Get the free Nebraska Medicaid Estate Recovery Certification Request - dhhs ne

Get, Create, Make and Sign nebraska medicaid estate recovery

How to edit nebraska medicaid estate recovery online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska medicaid estate recovery

How to fill out nebraska medicaid estate recovery

Who needs nebraska medicaid estate recovery?

Navigating the Nebraska Medicaid Estate Recovery Form

Overview of Medicaid estate recovery in Nebraska

Medicaid Estate Recovery is a process that enables states to recoup costs related to Medicaid services provided to individuals once they pass away. This process serves to reclaim funds for the state's Medicaid program, ensuring sustainability. In Nebraska, understanding how estate recovery operates is essential for families who may face this situation. It is designed to help recover costs associated with long-term care, service payments, and healthcare costs incurred by Medicaid beneficiaries.

The regulations surrounding Nebraska's Medicaid estate recovery are unique, influenced by state policies that outline eligibility requirements, the types of assets subject to recovery, and specific exemptions. Gaining a clear understanding allows benefactors and their families to better navigate this often-complex process, helping to mitigate financial burdens and safeguard remaining assets.

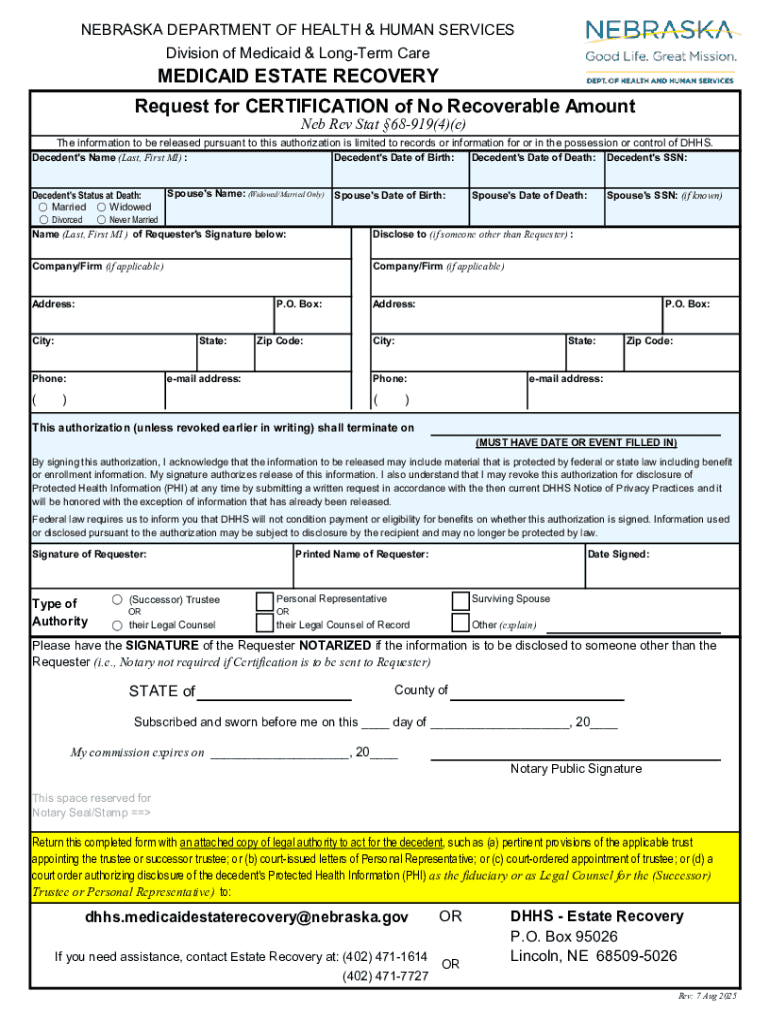

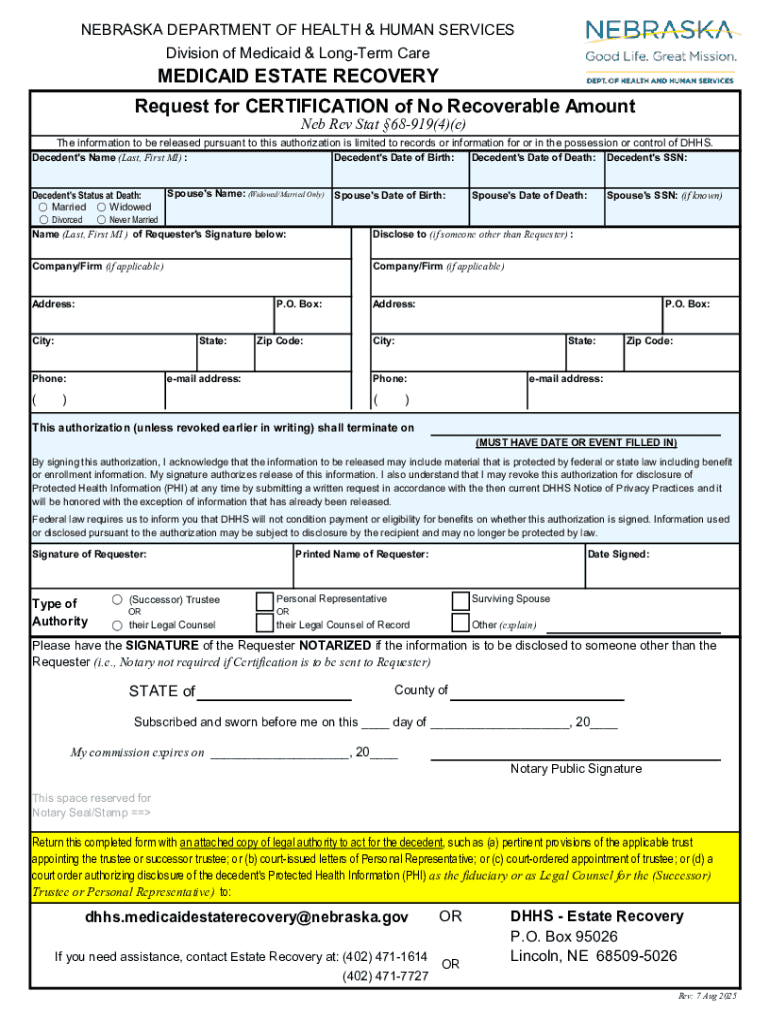

What is the Nebraska Medicaid estate recovery form?

The Nebraska Medicaid Estate Recovery Form serves as a formal document to initiate the estate recovery process. Primarily, it outlines the state’s claim against the estate of a deceased Medicaid beneficiary. Understanding the form is vital as it sets the groundwork for how the estate will settle Medicaid debts. It encompasses details surrounding the deceased's Medicaid benefits and the recoverable costs incurred by the state.

Individuals who need to complete this form typically include designated heirs, personal representatives, or executors of the estate. Familiarity with key terms is critical; terms such as "estate," "beneficiary," and "claim amount" will be encountered regularly throughout the process. Properly interpreting these concepts will facilitate accurate completion and understanding of implications and obligations related to estate recovery.

Steps to access and complete the Nebraska Medicaid estate recovery form

The process of accessing and completing the Nebraska Medicaid Estate Recovery Form consists of several clear steps, ensuring that all required information is accurately captured and submitted. Addressing each step systematically will help streamline the completion process.

Key components of the Nebraska Medicaid estate recovery process

Understanding the key components of the Nebraska Medicaid estate recovery process is paramount for any individual who finds themselves engaged in this procedure. A significant aspect to consider is the eligibility criteria for estate recovery, which generally applies to estates of individuals who received benefits from Medicaid from the age of 55 onward.

Various types of estates may be subject to recovery, including homes, bank accounts, and other assets. However, it’s important to note that certain exemptions and protections are available, particularly for low-income families and spouses of deceased beneficiaries. These protections are crucial in preserving family assets from state recovery claims.

The role of the Nebraska Department of Health and Human Services

The Nebraska Department of Health and Human Services (DHHS) plays an essential role in the estate recovery process, managing claims and overseeing the legislation governing this area. This department is responsible for determining the amount to be recovered and processing the submitted estate recovery forms.

If users have questions or need additional support, the DHHS provides contact information for inquiries, ensuring individuals can receive help whenever needed. Expect a thorough yet efficient process as the department handles your form, from acknowledgement to final reconciliation.

Frequently asked questions (FAQs)

Navigating the estate recovery process can prompt many questions, and understanding common inquiries surrounding the Nebraska Medicaid Estate Recovery Form can decrease anxiety associated with this sensitive subject. What happens after submission is a primary question; the form will undergo review, and the estate may receive any outstanding claims from the state.

Other inquiries might include how to contest a recovery claim or the consequences of failing to submit the form. In short, there are attorney services available specifically geared toward assisting individuals in understanding their rights and navigating the complexities of estate recovery.

Additional resources for understanding Medicaid estate recovery

Educating oneself further about Medicaid estate recovery in Nebraska can enhance understanding and empower families. Links to state-specific guidelines provide valuable insights, and educational materials are available to support beneficiaries in navigating the sometimes convoluted process.

Community support groups and advocacy resources are also abundant throughout Nebraska, helping individuals grasp the impact of estate recovery and connecting them with others who are facing similar challenges and obstacles.

Interactive tools on pdfFiller

pdfFiller offers an array of interactive tools specifically aimed at facilitating users' interactions with the Nebraska Medicaid Estate Recovery Form. From editing and managing documents to e-signing capabilities, the platform creates a seamless experience for users from any device.

Using pdfFiller, you can collaborate on documents with family members or professionals to ensure every detail is accounted for when submitting the form. Its advanced features simplify every stage of this process, enhancing the overall user experience with efficient document handling.

Important considerations when using the Nebraska Medicaid estate recovery form

There are several critical considerations to account for when navigating the Nebraska Medicaid Estate Recovery Form. Common mistakes can lead to complications, including the failure to include supporting documentation like bank statements and certification requests. Individuals should understand the timeline for recovery as well, factoring in potential delays as the form moves through the state’s review process.

Understanding the implications of estate recovery on family assets is also essential. While this process can reclaim funds, it can also uncover potential liabilities that families may not be prepared for, requiring careful planning and consultations with legal experts.

Navigating challenges in the Nebraska Medicaid estate recovery process

Managing and protecting assets during the Nebraska Medicaid estate recovery process can pose challenges. Developing strategies for asset protection, such as potentially transferring certain valuables or restructuring ownership prior to the recovery process, may be prudent.

However, it’s crucial to navigate these waters with care to avoid legal pitfalls. Should you encounter difficulties with your claim, seek guidance from knowledgeable legal counsel who specializes in estate planning and Medicaid recovery. Knowing when to act can make a significant difference in protecting your family's wealth and legacy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in nebraska medicaid estate recovery without leaving Chrome?

How do I fill out the nebraska medicaid estate recovery form on my smartphone?

How do I complete nebraska medicaid estate recovery on an iOS device?

What is nebraska medicaid estate recovery?

Who is required to file nebraska medicaid estate recovery?

How to fill out nebraska medicaid estate recovery?

What is the purpose of nebraska medicaid estate recovery?

What information must be reported on nebraska medicaid estate recovery?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.