Get the free Verification Worksheet–independent Student

Get, Create, Make and Sign verification worksheetindependent student

Editing verification worksheetindependent student online

Uncompromising security for your PDF editing and eSignature needs

How to fill out verification worksheetindependent student

How to fill out verification worksheetindependent student

Who needs verification worksheetindependent student?

Comprehensive Guide to the Verification Worksheet Independent Student Form

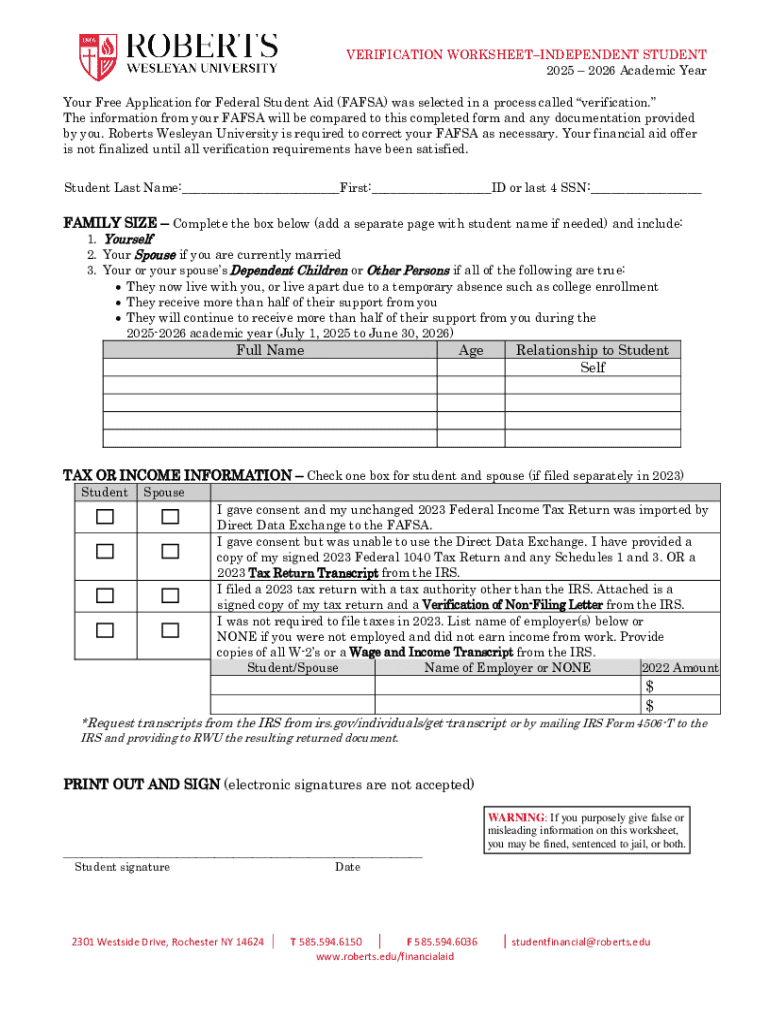

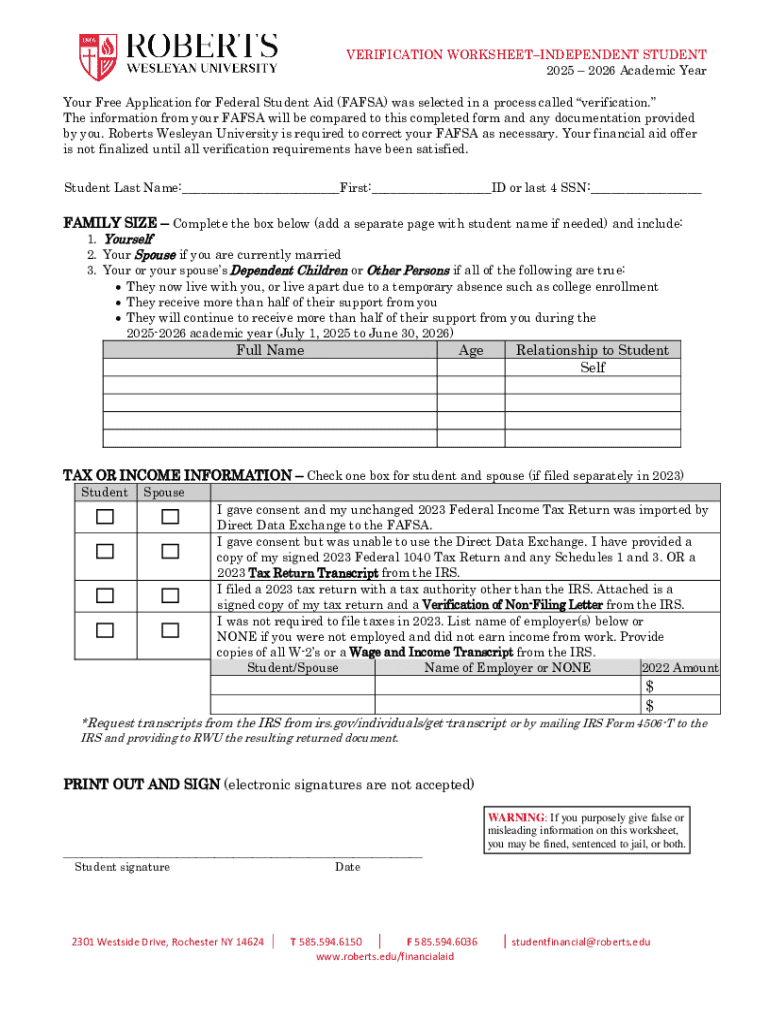

Understanding the verification process

Verification refers to the process that ensures the accuracy of the information provided on the Free Application for Federal Student Aid (FAFSA). This essential step is crucial for determining the financial aid eligibility of students, particularly independent students who submit a Verification Worksheet Independent Student Form. Being selected for verification does not imply wrongdoing; rather, it's a way for educational institutions to fulfill their responsibilities and provide financial assistance accurately.

The importance of verification in financial aid cannot be overstated. It protects both students and financial aid offices by ensuring that all awarded funds are based on verified income and eligibility. The Verification Worksheet for independent students specifically collects financial and demographic information that reflects the true financial status of the applicants.

By submitting this form, independent students provide necessary details that are crucial for finalizing their eligibility for grants, loans, and other forms of financial support.

Key components of the independent student verification worksheet

The Independent Student Verification Worksheet consists of several key components designed to capture essential information. Understanding each section is vital to ensure accurate and complete submissions.

Specific instructions should be adhered to while filling out each section to avoid common errors. For instance, be sure to use the correct tax year when reporting income and double-check all calculations.

Eligibility criteria for independent students

An independent student is one who meets specific criteria set by the U.S. Department of Education, which can include being 24 years old or older, being married, having dependents, or being a veteran among other factors. Understanding what constitutes an independent student is essential for correctly filling out the Verification Worksheet.

To determine independence, factors such as age, marital status, number of dependents, and military service are taken into account. The documentation required for verification often includes tax returns, proof of income, and sometimes court documents for those who have been in foster care or experienced homelessness.

Detailed instructions for completing the verification worksheet

Completing the Verification Worksheet requires careful attention to detail. Here’s a step-by-step guide to ensure all sections are completed accurately.

Consider using resources like pdfFiller for document preparation, offering tools to edit PDFs and facilitate the eSignature process efficiently. These features enhance the accuracy of your submission, minimizing delays in financial aid approval.

Necessary documentation for submission

To substantiate the information provided on the Verification Worksheet, submitting the right documentation is crucial. Here’s a list of acceptable documentation types:

Gathering required documents effectively can streamline the verification process. Utilize tools offered by pdfFiller to easily upload and edit documentation, ensuring that all materials are correctly formatted and free of errors.

Understanding verification items and exclusions

Verification involves several standard items that applicants must provide, such as AGI and income tax documentation. However, some items may be excluded from the verification requirements. Understanding these distinctions is crucial for independent students.

Certain extenuating circumstances, such as those involving confined or incarcerated individuals, may have different verification protocols. Students in these situations should seek guidance from their financial aid office to navigate unique requirements.

Navigating changes during the verification process

Once the verification worksheet is submitted, it may happen that circumstances change, necessitating updates to submitted information. Students must know how to handle these updates properly and timely.

If additional documentation is required, promptly contact your financial aid office for guidance. Understanding policies and procedures related to verification can prevent confusion and unnecessary delays. Failure to submit required documentation can lead to repercussions, including delays in receiving funds.

The role of verification in financial aid disbursements

Verification plays a pivotal role in the disbursement of financial aid. Understanding interim disbursements is crucial; these can occur while verification is still pending but only under specific circumstances.

Funds may be recovered from interim disbursements if the verification process reveals that the original submitted information was incorrect. Therefore, it’s essential to complete the verification process fully and accurately to avoid any financial issues later.

The timing of financial aid disbursements is heavily dependent on the completion of verification. Students are encouraged to monitor their financial aid status persistently to ensure all requirements are satisfied.

Supporting resources and tools

Utilizing tools like pdfFiller can significantly enhance the document management experience during the verification process. pdfFiller offers a range of capabilities, including editing PDFs, eSigning documents, and collaboration features that streamline communication and documentation.

Interactive tools for document management, such as filling out forms digitally, can save time and reduce the likelihood of errors. pdfFiller makes it easy for users to handle documents efficiently and from anywhere, ideal for busy independent students managing their verification requirements.

Frequently asked questions (FAQs)

While navigating the verification process, students often have questions about the Verification Worksheet. Here are some common queries:

For additional information, students can refer directly to resources provided by their financial aid offices, or refer to the comprehensive support offered through pdfFiller.

Final tips for a smooth verification experience

To ensure a seamless verification experience, adhere to best practices for submitting the Verification Worksheet. Prioritize accuracy and completeness by reviewing each section carefully.

A proactive approach ensures students remain on track with their financial aid and can focus on their education without unnecessary financial stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute verification worksheetindependent student online?

How do I edit verification worksheetindependent student in Chrome?

Can I create an electronic signature for the verification worksheetindependent student in Chrome?

What is verification worksheet independent student?

Who is required to file verification worksheet independent student?

How to fill out verification worksheet independent student?

What is the purpose of verification worksheet independent student?

What information must be reported on verification worksheet independent student?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.