Get the free what is georgia adjustment allowance

Get, Create, Make and Sign georgia adjustments allowance form

How to edit what is georgia adjustment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out what is georgia adjustment

How to fill out form g-4

Who needs form g-4?

Understanding Form G-4: Your Comprehensive Guide

Overview of form G-4

Form G-4, known as the Employee's Withholding Allowance Certificate, is a crucial document for employees in the state of Georgia. This form helps you declare the number of withholding allowances you want to claim, which directly influences how much tax is deducted from your wages. Filling out Form G-4 accurately ensures that your paycheck reflects the right amount of tax withholding, mitigating potential surprises during tax season.

Understanding withholding allowances is vital, as they affect not only the size of your paycheck but also your tax return. More allowances typically mean less tax is withheld, giving you more immediate funds, while fewer allowances result in higher tax deductions, which could lead to a refund when you file your yearly return.

Eligibility for form G-4

Most employees are eligible to file Form G-4. This includes anyone who is employed in Georgia and receives regular wages, encompassing full-time, part-time, and seasonal positions. Whether you are a new employee or a seasoned worker, understanding when to submit this form is essential for effective tax management.

Detailed breakdown of the form G-4

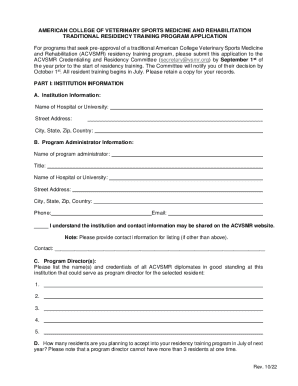

Form G-4 consists of several key components that guide you through the process of declaring your allowances. The form requires personal details, including your name, address, and Social Security number. Additionally, you’ll need to specify your filing status—single, married, or head of household—which can alter your tax calculations.

Furthermore, you must determine the number of withholding allowances you wish to claim. Each allowance reduces the amount of taxable income, which can lead to a lower overall tax liability. Understanding terms like exemptions, allowances, and instructions can significantly aid in the completion of Form G-4.

Step-by-step instructions for completing form G-4

Before filling out Form G-4, gather all necessary documents, including your previous year’s tax returns, and any relevant information regarding your current financial situation. The following steps detail how to complete the form accurately:

Being diligent during this process helps avoid common mistakes, such as miscalculating your allowances or failing to update your information when life changes occur.

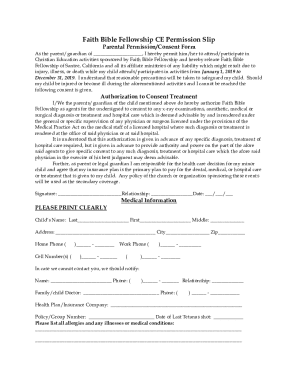

Submitting form G-4

Once you have completed Form G-4, it must be submitted to your employer. Generally, this can be done in person or electronically, depending on your employer's submission process. Make sure to check with your HR department regarding any specific submission guidelines that may apply in your state.

Note that there are deadlines for submitting Form G-4 to ensure that your withholding allowances are accounted for in your next paycheck. Timeliness in submission is crucial to avoid incorrect withholdings.

Updating or modifying form G-4

It’s important to revisit Form G-4 when significant life changes occur. For instance, if you get married, have a child, or experience a divorce, updating your form ensures that your withholding accurately reflects your new financial situation.

By proactively managing your withholding through Form G-4, you can better adapt to changes and avoid under- or over-withholding.

Interactive tools to simplify form G-4 usage

Several online tools are available to help you effectively determine your withholding allowances. One useful resource is an allowance calculator, which can provide guidance on how many allowances to claim based on your financial situation, deductions, and potential credits.

Using these interactive tools can drastically simplify the Form G-4 process and ensure compliance with state requirements.

Common queries about form G-4

If you’ve lost your Form G-4 or need a new one, reach out to your HR department for assistance. They can guide you on how to obtain a duplicate copy. Besides, if there are disputes over your withholding amounts, first consult with your employer. They can clarify discrepancies and advise on the next steps to resolve the issue.

Navigating through your questions confidently can help ensure that you maintain control over your financial obligations.

Related tax filing considerations

Aligning your Form G-4 with other tax forms, such as the federal W-4 form, is essential for managing your entire tax strategy. The G-4 and W-4 will work together but have different stipulations specific to state and federal taxes, respectively. Familiarizing yourself with how these forms interact allows for holistic management of your tax withholding.

Understanding these elements will empower you to make informed decisions regarding withholding allowances and tax responsibilities.

Expert insights on effective tax withholding

Best practices for effective withholding involve regularly reassessing your Form G-4, especially after personal financial changes. Communicating with your HR department and making use of digital tools can shed light on how to optimize your withholding strategy.

By following these practices, you can navigate the nuances of tax withholding effectively.

Popular searches related to form G-4

Individuals often explore related topics such as state-specific withholding forms or tools for optimizing tax filings. Staying informed about these areas can enhance your financial management strategies and give insight into new resources or potential changes in state legislation.

By expanding your knowledge base on these related searches, you can enhance your approach to tax planning.

Support resources for form G-4

If you encounter challenges with your Form G-4, pdfFiller offers a dedicated support system to guide you through the process. You can find specific instructions and contact information directly on their website, ensuring you have access to the resources needed for successful document management.

Access to these support resources significantly enhances the ease of managing your Form G-4.

Understanding the impact of form G-4 on your finances

Properly managing Form G-4 can have long-term implications on your financial health. Setting the right allowances ensures that you are adequately prepared for tax obligations, preventing the risk of owing money at tax time.

Incorporating these strategies into your financial planning can lead to more favorable outcomes during tax preparation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify what is georgia adjustment without leaving Google Drive?

Can I create an electronic signature for the what is georgia adjustment in Chrome?

How can I fill out what is georgia adjustment on an iOS device?

What is form g-4?

Who is required to file form g-4?

How to fill out form g-4?

What is the purpose of form g-4?

What information must be reported on form g-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.