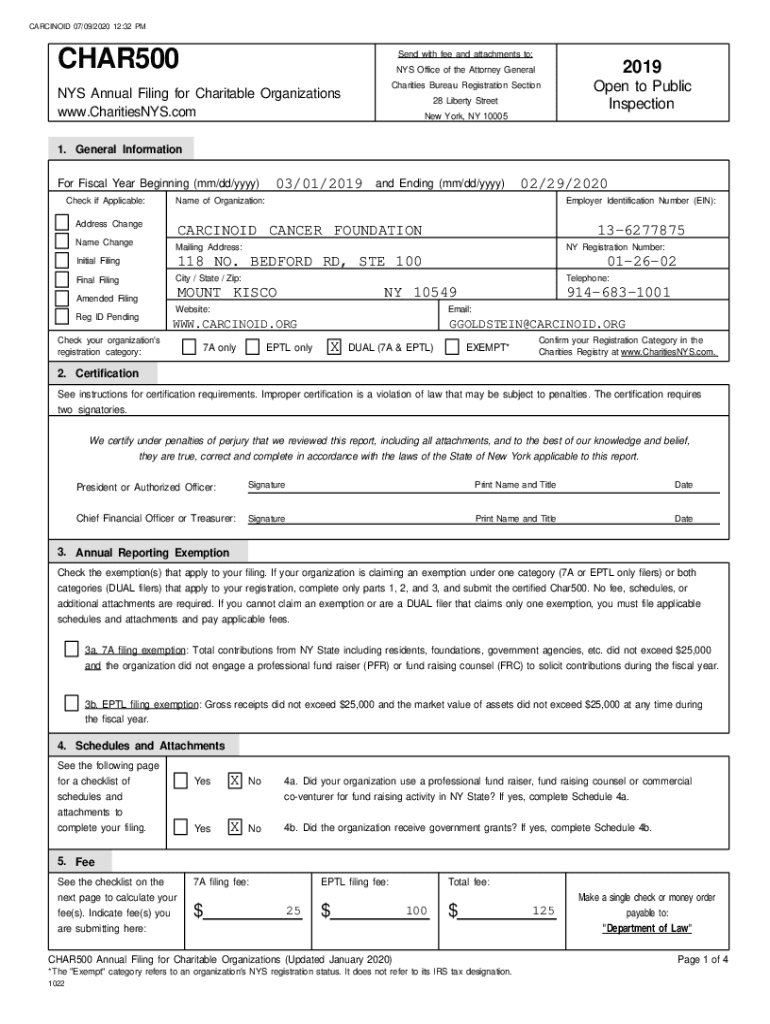

Understanding the char500 form

The char500 form is a crucial document for nonprofits operating in New York, serving as an annual report that outlines financial and operational activities. This comprehensive form is essential for transparency and compliance with state laws mandated by the Charities Bureau under the New York State Attorney General's Office. By filing the char500 form, charities maintain their good standing and support public accountability.

Key components of the char500 form

The char500 form comprises several key components designed to provide a complete picture of a charity's financial health and activities. Understanding these components is vital for accurate reporting. The form is structured with four primary sections: Coversheet, Financial Statements, Schedule of Activities, and Support Schedule.

Each section serves a unique purpose. The Coversheet provides essential identifying information, while the Financial Statements reflect the charity's income, expenses, and net assets. The Schedule of Activities details the organization's programs and services, and the Support Schedule lists the sources of funding and their allocation.

Preparing for filing

Preparing to file the char500 form requires an understanding of eligibility requirements, critical deadlines, and the specific documents needed for submission. Organizations that are required to file include those with gross revenue over a certain threshold, generally set at $25,000. Smaller organizations may be exempt but are encouraged to file for transparency.

Awareness of key dates is also essential for compliance. Charities generally need to submit their char500 form by November 15th of the year following their fiscal year end. Extensions are available but must be filed before the deadline to avoid penalties.

Step-by-step instructions for completing the char500 form

Completing the char500 form requires methodical attention to detail. Begin with gathering all necessary documents, including previous annual reports, current financial statements, bank statements, and IRS Form 990, if applicable. This preparation step creates a solid foundation for the filing process.

The next phase involves filling out the Financial Statements section, where you need to accurately input income and expenses. Follow this with the Schedule of Activities, which entails reporting on your charity's primary missions and services provided during the year. Finally, gather all required attachments, ensuring they are organized as per the guidelines to facilitate a smoother review process.

Filing options for the char500 form

There are various methods available for filing the char500 form, with online e-filing through platforms like pdfFiller being a convenient option. E-filing offers benefits such as faster processing times and the ability to easily correct any errors before submission. Users can navigate pdfFiller’s intuitive interface to complete the form efficiently.

Alternatively, charities may choose to submit their forms by mail or in-person at designated locations. It’s crucial to follow the specific guidelines for each method to ensure compliance and avoid delays.

Common challenges and solutions

Filing the char500 form can bring various challenges, from missing information to incorrect financial reporting. Many organizations often experience technical glitches during online submission, which can be frustrating. To mitigate these issues, charities should maintain detailed records and double-check all financial data before submission.

Moreover, engaging with compliance networks and attending workshops can equip organizations with useful insights and tips for smoother filing experiences. By proactively preparing, you can minimize the risks of complications.

Understanding post-filing procedures

Once the char500 form is submitted, it's essential to understand the subsequent steps. Organizations can track the status of their filing through the Charities Bureau's online portal, which provides updates on processing times and confirmations of receipt. This tracking is vital as it reassures charities that their compliance obligations have been met.

Receiving confirmation of your filing is critical, as it serves as evidence for compliance and can be beneficial if questions arise in the future regarding the organization's operational status or financial disposition.

Resources for assistance

For organizations needing assistance with the char500 form, pdfFiller offers robust support tools, including interactive help features and customer service contacts available to guide users through the filing process. Their comprehensive support ensures that charities can navigate challenges smoothly.

Additionally, external resources such as the New York State Attorney General’s Office and nonprofit support organizations provide valuable information and resources, including FAQs, workshops, and guidance on compliance updates.

Tips for future filings and compliance

To ensure future filings of the char500 form are efficient and compliant, it’s imperative to maintain accurate financial records throughout the year. Implementing a system for tracking contributions and expenses will facilitate easier preparation during filing season.

Setting up reminders for upcoming deadlines can also prevent any last-minute scrambles that could lead to errors or missed deadlines. Engaging with nonprofit compliance networks keeps organizations updated on regulations and best practices.

Special notes for first-time filers

First-time filers of the char500 form may feel overwhelmed by the process. Common concerns often revolve around understanding filing requirements and timelines. It’s recommended to review the guidelines thoroughly and seek out FAQs from reliable sources to clarify any uncertainties.

Implementing the tips provided for first-time filers, such as maintaining organized financial records and keeping communication open within your nonprofit community, will significantly enhance your initial filing experience.

Additional information on related forms

Beyond the char500 form, nonprofits may encounter other important documents essential for their compliance and operational integrity. For example, IRS Form 990 serves as the federal tax return for nonprofit organizations, while Certificate of Incorporation provides the foundation for legal operation.

Understanding guidelines for charitable lead and remainder trusts also enhances a charity's ability to manage and report its funds effectively, ensuring the organization remains compliant with both state and federal regulations.

Interactive tools and resources on pdfFiller

pdfFiller offers an array of online tools designed specifically for document management. This platform allows organizations to fill out, edit, sign, and manage their char500 forms and other essential documents effortlessly.

With interactive tools available, users can access step-by-step video tutorials that enhance their understanding of the filing process, ensuring a smooth experience. These resources make pdfFiller a go-to solution for charities navigating the complexities of form filing.

Continuous learning and development for nonprofits

Staying informed about changes in filing requirements and operational guidelines is vital for nonprofits. Regular participation in workshops and webinars enhances an organization’s ability to adapt to new regulations and filing processes.

By fostering an environment of continuous learning, nonprofits can ensure their teams are well-equipped to tackle compliance challenges and maintain effective operational practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my char500 in Gmail?

Where do I find char500?

How do I edit char500 on an iOS device?

What is char500?

Who is required to file char500?

How to fill out char500?

What is the purpose of char500?

What information must be reported on char500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.