Get the free Notice of Unclaimed Funds

Get, Create, Make and Sign notice of unclaimed funds

Editing notice of unclaimed funds online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of unclaimed funds

How to fill out notice of unclaimed funds

Who needs notice of unclaimed funds?

A Comprehensive Guide to the Notice of Unclaimed Funds Form

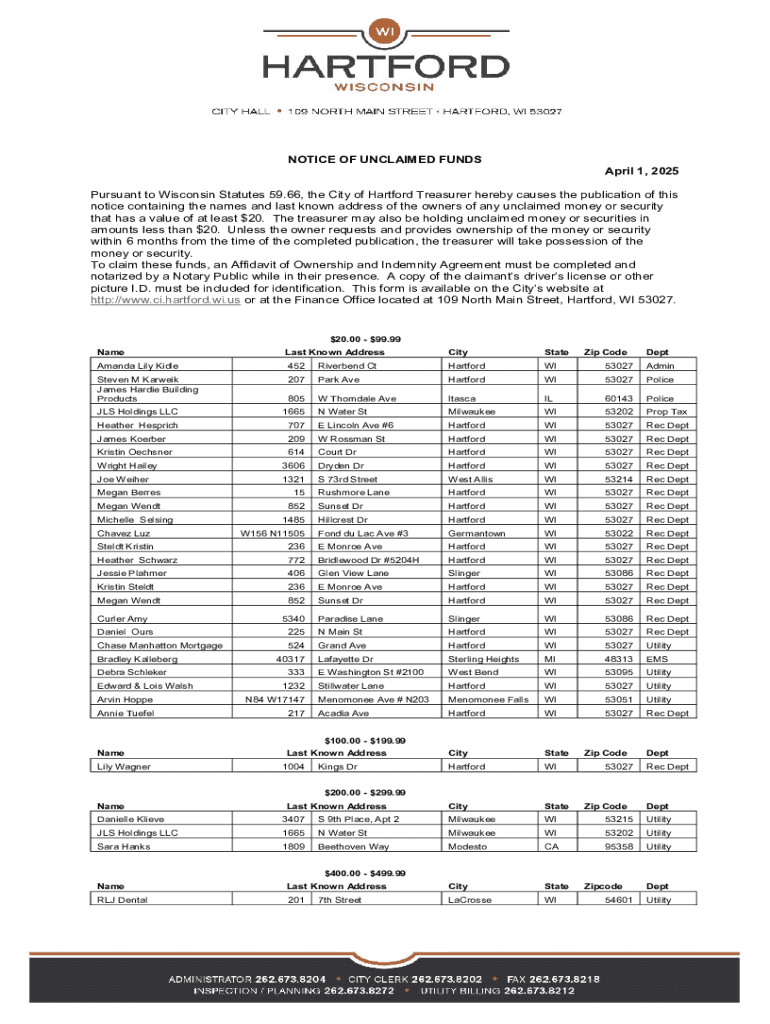

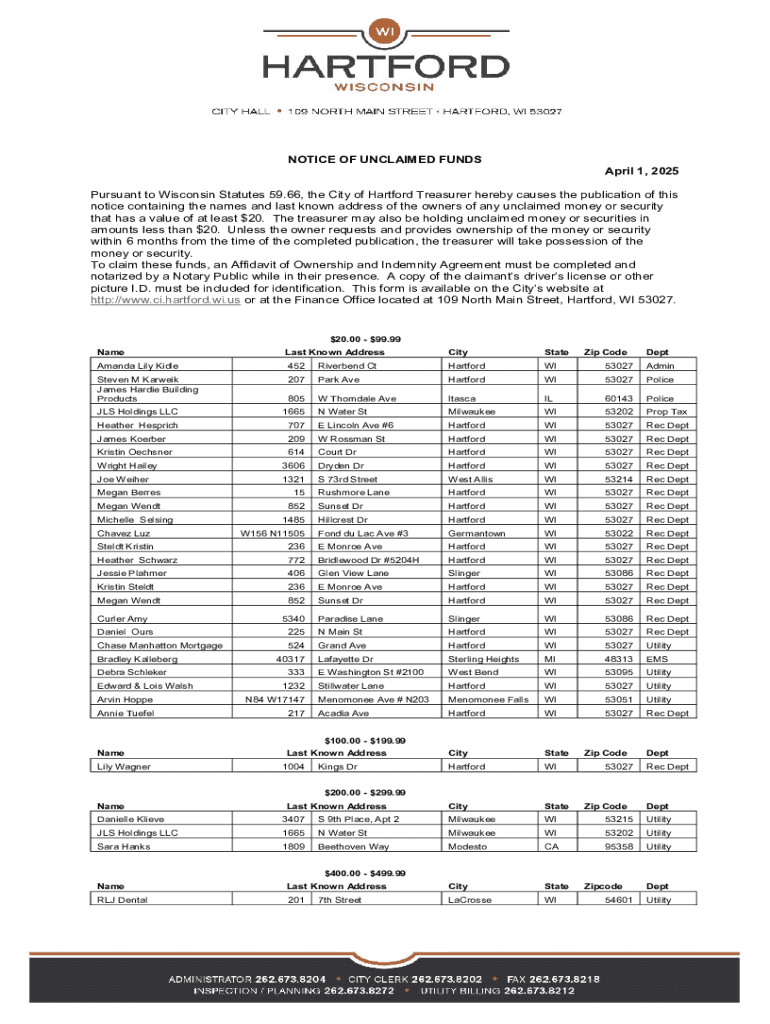

Understanding unclaimed funds

Unclaimed funds refer to money that is owed to individuals but has not been claimed or retrieved within a specific period. This often occurs when financial institutions lose track of account holders or when payments remain uncashed. These funds, which can accumulate over time, may surprise many individuals, as they often don’t realize they are entitled to this money.

The common sources of unclaimed funds include abandoned bank accounts, where individuals stop using their accounts without formally closing them, and uncashed checks, often from employers or government payments. Additionally, forgotten insurance policies can lead to substantial unclaimed funds when policyholders pass away without informing their beneficiaries.

Claiming unclaimed funds is crucial as it helps individuals recover money that rightfully belongs to them. It not only supports personal finances but also ensures that these funds are reintegrated into the economy. Understanding how to navigate the legal landscape surrounding these funds is imperative for anyone seeking their rightful property.

What is a notice of unclaimed funds form?

The notice of unclaimed funds form serves as a formal declaration that an individual or entity is making a claim on funds that have been deemed unclaimed. This form is critical for initiating the process of recovering funds that financial institutions, insurance companies, or governmental organizations are holding without a designated owner.

Typically, anyone who believes they have unclaimed funds — from individuals to businesses — needs this form. The completion of the notice signifies a legal assertion of ownership over the funds, and submitting the form is often required to kickstart the claims process.

Failure to file this notice can lead to unclaimed funds remaining with the state or originating institution indefinitely, making understanding the legal implications of unclaimed funds crucial for reclaiming what is yours.

Step-by-step guide to completing the notice of unclaimed funds form

Completing the notice of unclaimed funds form requires careful attention to detail. Start by gathering all required documentation. This typically includes valid identification, such as a driver’s license or passport, as well as proof of ownership for the funds in question, which can be bank statements or copies of checks.

When filling out the form, pay special attention to the personal information section, ensuring your name, address, and contact information are accurate. Describe the unclaimed funds thoroughly, including amounts and any relevant identifying details to assist in processing your claim.

Common mistakes to avoid include failing to provide sufficient documentation or omitting key information, as these can delay the processing of your form or result in denial of your claim. Take your time to complete the form meticulously.

Submitting the notice of unclaimed funds form

Once the notice of unclaimed funds form is completed, you have several options for submission. Many states offer online submission via their official websites, allowing for a quick and efficient claims process. Alternatively, forms can be mailed directly to the appropriate financial institution or state treasury’s office.

In-person submissions can also be an option, particularly if you seek immediate clarification or assistance with your claim. Regardless of the chosen method, being prepared for any fees associated with the submission is essential. Most places do not charge fees for the claims process, but specific states might require processing fees.

Expect a processing timeline ranging from a few weeks to several months, depending on the volume of claims and the complexity of your submission. Monitoring the claim status is advisable to ensure all proceedings are on track.

Tracking your claim status

After submitting your notice of unclaimed funds form, tracking the status of your claim becomes essential to ascertain when you might receive your funds. Most states provide online tracking systems enabling claimants to check the status of their applications using reference numbers assigned during submission.

Understanding notifications regarding claim status will keep you informed that your submission is under review, needs additional documentation, or has been approved. If there are delays or complications, keeping records of your communications will help clarify any issues.

Resources for claiming unclaimed funds

Each state has its specific resources available for individuals seeking to claim unclaimed funds, including online databases that allow users to search for lost property easily. For instance, a quick search of your state’s treasury website can reveal links to resources where you can verify unclaimed property.

Contacting your state's treasurer's office can also provide additional support and guidance in the claims process, offering expert advice tailored to your local regulations. Furthermore, numerous educational resources are available online, such as guides, articles, and even webinars that can enhance your knowledge on unclaimed property.

Success stories: claiming unclaimed funds

The process of claiming unclaimed funds has yielded numerous success stories, showcasing how individuals have turned overlooked money into valuable resources. For instance, in Los Angeles, a man found nearly $10,000 from a forgotten bank account, significantly easing his financial burdens.

These narratives highlight the importance of remaining proactive in looking for unclaimed funds. Many people are truly unaware of the potential resources that remain unclaimed. By actively pursuing these funds, not only can individuals gain financially, but they also contribute to consolidating finances within the community.

Utilizing pdfFiller for document management

pdfFiller serves as an invaluable resource when dealing with the notice of unclaimed funds form. With pdfFiller, users can seamlessly edit their forms, ensuring all information is correct before submission. Real-time editing features allow for modifications and adjustments on the go, making it easier to manage documents related to unclaimed funds instantly.

Furthermore, the platform enables users to eSign and collaborate on documents from anywhere. This feature streamlines the process of gathering signatures, making it quicker to complete essential documentation. Coupled with cloud storage capabilities, pdfFiller stores your documents securely and conveniently, ensuring that your important files are always accessible.

FAQs about the notice of unclaimed funds form

As users navigate the notice of unclaimed funds form, several common questions arise. Frequently asked inquiries include aspects such as how to complete the form correctly, what types of identification are acceptable, and the expected timeframes for receiving funds once the form is submitted.

Expert tips for a smooth claiming process often emphasize double-checking all information, ensuring you use clear and legible handwriting if filling the form manually, and keeping copies of all submitted documentation. Being organized can significantly minimize potential pitfalls in the claims process.

Additional tools and services offered by pdfFiller

In addition to managing the notice of unclaimed funds form, pdfFiller offers interactive tools that aid users in creating various financial documents. From templates specifically designed for financial forms to user-friendly features that accommodate document management, pdfFiller empowers individuals and teams to streamline their paperwork effectively.

The platform's versatility accommodates different needs, whether for individuals seeking personal financial management solutions or teams requiring collaborative document creation. This responsive approach ensures that users can find tailored support regardless of their specific document needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify notice of unclaimed funds without leaving Google Drive?

How do I edit notice of unclaimed funds in Chrome?

How do I edit notice of unclaimed funds straight from my smartphone?

What is notice of unclaimed funds?

Who is required to file notice of unclaimed funds?

How to fill out notice of unclaimed funds?

What is the purpose of notice of unclaimed funds?

What information must be reported on notice of unclaimed funds?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.