Get the free Acd – 31050

Get, Create, Make and Sign acd 31050

How to edit acd 31050 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out acd 31050

How to fill out acd 31050

Who needs acd 31050?

ACD 31050 Form: A Comprehensive Guide to Accurate Submission and Management

Understanding the ACD 31050 form

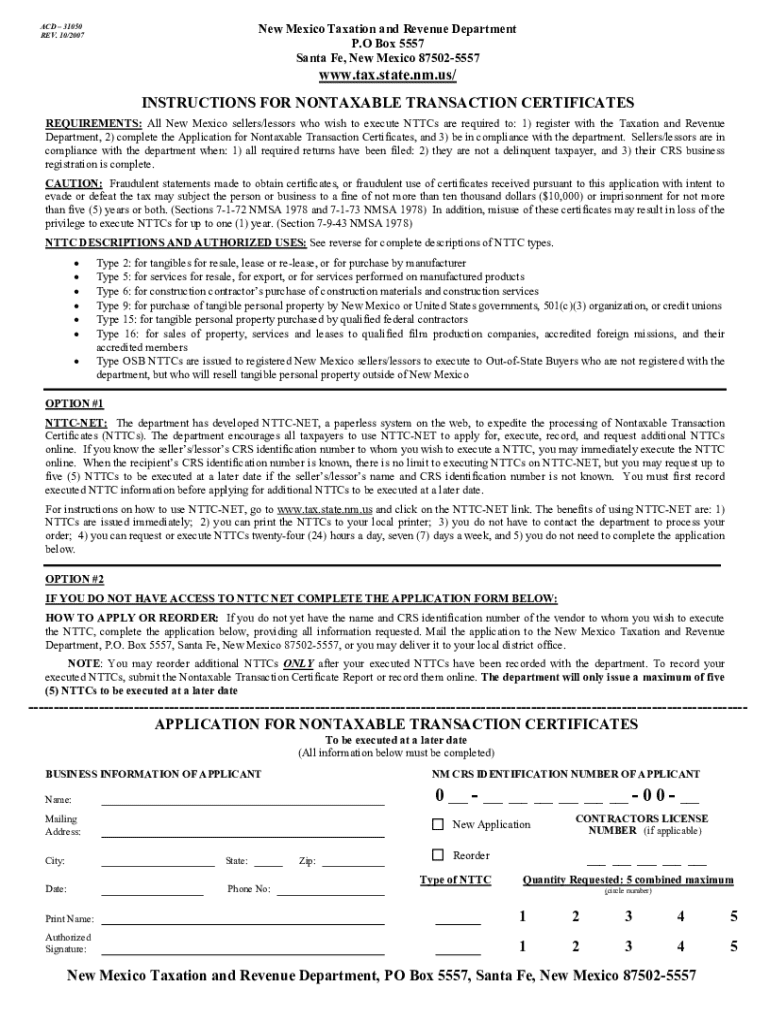

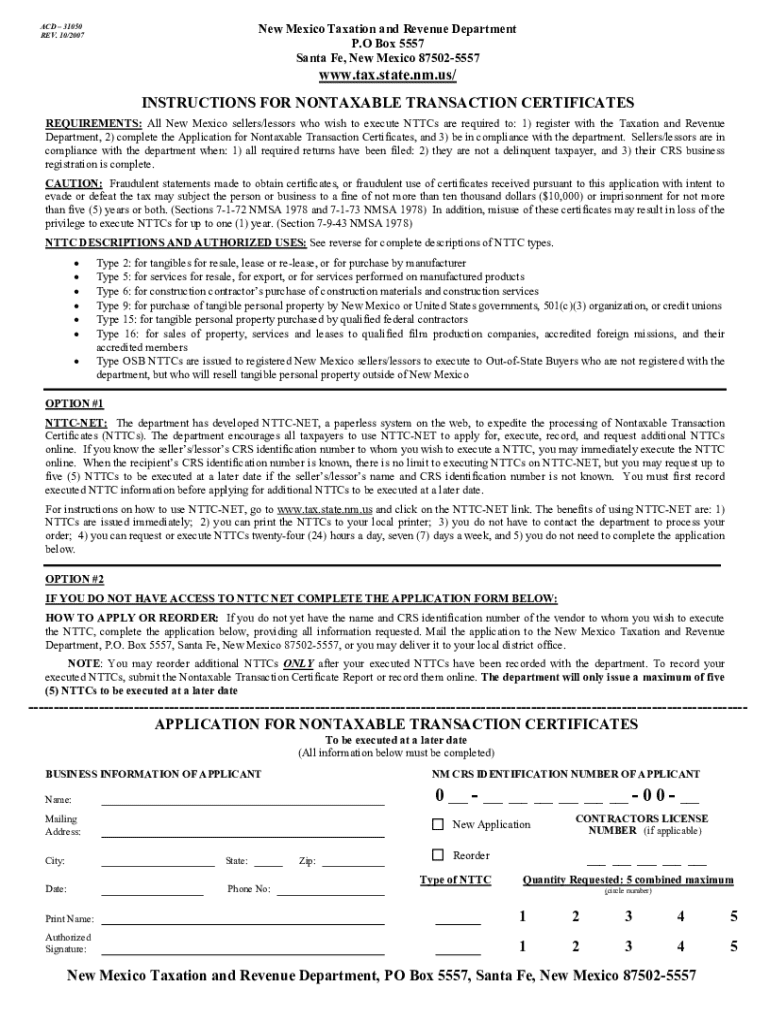

The ACD 31050 form is a crucial document utilized by individuals and businesses in New Mexico to apply for nontaxable transaction certificates. These certificates allow customers to claim deductions on gross receipts taxes for certain transactions as per the regulations set by the Taxation and Revenue Department. Accurate completion and timely submission of the ACD 31050 can significantly influence financial management and tax compliance.

Proper attention to detail when filling out the ACD 31050 form is vital. An incorrect or incomplete form not only holds up the processing time but may also lead to potential penalties or the denial of requested deductions. Understanding the different scenarios in which this form is necessary — such as when purchasing items for resale or leveraging other exemptions — can help users navigate the complexities of New Mexico's tax system.

Key features of the ACD 31050 form

The ACD 31050 form consists of several key sections designed to collect essential information from applicants. Each section serves a specific purpose, allowing for the accurate assessment and documentation of tax deductions. The primary components of the form include Personal Information, Financial Information, and Signature Requirements, each requiring thorough attention to ensure compliance.

Additionally, technology has made it easier for applicants to fill out the ACD 31050 form efficiently. With interactive tools, users can employ digital form fillers that streamline the process. Furthermore, automatic data-saving features ensure that applicants don’t lose their progress, ultimately facilitating a smoother completion experience.

Step-by-step guide to filling out the ACD 31050 form

Before starting to fill out the ACD 31050 form, it's crucial to gather all necessary information. Collect required documents such as previous tax returns, transaction records, and identification documents. Preparing these details in advance streamlines the process, ensuring that applicants provide complete and accurate information on their forms.

Filling out the ACD 31050 requires attention to detail in three main sections. In Section 1: Personal Information, verify the accuracy of your full name, address, and contact details. In Section 2: Financial Information, ensure that all entries regarding gross receipts and deductions align correctly with documented evidence. Lastly, Section 3 focuses on signatures; it is essential to know whether you need a digital signature or a physical one, depending on submission methods.

Common mistakes include omissions of key information, incorrect calculations of taxes owed, and failure to sign the application. Taking the time to double-check entries can prevent processing delays and enhance overall compliance with state regulations.

Editing the ACD 31050 form

If you find errors after filling out the ACD 31050 form, don’t panic. Making corrections and edits is a straightforward process if you use tools provided on platforms like pdfFiller. These robust editing tools allow users to easily add text, annotations, and make necessary changes.

Moreover, users can reorder pages or delete unnecessary sections, ensuring that their form reflects accurate and required information. Such capabilities significantly reduce the hassle associated with traditional paper applications, saving time and enhancing efficiency.

eSigning the ACD 31050 form

eSigning the ACD 31050 form through pdfFiller offers a variety of benefits. This feature not only accelerates the signing process but also enhances security, ensuring that your signature is verified and safeguarded against unauthorized access. By using electronic signatures, you eliminate the need for printing and mailing, streamlining your workflow.

The eSigning process itself is user-friendly. After completing your form, simply click on the eSign option, select your signature, and apply it to the document. This efficiency reduces time spent on paperwork, allowing you to focus on more critical aspects of your financial management.

Managing your ACD 31050 form

Once submitted, managing your ACD 31050 form effectively is crucial for tracking your application status. Many users prefer cloud-based storage options, enabling them to access their forms anytime and anywhere. Such solutions ensure that all forms are securely stored and easily retrievable, adding to peace of mind.

Furthermore, monitoring your form submission becomes significantly easier with digital tools. Applicants can receive updates on their submissions and reaccess or reprint forms as needed. This level of transparency and accessibility supports proactive management, particularly in financial scenarios where accurate documentation is key.

Frequently asked questions (FAQs)

The ACD 31050 form is primarily used for individuals and businesses in New Mexico seeking deductions on transaction taxes. After submission, processing times can vary; however, staying informed on average waiting periods can help manage expectations.

Mistakes after submission can often be rectified by contacting the Taxation and Revenue Department; however, resolutions may depend on the nature of the error. Many applicants wonder if they can submit the ACD 31050 form online; the answer is yes. With pdfFiller, digital submission options enhance accessibility and convenience.

Additional support information

For those encountering issues specifically related to the ACD 31050 form, reaching out to the appropriate support channels can provide clarity. The Taxation and Revenue Department offers assistance, as do online platforms like pdfFiller, where users find community forums and help sections loaded with valuable resources.

In addition to textual support, pdfFiller offers a variety of video guides and tutorials to simplify the completion and submission process. Leveraging these resources can greatly enhance user experience and proficiency in form handling.

Explore related forms and documents

Understanding the landscape of related forms and documents can significantly benefit users working with the ACD 31050 form. Access to other tax and financial forms ensures that individuals remain informed and compliant across various reporting requirements. Platforms like pdfFiller provide easy links to these documents, enhancing users' workflow and convenience.

By utilizing templates for the ACD 31050 form and other relevant forms, applicants can save time and ensure their submissions align with current regulations. Staying updated with regulatory publications and alterations ensures that applicants are prepared for any changes that may affect their deductions and overall tax obligations.

Real-world applications of the ACD 31050 form

Understanding real-world applications of the ACD 31050 form can help potential applicants appreciate its purpose. Numerous businesses in New Mexico rely on accurate completion of this form to effectively manage tax deductions. Case studies reveal that companies using the ACD 31050 have enjoyed significant savings, optimizing their financial positions across various transactions.

Testimonials from satisfied users highlight the advantages of utilizing pdfFiller for the ACD 31050 form. Their experiences indicate that timely and accurate form submission can lead to improved cash flow and sound financial management, illustrating the true impact that this form can have on overall business efficacy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the acd 31050 form on my smartphone?

How do I complete acd 31050 on an iOS device?

Can I edit acd 31050 on an Android device?

What is acd 31050?

Who is required to file acd 31050?

How to fill out acd 31050?

What is the purpose of acd 31050?

What information must be reported on acd 31050?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.