Get the free Accelerated Death Benefit Claim Form

Get, Create, Make and Sign accelerated death benefit claim

How to edit accelerated death benefit claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out accelerated death benefit claim

How to fill out accelerated death benefit claim

Who needs accelerated death benefit claim?

Accelerated Death Benefit Claim Form - How-to Guide

Understanding accelerated death benefits

Accelerated death benefits allow policyholders to access a portion of their life insurance benefits while still alive, especially under severe health conditions. This feature is designed to provide financial support to individuals facing terminal illnesses or chronic conditions that significantly limit their life expectancy. Understanding the nuances of this option is crucial for those who may need to utilize it during challenging times.

Key terms related to accelerated death benefits include 'policyholder,' 'death benefit,' and 'qualifying condition.' The term policyholder refers to the individual who owns the life insurance policy. The death benefit is the amount payable to beneficiaries upon the policyholder's passing. Qualifying conditions typically revolve around serious health issues, such as cancer, heart disease, or other catastrophic illnesses that significantly shorten life expectancy.

Eligibility criteria

To qualify for accelerated death benefits, specific criteria outlined in the insurance policy must be met. Generally, policies stipulate conditions such as terminal illness diagnosis with a limited prognosis, chronic illnesses requiring extensive medical care, or debilitating conditions that render the individual unable to perform daily activities. Each insurance provider may have different definitions and qualifying lists, so reviewing individual policies is essential.

Common qualifying illnesses or situations may include advanced-stage cancers, organ failure, or a diagnosis of a terminal condition where the life expectancy is less than 12 months. Policies may also allow access in cases of severe cognitive impairment or other significant health challenges.

Preparing to file an accelerated death benefit claim

Before filing an accelerated death benefit claim form, gathering all necessary documentation is crucial. Essential documents often include your life insurance policy number, proof of diagnosis such as medical records or statements from healthcare providers, and, if applicable, a death certificate if the insured person has already passed. Gathering these documents beforehand can streamline the claims process.

Understanding your insurance policy is a critical step before submitting your claim. Look for sections that discuss accelerated death benefits, including any exclusions or limitations. Familiarize yourself with terms, conditions, and definitions related to your coverage, as this knowledge will help you navigate the claims process more effectively.

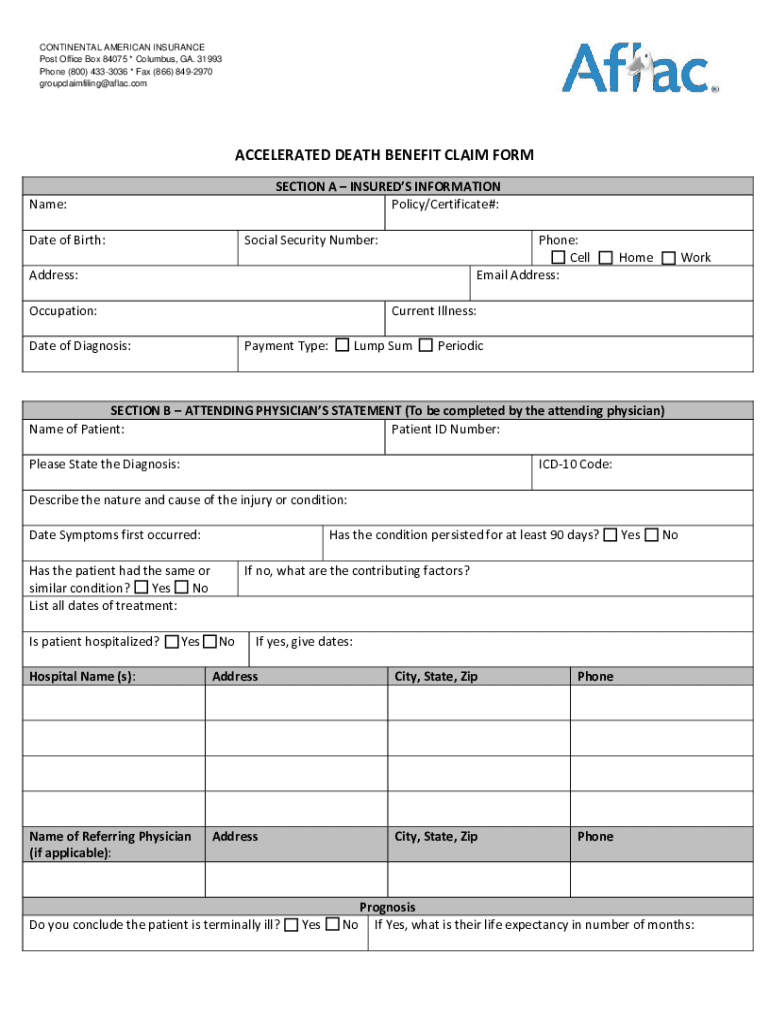

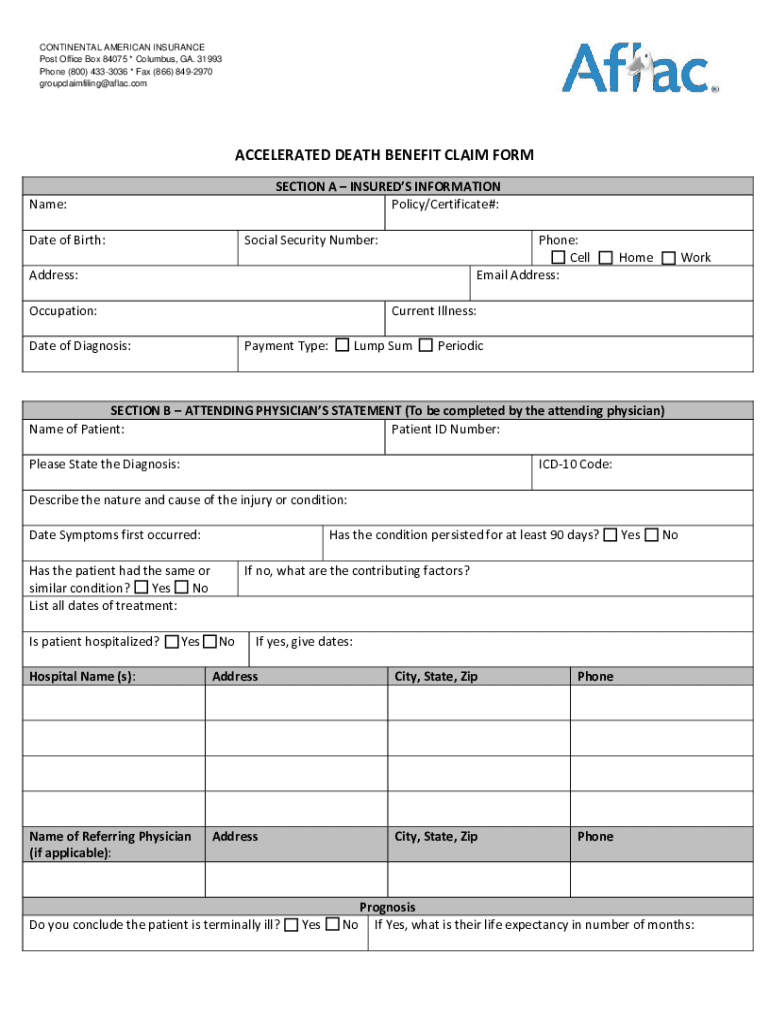

Completing the accelerated death benefit claim form

The accelerated death benefit claim form typically consists of several sections that need to be thoroughly completed for a successful submission. Each section is geared toward gathering specific information that supports the claim. Common fields include personal information of the policyholder, the nature of the claim, and detailed medical documentation.

Step-by-step completion of the form is advisable. Start with filling out your personal information accurately, specifying the claim type, and then provide details regarding medical documentation. Once the form is fill out, reviewing all information thoroughly before submitting ensures no errors will cause unnecessary delays.

Submitting the claim form

Submitting the accelerated death benefit claim form can be done through various methods. Digital submission via platforms like pdfFiller allows for quick and efficient uploads, ensuring that the claim is sent directly to the insurance provider. Alternatively, if preferred, claims can also be submitted via traditional mail.

After submission, tracking your claim is essential. Most insurance companies provide a way to monitor the status of your claim online or by contacting customer service. Understanding the expected timelines for processing can help set expectations and allow you to follow up appropriately.

Common pitfalls and how to avoid them

When completing an accelerated death benefit claim form, mistakes can occur that lead to delays or even claim rejections. Common issues include missing signatures, incorrect personal information, or failing to provide essential medical documentation. It's imperative to double-check every detail before submission to prevent these avoidable complications.

Factors contributing to delays in claim processing can include incomplete information, the complexity of the case, or even high volumes of claims being processed at certain times. To expedite your claim, ensure thoroughness in your submission and stay in communication with your insurer regarding any additional requirements.

Frequently asked questions (FAQs)

As you navigate the process of filing an accelerated death benefit claim, you may encounter several common questions related to eligibility, potential claim amounts, and the overall timeline for receiving benefits. Understanding these aspects can mitigate anxiety and prepare you for a smoother experience.

Specific queries related to the form submission often arise, such as 'What documents do I need to attach?' or 'How can I check my claim status?' Clarifying these can significantly ease the submission experience and guide you during each step.

Utilizing pdfFiller for your claim management

pdfFiller offers various advantages when managing your accelerated death benefit claim form. The platform allows for easy editing and customization, enabling you to fill out forms accurately and efficiently. Additionally, their seamless e-signature solutions mean you can sign documents electronically without needing to print them.

Accessing advanced features such as collaboration tools ensures that teams can work together seamlessly on document preparation. Furthermore, secure cloud storage allows for easy access to your documents from anywhere, reinforcing peace of mind during the claims process.

Support and assistance

If assistance is needed, pdfFiller provides a variety of customer support options. Users can reach out via live chat or access an extensive FAQ section designed to tackle common queries. Taking advantage of these resources can help demystify the claims process, ensuring that you aren’t left in the dark.

Additionally, pdfFiller offers related document templates and tools, allowing users to manage all types of necessary documentation conveniently, further easing the overall stress of managing claims.

Real-life experiences

Many individuals have successfully navigated the accelerated death benefit claim process, sharing testimonials about their experiences. These real-life success stories underscore the importance of understanding the claims process and utilizing the right tools for efficient submissions.

Insights gained from those who have gone through this process provide valuable learning opportunities for future claimants. Their experiences highlight the need for thorough preparation and effective use of resources such as pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send accelerated death benefit claim for eSignature?

How can I edit accelerated death benefit claim on a smartphone?

How do I fill out accelerated death benefit claim using my mobile device?

What is accelerated death benefit claim?

Who is required to file accelerated death benefit claim?

How to fill out accelerated death benefit claim?

What is the purpose of accelerated death benefit claim?

What information must be reported on accelerated death benefit claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.