Navigating the National Provident Fund Act Form: A Comprehensive Guide

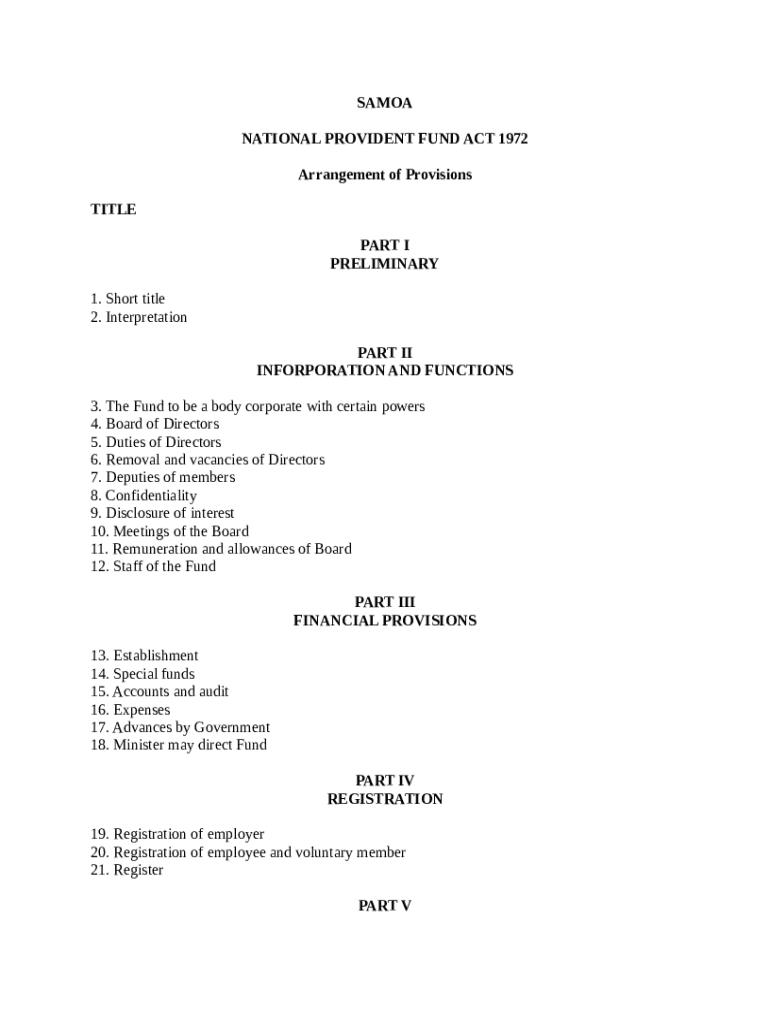

Overview of the National Provident Fund Act

The National Provident Fund Act was established to provide a financial safety net for individuals upon retirement and in cases of disability or death. Its origins trace back several decades when the need for mandatory savings for workers became evident, aiming to enhance financial security and support welfare programs. This fund plays a pivotal role in ensuring employees save systematically, fostering a culture of savings that can significantly contribute to financial independence during retirement.

The National Provident Fund serves as a vital source of income after employees exit the workforce, making its importance undeniable. It encourages individuals to contribute a portion of their salaries towards a collective pool that can be drawn upon in times of need. For teams and employers, this fund not only helps in retaining talent but also promotes a responsible corporate culture by ensuring the workforce is prepared for life beyond employment.

Retirement savings that accumulate interest over time.

Financial stability in cases of job loss or exigent circumstances.

Potential tax benefits that individuals can leverage.

Eligibility criteria

Eligibility to apply for the National Provident Fund varies slightly between individuals and employers. Generally, all employees are entitled to register for this fund as long as they meet specific requirements, while employers must also comply with national regulations concerning their employees’ enrollment in the scheme. Employees typically need to be of a certain age and in a formal employment status, which means seeking full-time or contracted work.

To prove eligibility, employees are required to submit documentation such as proof of identity, employment letters, and potentially, pay slips that indicate their employment details. Employers are mandated to provide company registration details and remuneration evidence for their employees. It's crucial to keep these documents organized and easily accessible to streamline the application process.

Types of forms associated with the National Provident Fund

Several forms are integral to the operations of the National Provident Fund, serving different purposes at various stages of interaction with the fund. The primary forms include application forms for enrollment, withdrawal forms for accessing funds when needed, and change of details forms that allow individuals to update their personal or employment information.

Application forms are categorized into individual enrollment forms, which employees fill out to join the fund, and employer registration forms for companies registering their employees. A systematic approach to filling these forms ensures a hitch-free application. Withdrawal forms outline the necessary processes and conditions for withdrawing funds, while change of details forms are used when an individual’s personal or work situation changes, affecting their participation in the fund.

Individual enrollment forms for personal registration.

Employer registration forms for corporate involvement.

Withdrawal forms for accessing funds.

Change of details forms for updating existing information.

Step-by-step guide to filling out the National Provident Fund Act form

Filling out the National Provident Fund Act form is essential for ensuring compliance and proper enrollment in the fund. The first step in this process is preparation, which involves gathering all necessary documentation such as proof of identity and employment status. Understanding the forms' terminology is crucial to avoid confusion during completion.

When filling out the form, it is important to follow a systematic approach. Start by carefully reading each section, ensuring that all required fields are completed accurately. Pay attention to detail and avoid common mistakes such as omitting information or misrepresenting data. Double-check your entries before finalizing to mitigate the likelihood of errors that could delay the process.

Editing and collaboration on your form

Utilizing the pdfFiller platform to edit your forms offers an array of benefits. The platform simplifies the process, allowing users to make changes effortlessly and ensuring that all entries are precise and up to date. Editing PDF forms through pdfFiller is straightforward; you can upload your document, make necessary changes, and save your work instantly.

Additionally, collaborating on form completion with colleagues or family members is an invaluable advantage of using pdfFiller. The platform allows multiple users to access and edit forms simultaneously, promoting transparency and collaboration. Step-by-step instructions for editing a PDF form are available on pdfFiller, making the process user-friendly even for those unfamiliar with digital document handling.

eSigning your National Provident Fund Act form

The importance of electronic signatures cannot be overstated in the digital age, especially concerning the National Provident Fund Act form. eSigning enhances security and expedites the signing process, making it a preferred option for many. Signing documents electronically using pdfFiller ensures that your signature is both legally valid and secure.

To securely eSign your National Provident Fund Act form, pdfFiller provides an intuitive interface where you can create your signature, apply it to the document, and finalize it with ease. Understanding the legal validity of eSignatures in the context of the National Provident Fund is crucial, as these signatures carry the same weight as traditional signatures, respecting the regulations governing digital documentation.

Submitting your completed form

Once your National Provident Fund Act form is complete and signed, it’s time to submit your application. The submission methods available include online submission via designated portals, sending the form by post, or delivering it in person to the appropriate offices. Knowing the best practices for submission can significantly influence the speed at which your form is processed.

Ensuring your form is submitted correctly involves checking the requirements listed for each submission method. After submission, you can expect a confirmation notification, which varies in timeframe depending on the method used and the organization's processing capabilities. Knowing what to expect after submission will help you stay informed during the process.

Managing your National Provident Fund documentation

Keeping track of your submission status is vital once you've submitted your forms. pdfFiller offers various tools that make document management simpler, allowing you to check the status of your submissions easily. Being proactive in managing your documents helps prevent any loss or miscommunication regarding your application.

Moreover, pdfFiller allows users to access and retrieve their forms and documents from anywhere. Keeping organized records of your forms can help you reference past submissions easily and aid in any future applications or queries related to your National Provident Fund dealings.

Common queries surrounding the National Provident Fund Act

Navigating the National Provident Fund can raise several questions for both employees and employers. Common queries often include who to contact for issues related to submission or what actions to take in case an application is denied. Each organizational jurisdiction may have a specified line of communication for resolving such issues promptly, and understanding these channels is key.

In addressing challenges in the application process, it is important to stay informed and proactive. For instance, if your application is denied, prompt follow-up with the appropriate department can help clarify the reasons and allow you to rectify any issues swiftly.

Contact customer service for clarification on submission issues.

Review denial reasons thoroughly and address them promptly.

Keep records of all communications for future reference.

Relevant regulations and compliance

An understanding of national regulations governing the National Provident Fund is essential for both employees and employers. Compliance with these regulations not only protects the interests of all parties involved but also ensures that processes are conducted smoothly and legally. Employers, in particular, must remain diligent in their adherence to all guidelines surrounding fund contributions for their employees.

Resources are available to help users understand their rights and responsibilities concerning the National Provident Fund. Familiarizing yourself with these resources equips you with knowledge that can be beneficial in managing your applications and dealings effectively.

Resources and links

For users looking to access the National Provident Fund Act forms, pdfFiller provides a user-friendly platform where you can find downloadable forms. It's essential to have access to relevant regulatory documents and instructional resources as you navigate this process. Additionally, having contact information readily available for support and assistance can ensure you have the guidance needed when faced with challenges.

Final thoughts on the National Provident Fund Act

The National Provident Fund is an indispensable component of responsible financial planning for individuals and their families. Understanding its implications and actively participating in this fund contributes significantly to long-term financial security. As you navigate the processes associated with the National Provident Fund Act form, leveraging tools like pdfFiller can simplify the often complex journey of document management, eSigning, and collaboration.

Encouraging a responsible approach to the National Provident Fund will pave the way for less uncertainty in financial planning and promote overall well-being for individuals looking towards their futures.